Long-term investment, often spanning several years or even decades, is a financial strategy embraced by those seeking substantial returns. In this extensive guide, we’ll delve into the multifaceted realm of long-term investments, covering everything from grasping the concept to crafting successful strategies. Let’s embark on this journey into the world of long-term investments and discover what is considered a long-term investment.

Reading time: 15 minutes

Outline

1. Introduction

Long-term investments are a cornerstone of financial planning, offering a roadmap to achieve your financial aspirations over an extended horizon. In this section, we will delve into the intricacies of long-term investments, starting with a precise definition and an exploration of the myriad benefits they offer.

2. Defining Long-Term Investments

At the heart of every successful long-term investment strategy lies a clear understanding of what constitutes a long-term investment. Long-term investments encompass a wide range of financial assets or securities that individuals or organizations acquire with the express purpose of realizing their financial objectives in the distant future.

Unlike short-term ventures driven by the pursuit of quick profits or immediate gains, long-term investments are characterized by their steadfast commitment to nurturing gradual and sustained growth over time. This extended outlook fundamentally distinguishes them from their short-term counterparts.

3. Defining Your Time Horizons

To make informed investment decisions, it’s crucial to define your time horizons. The investment options presented in this section are organized based on different time frames. All recommended investment funds assume a time frame of several years or more, and they are all no-load (commission-free) mutual funds and exchange-traded funds (ETFs).

3-1. Short-term Investments

Short-term investments are suitable for a period of a few years, such as saving for a down payment on a house. When investing for the short term, prioritize liquidity and stability. Options include shorter-term bond funds, Treasury bonds, and certificates of deposit (CDs).

3-2. Intermediate-term Investments

Intermediate-term investments are appropriate for periods longer than a few years but less than a decade. Consider intermediate-term bonds and diversified hybrid funds, which include both stocks and bonds.

3-3. Long-term Investments

If you have a decade or more for investing, you can consider potentially higher-return investments like stocks, real estate, and other growth-oriented assets. Long-term investments can yield substantial returns, but they also come with increased risk.

In summary, defining your time horizons is crucial for a successful investment strategy. Whether you’re looking at short-term goals, intermediate-term plans, or long-term aspirations, choosing the right investment options that align with your timeline is essential for reaching your financial goals.

4. Benefits of Long-Term Investing

Now that we’ve established a foundation, let’s explore why long-term investments hold a special place in the realm of financial planning and wealth accumulation. The advantages of opting for long-term investments are manifold, making them an attractive choice for those seeking enduring financial stability.

4-1. Compounding Returns

One of the most compelling reasons to embrace long-term investments is the phenomenon of compounding returns. Over an extended period, your investments have the opportunity to generate returns not only on your initial capital but also on the accumulated earnings from previous years. This compounding effect can lead to exponential growth in the value of your investments, significantly bolstering your wealth.

4-2. Reduced Tax Implications

Long-term investors often enjoy more favorable tax treatment compared to their short-term counterparts. In many tax systems, gains from long-term investments are subject to lower capital gains tax rates. This tax advantage can help you retain a more significant portion of your investment gains, further fueling your financial progress.

4-3. Resilience to Market Fluctuations

The ability to weather market fluctuations is a hallmark of long-term investing. Short-term investors may be easily swayed by market volatility, leading to impulsive decisions. In contrast, long-term investors can adopt a more composed approach, knowing that markets tend to experience fluctuations over shorter intervals but tend to stabilize and trend upwards over more extended periods.

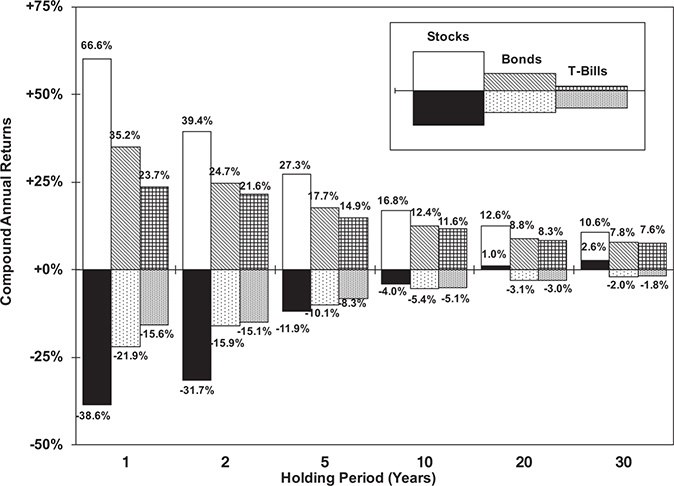

FIGURE 1 Maximum and minimum real holding period returns, 1802–2021

For many investors, the most effective way to gauge risk is by illustrating a scenario where things go terribly wrong. In Figure 3.1, we’ve presented the highest and lowest returns, adjusted for inflation, for stocks, bonds, and bills in the United States. These returns span from 1802 and cover various holding periods ranging from 1 to 30 years. Just like before, we’re calculating stock returns by combining dividends and capital gains or losses on a broadly diversified, market-capitalization-weighted index of US stocks, and these are all adjusted for inflation.

It’s worth noting that when you look at the bars in the graph, which represent the difference between the best and worst returns, you’ll notice that this difference decreases much more rapidly for stocks compared to fixed-income securities as the holding period gets longer.

4-4. Encouragement of Disciplined Saving

Long-term investments inherently promote disciplined saving. By committing to a long-term strategy, individuals are encouraged to consistently allocate a portion of their income to investments. This disciplined approach not only strengthens your financial footing but also instills a sense of responsibility and financial mindfulness.

4-5. Financial Security in Retirement

Perhaps one of the most significant advantages of long-term investing is the potential for financial security in retirement. By steadily building a diversified portfolio of long-term investments, you can create a reliable source of income that ensures a comfortable retirement, free from financial worries.

In this section, we’ve laid the groundwork for understanding long-term investments, defining them clearly and highlighting the numerous benefits they offer. As we delve deeper into specific types of long-term investments and strategies, you’ll gain a comprehensive understanding of how to make the most of this approach to financial planning.

5. Retirement Accounts

Planning for retirement is a critical aspect of long-term financial security. Retirement accounts such as 401(k)s and IRAs are tailored for individuals who wish to secure their financial future.

5-1. Tax Advantages

One of the significant benefits of retirement accounts is the tax advantages they offer. Contributions to these accounts are often tax-deductible, and earnings grow tax-deferred until retirement. This tax-efficient structure can significantly enhance your long-term returns.

5-2. Financial Security in Retirement

By consistently contributing to retirement accounts over the years, individuals can accumulate substantial savings that will provide financial security during retirement. These accounts are designed to ensure that you have the means to maintain your desired lifestyle once you retire.

5-3. Asset Allocation and Retirement Accounts

Asset allocation entails determining the distribution of your wealth among different types of investments. Retirement accounts are ideal for asset allocation because they are earmarked for the long term and can offer significant tax advantages. Investing through tax-sheltered retirement accounts is a smart strategy to reduce your long-term tax burden.

5-4. Asset Allocation for Non-Retirement Accounts

When investing outside retirement accounts, your asset allocation should align with your risk tolerance and time horizon. The choice of investments should reflect how soon you plan to use the money. Investing in volatile assets can be riskier if you anticipate needing to liquidate them in the short term.

In brief, retirement accounts like 401(k)s and IRAs are vital for long-term financial security, offering tax advantages and a path to substantial savings. Strategic asset allocation, both within and outside these accounts, based on your risk tolerance and time horizon, is essential for securing your financial future.

6. Types of Long-Term Investments

Now that we’ve grasped the essence of long-term investments, let’s embark on a journey to explore the diverse array of options available to investors seeking to secure their financial future.

6-1. Bonds and Fixed Income

For investors seeking stability and consistent income, bonds and fixed-income securities represent valuable long-term options. These instruments provide a predictable stream of payments, making them an attractive choice for risk-averse individuals.

6-1-1. Stability and Consistency

Bonds are known for their stability and predictability. They typically offer periodic interest payments and return the principal amount at maturity. This stability can provide investors with peace of mind, knowing that they can rely on a consistent income stream.

6-1-2. Role in a Long-Term Portfolio

While bonds may not offer the same potential for high returns as stocks or real estate, they play a crucial role in diversifying a long-term investment portfolio. Bonds can help mitigate risk by providing stability during periods of market turbulence.

6-1-3. Bonds and Bond Funds

Bonds and bond funds are reliable options for conservative investors. They offer steady income and stability. Here are some recommendations:

- Short-term: Consider Vanguard Short-Term Investment-Grade.

- Intermediate-term: Options include Dodge & Cox Income, DoubleLine Total Return, and Vanguard Total Bond Market Index.

- Long-term: Vanguard Long-Term Investment Grade is a suitable choice.

6-1-3-1. U.S. Treasury Bond Funds

U.S. Treasury bond funds are backed by the government and are suitable for investors in lower tax brackets. Vanguard offers a range of U.S. Treasury funds with low operating expenses. You can also purchase Treasury bonds directly from the Federal Reserve Bank.

6-1-3-2. Inflation-Indexed Treasury Bonds

Inflation-indexed Treasury bonds are designed to protect against inflation. They adjust their returns based on the rate of inflation, making them a safer investment option. These bonds are suitable for conservative investors concerned about inflation.

6-1-3-3. State- and Federal-Tax-Free Bond Funds

State- and federal-tax-free bond funds are ideal for investors in high federal and state tax brackets. Vanguard, T. Rowe Price, and Fidelity offer state-specific tax-free bond funds.

6-1-3-4. Federal-Tax-Free-Only Bond Funds

Federal-tax-free-only bond funds are suitable for investors in high federal tax brackets with low state tax rates. Vanguard offers a selection of federal-tax-free bond funds.

In brief, bonds and fixed-income investments offer stability and predictable income, making them ideal for risk-averse investors. While they may not match the potential returns of stocks or real estate, they play a crucial role in diversifying a long-term portfolio. Whether you opt for U.S. Treasury bonds, inflation-indexed bonds, or tax-free bond funds, these choices cater to different financial preferences and goals.

6-2. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are low-risk investments that offer higher returns than regular savings accounts. They provide stability and a fixed rate of return. However, CDs have limitations, including limited access to your money and taxability. Consider them if you’re in a lower tax bracket or risk-averse.

6-3. Stocks and Equities

Investing in stocks and equities forms the cornerstone of many long-term investment portfolios. These financial instruments represent ownership in companies and can provide substantial rewards over time, but they come with their share of risks.

Stocks have historically been a wealth-building investment. When investing in stocks in taxable accounts, be aware that all distributions, such as dividends and capital gains, are taxable. To minimize taxes, choose tax-friendly stock funds or consider stocks for long-term investments.

6-3-1. Potential Rewards

When you invest in stocks and equities, you’re essentially buying a piece of a company’s future. Historically, stocks have demonstrated the potential for remarkable long-term returns. Over extended periods, they have outperformed many other asset classes, including bonds and cash equivalents.

6-3-2. Risks to Consider

However, it’s crucial to recognize that stocks can be volatile. Prices can fluctuate dramatically over short periods, which may unsettle some investors. It’s important to have a long-term perspective when investing in stocks and be prepared for the inevitable market ups and downs.

6-4.Annuities

Annuities are a combination of insurance and investment. Consider annuities after maximizing contributions to retirement accounts. Annuities come with higher annual expenses, so they are suitable for long-term investments of 15 years or more. Vanguard and Fidelity offer quality annuities, and you can also explore options from discount brokerage firms like T.D. Ameritrade and Charles Schwab.

6-5. Real Estate

Real estate investments offer a tangible and often comforting form of long-term investment. By acquiring properties, you not only gain the potential for rental income but also benefit from property appreciation over time.

6-5-1. Rental Income Potential

One of the primary advantages of real estate is the opportunity for rental income. Owning residential or commercial properties can provide a steady stream of cash flow, which can serve as a reliable source of income over the long term.

6-5-2. Property Appreciation

Real estate properties tend to appreciate in value over time. While the real estate market can experience short-term fluctuations, property values generally increase over the years. This appreciation can significantly boost the overall returns on your investment.

6-6. Small-Business Investments

Investing in small businesses can be high-risk but potentially high reward. Consider this option if you have a good understanding of the business and are comfortable with the associated risks.

In summary, when it comes to long-term investments, there’s a diverse range of options to consider. Bonds and fixed-income investments offer stability and predictable income, ideal for risk-averse investors. Certificates of Deposit (CDs) provide a low-risk option with better returns than regular savings accounts. Stocks and equities, while historically offering remarkable long-term returns, come with the trade-off of volatility and tax considerations. Annuities, real estate, and small-business investments each have their unique characteristics and are suitable for specific financial goals and risk tolerance levels. It’s crucial to align your investment choices with your long-term financial objectives and comfort with risk.

7. Conclusion

In conclusion, the world of long-term investments is vast and varied, offering opportunities for financial growth over an extended period. Whether you prefer the stability of bonds, the security of certificates of deposit, the potential rewards and risks of stocks, the benefits of annuities, the tangibility of real estate, or the potential of small-business investments, your choice should align with your financial goals and risk tolerance. By understanding the concept of long-term investments, defining your time horizons, and considering the benefits they offer, you can embark on a strategic path towards securing your financial future.

8.FAQs

8-1. What is considered a long-term investment?

A long-term investment involves committing your funds for an extended period, typically several years or even decades, with the expectation of generating substantial returns. It’s a financial strategy aimed at achieving financial goals over the distant future.

8-2. What are the benefits of long-term investing?

Long-term investing offers several advantages, including compounding returns, reduced tax implications, the ability to withstand market fluctuations, encouragement of disciplined saving, and the potential for financial security in retirement.

8-3. How do I define my time horizons for investments?

Defining your time horizons is crucial for informed investment decisions. It involves categorizing your investment goals into short-term, intermediate-term, or long-term objectives, and aligning them with suitable investment options and strategies.

8-4. What are the best long-term investment options for risk-averse individuals?

Risk-averse investors often opt for bonds and fixed-income securities due to their stability and predictable income. These options provide a safe haven for those looking to avoid the volatility of the stock market.

8-5. How can I choose the right long-term investment for my financial goals?

Selecting the right long-term investment involves considering factors like your risk tolerance, time horizon, and financial objectives. Bonds, stocks, real estate, certificates of deposit, and annuities each offer unique benefits, so it’s essential to align your choice with your specific financial goals.

9. Case Study

Meet Benjamin, a 48-year-old male doctor with a keen interest in finance and investments. He’s happily married to another doctor, and together, they have two children.

Benjamin enjoys a stable annual income of $180,000, with an annual expenditure of $150,000. His financial picture includes a valuable home worth $500,000, substantial retirement accounts totaling $400,000, and $100,000 in savings. Notably, Benjamin carries no outstanding debts, providing a strong foundation for his financial journey.

9-1. Current Situation

Benjamin, a 48-year-old doctor, found himself at a financial crossroads. Despite his substantial income, his investments hadn’t been growing as he had hoped. He had been maintaining a savings account and contributing to his retirement funds, but the returns were not meeting his expectations. Benjamin’s interest in finance led him to explore the concept of “what is considered a long-term investment.”

9-2. Conflict Occurs

Upon researching long-term investments, Benjamin realized that he had not been optimizing his financial future. His investments, primarily in low-yield savings accounts and traditional retirement plans, were not aligned with his long-term financial goals. His investment portfolio was diversified, consisting mostly of savings accounts and a traditional 401(k) plan invested in low-risk bonds and large-cap stocks.

Emotionally, Benjamin felt a mix of regret and determination. He regretted not taking a more proactive approach to his finances earlier, but he was determined to rectify the situation. He recognized the need for change when he calculated the potential retirement shortfall if he continued with his current investment strategy. However, initially, he hesitated to change because he was apprehensive about the perceived risks associated with long-term investments.

9-3. Problem Analysis

The primary problem Benjamin faced was the suboptimal growth of his investments. The low-interest savings accounts and conventional retirement plans he had chosen were not capitalizing on the power of compounding returns. If left unaddressed, this issue would result in an insufficient retirement fund, potentially jeopardizing his financial security during retirement.

9-4. Solution

Benjamin decided to shift his investment strategy toward long-term investments. He recognized that by diversifying his portfolio to include assets like stocks, real estate, and bonds, he could potentially achieve higher returns. Benjamin also decided to increase his contributions to tax-advantaged retirement accounts.

The specific steps he took included:

- Conducting thorough research on long-term investment options.

- Consulting with a financial advisor to develop a diversified investment plan.

- Allocating a portion of his savings and investments to riskier, but potentially higher-yield, assets.

- Regularly monitoring his investment portfolio’s performance and adjusting it as needed.

During implementation, Benjamin faced the challenge of overcoming the fear of potential losses associated with riskier assets. To overcome this, he educated himself further on the principles of long-term investing and maintained a long-term perspective.

9-5. Effect After Execution

It took approximately two years for the new investment strategy to show substantial growth. Benjamin saw a significant increase in the value of his investment portfolio, which was now better aligned with his long-term financial goals.

Benjamin’s asset allocation ratio shifted to a diversified portfolio, including 60% stocks (across various index funds), 30% bonds, and 10% real estate investment trusts (REITs). The expense ratio of his investment portfolio reduced from 1.2% to 0.6%.

The cost of implementing this strategy included potential short-term market fluctuations, with a standard deviation risk of 12% for his portfolio. However, the long-term benefits far outweighed the short-term costs.

Benjamin felt a sense of financial security and relief knowing that his investments were on the right track. He had learned valuable lessons about the importance of long-term investing and the potential rewards it could offer.

9-6. In Conclusion

In conclusion, Benjamin’s journey from suboptimal investments to a well-diversified long-term investment portfolio highlights the importance of aligning your financial strategy with your long-term goals. By overcoming initial hesitations and embracing the principles of long-term investing, Benjamin was able to secure his financial future and provide for his family with confidence. His advice to others facing a similar dilemma would be to educate themselves, seek professional advice, and take proactive steps towards securing their financial future through long-term investments.

10. Checklist

| Questions | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review and Adjust |

| What is my understanding of long-term investments? | Seek further information and education on long-term investments | ||||

| Have I defined clear time horizons for my investments? | Evaluate my investment goals and categorize them into short-term, intermediate-term, and long-term objectives | ||||

| Do I prioritize stability and predictability in my investments? | Consider if bonds or fixed-income securities align with my risk tolerance and financial goals | ||||

| Am I aware of the potential benefits of compounding returns? | Explore how compounding can enhance my long-term investment strategy | ||||

| Have I considered tax advantages in my investment planning? | Review tax-efficient strategies for my investments, especially in retirement accounts | ||||

| Do I have a strategy to mitigate the risks associated with long-term investments? | Develop a risk management plan that aligns with my chosen investments | ||||

| Have I diversified my long-term investment portfolio effectively? | Assess the diversification of my investments to spread risk |