In the ever-evolving landscape of finance, the chance to venture beyond your national boundaries and invest in foreign stocks has become increasingly accessible and appealing. The allure of international markets and the potential of foreign stocks have captured the attention of both experienced investors and newcomers alike. In this piece, we will dive deep into the realm of investing in foreign stocks, uncovering its advantages, associated risks, diverse investment approaches, effective research strategies, and much more.

Outline

- Benefits of Investing in Foreign Stocks

- Risks Associated with Foreign Stock Investments

- The Global Economy Perspective

- Major Investment Opportunities

- Insights from Professor Jeremy Siegel

- Ways to Invest in Foreign Stocks

- Steps to Get Started with Foreign Stock Investments

- Managing and Monitoring Foreign Stock Investments

- Tax Implications of Investing in Foreign Stocks

- Common Myths About Foreign Stock Investments

- Conclusion

- FAQs

- Case Study

- Checklist

Reading time: 26 minutes

1. Benefits of Investing in Foreign Stocks

1-1. Diversification of Portfolio

When it comes to investing, diversification is like a safety net for your hard-earned money. It’s the practice of not putting all your eggs in one basket, and foreign stocks play a pivotal role in this strategy. The beauty of diversification lies in its ability to minimize risk. Picture this: your investment portfolio is like a lush garden. Just as you wouldn’t want all your flowers vulnerable to the same pest, you don’t want all your investments vulnerable to the same market turmoil.

Here’s where “invest in foreign stocks” steps in as a powerful strategy. These stocks often dance to a different rhythm than their domestic counterparts. When your local markets stumble, foreign stocks might be doing a graceful waltz. By introducing international stocks to your portfolio, you introduce an element of unpredictability – and that’s a good thing. The performance of foreign stocks doesn’t necessarily mimic what’s happening in your homeland. That’s the beauty of global markets – they have their own stories to tell.

1-2. Access to Growing Markets

Imagine yourself as an early explorer in a land of hidden treasures. That’s what investing in foreign stocks can feel like – an exciting journey into untapped growth. Emerging economies, those energetic newcomers, often outshine the growth rates of well-established countries. When you invest in foreign stocks, you’re not just buying shares; you’re hitching a ride on the back of a soaring economic rocket.

Think about it: you’re not limited to the ups and downs of your own country’s economic roller coaster. Instead, you’re boarding a new thrill ride that could lead to substantial rewards. As economies blossom, companies thrive. By investing in foreign stocks, you’re becoming a part of these success stories, potentially reaping substantial rewards as these markets expand and evolve.

1-3. Currency Diversification

The world of finance has its own currency waltz, and it’s not always a smooth one. Currencies can be as volatile as a summer storm, and their fluctuations can sway the value of your investments. This is where the concept of “invest in foreign stocks” dons a powerful armor – currency diversification.

Let’s liken your investment portfolio to a treasure chest. Inside, you’ve got stocks from different countries, each linked to its respective currency. This diversification provides a level of defense against the wild swings of a single currency. If one currency takes a nosedive, the others might remain steady or even rise. You’re essentially spreading your risk like a savvy investor. By holding a mix of stocks denominated in various currencies, you’re safeguarding your portfolio against the impact of a single currency’s depreciation.

2. Risks Associated with Foreign Stock Investments

Investing in foreign stocks is like exploring new frontiers – full of potential but not without its challenges. Let’s dive into the risks that come hand in hand with this adventure.

2-1. Currency Fluctuations

Think of currency exchange rates as the heartbeat of the global financial system. They can be as unpredictable as a wild river, and they introduce a unique risk when you invest in foreign stocks. Imagine this scenario: You’ve invested in a foreign company whose stock has been soaring. But when you convert those gains back to your home currency, the exchange rate has shifted unfavorably. Suddenly, your impressive returns are somewhat diminished.

This is the heartache of currency risk. Exchange rates can swing dramatically, and these fluctuations can eat into your hard-earned profits. It’s like sailing on a sea of uncertainty. However, remember that diversification extends its protective hand here too. By holding stocks in different currencies, you can offset the impact of a single currency’s roller-coaster ride.

2-2. Political and Economic Instability

The global financial landscape is influenced not only by economic trends but also by political currents. Political turmoil and economic instability are like unexpected storms that can rock the boat when you invest in foreign stocks. Picture this: a sudden shift in government policies, an unforeseen political crisis, or a disruptive geopolitical event can send shockwaves through foreign markets.

These ripples often find their way to the stock market, causing abrupt shifts in stock prices. You could be riding high on a company’s success, only to see it plummet due to circumstances beyond your control. It’s a reminder that investing in foreign stocks requires a keen eye on global events, so you’re not caught off guard by the waves of uncertainty.

2-3. Legal and Regulatory Differences

Different countries, different rules. That’s the mantra you encounter when you invest in foreign stocks. Each nation has its own legal and regulatory framework governing investments. This landscape can be as intricate as a maze, and you need to navigate it skillfully.

Imagine researching a promising foreign company, only to discover that investing in it is a bureaucratic ordeal due to complex regulations. Or worse, imagine investing in a company only to find out later that the rules have changed, impacting your returns. These legal and regulatory differences add a layer of uncertainty to your investments. It’s like trying to build a puzzle with pieces that keep changing shape.

However, knowledge is your most potent tool. Understand the rules of the game, stay updated on regulatory changes, and be prepared to adapt your strategy accordingly. This way, you can navigate the labyrinth of legal nuances and make informed decisions in the world of international investing.

3. The Global Economy Perspective

In today’s interconnected global economy, the lines that once sharply divided U.S. and non-U.S. companies have significantly blurred. This phenomenon is a testament to the profound impact of globalization on the business landscape. Notably, a substantial number of U.S. companies have extended their operations beyond national borders, establishing a significant international presence. At the same time, many foreign companies have ventured into the U.S. market, contributing to a more integrated and interdependent global business ecosystem.

3-1. U.S. and International Companies: Mutual Expansion

3-1-1. U.S. Companies with International Reach

The dynamic nature of the global economy has propelled numerous U.S. companies to explore opportunities beyond their domestic market. With advancements in communication, technology, and transportation, expanding into foreign markets has become increasingly viable. These U.S. companies now conduct operations, sell products, and provide services in various countries, making them integral players in the global marketplace.

3-1-2. Foreign Companies in the U.S. Market

Simultaneously, foreign companies have embraced the allure of the U.S. market. With its vast consumer base, technological advancements, and economic stability, the United States serves as a magnet for international businesses aiming to tap into its immense potential. Consequently, the presence of foreign companies in the U.S. market has grown significantly, contributing to the diverse and dynamic business environment.

3-2. Redefining “Domestic” and “Foreign”

As U.S. companies establish international operations and foreign companies enter the U.S. market, the traditional labels of “domestic” and “foreign” have become less distinct. The notion of a company’s origin no longer definitively characterizes its reach or impact. Instead, a company’s global footprint determines its influence, with operations spanning continents and markets.

3-3. Economic Interdependence

This interconnectedness transcends geographic borders and underscores the economic interdependence of nations. The success of a company in one part of the world can have ripple effects across various economies. Movements in supply chains, financial markets, and consumer behavior reverberate globally, highlighting the intricate web of connections that define today’s economic reality.

3-4. Opportunities and Considerations

As you invest in foreign stocks, understanding this global perspective becomes crucial. Companies that might appear “foreign” in terms of origin could have a significant influence on your investment portfolio. The performance of these international players can be influenced by a myriad of global factors, underscoring the need for a comprehensive understanding of the global economic landscape.

In navigating the realm of international investing, recognizing the interconnectedness of economies can provide valuable insights. This perspective encourages investors to look beyond national boundaries and consider the broader implications of their investment decisions. As the global economy continues to evolve, embracing this interconnected reality becomes paramount for informed and strategic investing in foreign stocks.

4. Major Investment Opportunities

When you decide to invest in foreign stocks, understanding the specific geographic regions that investment managers target can help you strategically diversify your portfolio. These regions offer distinct market dynamics and growth potentials that can shape your investment decisions.

4-1. Latin America: Emerging Economies and Growing Markets

4-1-1. Diverse Countries in Focus

Latin America encompasses a diverse range of countries, each with its unique economic landscape. From the economic powerhouses of Brazil and Mexico to the emerging markets of Chile and Colombia, this region holds promising opportunities for investors seeking exposure to vibrant and evolving economies.

4-1-2. Resource-Rich Potential

Several Latin American countries possess rich natural resources, creating investment potential in sectors like energy, mining, and agriculture. These resources contribute to economic growth and can offer strategic entry points for investors looking to invest in foreign stocks.

4-1-3. Economic Transformation

As Latin American countries focus on economic diversification, sectors such as technology, finance, and manufacturing are gaining prominence. These shifts in focus open doors for investors to capitalize on industries experiencing rapid expansion and innovation.

4-2. Europe: Established Markets and Innovation Hubs

4-2-1. Economic Diversity

Europe boasts a spectrum of developed and emerging markets, each with its unique economic strengths. Countries like Germany, France, and the United Kingdom have established themselves as economic powerhouses, while Eastern European nations are undergoing rapid development.

4-2-2. Innovation and Technology Centers

European cities are renowned for their innovation and technological advancements. Countries like Sweden, known for their cutting-edge research and development, provide opportunities to invest in companies at the forefront of global innovation.

4-2-3. Stability and Longevity

Europe’s history of stable economies and well-established institutions can offer a sense of security to investors. Companies operating in these markets often have a track record of resilience and can contribute to stable long-term investment returns.

4-3. Asia-Pacific: Dynamic Growth and Market Expansion

4-3-1. Diverse Market Landscape

The Asia-Pacific region encompasses a wide spectrum of economies, from established giants like Japan to rapidly growing nations like China and India. This diversity presents a range of investment opportunities across industries and sectors.

4-3-2. Emerging Markets Potential

Many Asia-Pacific countries are experiencing rapid economic growth and urbanization. This growth fuels consumer demand, technological advancements, and infrastructure development, creating fertile ground for investment.

4-3-3. Global Trade and Connectivity

Asian economies are deeply integrated into global trade networks, making them sensitive to global market trends. Investing in companies connected to Asia-Pacific markets can provide insights into the broader shifts in global trade dynamics.

4-4. Canadian Holdings: North American Influence

4-4-1. International Yet Neighboring

While often grouped within international portfolios, Canadian holdings carry unique significance due to their geographic proximity to the United States. The economic ties between these North American nations can influence investment opportunities.

4-4-2. Resource-Rich Industries

Canada’s resource-rich sectors, such as energy, mining, and forestry, offer avenues for investors interested in commodities. These industries can provide stability and diversification within international investment portfolios.

4-4-3. Global Trade Partnerships

Canada’s involvement in global trade agreements positions it as a key player in international commerce. Understanding the influence of these trade relationships can enhance your insights into the dynamics of investing in Canadian holdings.

4-5. In Conclusion

Investing in foreign stocks means immersing yourself in the potential of diverse economies, industries, and regions. Whether you’re drawn to the emerging markets of Latin America, the stability of European economies, the dynamism of the Asia-Pacific, or the unique significance of Canadian holdings, each region offers a distinct avenue for growth and diversification. As you explore these investment opportunities, a nuanced understanding of each region’s economic landscape can empower you to make informed and strategic decisions that align with your investment goals.

5. Insights from Professor Jeremy Siegel

When considering your decision to invest in foreign stocks, it’s crucial to heed the wisdom of experts in the field. Professor Jeremy Siegel, a respected authority in finance, advocates for global diversification as a strategy to optimize returns while mitigating risk. His insights shed light on the evolving dynamics of the global equity landscape and the rationale behind expanding your investment horizon.

5-1. Rethinking Traditional Investment Boundaries

5-1-1. Globalization’s Impact on Investment

Professor Siegel’s emphasis on global diversification underscores the transformative impact of globalization on investment strategies. The world’s equity capital distribution has undergone a significant shift over the decades, challenging the notion that U.S. markets alone can ensure optimal returns.

5-1-2. The Dispersed Equity Landscape

The once-concentrated equity capital in the U.S. market has now diffused across the globe. This diversification signifies a departure from the era when the United States exclusively held the majority of the world’s equity capital.

5-2. The Power of Developed Economies and Emerging Nations

5-2-1. Continued Dominance of Developed Economies

While the global equity landscape has diversified, developed economies continue to hold economic prominence. The established markets of the developed world, including the United States, maintain a significant share of the world’s economic activity and equity capital.

5-2-2. Rise of Emerging Nations

Simultaneously, the ascent of emerging nations is reshaping the equity landscape. Nations like China and India are rapidly gaining economic ground, with the potential to rival the dominance of developed economies. These emerging nations contribute to the dynamic shifts in investment opportunities.

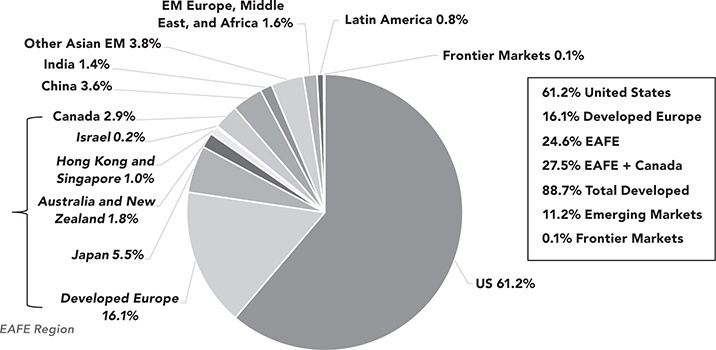

FIGURE 1 Distribution of global equity market capitalization, 2021

5-3. A Strategic Approach to Global Diversification

5-3-1. Optimal Portfolio Allocation

Professor Siegel’s insights underscore the importance of strategically allocating a portion of your portfolio to foreign stocks. While U.S. markets remain significant, a globally diversified approach acknowledges the changing dynamics of the equity landscape and seeks to maximize returns.

5-3-2. The Role of Risk Mitigation

Diversifying across international markets doesn’t just maximize returns; it also plays a crucial role in risk management. By spreading investments across economies with varying growth trajectories and market behaviors, investors can enhance their portfolio’s resilience.

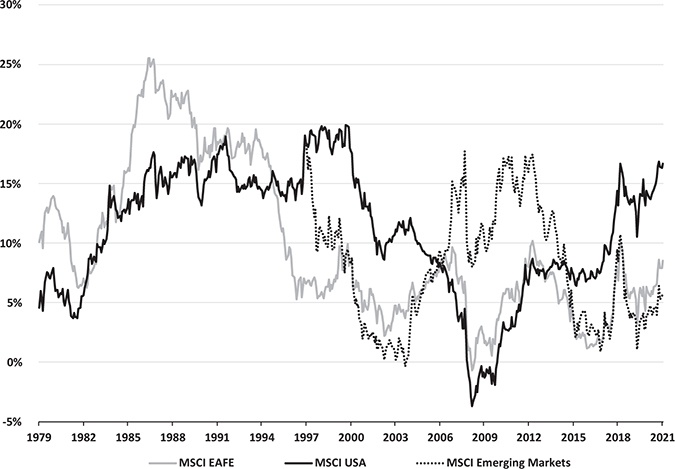

FIGURE 2 10-year rolling period returns

5-4. Projections for the Future

5-4-1. Predicting the Evolving Landscape

Professor Siegel’s forward-looking projections highlight the potential evolution of the global equity landscape. He anticipates that by 2050, the economic contributions of emerging nations like China and India will likely equal a significant portion of the world’s GDP and stock market values.

5-4-2. A Holistic Perspective on Capital Appreciation

However, Professor Siegel also emphasizes a nuanced view. He cautions that an increase in a country’s share of world capital doesn’t guarantee substantial capital appreciation for existing shares. Economic growth doesn’t necessarily translate into equivalent investment returns.

5-5. In Conclusion

Professor Jeremy Siegel’s insights underscore the dynamic nature of global investment. As you navigate the decision to invest in foreign stocks, his wisdom serves as a guiding light. Embracing a globally diversified approach aligns with the evolving equity landscape, capitalizing on the strengths of both established economies and emerging nations. In doing so, you position yourself to optimize returns while wisely managing risk, creating a robust foundation for your investment journey.

6. Ways to Invest in Foreign Stocks

Now that we’ve explored the benefits and risks of investing in foreign stocks, it’s time to unpack the various avenues you can take to venture into these international waters.

6-1. Direct Stock Purchases

Imagine yourself as a globe-trotting investor, directly owning a piece of a foreign company. This is the essence of direct stock purchases. When you invest in foreign stocks this way, you’re buying shares of companies listed on international stock exchanges. It’s like becoming a shareholder in a distant land, holding a tangible stake in a foreign enterprise.

This approach offers you a sense of control and ownership that’s akin to being the captain of your own investment ship. Your portfolio becomes a canvas that you paint with the colors of international businesses. Direct stock purchases empower you to navigate the global investment landscape with the rudder of your own choices.

6-2. Global Depository Receipts (GDRs)

If you’re looking for a more indirect route to invest in foreign stocks, say hello to Global Depository Receipts, or GDRs. These are like postcards from the international stock market, allowing you to catch a glimpse of foreign companies without venturing into the markets directly.

Think of GDRs as certificates that represent shares of foreign companies. These certificates are issued by banks and are traded on local exchanges. It’s like having a ticket to a global concert – you get to enjoy the performance without dealing with the backstage chaos. GDRs offer a bridge between your local market and the international stage, giving you a taste of the international investment experience without the intricacies of foreign market navigation.

6-3. Exchange-Traded Funds (ETFs)

Imagine you’re building an investment mosaic, and each piece is a slice of international success. That’s the magic of Exchange-Traded Funds (ETFs) when you invest in foreign stocks. ETFs are like baskets filled with a variety of stocks, and they trade on stock exchanges just like individual shares.

When you invest in international ETFs, you’re essentially spreading your investments across a range of foreign companies. It’s like being a curator of your own global art gallery, showcasing the talents of businesses from around the world. These funds often mirror the performance of a specific index or a group of assets. International ETFs grant you exposure to foreign markets without the need to cherry-pick individual stocks. It’s a convenient way to paint your investment canvas with the diverse hues of international growth.

6-4. Mutual Funds

Imagine an investment picnic where everyone brings their favorite dishes to share. That’s the spirit of mutual funds when you invest in foreign stocks. These funds pool money from multiple investors to create a diversified portfolio managed by professionals.

When you opt for mutual funds that focus on foreign stocks, you’re joining a communal effort to tap into international opportunities. It’s like being part of a global investment potluck where everyone contributes, and everyone benefits. Professional fund managers handle the recipe, ensuring a blend of stocks from various countries and industries. This approach lets you enjoy the flavors of international markets without the hassle of DIY research and management.

7. Steps to Get Started with Foreign Stock Investments

As you prepare to invest in foreign stocks, it’s like embarking on a journey to a new destination. Let’s chart the course with a step-by-step guide that ensures you set sail with confidence.

7-1. Selecting a Brokerage Account

Think of a brokerage account as your gateway to global markets. It’s like the passport that lets you explore foreign investment landscapes. When you invest in foreign stocks, it’s essential to choose a brokerage that doesn’t just offer access to international markets, but also provides you with tools and resources for effective analysis.

You want a platform that’s your co-pilot, guiding you through the complexities of foreign stock analysis. Look for research tools, market insights, and access to real-time data. Remember, this choice isn’t just about a trading platform; it’s about having a reliable companion on your investment journey.

7-2. Creating a Diversified Portfolio

Diversification is the armor of the wise investor. When you invest in foreign stocks, you’re not just collecting stamps in your investment passport; you’re assembling a collection of valuable assets. Imagine your portfolio as a mosaic, each piece representing a different opportunity.

To create a diversified portfolio, spread your investments across countries, industries, and market capitalizations. It’s like planting various seeds in a garden – some might bloom early, while others flourish later. Diversification helps you manage risk by not putting all your eggs in one proverbial basket. It’s the ultimate strategy to safeguard against market turbulence while embracing the potential of global growth.

7-3. Setting Investment Goals

Every journey begins with a destination in mind. When you invest in foreign stocks, your investment goals serve as your North Star. Are you aiming for long-term wealth accumulation, or are you looking for short-term gains? Your goals will shape your strategy, determine your risk tolerance, and guide your decisions along the way.

Setting investment goals is like plotting your course on a map. It provides direction and purpose to your investment journey. Are you chasing the thrill of high returns, or are you seeking steady, reliable growth? By defining your goals, you’re not just investing; you’re crafting a strategy tailored to your aspirations.

8. Managing and Monitoring Foreign Stock Investments

As you invest in foreign stocks, you’re not just planting seeds and walking away; you’re tending to a garden of opportunities. Effective management and vigilant monitoring are the keys to nurturing growth and reaping the rewards.

8-1. Regular Portfolio Review

Think of your investment portfolio as a living entity, evolving with time. When you invest in foreign stocks, it’s essential to regularly review how your garden is blooming. Market conditions are like seasons – they change, sometimes dramatically. Your portfolio’s performance can sway like a tree in the wind, and that’s why regular review is crucial.

Picture this: you started with a balanced mix of international stocks, but market dynamics might have shifted. Some stocks might have surged, while others dipped. This is where portfolio rebalancing comes in. It’s like trimming the branches of a tree to maintain its shape. By selling some of the overperforming stocks and reinvesting in underperforming ones, you’re ensuring your portfolio’s alignment with your goals.

8-2. Staying Informed about Global Events

Imagine yourself as a global news detective. When you invest in foreign stocks, staying informed about global events is like having a magnifying glass to detect trends and shifts. Global events, whether they’re geopolitical developments or economic indicators, are like waves that ripple through international markets.

Geopolitical developments, like political unrest or trade agreements, can send shockwaves through markets. Economic indicators, like unemployment rates or inflation figures, provide insights into the health of economies. By staying informed, you’re not just a spectator; you’re an active participant in your investment journey. You’re equipped to anticipate market movements and make informed decisions that can protect and enhance your returns.

9. Tax Implications of Investing in Foreign Stocks

When you invest in foreign stocks, the financial landscape isn’t just about potential gains and losses. It’s also about navigating the maze of tax implications that come with global investments. Let’s explore the tax considerations that can impact your investment journey.

9-1. Double Taxation Treaties

Think of double taxation as a roadblock on your financial journey. Nobody likes to pay taxes twice on the same income, and that’s where double taxation treaties come into play. Imagine this scenario: you receive dividends from a foreign company, and both your home country and the foreign country want a piece of the pie. This is where double taxation treaties step in as peacemakers.

These treaties are like diplomatic agreements between countries, designed to prevent investors from being unfairly taxed twice. They’re like bridges that connect the financial landscapes of different nations. Understanding these treaties is essential when you invest in foreign stocks. They can help you optimize your tax liabilities and ensure you’re not overpaying due to the complexities of international tax systems.

9-2. Foreign Tax Credits

Imagine you’re collecting souvenirs from different countries, each with its own price tag. When you invest in foreign stocks, those price tags can be taxes imposed on dividends from foreign companies. However, there’s a strategy that can reduce the impact of this double taxation: foreign tax credits.

Foreign tax credits are like discounts that your home country offers to offset the taxes you’ve paid abroad. Think of it as a way to avoid paying taxes twice on the same income. These credits can boost your after-tax returns, making your investment journey more financially efficient. It’s like finding a treasure chest of coins that were once lost to the sea of international taxation.

10. Common Myths About Foreign Stock Investments

When it comes to international investing, there’s a blend of fact and fiction swirling in the air. Let’s dispel some of the most common myths surrounding investing in foreign stocks and shed light on the reality beneath the surface.

10-1. It’s Only for the Wealthy

Imagine international investing as an exclusive club with velvet ropes and high price tags. The myth that investing in foreign stocks is only for the wealthy is like a closed door that many believe they can’t open. However, let’s throw that door wide open.

In reality, international investing welcomes investors of all budgets. It’s like a buffet offering options for every appetite. Whether you’re bringing a feast or just a snack, there are various investment avenues that cater to your budget size. From fractional shares to low-cost index funds, the world of foreign stocks isn’t a members-only club; it’s an inclusive marketplace waiting for you to explore.

10-2. Too Complex for Individual Investors

Navigating international waters can seem like a daunting task, especially when it comes to finances. The myth that international investing is too complex for individual investors is like a fog that obscures the possibilities. However, modern times have brought along modern tools.

Picture this: you have a smartphone that’s a gateway to a world of information and connectivity. The same goes for investing platforms. These platforms are like compasses that guide you through the complexities of international investing. They offer research tools, insights, and resources that simplify the journey. International investing is no longer reserved for financial experts; it’s a terrain accessible to curious explorers armed with technology.

10-3. High Risk, Low Reward

The myth that investing in foreign stocks is all risk and no reward is like a cloud that casts a shadow over a sunlit field. Yes, like any investment, there are risks involved, but let’s not forget the flip side of the coin – rewards.

Foreign stocks aren’t just tokens of risk; they’re opportunities that come with potential. The international stage is full of diverse economies, industries, and growth trajectories. When approached with an informed strategy, foreign stocks can be the vehicles that carry you to significant rewards. It’s like setting sail on a sea of opportunity, aware of the waves but driven by the potential of the horizon.

11. Conclusion

Investing in foreign stocks can be a rewarding way to diversify your portfolio, tap into high-growth markets, and harness the benefits of currency diversification. While risks exist, diligent research, strategic planning, and staying informed can help you navigate the global investment landscape successfully.

12. FAQs

12-1. What are the main benefits of choosing to invest in foreign stocks?

Investing in foreign stocks brings several advantages. It allows you to diversify your portfolio, gain access to high-growth markets, and benefit from currency diversification. By including international stocks, you can potentially mitigate risk and enhance potential returns through exposure to different economic landscapes.

12-2. How can I manage the risks associated with investing in foreign stocks?

Investing in foreign stocks does come with certain risks, including currency fluctuations, political instability, and regulatory differences. To manage these risks, it’s important to conduct thorough research and stay informed about global events. Diversifying your investments across various regions and industries can also help spread risk and enhance your portfolio’s resilience.

12-3. What investment opportunities do different geographic regions offer for foreign stock investments?

Various geographic regions offer unique investment opportunities. For instance, Latin America provides access to emerging economies and resource-rich sectors, while Europe offers stability and innovation hubs. The Asia-Pacific region is known for dynamic growth, and Canadian holdings offer proximity to the North American market. Understanding these regions’ dynamics can guide your investment decisions.

12-4. How can I get started with investing in foreign stocks?

Getting started involves selecting a reputable brokerage account that provides access to international markets and research tools. Creating a diversified portfolio across countries, industries, and market capitalizations is crucial for risk management and potential growth. Setting clear investment goals based on your risk tolerance and objectives will shape your strategy.

12-5. What are the tax implications of investing in foreign stocks?

Investing in foreign stocks can have tax implications due to double taxation and varying tax regulations. Some countries have double taxation treaties to prevent investors from being taxed twice on the same income. Foreign tax credits can help offset taxes paid abroad. It’s essential to understand these tax considerations to optimize your returns and manage your tax liabilities effectively.

13. Case Study

Meet Aaron, a 29-year-old male artist who finds his muse in creativity. He lives an independent life, putting his heart and soul into his artwork.

Despite his passion, Aaron’s income is irregular, averaging around $35,000 per year, due to the fluctuating demand for his pieces. He carefully manages his finances, with monthly expenditures totaling $2,500.

His assets include $15,000 in savings and a small investment of $5,000 in the US stock market. However, his liabilities, consisting of student loans, amount to $10,000.

13-1. Current Situation

Intrigued by the concept of investment, Aaron decided to venture into the stock market with his $5,000 investment. He chose to invest solely in the US market, placing his funds into Exchange-Traded Funds (ETFs) that tracked the performance of US companies. This decision seemed prudent, given his familiarity with his home country’s market.

13-2. Conflict Occurs

The tranquility of Aaron’s investment journey was shattered when the US stock market experienced a sudden downturn. Witnessing his $5,000 investment decrease to $3,500 within a few months was a stark wake-up call. The volatility of the market left Aaron emotionally torn between anxiety and frustration. This incident triggered a realization: the need to diversify his investment strategy beyond the confines of a single country’s market.

13-3. Problem Analysis

Aaron’s predicament stemmed from his reliance on the US market alone. The abrupt market downturn highlighted the risks of concentrating all his investments in one place. His well-intentioned approach lacked the depth needed to navigate the intricate world of investment diversification.

13-4. Solution

Determined to overcome the challenges, Aaron committed to in-depth research. He recognized that diversification across multiple countries and markets was crucial to mitigating investment risk. He decided to transition from solely investing in the US market to exploring foreign stock markets using ETFs.

Aaron’s solution involved allocating a portion of his savings towards foreign ETFs. He adjusted his asset allocation ratio to include 50% US market ETFs and 50% international market ETFs. This strategic shift aimed to temper the volatility of his portfolio by tapping into the potential of various global markets. His goal was to reduce risk and enhance the possibility of better returns over time.

13-5. Effects After Execution

As Aaron’s new investment strategy unfolded, he experienced a newfound sense of security. While the US market’s performance still influenced his portfolio, the inclusion of foreign ETFs helped dampen the impact of local market downturns. This diversification allowed Aaron to navigate market fluctuations more gracefully and experience smoother growth patterns.

Over the course of a year, Aaron’s diversified portfolio encountered its share of ups and downs. Despite a 5% loss in the US market ETFs, his international ETFs returned 8%, resulting in an overall 1.5% gain. This outcome demonstrated the effectiveness of his strategy in mitigating losses and capitalizing on gains across markets.

| Metrics | Before Diversification | After Diversification |

| Investment Focus | US Market ETFs | US & Foreign Market ETFs |

| Initial Investment Amount | $5,000 | $5,000 |

| Asset Allocation Ratio | 100% US Market ETFs | 50% US, 50% Foreign ETFs |

| Market Performance (1 Year) | US Market ETFs: -10% | US Market ETFs: -5% |

| Foreign ETFs: N/A | Foreign ETFs: +8% | |

| Portfolio Return (1 Year) | -10% | +1.5% |

| Loss Amount | $500 (=$5,000*100%*-10%) | $125 (=$5,000*50%*-5%) |

| Gain Amount | N/A | $200 (=$5,000*50%*8%) |

| Net Effect on Portfolio | Decreased | Increased |

| Emotional Impact | Anxiety & Frustration | Improved Confidence |

| Risk Mitigation | Limited | Enhanced |

| Investment Approach | Single-Country Focus | Global Diversification |

| Financial Resilience | Vulnerable to Market Trends | More Resilient |

13-6. In Conclusion

Aaron’s journey from relying solely on US market ETFs to embracing international diversification underscores the power of adapting to new insights. His experience demonstrates the significance of incorporating data-driven decision-making into investment strategies. By diversifying his portfolio across borders, Aaron not only weathered market turbulence more effectively but also positioned himself for potentially greater financial growth. His story serves as a reminder that a well-informed approach, backed by data and analysis, can pave the way for a more resilient and promising investment future.

14. Checklist

| Questions | Your Reflections | Suggested Improvement Strategies | Improvement Plans | Implementation Results | Review and Adjust |

| Have I diversified my investment portfolio to include foreign stocks? | Research and identify potential foreign stocks to invest in different regions. | ||||

| Am I aware of the benefits of investing in foreign stocks, such as portfolio diversification and access to growing markets? | Explore more about how foreign stocks can enhance portfolio stability and growth potential. | ||||

| Do I understand the risks associated with investing in foreign stocks, such as currency fluctuations and political instability? | Educate myself further on managing and mitigating these risks through research and expert insights. | ||||

| Have I considered different methods of investing in foreign stocks, such as ETFs and mutual funds? | Research and compare different investment methods to find the most suitable ones for my goals. | ||||

| Am I informed about the global economic perspective and how it impacts my investment decisions? | Stay updated on global economic trends and their implications for international investments. | ||||

| Have I set clear investment goals that align with my risk tolerance and desired outcomes? | Reflect on my investment objectives and adjust them if necessary to match my risk appetite. | ||||

| Do I understand the tax implications of investing in foreign stocks and how to optimize my tax liabilities? | Consult with tax professionals and research tax treaties to ensure efficient tax management. |