Investing in the financial world can be an exhilarating yet nerve-wracking experience, especially when the unpredictable nature of markets comes into play. Amid this uncertainty, a strategy that seasoned investors have mastered is investment diversification. By strategically allocating your funds across a spectrum of assets, you can effectively manage risk and enhance the potential for attractive returns. In this comprehensive guide, we’ll delve deep into the world of investment diversification, unveiling its nuances and providing actionable insights into constructing a successful and robust diversified portfolio.

Outline

- Understanding Investment Diversification

- Types of Investment Assets

- Risks of Not Diversifying Investments

- Building a Diversified Investment Portfolio

- Asset Allocation Strategies

- Risk Management through Diversification

- Global Diversification

- The Dilemma of Lump Sum Investments

- Periodic Portfolio Review

- Long-Term Perspective

- Conclusion

- FAQs

- Case Study

- Checklist

Reading time: 31 minutes

1. Understanding Investment Diversification

In the intricate world of investments, investment diversification strategy emerges as a beacon of prudence and protection. Imagine it as a tapestry carefully woven with threads of different colors and textures, each representing a distinct asset class. This strategy revolves around the age-old wisdom of not putting all your eggs in one basket. It’s a dynamic approach that involves spreading your investment funds across a spectrum of assets, mitigating the impact of poor performance in any single investment.

1-1. The Core Principle

At its core, an investment diversification strategy relies on the principle that different asset classes react differently to market fluctuations. By blending assets with varying risk and return profiles, you create a well-rounded portfolio that can weather the storm of market volatility. Stocks, for instance, might experience soaring highs and plummeting lows, while bonds provide stability and generate income. Real estate, commodities, and alternative investments introduce additional layers of diversification, further enhancing your portfolio’s resilience.

1-2. Reducing Volatility

The heart of the matter is risk reduction. Volatility in the investment world refers to the extent of fluctuation in an asset’s price. By diversifying your investments, you minimize the potential impact of a single asset’s poor performance. Imagine a ship with multiple sails – if one sail is damaged, the others keep the ship afloat. Similarly, if one sector of the market faces a downturn, the other sectors can act as a buffer, preventing your entire portfolio from sinking.

1-3. Balancing Risk and Reward

Investment diversification strategy isn’t just about risk reduction; it’s also about finding the right balance between risk and reward. The goal is to achieve a mix that aligns with your risk tolerance, financial goals, and investment horizon. If you’re a risk-averse investor, a more conservative allocation that includes bonds and stable assets might be your preference. On the other hand, if you’re comfortable with risk and aiming for higher growth, a larger allocation to stocks could be suitable.

1-4. Beyond Asset Classes

Diversification extends its influence beyond asset classes. Within each class, you can further diversify by investing in different industries, sectors, or geographic regions. This micro-level diversification adds yet another layer of protection. For instance, if technology stocks falter, having investments in healthcare or energy can counterbalance the impact. Similarly, global diversification introduces exposure to international markets, reducing your vulnerability to the economic fluctuations of a single country.

1-5. Embracing Complexity

While an investment diversification strategy appears straightforward, implementing it effectively can be intricate. It involves a delicate balance between crafting a diversified portfolio and avoiding over-diversification. The latter can dilute your potential for substantial returns. Furthermore, diversification requires periodic monitoring and adjustments to maintain the desired asset allocation. Engaging with financial advisors or leveraging modern robo-advisors can streamline the process, ensuring your portfolio remains aligned with your goals.

1-6. The Takeaway

In the grand tapestry of investments, investment diversification strategy is the thread that weaves together stability and growth. By strategically spreading your investments across various asset classes, industries, and regions, you create a fortress that stands resilient against the unpredictable winds of the market. This strategy doesn’t eliminate risk, but it tempers it, offering you the confidence to navigate the investment landscape with a steady hand. As you embark on your journey of financial growth, remember that diversification is your compass, guiding you toward a more secure and prosperous future.

2. Types of Investment Assets

Diving deeper into the realm of investment diversification strategy, let’s explore the array of investment assets that constitute the building blocks of a diversified portfolio. Each asset class brings its unique characteristics, risk factors, and potential for returns to the table. As you embark on your journey to create a well-rounded portfolio, understanding these assets and their dynamics becomes paramount.

2-1. Stocks: Pursuing Growth Amid Volatility

Stocks, also known as equities, represent ownership in a company. Investing in stocks means you’re buying a stake in the company’s future success. Stocks are synonymous with growth potential, often delivering substantial returns over the long term. However, they come hand-in-hand with higher volatility. Market fluctuations can send stock prices soaring to new heights or plummeting to unexpected lows. Investment diversification strategy recognizes stocks as a core asset class but emphasizes the importance of balancing their risk with other assets.

2-2. Bonds: Stability and Income Generation

Enter the world of bonds, where stability and income generation take center stage. Bonds are essentially loans that you provide to corporations or governments. In return, you receive periodic interest payments, and upon maturity, your principal is returned. Bonds serve as a counterbalance to the volatile nature of stocks. While they may offer relatively lower returns compared to stocks, they provide a reliable income stream and act as a cushion during market downturns. Investment diversification strategy integrates bonds to add a layer of stability to your portfolio.

2-4. Real Estate: A Tangible Investment

Real estate presents a tangible and potentially lucrative avenue for diversification. Investing in properties – residential, commercial, or industrial – allows you to benefit from rental income and property value appreciation. Real estate is often considered a hedge against inflation, as property values tend to rise over time. However, this asset class requires careful consideration, as it involves property management and market dynamics. Investment diversification strategy may include real estate to introduce diversity beyond traditional financial markets.

2-5. Commodities: Uncovering Market Dynamics

Commodities are the raw materials that fuel our world – from agricultural products like wheat and coffee to precious metals like gold and silver. Investing in commodities provides exposure to the fundamental forces driving economies. Commodities often move independently of traditional financial assets, making them valuable for diversification. However, their prices can be influenced by factors such as weather conditions, geopolitical events, and supply-demand dynamics. Investment diversification strategy may allocate a portion of your portfolio to commodities for an added layer of complexity.

2-6. Alternative Investments: Expanding Horizons

Alternative investments encompass a wide range of unconventional assets that don’t fit neatly into traditional categories. This includes hedge funds, private equity, venture capital, and even cryptocurrencies. Alternative investments often have a low correlation with traditional assets, making them attractive for further diversification. However, they come with a unique set of risks and complexities that require in-depth understanding. Investment diversification strategy might explore alternative investments to introduce a unique flavor to your portfolio.

2-7. Creating a Harmonious Symphony

The heart of investment diversification strategy lies in creating a harmonious symphony of these asset classes within your portfolio. The allocation percentages vary based on your risk tolerance, financial goals, and investment horizon. Your portfolio might emphasize stocks for growth, bonds for stability, and other assets for additional layers of diversification. By striking the right balance, you navigate the intricate dance of risk and reward, crafting a portfolio that stands strong against the changing tides of the market.

3. Risks of Not Diversifying Investments

The absence of a robust investment diversification strategy can expose your financial journey to a range of risks that could jeopardize your wealth-building efforts. Imagine a scenario where you pour all your funds into a single investment, hoping for grand returns. While it might seem like a shortcut to success, the reality is far more complex. Let’s delve into the risks associated with not diversifying investments and understand why spreading your bets is a prudent approach.

3-1. Putting All Eggs in One Basket

Investing heavily in a single asset class or individual investment is akin to putting all your eggs in one basket. This lack of diversification leaves your portfolio vulnerable to the performance of a single entity. If that investment stumbles due to unforeseen circumstances – be it a company-specific setback or market turbulence – the repercussions can be severe. Investment diversification strategy recognizes the fragility of this approach and seeks to mitigate such risks by distributing investments across various assets.

3-2. Amplified Impact of Poor Performance

When your portfolio is concentrated in a single investment, the impact of poor performance is magnified. A significant downturn in that particular investment can lead to substantial losses in your overall portfolio. This concentration risk is particularly hazardous in volatile markets, where swift fluctuations can result in rapid value erosion. Investment diversification strategy aims to dilute the impact of such poor performance by spreading investments across assets with differing risk profiles.

3-3. Missed Opportunities for Growth

Failing to diversify investments not only exposes you to risks but also hinders your potential for growth. Different asset classes exhibit varying growth patterns over time. By limiting yourself to a narrow set of investments, you might miss out on lucrative opportunities present in other sectors. The dynamic nature of financial markets means that what’s performing well today might not be the winner tomorrow. Investment diversification strategy seeks to capture growth from multiple sources, ensuring you’re not overly reliant on one avenue.

3-4. The Downside of Emotional Decision-Making

Concentrated portfolios are often more susceptible to emotional decision-making. When a substantial portion of your wealth is tied to a single investment, market fluctuations can trigger anxiety and impulsive actions. Fear of loss or the desire to cash out during periods of uncertainty can lead to irrational decisions that harm your long-term financial prospects. Investment diversification strategy aims to foster a disciplined approach, helping you make informed decisions based on a comprehensive view of your diversified holdings.

3-5. A Comprehensive Shield: Diversification

Incorporating a well-structured investment diversification strategy acts as a comprehensive shield against the vulnerabilities discussed above. Diversification doesn’t eliminate all risks, but it significantly reduces the impact of poor performance in a single investment. By spreading your investments across multiple assets, you create a buffer that cushions your portfolio from extreme swings in any one direction. This risk mitigation approach forms the cornerstone of a prudent and forward-thinking investment strategy.

4. Building a Diversified Investment Portfolio

Crafting a well-structured investment diversification strategy is akin to building a sturdy financial fortress. It’s not about randomly scattering investments; it’s a thoughtful process that aligns with your risk tolerance, financial goals, and market insights. Let’s delve into the steps involved in creating a diversified investment portfolio that safeguards your wealth and maximizes your potential returns.

4-1. Step 1: Know Your Risk Tolerance and Goals

The foundation of any successful investment diversification strategy begins with self-awareness. Understand your risk tolerance – the level of market fluctuations you can comfortably endure – and identify your investment goals. Are you aiming for long-term growth, stable income, or a balance between the two? This knowledge will guide the allocation of assets in your portfolio.

4-2. Step 2: Embrace Asset Allocation

Asset allocation is the heart of a well-structured investment diversification strategy. It involves dividing your investments among various asset classes, such as stocks, bonds, real estate, and commodities. Each asset class carries its risk and return characteristics. By allocating your funds strategically, you create a balanced blend that cushions your portfolio against extreme market swings.

4-3. Step 3: Conservative, Balanced, or Aggressive?

Your investment diversification strategy should mirror your risk appetite. A conservative approach allocates a higher portion to stable assets like bonds and cash, aiming for wealth preservation. A balanced strategy seeks to balance growth with stability, while an aggressive strategy leans heavily toward growth assets like stocks. The key is to strike a balance that aligns with your financial objectives.

4-4. Step 4: Regularly Rebalance Your Portfolio

Markets are dynamic, and over time, your portfolio’s allocation can deviate from your intended targets due to varying asset performance. Regularly rebalancing your portfolio – a critical aspect of your investment diversification strategy – ensures that your asset allocation remains in line with your goals. Selling overperforming assets and buying underperforming ones maintains the desired balance.

4-5. Step 5: The Art of Diversification within Asset Classes

Investment diversification strategy doesn’t end with diversifying across asset classes; it extends within them as well. For instance, within the stock asset class, consider investments in different sectors like technology, healthcare, and finance. This further spreads your risk by reducing concentration within a single sector.

4-6. Step 6: Global Diversification

To truly fortify your portfolio, consider global diversification. Different economies perform independently, and including international investments can shield you from overreliance on one country’s economic health. This broader scope provides insulation against domestic market volatilities and taps into opportunities abroad.

4-7. Step 7: Invest in the Long Haul

Patience is a virtue in the realm of investing. Your investment diversification strategy is designed for the long term. Avoid succumbing to short-term market noise or trying to time the market’s ups and downs. Over extended periods, the power of compounding across diversified assets can yield remarkable results.

4-8. Step 8: Seek Professional Guidance

Crafting an effective investment diversification strategy can be complex, especially for those new to investing. Seeking guidance from financial advisors or experts can provide invaluable insights. They can help tailor a strategy that aligns with your unique financial situation, goals, and risk tolerance.

4-9. A Solid Foundation for Financial Success

Incorporating an effective investment diversification strategy is like constructing a robust financial foundation. It safeguards your wealth from undue risk while positioning you to capitalize on market opportunities. Remember, the key lies in understanding your risk tolerance, embracing asset allocation, and maintaining a disciplined approach that transcends short-term market fluctuations. By adhering to these principles, you’ll pave the way for a resilient and prosperous financial future.

5. Asset Allocation Strategies

Crafting an effective investment diversification strategy requires more than just diversifying your investments across different asset classes. It involves a thoughtful approach to asset allocation – determining the right mix of assets within your portfolio. Your asset allocation strategy should align with your financial goals, risk tolerance, and time horizon. Let’s delve into the various asset allocation strategies and how they contribute to building a resilient investment portfolio.

5-1. Conservative Asset Allocation

A conservative investment diversification strategy prioritizes stability over aggressive growth. Investors who lean towards this approach allocate a significant portion of their portfolio to low-risk assets like bonds and cash equivalents. The aim is to minimize volatility and protect the principal investment. While the potential for high returns might be limited, the focus is on capital preservation, making this strategy suitable for those with a low-risk tolerance and a shorter time horizon.

5-2. Balanced Asset Allocation

A balanced investment diversification strategy strikes a harmonious blend between growth and stability. In this approach, investors allocate their funds across a mix of asset classes, including stocks, bonds, and potentially other alternatives. The goal is to achieve moderate growth while mitigating risk. This strategy is well-suited for those seeking a balance between capital appreciation and wealth preservation. It aligns with individuals with a moderate risk tolerance and a medium- to long-term investment horizon.

5-3. Aggressive Asset Allocation

Investors with a higher risk appetite might opt for an aggressive investment diversification strategy. This approach focuses on maximizing growth potential by allocating a significant portion of the portfolio to higher-risk, higher-reward assets such as stocks. While the potential for substantial returns exists, so does the risk of greater volatility and potential losses. This strategy is ideal for individuals who can tolerate market fluctuations, have a longer investment horizon, and seek to build wealth over the long term.

5-4. The Guideline: Age-Based Allocation

A simple yet useful guideline for structuring your investment portfolio is based on your age. To determine the allocation, subtract your age from 110. For a more aggressive approach, you can subtract from 120, and for a conservative stance, use 100. The resulting percentage represents the portion to invest in stocks, with the remainder allocated to bonds. For instance, if you’re 30 years old, you might invest between 70% to 90% in stocks and the remaining 10% to 30% in bonds.

Using Table 8-4 for Allocation

| Your Investment Attitude | Bond Allocation (%) | Stock Allocation (%) |

|---|---|---|

| Play it safer | = Age | = 100 – age |

| Middle-of-the-road | = Age – 10 | = 110 – age |

| Aggressive | = Age – 20 | = 120 – age |

If you fall into the middle-of-the-road category, appreciating growth while avoiding excessive risk, this table can guide your allocation. For example, if you’re 40 years old, a suitable allocation might be 30% in bonds (40 – 10) and 70% in stocks (110 – 40), providing a balanced approach to your investment mix.

5-5. Long-Term Discipline Matters

Regardless of the chosen investment diversification strategy, one key principle remains constant – discipline. It’s easy to get swayed by short-term market movements or emotional impulses. However, successful investing is a marathon, not a sprint. Stay committed to your chosen asset allocation strategy, resist the urge to make impulsive changes, and regularly review and rebalance your portfolio to ensure it aligns with your goals.

5-6. A Strategy Tailored to You

Selecting the right investment diversification strategy depends on your individual financial situation, goals, risk tolerance, and time horizon. It’s essential to understand the nuances of each strategy and seek professional guidance if needed. Remember, the goal is to create a portfolio that not only reflects your financial aspirations but also provides a robust defense against market turbulence. By aligning your asset allocation strategy with your unique circumstances, you’ll be well on your way to achieving your financial goals.

6. Risk Management through Diversification

A well-crafted investment diversification strategy serves as a powerful tool for managing risk within your investment portfolio. Diversification acts as a shield against the inherent volatility of financial markets, helping you navigate the ups and downs with more confidence. Let’s explore how effective diversification minimizes risk and contributes to the overall stability of your investment journey.

6-1. Spreading Risk Across Asset Classes

The heart of any investment diversification strategy lies in spreading risk across different asset classes. By allocating your funds to a mix of stocks, bonds, real estate, and other assets, you ensure that poor performance in one area doesn’t translate to catastrophic losses for your entire portfolio. This intelligent spreading of risk reduces the impact of negative events on your investments, making your financial journey smoother.

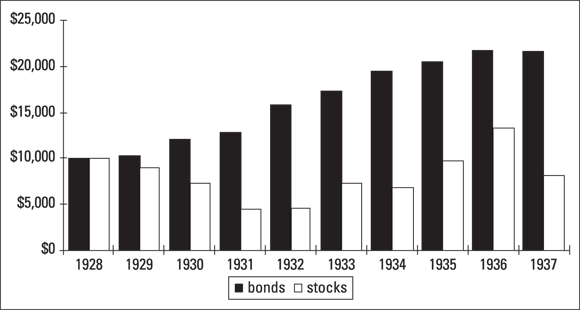

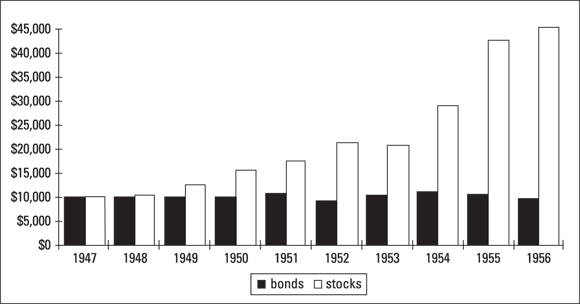

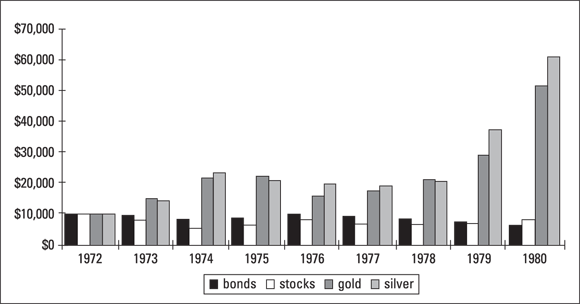

Historical data, represented in Figures – 1, 2, and 3, demonstrate how diversification can mitigate risk. Different investments have performed better during different economic environments and time periods. These examples highlight the value of having a diversified portfolio to navigate various market conditions.

Remember that regardless of who someone works for or their professional qualifications, there’s no assurance of guaranteed returns on an investment. While conducting thorough research and perhaps encountering fortunate outcomes is possible, it’s crucial to acknowledge that everyone is susceptible to the possibility of experiencing financial losses.

6-2. Cushioning Market Volatility

Financial markets are notorious for their unpredictable fluctuations. However, a diversified portfolio is better equipped to handle market volatility. When certain asset classes experience downturns, others may remain stable or even thrive. For instance, during an economic downturn, bonds might provide a buffer against losses incurred in the stock market. This cushioning effect softens the blow and provides a level of stability.

6-3. Mitigating Company-Specific Risks

Beyond market-wide fluctuations, investment diversification strategies also help mitigate company-specific risks. If you’ve heavily invested in a single company’s stock, the consequences of that company’s poor performance can be dire. Diversification helps you avoid such concentrated risk by spreading your investments across various companies and industries. This way, the failure of one company doesn’t disproportionately affect your overall portfolio.

6-4. Unforeseen Events and Black Swans

Black swan events – unforeseen and rare occurrences with significant impact – can send shockwaves through the financial world. While such events are challenging to predict, a diversified portfolio can provide a degree of protection. By holding assets that react differently to various events, you reduce your vulnerability to being blindsided by the unexpected. This aspect of diversification enhances your portfolio’s resilience.

6-5. Achieving Consistent Returns

One of the most appealing aspects of an effective investment diversification strategy is its ability to deliver consistent returns over time. While some investments may experience fluctuations, a diversified portfolio generally remains on a more even keel. The concept of “not putting all your eggs in one basket” extends to the idea of not relying solely on the success of a single investment. Consistency in returns is a hallmark of a well-diversified portfolio.

6-6. Case Study: Weathering the Storm

Consider a case study where an investor had a portfolio heavily concentrated in technology stocks during the dot-com bubble burst of the early 2000s. As technology stocks plummeted, the portfolio suffered significant losses. Now, imagine the same investor had diversified their portfolio to include other sectors like healthcare, consumer goods, and real estate. While the technology sector decline would still have an impact, the diversified portfolio’s losses would have been significantly mitigated by the other holdings.

6-7. The Essence of Risk Reduction

In essence, the core principle of risk management through investment diversification strategies is reducing the impact of negative events on your financial well-being. While diversification doesn’t eliminate risk entirely, it provides a layer of protection that can be instrumental during turbulent times. By strategically allocating your funds across a range of assets, you build a sturdy fortress that guards your wealth and helps you stay on course towards your financial goals.

7. Global Diversification

In a world where financial markets are interconnected like never before, the concept of global diversification has gained substantial traction within the realm of investment strategies. The idea is simple yet powerful: instead of confining your investments within the borders of a single country, you cast a wider net across international markets. This approach introduces a new layer of complexity to your investment diversification strategy, but it also offers unique advantages that can significantly impact your portfolio’s resilience and potential for growth.

7-1. The Advantages of Going Global

Global diversification serves as a countermeasure against the risks associated with being heavily dependent on the economic health of a single nation. Different countries often exhibit varying economic cycles, political landscapes, and market behaviors. By investing in multiple regions, you mitigate the impact of localized downturns. When one market experiences a setback, others might be on an upswing, thus reducing the overall volatility of your portfolio.

7-2. Embracing Uniqueness and Opportunity

Each country brings its own set of industries, resources, and innovations to the global market. By investing globally, you gain exposure to sectors that might not even exist in your home country. For instance, a technology enthusiast in the United States might find promising opportunities in Asian tech giants. This diversity of assets allows you to capitalize on emerging trends and capitalize on unique growth potential.

7-3. Considerations for Global Diversification

While global diversification offers enticing benefits, it’s important to approach it with a well-informed strategy. Factors such as currency exchange rates, political stability, and regulatory environments can significantly impact your investments. Conduct thorough research on the countries you’re considering and analyze their market trends. It’s also prudent to consult with financial experts who have a deep understanding of international markets.

7-4. Implementing Global Diversification

Incorporating global assets into your portfolio can be achieved through various avenues. International mutual funds, exchange-traded funds (ETFs), or even purchasing shares of foreign companies directly on international stock exchanges are common approaches. These instruments allow you to access a diverse array of assets from different countries without the complexities of navigating foreign markets individually.

7-5. Achieving Balance in Global Exposure

While global diversification offers numerous advantages, it’s important to strike a balance. Overexposure to international markets can expose you to currency risk and political uncertainties. Therefore, consider your risk tolerance and investment goals when determining the extent of global exposure you’re comfortable with. A harmonious blend of domestic and international assets can create a well-rounded portfolio.

7-6. Broadening Your Investment Horizons

As financial markets continue to evolve and integrate across borders, the merits of global diversification become increasingly evident. This strategy aligns with the dynamic nature of our interconnected world and positions your portfolio to benefit from the strengths of multiple economies. However, like any investment decision, global diversification demands careful research, strategic planning, and a long-term outlook. By broadening your investment horizons beyond your home country, you embrace the potential for enhanced stability and growth within your overarching investment diversification strategy.

8. The Dilemma of Lump Sum Investments

When faced with a substantial sum of money to invest, whether it’s from years of savings, an inheritance, or recent earnings, the decision can be overwhelming. While it’s a fortunate problem to have, the challenge lies in deciding how to best utilize these funds. The prospect of investing a significant lump sum all at once can evoke unease and uncertainty.

8-1. Taking a Prudent Approach

If your money currently resides in a savings or money-market account, you might feel the urge to put it to work immediately. However, rushing into an investment without careful consideration is not advisable. Earning a modest return in a money-market account is reasonable, especially when compared to the risk of potentially losing a substantial portion of your investment. Taking a patient approach is essential, and you should resist the pressure to make rapid decisions.

8-2. The Concept of Dollar-Cost Averaging (DCA)

One method that can help ease the process of investing a lump sum is called dollar-cost averaging (DCA). With DCA, you gradually invest your funds in equal portions at regular intervals, such as monthly. For instance, if you have $100,000 to invest, you could allocate $4,000 per month over a couple of years. During this time, the funds not yet invested can earn interest in a money-market account.

8-3. The Advantages and Drawbacks of DCA

DCA offers a valuable advantage by allowing you to enter the market incrementally, avoiding the risk of investing everything at a potentially unfavorable moment. If the value of your chosen investment drops after your initial purchases, DCA lets you buy more at lower prices. Conversely, the downside is that if your investment appreciates rapidly, you might regret not investing the entire sum sooner. Moreover, committing to DCA might lead to uncertainty when the investment value decreases continuously, causing doubts about its potential.

8-4. Making DCA Work for You

DCA can be particularly beneficial when dealing with a substantial portion of your total assets. Consistency is key, so establish an automatic investing schedule to ensure you stick to your plan, even in times of market volatility. Automatic investing services offered by recommended investment firms can simplify this process and minimize the chances of second-guessing your decisions.

8-5. Embracing Prudent Investing for Long-Term Success

Facing the challenge of investing in a lump sum requires careful consideration. The concept of dollar-cost averaging provides a methodical way to approach this task, allowing you to gradually invest while minimizing the risks associated with market fluctuations. While DCA has its advantages, it’s essential to remain mindful of its drawbacks and tailor your strategy to your financial goals. By maintaining a disciplined approach and making informed decisions, you can make the most of your lump sum investment while mitigating potential pitfalls.

9. Periodic Portfolio Review

In the dynamic world of investments, where market conditions can change swiftly, the importance of a periodic portfolio review cannot be overstated. As an integral component of your investment diversification strategy, regular assessments of your portfolio’s performance and alignment with your goals ensure that you’re on track to achieve the desired outcomes. This strategic practice empowers you to make informed decisions, capitalize on emerging opportunities, and maintain the optimal balance between risk and reward.

9-1. The Rationale Behind Reviewing

Market fluctuations, economic shifts, and changes in your personal circumstances can all impact the effectiveness of your investment diversification strategy. A periodic portfolio review offers you a chance to recalibrate your investment mix based on these evolving factors. It’s a proactive approach that prevents your portfolio from becoming outdated and misaligned with your goals over time.

9-2. Recommended Frequency of Reviews

The frequency of your periodic portfolio reviews depends on your specific situation and goals. For many investors, conducting a review annually is a reasonable starting point. However, major life events such as marriage, having children, or nearing retirement might necessitate more frequent assessments. Remember that the aim is not to micromanage your investments, but rather to ensure they remain in sync with your evolving financial journey.

Avoid the temptation to tinker with your investment portfolio on a daily, weekly, or monthly basis. Instead of reacting to short-term market fluctuations, consider rebalancing your holdings every one to three years to maintain your desired asset allocation. Frequent trading in pursuit of quick gains can lead to subpar long-term returns.

9-3. The Rebalancing Act

One of the primary purposes of a periodic portfolio review is to rebalance your investments. Over time, the value of different assets within your portfolio can shift, leading to an unintended allocation that deviates from your original plan. Rebalancing involves selling some of the assets that have grown significantly and reallocating the proceeds to assets that may have underperformed. This disciplined approach ensures that your risk exposure remains in check and your portfolio maintains its intended risk-reward profile.

9-3-1. The Illusion of Chasing Winners

When an investment gains sudden and widespread attention due to its remarkable performance, it’s crucial to exercise caution. A steep rise in an investment’s price often indicates the risk of it being overvalued. Resist the urge to follow the crowd and remember that chasing winners can lead to disappointment over time.

Learning from Past Trends. The late 1990s witnessed the meteoric ascent of technology stocks, captivating investors’ interest. However, not all technology stocks were wise choices. Investing without thorough research led some individuals to suffer significant losses when the technology bubble burst in the early 2000s. A comprehensive evaluation is essential.

9-3-2. Embracing Opportunities Amidst Decline.

During periods of market downturns, panic can drive investors to sell their holdings, missing out on valuable opportunities. Straying from your asset allocation plan due to fear can be detrimental. When stocks face losses, it’s often a chance to acquire valuable assets at discounted prices.

The Courage to Defy the Herd. While people revel in buying items on sale, a similar approach should be applied to investing during market downturns. Unfortunately, many investors tend to flee during market corrections instead of seizing the chance to make astute investments. Displaying courage by not succumbing to herd mentality can lead to advantageous outcomes.

9-4. Empowering Your Investment Journey

A well-executed periodic portfolio review is a cornerstone of a successful investment diversification strategy. By taking the time to assess your investments, realign your allocation, and stay informed about market dynamics, you empower yourself to navigate the complex landscape of investments with confidence. Remember that your investment journey is a marathon, not a sprint, and regular reviews ensure that you’re always heading in the right direction towards your financial aspirations.

10. Long-Term Perspective

In the world of investing, adopting a long-term perspective is akin to harnessing the power of compounding – a force that can exponentially grow your wealth over time. When integrated into your investment diversification strategy, this approach not only tempers short-term fluctuations but also capitalizes on the inherent strength of diversified investments to generate substantial gains in the long run.

10-1. Embracing the Journey of Compounding

At the heart of the long-term perspective lies the principle of compounding. This financial phenomenon allows your investments to earn returns not only on the original principal but also on the accumulated gains. Over time, this compounding effect snowballs, amplifying your investment’s growth potential. When you integrate investment diversification strategy into the equation, you’re essentially multiplying the channels through which compounding can work its magic.

10-2. Navigating Through Market Volatility

Market volatility is an unavoidable aspect of investing. Prices can surge and plummet in response to various factors, from economic data to geopolitical events. A long-term perspective provides a shield against knee-jerk reactions to these fluctuations. By focusing on the bigger picture and the enduring strength of diversified investments, you’re better equipped to weather the storm of short-term volatility.

10-3. The Power of Patience

A long-term perspective is grounded in patience. Instead of seeking instant gratification, you acknowledge that building substantial wealth takes time. This mindset encourages you to stay the course even when faced with challenges or periods of underperformance. With a well-crafted investment diversification strategy, you have a roadmap that guides you through these inevitable phases, reminding you of the long-term goals that you’re striving to achieve.

10-4. Cultivating Wealth Over Generations

Perhaps one of the most compelling aspects of a long-term perspective within an investment diversification strategy is its potential to benefit not just you, but also future generations. By consistently reinvesting gains and letting them compound over extended periods, you’re laying the foundation for a lasting legacy. Your prudent approach today can have a positive ripple effect that transcends your own lifetime.

10-5. The Counterbalance to Short-Term Noise

In a world saturated with news, opinions, and market commentary, it’s easy to get swayed by short-term noise. A long-term perspective acts as a counterbalance to this inundation. It reminds you to focus on the core tenets of your investment diversification strategy, the strength of diversified portfolios, and the overarching goals you’ve set, rather than being derailed by transient market chatter.

10-6. Sowing Seeds of Financial Success

As you embark on your investment journey, remember that adopting a long-term perspective within your investment diversification strategy is akin to planting seeds of financial success. By nurturing your investments over time, staying resilient in the face of market fluctuations, and leveraging the power of compounding, you’re not only building wealth but also fortifying your financial future. Embrace the journey with patience, and let the rewards of your well-crafted strategy flourish over the years to come.

11. Conclusion

In the world of investing, where uncertainty is a constant companion, an investment diversification strategy emerges as a beacon of resilience. Through thoughtful allocation across various asset classes, you build a fortress that guards against the fickle whims of the market. The journey is continuous, marked by periodic assessments and strategic recalibrations. As you navigate through the landscape of investments, remember that diversification isn’t a mere strategy; it’s a philosophy that empowers you to craft a stable and prosperous financial future.

12. FAQs

12-1. What is an investment diversification strategy?

An investment diversification strategy is a methodical approach to spreading your investments across various asset classes to manage risk and enhance stability in your portfolio. By allocating funds to different types of investments such as stocks, bonds, real estate, and more, you aim to reduce the impact of poor performance in one area on your overall financial well-being.

12-2. Why is an investment diversification strategy important?

An investment diversification strategy is crucial because it helps safeguard your investments against the inherent volatility of financial markets. By not putting all your eggs in one basket, you’re less susceptible to catastrophic losses caused by a downturn in a single sector. Diversification serves as a shield against market fluctuations and unexpected events, contributing to the longevity and consistency of your returns.

12-3. How does investment diversification strategy mitigate risks?

An investment diversification strategy mitigates risks by spreading your investments across different asset classes, industries, and geographic regions. This strategy ensures that the poor performance of one investment doesn’t have a disproportionately negative impact on your entire portfolio. It cushions market volatility, helps navigate company-specific risks, and even offers protection against unforeseen events or “black swan” occurrences.

12-4. What are the key components of a successful investment diversification strategy?

A successful investment diversification strategy involves spreading your investments across a mix of asset classes, such as stocks, bonds, real estate, and potentially others. It’s important to consider global diversification as well, by investing in different countries and regions. Regular portfolio reviews and rebalancing are also essential to ensure that your investments align with your goals and risk tolerance over time.

12-5. How can I implement an investment diversification strategy effectively?

Implementing an investment diversification strategy effectively involves careful research and planning. Start by determining your financial goals, risk tolerance, and time horizon. Then, allocate your funds across different asset classes and industries based on your objectives. Consider using investment vehicles like mutual funds, ETFs, or individual stocks and bonds to achieve diversification. Regularly review your portfolio to maintain its alignment with your goals and make adjustments as needed.

13. Case Study

Meet Matt, a 50-year-old male writer who has spent years crafting engaging narratives. With a stable income of $80,000 annually from his writing endeavors, Matt enjoys delving into the world of literature and financial exploration.

His love for his family is evident as he supports his wife and two children with a comfortable lifestyle. Matt’s yearly expenses average around $60,000, leaving room for savings and investments.

13-1. Current Situation

In early 2020, Matt’s portfolio primarily consisted of technology stocks, representing 80% of his total investments. The booming tech sector had rewarded him handsomely, with an average annual return of 20%. Matt’s investment projects included stocks, real estate, and fixed deposits, with a total portfolio value of $400,000.

13-2. Conflict Occurs

As the COVID-19 pandemic spread globally, financial markets plunged into uncertainty. By mid-2020, Matt’s technology-heavy portfolio had incurred losses of over 30%, reducing his portfolio’s value to $280,000. The emotional toll was substantial as Matt grappled with anxiety and frustration over his financial situation.

13-3. Problem Analysis

The pandemic’s impact highlighted a significant flaw in Matt’s investment strategy: his lack of diversification. His heavy reliance on the technology sector amplified his losses during the crisis. The problem stemmed from the fact that 80% of his portfolio was concentrated in a single asset class.

13-4. Solution

In response, Matt decided to adopt a well-structured investment diversification strategy. He reallocated his investments, aiming for a more balanced asset allocation ratio. He moved 40% of his portfolio into healthcare stocks, bonds, and real estate projects. This adjustment was based on thorough research, with a focus on managing risk and potential returns.

13-5. Effects After Execution

Over the following year, Matt’s investment diversification strategy began to bear fruit. While his technology stocks continued to recover, his diversified investments provided stability. His healthcare stocks yielded an average annual return of 15%, bonds contributed 7%, and real estate appreciated by 10%. This strategic diversification mitigated the overall impact of the crisis on his financial well-being.

13-6. In Conclusion

Matt’s experience underscores the importance of a comprehensive investment diversification strategy. Through careful planning and calculated risk management, he was able to weather the storm brought about by the pandemic. His portfolio rebounded to a total value of $320,000, showcasing the power of diversification. Matt’s story serves as a valuable lesson in adapting to unforeseen challenges and building a resilient financial future.

14. Checklist

| Questions | Your Reflections | Suggested Improvement Strategies | Improvement Plans | Implementation Results | Review & Adjust |

| How well have I diversified my investment portfolio? | Research different asset classes and their potential returns and risks. | ||||

| Am I overly reliant on a specific industry or sector? | Analyze my portfolio’s allocation and identify any concentration risks. | ||||

| Have I considered global diversification in my investments? | Explore opportunities in international markets and their potential impacts. | ||||

| Do I have a clear plan for periodic portfolio reviews? | Establish a schedule for regular portfolio assessments and rebalancing. | ||||

| What is my reaction to short-term market fluctuations? | Evaluate my emotional response and how it influences my investment decisions. | ||||

| Am I aligning my investments with my long-term financial goals? | Reflect on whether my investments are contributing to my overall objectives. | ||||

| Have I implemented a diversified strategy to manage financial risks? | Take steps to allocate investments across various assets to reduce risks. |