Investing wisely is a fundamental step toward achieving financial prosperity. Wealth building is not a sprint but a marathon, requiring deliberate strategies and a commitment to long-term goals. One of the most powerful avenues for wealth accumulation is through investing in stocks. In this article, we’ll explore the ins and outs of stock investing and how it can contribute to your journey of building lasting wealth.

Outline

- Understanding Wealth Building

- The Power of Stock Investments

- Getting Started with Stock Investing

- Mutual Funds and Exchange-Traded Funds

- Exploring the Landscape Beyond Stocks

- Drawbacks of Investing in Individual Stocks

- Key Principles for Successful Stock Investing

- Conclusion

- FAQs

- Case Study

- Checklist

Reading time: 26 minutes

1. Understanding Wealth Building

Wealth building involves systematically growing your assets over time, leading to financial security and independence. Unlike saving, which involves setting aside money, investing puts your money to work. This difference is pivotal, as investments have the potential to earn returns that outpace inflation. A cornerstone of wealth building is understanding the distinction between short-term gratification and the long-term benefits that come from consistent investment efforts.

At the heart of successful wealth building is the concept of compounding. This phenomenon allows your money to earn returns, and then those returns themselves earn returns, creating a snowball effect over time. The earlier you start investing, the more time your investments have to compound and multiply, making compounding an essential element in achieving significant financial growth.

2. The Power of Stock Investments

In the vast landscape of investment options, stocks shine as a beacon of potential, capable of generating substantial returns. While they do come accompanied by higher levels of risk compared to some alternative assets, their unparalleled potential for growth has positioned them as a cornerstone of wealth building strategies. Delving deeper into the dynamics of stock investments, we uncover the historical evidence and strategic considerations that make them a favored choice for long-term wealth accumulation.

2-1. Stock Market Performance: A Historical Advantage

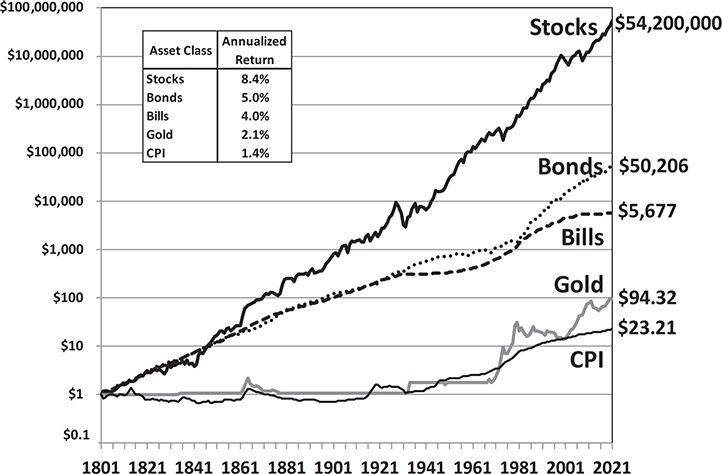

The allure of stock investments is grounded in their historical track record of outperformance. Over extended periods, the stock market has demonstrated a remarkable ability to surpass the returns generated by other asset classes. This historical advantage isn’t a mere coincidence; it’s a testament to the inherent dynamics that fuel the growth potential of stocks.

FIGURE-1 Total nominal return indexes, 1802–2021

2-1-1. Triumph Over Time

Historical data attests to the resilience and growth trajectory of the stock market. Through numerous economic cycles, market fluctuations, and global events, stocks have consistently demonstrated their capacity to rebound and thrive. This triumph over time is a reflection of the underlying businesses that stocks represent—businesses that innovate, adapt, and contribute to the progress of economies.

2-2. Ownership in Innovators and Growth Engines

At the heart of stock investing lies the opportunity to be a part-owner in companies that possess the potential to innovate and thrive. Unlike passive investments, such as bonds, stocks offer an active stake in companies that are shaping industries and driving progress. This ownership extends beyond mere financial interest; it aligns investors with the growth and success of the companies they invest in.

2-2-1. A Role in Innovation

By investing in stocks, you become a participant in the innovation and growth endeavors of companies. Your capital supports research, development, expansion, and innovation—elements that fuel the ascent of companies in competitive landscapes. This alignment with innovation sets stocks apart from more static investment options.

2-2-2. The Growth Potential Paradigm

Stocks possess an inherent growth potential that can lead to significant gains for investors. As companies thrive and execute successful strategies, their stock prices have the capacity to surge substantially. This upward trajectory of stock prices is an embodiment of the cumulative efforts and successes of the companies in which you hold ownership.

2-3. Companies Going Public: The Stock Issuance

The journey of stock investments often commences when companies make the decision to go public. Through this process, companies issue shares of their ownership to the public, enabling individuals like you to become shareholders. These shares are made available on major stock exchanges, the likes of the New York Stock Exchange and NASDAQ. The accessibility of these exchanges transforms ordinary individuals into investors who hold a stake in the companies shaping the economic landscape.

2-3-1. Stock Prices and Economic Growth

Stock investments are intrinsically tied to the health and trajectory of companies and the broader economy. As companies flourish and the economy expands, stock prices tend to ascend in response to increased profitability and positive market sentiment. This ascent is accompanied by dividends, which represent a portion of a company’s profits distributed to shareholders.

2-3-2. The Intricate Relationship

The relationship between stock prices, dividends, and company earnings is a key pillar of understanding wealth building strategies through stock investments. At its core, this relationship underscores the alignment between company performance and investor returns. This interplay manifests in the price/earnings ratio (P/E ratio), a metric that gauges the relation between stock prices and company earnings.

2-3-3. Decoding the P/E Ratio

The P/E ratio is a crucial tool for investors seeking insights into the valuation of stocks. On average, U.S. stocks maintain a P/E ratio of around 15. This ratio signifies that stock prices are approximately 15 times the earnings per share. While stock prices and dividends don’t mirror earnings with absolute precision, their close correlation accentuates the substantial impact of a company’s financial performance on shareholder value.

2-3-4. Performance Consistency and Long-Term Returns

The enduring nature of the relationship between stock prices, dividends, and earnings underscores the consistency of performance that characterizes wealth building strategies rooted in stock investments. While short-term fluctuations can influence stock prices, the long-term trajectory is heavily influenced by a company’s ability to sustain and enhance its earnings over time. This resilience lends itself to stable dividend payouts and the potential for investors to reap substantial returns.

2-4. Industry Diversity and Market Capitalization

Companies from diverse sectors and industries partake in the stock market, underscoring the inclusivity and breadth of investment opportunities. From technology titans to hospitality establishments, the scope of companies issuing stocks spans a vast spectrum.

2-4-1. Market Capitalization as a Gauge

The concept of market capitalization serves as a pivotal gauge in the world of stock investments. Calculated by multiplying the total shares of a company by its market price per share, market capitalization categorizes companies as large cap or small cap. This classification facilitates an understanding of a company’s scale and size within the market landscape.

2-4-2. Large Cap and Small Cap Distinctions

The classification of companies as large cap or small cap is more than just a labeling exercise; it offers insights into the potential for growth and risk. Large cap companies, with substantial market capitalization, often denote established entities with a history of stability. On the other hand, small cap companies, characterized by smaller market capitalization, typically carry higher growth potential but also entail increased risk.

2-5. Navigating Market Volatility

Stock investments operate within the realm of market volatility, where prices can experience rapid fluctuations over shorter periods. This volatility is a natural characteristic of markets and is influenced by a multitude of factors, including economic indicators, geopolitical events, and investor sentiment. Understanding and effectively navigating this volatility is integral to maximizing the potential of stock investments.

2-5-1. The Crucial Role of Long-Term Perspective

The propensity for short-term market fluctuations necessitates a strategic approach that prioritizes a long-term perspective. Stock investments, geared towards wealth building, thrive under the umbrella of a patient and enduring outlook. The impacts of short-term market swings often pale in comparison to the upward trajectory that stocks can experience over extended periods.

2-5-2. Weathering the Storms

Market ups and downs are an intrinsic aspect of stock investing. It’s important to recognize that these fluctuations are temporary and are often dwarfed by the broader trend of growth exhibited by stocks. This resilience underscores the importance of remaining steadfast in the face of market turbulence and aligning investment decisions with long-term objectives.

2-6. In Conclusion

The power of stock investments transcends mere financial transactions; it embodies the potential for substantial growth, ownership in innovation, and active participation in the dynamic world of commerce. While the path may be characterized by volatility, the historical advantage, growth potential, and alignment with long-term goals make stocks a formidable tool in wealth-building strategies. By adopting a patient and strategic approach, investors can harness the power of stocks to propel their financial journey toward lasting prosperity.

3. Getting Started with Stock Investing

Embarking on the journey of stock investing requires more than just capital; it demands preparation and knowledge. As you step into this dynamic realm, research emerges as your most trusted ally. This phase is a pivotal juncture where familiarizing yourself with investment concepts, different vehicles, and the foundational principles of the stock market lays the groundwork for informed decision-making. Equipped with this knowledge, you’re poised to navigate the complexities of stock investments with confidence and strategic acumen.

3-1. The Knowledge Arsenal

Your foray into stock investing begins by arming yourself with a comprehensive knowledge arsenal. This journey involves acquainting yourself with a host of concepts and components that define the world of investments. As you delve into this wealth of information, you uncover the building blocks that facilitate your engagement in wealth-building strategies through stock investments.

3-1-1. Grasping Investment Concepts

Investment concepts span a spectrum that ranges from risk and return to portfolio diversification. Understanding these concepts empowers you to make strategic choices that align with your financial goals and risk tolerance. The interplay between risk and return, for instance, guides your decisions regarding the balance between potential gains and acceptable risk levels.

3-1-2. Exploring Investment Vehicles

Stock investing isn’t a solitary pursuit; it exists within a constellation of investment vehicles. Exploring these options, such as mutual funds, ETFs, and bonds, provides you with a panoramic view of the diverse ways to channel your capital. Each investment vehicle possesses distinct characteristics, risk profiles, and potential returns, enabling you to tailor your portfolio to your unique preferences.

3-2. The Dichotomy of Investment Choices

When it comes to stock investing, a crucial decision looms: choosing between individual stocks and exchange-traded funds (ETFs). This choice defines the nature of your ownership and the degree of diversification you attain.

3-2-1. The Individual Stock Odyssey

Individual stocks offer a direct link to specific companies, allowing you to become a direct shareholder. The allure of individual stocks lies in the potential for substantial gains tied to the fortunes of specific companies. However, this path also carries a higher degree of risk, as the success of your investment hinges on the performance of a single entity.

3-2-2. Embracing ETFs: Instant Diversification

Exchange-traded funds (ETFs) usher in a different approach, characterized by diversification. These funds provide exposure to a collection of stocks, spanning various industries and sectors. This diversified portfolio inherently reduces the risk associated with investing in a single company. For beginners, ETFs often serve as a strategic starting point, offering an accessible way to engage in stock investments while mitigating the impact of individual company volatility.

3-3. The Role of the Brokerage Account

With knowledge in hand and investment preferences defined, the next step is setting up a brokerage account. This financial conduit serves as the gateway to the stock market, enabling you to buy, sell, and hold stocks.

3-3-1. Navigating the Brokerage Landscape

Selecting a reputable brokerage is paramount. Your chosen brokerage should align with your investment objectives and offer user-friendly tools and resources. The interface provided by the brokerage is a pivotal aspect, as it influences your ability to execute transactions and monitor your investments with ease.

3-3-2. The Trading Know-How

Familiarity with trading basics augments your capabilities as a stock investor. Concepts such as market orders and limit orders are foundational to effective trading. Market orders facilitate the immediate purchase or sale of stocks at the prevailing market price, while limit orders enable you to set specific price thresholds for buying or selling, granting you a greater degree of control over your transactions.

3-4. In Conclusion

The journey of stock investing begins with education, exploration, and strategic choices. Equipped with knowledge, you’re empowered to navigate the diverse landscape of investment concepts and vehicles. Whether you opt for individual stocks or embrace the diversification of ETFs, your chosen path defines your investment journey. Through a well-chosen brokerage, you gain access to the stock market and the tools needed to execute transactions proficiently. With the basics of trading under your belt, you’re primed to embark on the exciting voyage of stock investing, armed with a solid foundation and a roadmap to guide your wealth building strategies.

4. Mutual Funds and Exchange-Traded Funds: Your Path to Diversification

As you embark on your wealth-building strategies through stock investing, the choice between individual stock selection and relying on mutual funds or exchange-traded funds (ETFs) presents itself. These investment vehicles serve as bridges to the world of professional money management and diversified portfolios, catering to the varied preferences of investors seeking different risk levels and potential returns.

4-1. Mutual Funds: The Expert Management Advantage

Mutual funds emerge as a strategic option for investors who seek expert guidance and diversified exposure to the stock market. These funds are managed by professional money managers who are well-versed in the intricacies of the market. The core appeal of mutual funds lies in their ability to provide cost-effective access to these seasoned managers.

4-1-1. The Diverse Spectrum of Risk and Returns

One of the striking features of mutual funds is their capacity to cover a wide spectrum of risk and returns. These funds span the gamut from conservative money-market funds to more aggressive stock funds. As an investor, this allows you to tailor your investment strategy to your risk tolerance and financial goals. Whether you’re seeking stability or growth, there’s likely a mutual fund that aligns with your aspirations.

4-1-2. The Magic of Diversification

Diversification, a fundamental principle of investment, is amplified through mutual funds. By pooling resources from multiple investors, mutual funds amass a diverse collection of stocks. This diversity mitigates the risk associated with investing in individual stocks. A single stock’s underperformance is balanced by the potential outperformance of others, leading to a more consistent and stable portfolio.

4-2. Exchange-Traded Funds: Where Flexibility Meets Diversification

Exchange-traded funds (ETFs) present an intriguing alternative to traditional mutual funds. Similar in concept, ETFs also offer exposure to a diversified portfolio of stocks. However, they boast a unique characteristic—their trading flexibility, reminiscent of individual stocks.

4-2-1. The Index-Tracking Advantage

ETFs track specific indexes, reflecting the performance of a particular market or industry. This index-tracking feature offers investors a convenient way to gain exposure to the broader market without needing to select individual stocks. It also aligns with the principle of diversification, as these funds encompass a range of companies within the index.

4-2-2. The Trading Dance

The trading flexibility of ETFs is a defining trait. Unlike mutual funds, which are priced at the end of the trading day, ETFs can be bought and sold throughout the trading day, much like individual stocks. This real-time trading capability empowers investors to respond swiftly to market developments and execute transactions when opportunities arise.

4-2-3. The Diversity Advantage

ETFs derive their strength from diversity. By pooling resources from various investors, ETFs construct portfolios that span multiple asset classes, sectors, and industries. This diversification minimizes risk by reducing vulnerability to the fluctuations of any single asset, offering a more stable foundation for wealth building.

4-2-4. The Ease of Entry

Investing in ETFs is accessible and straightforward. With a single ETF investment, you gain exposure to a broad range of underlying assets. This convenience eliminates the need for individual stock selection and lowers the barrier to entry for novice investors seeking a comprehensive portfolio.

4-3. Making the Right Choice

The decision between mutual funds and ETFs hinges on your investment objectives, risk tolerance, and trading preferences. Mutual funds shine as the vehicle for those seeking professional money management and the benefits of diversification. On the other hand, ETFs cater to investors who value real-time trading flexibility while still reaping the rewards of a diversified portfolio.

4-3-1. The Dual Edge of Diversification

Both mutual funds and ETFs serve as conduits to diversification. This strategy’s power cannot be overstated—it allows you to spread your investments across multiple companies and sectors, reducing vulnerability to the volatility of a single stock. Whether you opt for mutual funds’ guided approach or ETFs’ dynamic trading, diversification remains a guiding light on your investment journey.

4-4. In Conclusion

Mutual funds and ETFs stand as gateways to a diversified investment journey, each offering its own blend of advantages. While mutual funds provide access to expert money managers and a range of risk-return profiles, ETFs combine diversification with real-time trading flexibility. Your choice between these vehicles depends on your investment philosophy and priorities. Regardless of your preference, both options underscore the vital principle of diversification, supporting your pursuit of long-term wealth building strategies through stock investing.

5. Exploring the Landscape Beyond Stocks

Diversifying your investment portfolio extends beyond the realm of individual stock selection. Alternative options beckon, each with distinct characteristics and potential benefits. These options offer investors a spectrum of possibilities, each tailored to specific preferences and objectives.

5-1. Navigating Complexity: Hedge Funds on the Horizon

Hedge funds emerge as a sophisticated option, tailored for wealthier investors seeking unique investment strategies. While offering potential for enhanced returns, hedge funds demand careful consideration due to their elevated risk and cost profile.

5-1-1. Unpacking the Risk-Reward Equation

Hedge funds operate on strategies that aim to generate returns regardless of market conditions. These strategies, often involving complex financial instruments, can yield substantial profits. However, the same complexity contributes to heightened risk, as misjudgment or unexpected market shifts can lead to losses. It’s crucial to align your risk tolerance with the nature of hedge fund investments.

5-1-2. The Financial Landscape of Hedge Funds

Investing in hedge funds requires more than financial commitment; it demands substantial capital. Moreover, hedge funds typically carry higher management fees compared to traditional investment vehicles. These fees, often a percentage of assets under management and a portion of gains, impact overall returns. Considering the financial implications is essential when evaluating hedge fund viability.

5-2. Professional Management: Managed Accounts at Your Fingertips

Managed accounts, offered through brokerage firms, extend the opportunity for investors to tap into the expertise of professional money managers. While aligning with the essence of mutual funds, managed accounts often come with distinct features and implications.

5-2-1. The Expertise Advantage

Managed accounts grant access to investment professionals who craft and manage portfolios tailored to specific risk profiles and financial goals. This expertise guides the selection of assets and allocation strategies, potentially enhancing the performance of your investments.

5-2-2. The Fee Consideration

While managed accounts offer the advantage of professional management, they also entail higher fees compared to other investment avenues. These fees can impact your overall returns, necessitating a careful evaluation of the benefits gained through expert management.

5-3. Weighing the Options: A Path Forward

As you navigate the landscape of investment alternatives, understanding the nuances of each option is paramount. The decision to venture beyond individual stocks involves a delicate balance of risk, reward, and alignment with your financial aspirations.

5-3-1. The Tapestry of Choices

The investment world unfolds as a tapestry woven with diverse options. From ETFs offering convenience and diversification to hedge funds demanding risk-awareness and managed accounts providing professional guidance, each alternative contributes to the intricate fabric of your investment journey.

5-3-2. The Personal Odyssey

Ultimately, the choice of investment alternative is a reflection of your investment philosophy and objectives. A thorough understanding of the nuances, risks, and benefits is essential to make an informed decision that resonates with your financial aspirations.

5-4. In Conclusion

Diversification extends beyond the mere acquisition of different assets; it encompasses the exploration of alternative investment avenues. The path you choose is a testament to your willingness to embrace complexity, navigate risk, and pursue financial growth. By delving into ETFs, hedge funds, or managed accounts, you open doors to new strategies and possibilities, enriching your wealth building journey.

6. Drawbacks of Investing in Individual Stocks

6-1. The Importance of Research

Investing in individual stocks can be an alluring path towards wealth building strategies. However, it comes with significant challenges that are important to consider. Research is a cornerstone of successful investing in this arena. To make informed decisions, you need to dedicate substantial time to understanding the companies you’re investing in. Key questions revolve around the products or services a company offers, its growth potential, profitability prospects, and its debt burden. This research isn’t just a one-time task – it’s an ongoing commitment that demands your valuable time and sometimes financial resources.

6-2. Emotional Challenges

Analyzing financial statements, corporate strategies, and competitive positions requires intelligence and insight, but that’s not all. The emotional aspect of investing can’t be overlooked. Even with thorough research, emotions can cloud your judgment. The real test comes when a stock you believed in takes a steep dive – will you have the resolve to hold on? Will you be able to make the tough call if new research suggests that the drop is more than a mere setback? Emotions often hinder sound long-term decisions, and many lack the psychological constitution to outwit the financial markets.

6-3. Lack of Diversification

Diversification is a crucial risk management strategy. However, achieving it when investing in individual stocks might be a challenge for those with limited resources. Developing and monitoring a diversified portfolio demands significant investment – both financially and time-wise. Holding stocks from various industries and companies within those industries is ideal, yet without sufficient funds, diversification becomes difficult, adding unnecessary risk to your investments.

6-4. Accounting and Bookkeeping Hassles

The intricacies of investing in individual securities extend beyond the realm of research. Selling specific stocks involves reporting transactions on your tax returns, even if you outsource your tax filing. Managing statements and receipts for tax purposes can be a hassle, adding administrative burden to your investment journey.

6-5. Skepticism of Stock-Picking Claims

Amidst the challenges, you may encounter proponents who advocate for stock-picking as an easy and profitable path. These advocates often fall into categories with vested interests:

6-5-1. Newsletter Writers

Some suggest that following their stock recommendations can lead to success. However, their true intent might be selling you newsletters or frequenting their ad-filled websites, making you dependent on their advice.

6-5-2. Book Authors

Investing books might promise strategies for beating the system. However, claims might lack audited success records. Disreputable authors have faced legal consequences for unsubstantiated claims.

6-5-3. Stockbrokers/Investment Advisors

Brokers might steer you towards individual stocks for their gains, not yours. High-commission brokers profit from stock purchases and transactions, potentially leaving you dependent on their advice.

6-6. Competing Against Professionals

Researching individual stocks is a demanding endeavor that can be a full-time job. If you opt for this path, remember that you’re competing with professionals who do this full-time. While deriving pleasure from managing your stocks is possible, it’s vital to recognize the challenges. For independent opinions and useful research reports, resources like Value Line can be valuable. Keeping individual stock holdings limited to a reasonable percentage of your overall investments is a wise approach to managing risk.

In the quest for wealth building strategies, investing in individual stocks might seem appealing, but it’s crucial to weigh the drawbacks carefully. From the demands of research and emotional challenges to the difficulty of diversification and administrative hassles, the road is riddled with obstacles. Skepticism of stock-picking claims is wise, and remember that you’re competing against professionals. By staying informed and mindful of these aspects, you can make more prudent decisions on your investment journey.

7. Key Principles for Successful Stock Investing

Embarking on the journey of stock investing requires not only knowledge but also a strategic compass to navigate the complexities of the market. Several key principles serve as beacons, illuminating the way toward successful stock investments and bolstering your chances of achieving your wealth building strategies.

7-1. The Vital Role of Diversification

Diversification stands as a cornerstone principle in the realm of stock investing. This strategy revolves around spreading your investments across different stocks and sectors. The rationale behind diversification is simple yet powerful: by avoiding overconcentration in a single industry or company, you reduce the risk of your entire portfolio being adversely impacted by downturns in one sector.

7-1-1. The Armor Against Risk

In the dynamic landscape of the stock market, industries and sectors can experience periods of volatility and decline. By diversifying your holdings, you create a protective armor that shields your portfolio from the impact of sector-specific fluctuations. This resilience is integral to maintaining stability in the face of market turbulence.

7-1-2. The Art of Balance

Diversification isn’t merely about spreading your investments thinly; it’s about achieving a strategic balance that aligns with your risk tolerance and financial objectives. By holding a mix of stocks from different sectors, you construct a portfolio that has the potential to weather market cycles and emerge stronger over time.

7-2. The Strategy of Dollar-Cost Averaging

A key strategy that aligns with the principle of patience and discipline is dollar-cost averaging. This approach involves investing a fixed amount of capital at regular intervals, irrespective of market conditions. The beauty of this strategy lies in its ability to mitigate the impact of market volatility on your investment decisions.

7-2-1. A Buffer Against Market Fluctuations

Market volatility is an inherent characteristic of stock investing. Dollar-cost averaging acts as a buffer against the impact of market highs and lows. When prices are high, you purchase fewer shares, and when prices are low, you purchase more shares. Over time, this strategy averages out the cost of your investments, resulting in a more stable and consistent approach to building your portfolio.

7-2-2. The Consistency Factor

Dollar-cost averaging is rooted in consistency. By adhering to a predetermined schedule of investments, you eliminate the need to time the market or make impulsive decisions based on short-term fluctuations. This consistency empowers you to stay the course and remain focused on your long-term objectives.

7-3. The Long-Term Mindset

At the heart of successful stock investing lies the foundational principle of long-term thinking. While it’s natural to react to short-term market fluctuations, seasoned investors prioritize their overarching financial goals and remain anchored in the realm of long-term vision.

7-3-1. Resisting the Urge to Time the Market

Attempting to time the market is a perilous endeavor. Even seasoned experts struggle to consistently predict market movements. The principle of long-term thinking urges you to transcend the allure of short-term gains and losses and remain steadfast in your commitment to your investment journey.

7-3-2. The Magic of Compounding

Long-term investments benefit from the magic of compounding. As your investments generate returns, those returns themselves begin to generate additional returns. This compounding effect can yield significant growth over extended periods, emphasizing the importance of patient and enduring strategies.

7-4. In Conclusion

The principles that underpin successful stock investing are both practical and profound. Diversification guards against overexposure to risk, while dollar-cost averaging tames the impact of market volatility. Anchored in long-term thinking, these principles form the bedrock of prudent investment strategies. By adopting these principles, you arm yourself with a strategic compass that guides your decisions, nurtures your investments, and propels your journey toward achieving your wealth building strategies.

8. Conclusion

Investing in stocks is a potent strategy for building wealth over the long term. While it involves risks, the potential rewards are substantial. By understanding the principles of wealth building, delving into the power of stock investments, and adhering to key investment principles, you can navigate the complex world of investing with confidence. Remember, success in stock investing requires continuous learning, disciplined execution, and a focus on your long-term financial objectives.

9. FAQs

9-1. How do wealth building strategies differ from simply saving money?

Wealth building strategies involve putting your money to work through investments, such as stocks, to generate returns that outpace inflation. Unlike saving, where money is set aside, these strategies harness the power of compounding to grow your assets over time. It’s a long-term approach that aims to create financial security and independence.

9-2. Can I start wealth building with a small amount of money?

Absolutely. Many investment options, like stocks and exchange-traded funds (ETFs), offer accessible entry points. Through strategies like dollar-cost averaging, you can start with a modest investment and gradually contribute over time. The key is consistency and patience, allowing your investments to grow and compound over the years.

9-3. Are stocks a reliable choice for wealth building strategies?

Yes, stocks can be a reliable choice, but they come with risks. While they offer the potential for significant growth over the long term, their value can also fluctuate in the short term due to market volatility. Diversification, patience, and a long-term mindset are essential when using stocks as part of your wealth-building plan.

9-4. What’s the role of diversification in wealth building strategies?

Diversification is a crucial risk management strategy. By spreading your investments across different assets, sectors, and industries, you reduce the impact of a poor-performing investment on your overall portfolio. This strategy can help minimize the potential for significant losses while maintaining the potential for growth.

9-5. How can I balance risk and reward in my wealth building strategies?

Balancing risk and reward involves understanding your risk tolerance and financial goals. While riskier investments might offer higher potential returns, they also come with increased volatility. Conservative investments may offer stability but with potentially lower returns. A well-rounded approach that includes a mix of assets, such as stocks, bonds, and alternative investments, can help you find the right balance for your individual circumstances.

10. Case Study-Kate’s Journey: From Financial Stagnation to Smart Wealth Building

Meet Kate, a 38-year-old female psychologist, navigating the intricate realm of emotions while treading cautiously in the world of finances.

With an annual income of $75,000, Kate balanced her psychology practice with her roles as a wife and mother of two.

Her interests lay in her family, but her financial strategy had been limited to traditional deposits, yielding little growth.

10-1. Current Situation

One fateful day, Kate received an email from her accountant that served as a financial wake-up call. The stark reality hit her – her stagnant wealth, despite an income and savings, was not keeping pace with rising costs. Her deposits were earning a meager 0.5% interest, resulting in a savings balance of $50,000.

10-2. Conflict Occurs

Mixed emotions surged within Kate as she confronted the reality of her financial stagnation. Frustration and anxiety gripped her, compelling her to seek a change. The urgency to improve her financial situation weighed heavily on her, leading her to acknowledge the need for a transformation.

10-3. Problem Analysis

The root of Kate’s dilemma lay in her passive financial approach. Her savings, while present, were parked in low-interest deposits that failed to outpace inflation. The consequences were evident – her purchasing power was eroding. Additionally, Kate’s attempts at stock investments were marred by a lack of understanding. Poorly chosen companies with weak earnings led to a loss of $5,000 in investments.

If left unchecked, this trajectory would have dire consequences for Kate’s financial security. Her passive approach was costing her not just in terms of lost opportunity, but also in terms of her future stability.

10-4. Solution

Embracing financial education, Kate embarked on a journey of empowerment. She recognized that stock market knowledge was pivotal and sought to understand the art of stock selection. Armed with educational resources, she learned to identify companies with strong fundamentals.

However, her learning didn’t stop there. Kate realized the importance of diversification and opted for a blend of commission-free mutual funds and ETFs. With a targeted asset allocation of 70% equity and 30% fixed income, she began investing $500 per month. This strategic approach aimed for long-term growth, fortified against market volatility.

10-5. Effects After Execution

Kate’s dedication began yielding results. Over a period of 2 years, her investment portfolio grew by 12%, outperforming her previous stagnant savings. The erosion of her purchasing power reversed its course, allowing her family to maintain their quality of life. Kate’s confidence surged as she engaged in conversations about financial planning, leveraging her newfound knowledge to make informed decisions.

The transformation extended beyond finances – Kate’s attitude towards her financial future had undergone a profound shift. She realized that her journey wasn’t just about numbers, but about the empowerment that comes with financial literacy.

10-6. In Conclusion

Kate’s story encapsulates the journey from financial stagnation to strategic empowerment. Her transition from complacency to proactive wealth-building wasn’t just about numbers on paper; it was a transformation of mindset and strategy. Armed with knowledge and determination, Kate’s embrace of diversified investments showcases the potential for a secure financial future. Her journey stands as a testament to the power of education, strategic action, and the remarkable resilience of the human spirit.

11. Checklist

| Questions | Your Reflections | Suggested Improvement Strategies | Improvement Plans | Implementation Results | Review and Adjust |

| Have I fully understood the concept of wealth building strategies through stock investing? | Revisit the article to ensure a clear grasp of the strategies. | ||||

| Am I aware of the power of compounding in wealth building? | Reflect on how I can start investing early to maximize compounding effects. | ||||

| Do I understand the historical advantage of stock investments in terms of performance? | Research more about historical stock market trends for better understanding. | ||||

| Have I considered the benefits of ownership in innovative companies through stocks? | Explore industries and companies I believe in for potential investment. | ||||

| Do I know the differences between mutual funds and ETFs for diversified investments? | Learn more about mutual funds and ETFs to make informed investment decisions. | ||||

| Have I weighed the drawbacks of investing in individual stocks? | Reflect on how I can manage research demands and emotional challenges effectively. | ||||

| Am I aligned with the key principles for successful stock investing? | Evaluate my portfolio’s diversification, dollar-cost averaging, and long-term focus. |