If you’re looking to invest your money wisely and build a strong financial future, understanding what low-cost index funds are and how they work is crucial. In this comprehensive guide, we’ll break down the fundamentals, benefits, and strategies of investing in these financial instruments. So, let’s dive right in and explore the world of low-cost index funds.

Reading time: 20 minutes

Outline

- Understanding the Basics of Index Funds

- Benefits of Investing in Low-Cost Index Funds

- Finding the Right Low-Cost Index Funds

- Top Low-Cost Index Funds in the Market

- Strategies for Maximizing Returns with Index Funds

- Risks and Considerations with Low-Cost Index Funds

- Conclusion: Building Wealth with Low-Cost Index Funds

- FAQs

- Case Study

- Checklist

1. Understanding the Basics of Index Funds

1-1. What Exactly Is an Index Fund?

1-1-1. The Core Concept

At the heart of your quest to understand what low-cost index funds are lies a fundamental concept: index funds aim to mirror the performance of a specific market index. In essence, when you invest in an index fund, you are purchasing a share in a diversified portfolio designed to mimic the movements of a chosen market index, such as the S&P 500. But let’s dive deeper into what this concept entails.

1-1-2. Replicating Market Indices

1-1-2-1. Index Funds as Imitators

Index funds serve as meticulous imitators of their chosen market indices. This replication process is achieved through portfolio composition, with fund managers strategically selecting a basket of assets (typically stocks or bonds) that closely resemble the makeup of the target index. In the case of the S&P 500, for instance, an index fund would invest in the 500 companies represented within that index.

1-1-2-2. Diversification Benefits

This replication strategy offers investors a distinct advantage – diversification. By holding a slice of each constituent within the index, index fund investors benefit from reduced risk associated with individual stock selection. Diversification spreads risk across a wide array of assets, cushioning the impact of poor-performing stocks.

1-2. Why Choose Index Funds for Investment?

1-2-1. The Power of Simplicity

1-2-1-1. Passive Investment Approach

One of the primary attractions of low-cost index funds is their simplicity. These funds embody a passive investment approach. Unlike actively managed funds, which involve continuous decision-making by fund managers, index funds operate on autopilot. They aim to replicate the index’s performance without frequent buying or selling of assets.

1-2-1-2. Eliminating Active Management Hassles

Active stock picking and market timing can be daunting and challenging even for seasoned investors. The allure of index funds lies in their ability to relieve investors of these burdens. Whether you’re a beginner taking your first steps into investing or an experienced investor looking for a hassle-free strategy, index funds offer an accessible and hands-off option.

In conclusion, the concept of low-cost index funds revolves around the replication of market indices. They achieve this by carefully selecting a diversified portfolio of assets that mirror the index’s composition. This strategy provides investors with a simplified and passive approach to investment, eliminating the need for active stock selection and market timing. With this understanding, you’re well-equipped to explore the myriad benefits and strategies associated with low-cost index funds in your investment journey.

2. Benefits of Investing in Low-Cost Index Funds

When considering investments, the benefits of low-cost index funds stand out prominently. Let’s delve into two core advantages that make them an attractive choice for investors.

2-1. Diversification Made Simple

2-1-1. A Risk Management Strategy

Diversification is like the shield that guards your investments against market storms. It involves spreading your money across various assets to reduce the risk of a single poor performer dragging down your entire portfolio. Low-cost index funds excel in this arena.

2-1-2. Instant Diversification

Imagine instantly owning a piece of a broad swath of the market without individually selecting stocks or bonds. That’s precisely what index funds offer. These funds bundle together a diversified mix of assets, often representing a particular market index like the S&P 500 or the FTSE 100. By investing in one index fund, you effectively hold numerous underlying assets, distributing your risk.

2-1-3. Minimizing the Impact of Poor-Performing Assets

Market fluctuations are inevitable, and some individual assets may underperform. However, the beauty of diversification through index funds is that the stellar performers can offset the weaker ones. This balance helps cushion the impact of assets that don’t meet expectations, contributing to a smoother investment journey.

2-2. Cost-Efficiency: A Key Advantage

2-2-1. The Impact of Fees

Investment fees may seem inconsequential, but over time, they can take a significant bite out of your returns. This is where the cost-efficiency of low-cost index funds shines.

2-2-2. Minimal Expense Ratios

Low-cost index funds are aptly named for their minimal expense ratios, which represent the fees investors pay for fund management and administration. These ratios are typically substantially lower than those of actively managed funds. The lower the expense ratio, the less you lose to fees, leaving more of your returns to compound and grow.

2-2-3. The Long-Term Benefits

While the difference in fees may appear small initially, the long-term effects are substantial. As your investments compound over the years, even slight reductions in fees can translate into significantly more money in your pocket. This is particularly evident when comparing index funds to actively managed funds with higher expense ratios.

In conclusion, the benefits of investing in low-cost index funds can’t be overstated. They simplify diversification by offering instant access to a wide range of assets, helping manage risk effectively. Additionally, their cost-efficiency, driven by minimal expense ratios, allows your investments to grow more robustly over time. By choosing low-cost index funds, you’re not just investing wisely; you’re setting yourself up for a potentially prosperous financial future.

3. Finding the Right Low-Cost Index Funds

In your quest to invest wisely, finding the right low-cost index funds is pivotal. This section explores essential steps to identify the most suitable funds for your financial goals.

3-1. Researching Index Funds

3-1-1. The Starting Point

Before diving into any investment, especially low-cost index funds, thorough research is your foundation for informed decisions.

3-1-2. Historical Performance

3-1-2-1. Gauging Past Success

Begin by examining the historical performance of potential index funds. This involves scrutinizing how the fund has fared over the years. Look for consistent, positive returns, but remember that past performance doesn’t guarantee future results.

3-1-2-2. Consider Timeframes

Assess the fund’s performance over various timeframes, including short-term and long-term. This gives you insights into how the fund has weathered different market conditions.

3-1-3. Fund Objectives

3-1-3-1. Aligning with Goals

Each index fund has specific objectives. Some may focus on large-cap stocks, while others may target bonds or international markets. Align these objectives with your financial goals. For example, if you’re planning for retirement, an S&P 500 index fund might be apt.

3-1-3-2. Risk Tolerance

Understand the risk level associated with the fund’s objectives. More aggressive funds may yield higher returns but come with increased volatility. Assess your risk tolerance to choose funds that match your comfort level.

3-2. Evaluating Expense Ratios and Tracking Error

3-2-1. Expense Ratios: The Hidden Culprit

3-2-1-1. Crucial Cost Assessment

Expense ratios are the silent detractors of your returns. These ratios represent the annual fees you pay for fund management. Low-cost index funds are favored for their minimal expense ratios.

3-2-1-2. Impact on Returns

Even seemingly minor differences in expense ratios can have a significant impact on your returns over time. Compare expense ratios among similar funds and opt for those with the lowest costs.

3-2-2. Tracking Error: The Measure of Precision

3-2-2-1. How Well Does It Follow?

Tracking error measures how closely an index fund’s performance aligns with its benchmark index. A lower tracking error indicates more precise replication.

3-2-2-2. Benchmark Alignment

Ensure that the fund’s tracking error is consistently low, as this demonstrates that it accurately mirrors the index’s movements. High tracking error can erode the effectiveness of index fund investing.

In your pursuit of the right low-cost index funds, diligent research is your ally. Scrutinize historical performance to gauge consistency, match fund objectives with your goals and risk tolerance, and be vigilant about expense ratios and tracking errors. Armed with this knowledge, you can confidently select index funds that align with your financial aspirations and set you on a path toward financial success.

4. Top Low-Cost Index Funds in the Market

Navigating the world of low-cost index funds can be daunting, but finding the right ones is essential for your investment success. In this section, we’ll introduce you to two of the top players in the index fund arena and shed light on their unique attributes.

4-1. Vanguard 500 Index Fund (VFIAX)

4-1-1. A Pioneer in Index Fund Investing

Vanguard’s 500 Index Fund, often denoted by its ticker symbol VFIAX, is a heavyweight in the index fund universe. It’s a go-to choice for investors seeking exposure to the largest 500 U.S. companies.

4-1-2. Key Features

4-1-2-1. Diversification on a Grand Scale

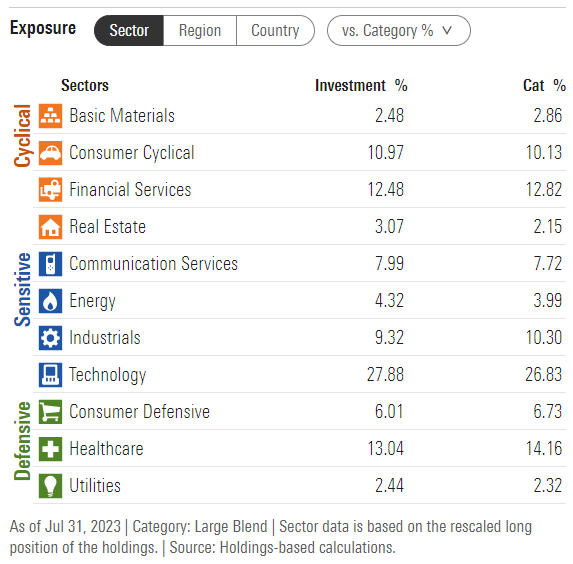

VFIAX offers an efficient way to gain exposure to some of the most prominent companies in the United States. By investing in this fund, you effectively own a piece of the entire S&P 500 index. This diversification across various sectors and industries can help spread risk.

4-1-2-2. Cost-Efficiency

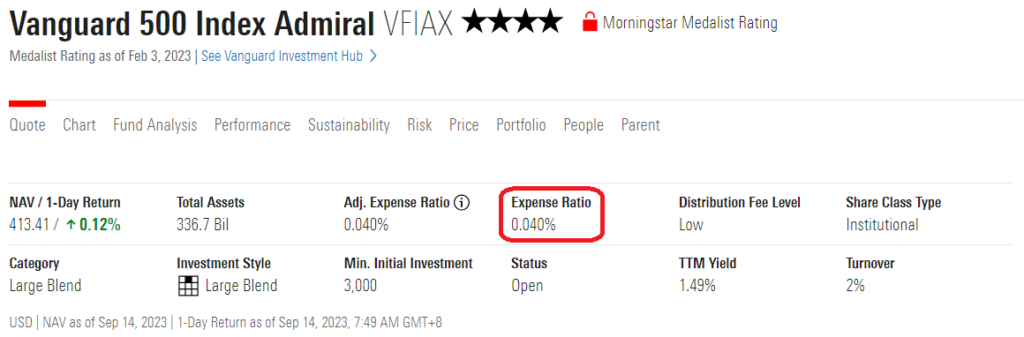

One of the standout features of VFIAX is its low expense ratio (0.04%). Vanguard has a reputation for offering funds with minimal fees, and VFIAX is no exception. The low expense ratio translates to more of your investment returns staying in your pocket.

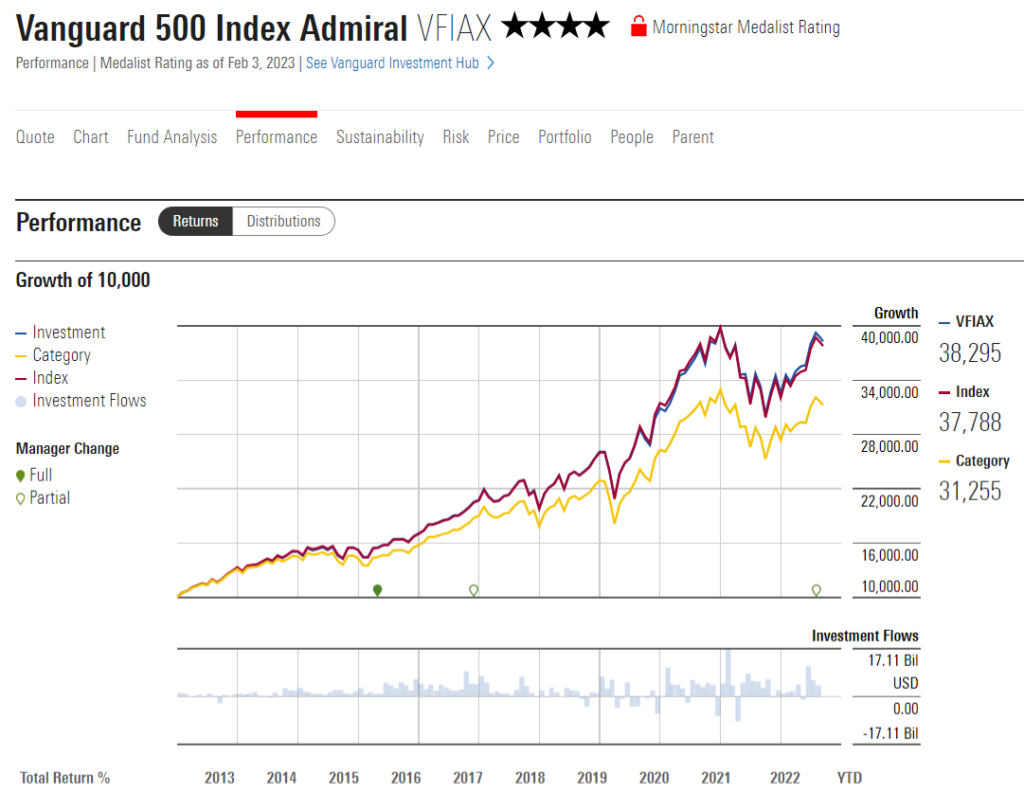

4-1-2-3. Historical Performance

VFIAX boasts a solid track record of delivering competitive returns over the long term. While past performance isn’t a guarantee of future results, this consistency is reassuring for investors.

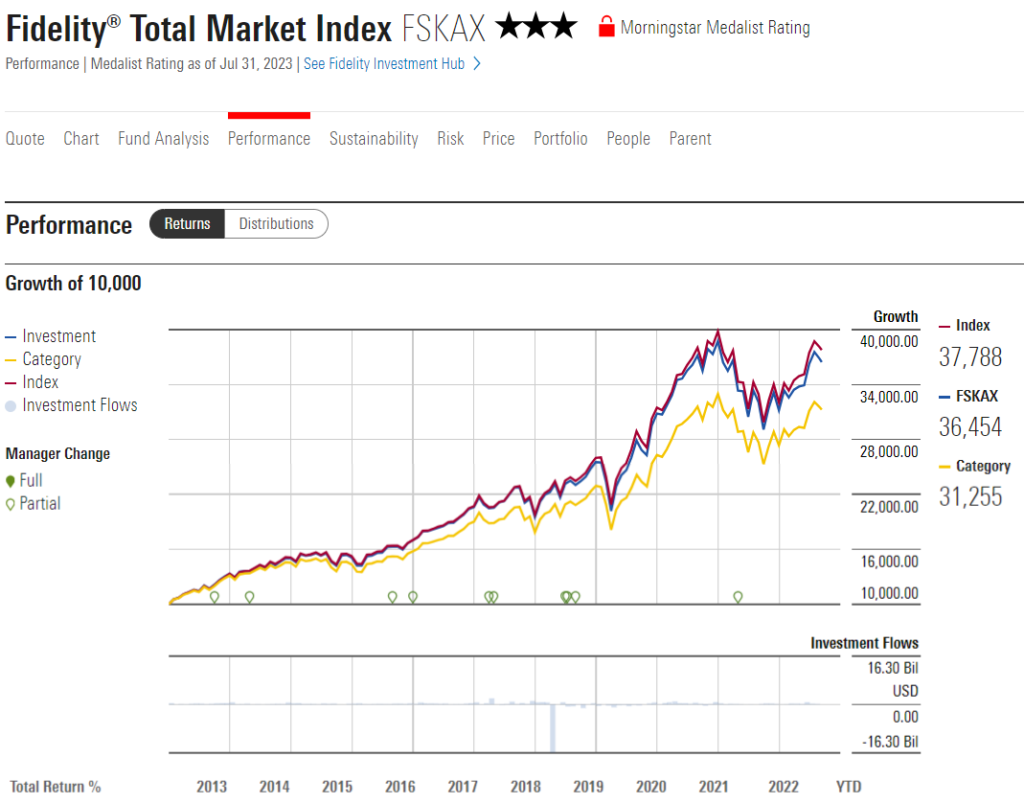

4-2. Fidelity Total Market Index Fund (FSKAX)

4-2-1. Broad Market Exposure

Fidelity’s Total Market Index Fund, represented by the ticker symbol FSKAX, takes a broader perspective on market representation. In addition to large-cap companies, it includes small and mid-cap stocks, providing a more encompassing market exposure.

4-2-2. Notable Features

4-2-2-1. All-Encompassing Diversification

FSKAX stands out for its inclusivity. It includes a wide array of stocks, from the giants to the up-and-comers. This approach offers investors a more comprehensive view of the U.S. stock market.

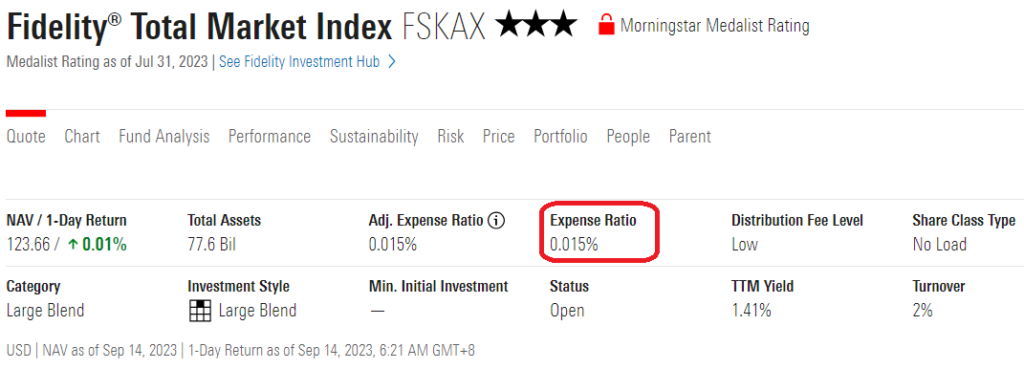

4-2-2-2. Competitive Expense Ratio

Like VFIAX, FSKAX prides itself on its low expense ratio (0.015%). This cost-efficiency means you keep more of your returns over time, a critical factor for long-term investors.

4-2-2-3. Proven Track Record

FSKAX has a history of delivering consistent returns that align with its benchmark index. This reliability makes it a favored choice among investors looking for stability.

In the realm of low-cost index funds, the Vanguard 500 Index Fund (VFIAX) and the Fidelity Total Market Index Fund (FSKAX) are stalwarts. VFIAX focuses on the largest 500 U.S. companies and offers an exemplary blend of diversification, cost-efficiency, and historical performance. On the other hand, FSKAX provides a broader market exposure that includes small and mid-cap stocks while maintaining a competitive expense ratio and a strong track record.

When choosing between these top options, consider your investment objectives, risk tolerance, and preferences for diversification. Either way, you’ll be in the company of two industry leaders as you embark on your journey to explore what low-cost index funds can offer in building a solid investment portfolio.

5. Strategies for Maximizing Returns with Index Funds

In the realm of low-cost index funds, knowing how to employ effective strategies can make a significant difference in your investment journey. Here, we delve into two key strategies that can help you maximize returns while navigating the world of index funds.

5-1. Dollar-Cost Averaging

5-1-1. A Steady Approach to Investing

Dollar-cost averaging is a methodical strategy that involves consistently investing a fixed amount of money into an index fund over regular intervals, regardless of market conditions.

5-1-2. Mitigating Market Volatility

5-1-2-1. Market Volatility

Financial markets are known for their ups and downs. Dollar-cost averaging mitigates the impact of market volatility by spreading your investments over time. During market downturns, your fixed investment buys more shares, and during upswings, it buys fewer. This process naturally “averages” the cost of your investments.

5-1-2-2. Emotional Control

Dollar-cost averaging also helps investors avoid making emotional investment decisions. By adhering to a fixed investment schedule, you are less likely to be swayed by market turbulence or news headlines.

5-1-2-3. Long-Term Gains

Over time, this disciplined approach can lead to significant long-term gains. It allows you to benefit from both the highs and lows of the market, with the goal of achieving a lower average cost per share.

5-2. Rebalancing Your Portfolio

5-2-1. The Art of Asset Realignment

Once you’ve established your initial asset allocation within your index funds, it’s essential to regularly review and rebalance your portfolio.

5-2-2. Staying Aligned with Goals

5-2-2-1. Maintaining Risk Tolerance

Market fluctuations can cause your portfolio’s asset allocation to deviate from your original intentions. Rebalancing involves selling or buying assets within your index funds to bring your portfolio back in line with your desired risk tolerance and financial objectives.

5-2-2-2. Long-Term Focus

Rebalancing ensures that you don’t become overly weighted in one asset class, which can expose you to more risk than you’re comfortable with. It’s a proactive measure to maintain a balanced and diversified investment strategy.

5-2-3. How Often to Rebalance?

5-2-3-1. Frequency Considerations

The frequency of rebalancing can vary based on your preferences and market conditions. Some investors choose to rebalance annually, while others may do so quarterly or even more frequently.

5-2-3-2. Market Timing

Timing the market perfectly is challenging, and frequent rebalancing can lead to higher transaction costs. Strike a balance that aligns with your financial goals and minimizes costs.

In conclusion, effective strategies are the backbone of successful index fund investing. Dollar-cost averaging provides a systematic way to invest over time, smoothing out market volatility and potentially leading to substantial long-term gains. On the other hand, rebalancing your portfolio ensures that your asset allocation stays aligned with your risk tolerance and financial objectives, contributing to a balanced and diversified investment strategy. By mastering these strategies, you can harness the full potential of what low-cost index funds have to offer in building and growing your wealth.

6. Risks and Considerations with Low-Cost Index Funds

In the pursuit of financial growth through low-cost index funds, it’s vital to understand the risks and considerations associated with this investment approach. Let’s explore two critical aspects that can significantly impact your investment journey.

6-1. Market Fluctuations and Index Funds

6-1-1. Market Dynamics and Index Funds

While index funds are often lauded for their stability and long-term growth potential, they are not immune to the ebb and flow of financial markets.

6-1-2. Navigating Market Volatility

6-1-2-1. Economic Downturns

Economic downturns can lead to significant fluctuations in the value of index funds. During these periods, it’s common to see declines in the stock market, and index funds that track these markets will also experience declines.

6-1-2-2. Long-Term Perspective

To mitigate the impact of market fluctuations, it’s crucial to maintain a long-term perspective when investing in index funds. Historical data shows that markets tend to recover and continue their upward trajectory over time.

6-1-3. Dollar-Cost Averaging Revisited

A Protective Strategy. Remember the dollar-cost averaging strategy we discussed earlier? It plays a valuable role in navigating market fluctuations. By investing a fixed amount at regular intervals, you automatically buy more shares when prices are lower and fewer shares when prices are higher, potentially lowering your average cost per share.

6-2. Tax Implications of Index Fund Investments

6-2-1. The Tax Factor

Understanding Tax Consequences. Taxes can have a substantial impact on your overall returns from index fund investments. It’s essential to be aware of the tax implications specific to your situation.

6-2-2. Tax Bracket Considerations

6-2-2-1. Tax Bracket Influence

Your tax bracket plays a significant role in how much you’ll owe in taxes on your investment gains. If you’re in a higher tax bracket, a portion of your returns may be earmarked for taxes.

6-2-2-2. Tax-Efficient Funds

Some index funds are structured to be tax-efficient, which means they generate fewer taxable events like capital gains distributions. These funds can be a smart choice for investors looking to minimize their tax liabilities.

6-2-3. Account Type Matters

6-2-3-1. Account Selection

The type of investment account you use can also impact your taxes. For example, retirement accounts like IRAs and 401(k)s offer tax advantages, such as tax-deferred growth or tax-free withdrawals in the case of Roth accounts. Understanding which account suits your financial goals and tax situation is essential.

6-2-3-2. Tax Loss Harvesting

In taxable investment accounts, consider tax loss harvesting, a strategy where you sell investments that are at a loss to offset gains in other areas of your portfolio, potentially reducing your tax bill.

In conclusion, as you explore the world of low-cost index funds, it’s crucial to acknowledge and address potential risks and considerations. Market fluctuations are an inherent part of investing, but maintaining a long-term perspective can help you weather the storm. Additionally, understanding the tax implications of your investments and making informed decisions based on your tax bracket and choice of accounts can significantly impact your overall returns. By being well-informed and prepared, you can confidently navigate the path to financial success with low-cost index funds.

7. Conclusion: Building Wealth with Low-Cost Index Funds

In conclusion, low-cost index funds are powerful tools for investors seeking a straightforward, cost-effective, and diversified approach to building wealth. By understanding their benefits, selecting the right funds, and implementing smart investment strategies, you can pave the way toward a secure financial future.

8. FAQs

8-1. What exactly are low-cost index funds?

Low-cost index funds are investment funds designed to replicate the performance of a specific market index, like the S&P 500. They provide investors with diversified exposure to a wide range of assets, helping to spread risk and minimize individual stock risk.

8-2. Why should I consider investing in low-cost index funds?

Investing in low-cost index funds offers simplicity and diversification. They follow a passive investment approach, making them accessible to both beginners and experienced investors. With low expense ratios, they can significantly impact long-term returns compared to actively managed funds with higher fees.

8-3. How do I find the right low-cost index funds for my portfolio?

To find the right low-cost index funds, research is essential. Analyze historical performance, fund objectives, and consider your financial goals. Evaluating expense ratios and tracking errors is also crucial to make informed investment choices.

8-4. What are some popular low-cost index funds in the market today?

Two popular options are the Vanguard 500 Index Fund (VFIAX) and the Fidelity Total Market Index Fund (FSKAX). VFIAX offers exposure to the largest 500 U.S. companies, while FSKAX provides broader market exposure, including small and mid-cap stocks.

8-5. Are there any strategies for maximizing returns with low-cost index funds?

Yes, two effective strategies are dollar-cost averaging and portfolio rebalancing. Dollar-cost averaging involves regular, fixed investments over time, helping mitigate market volatility. Rebalancing ensures that your portfolio stays aligned with your risk tolerance and financial goals. Both strategies can lead to significant long-term gains.

9. Case Study

Meet Lisa, a 43-year-old marketing manager who is passionate about travel, reading, and personal finance. Lisa is happily married and enjoys life with her husband and two children.

She earns a steady annual income of $100,000, which allows her family to lead a comfortable lifestyle.

They own a home valued at $350,000 and have diligently saved $150,000 for their retirement. However, Lisa also carries financial responsibilities, including a mortgage of $200,000 and a car loan of $15,000.

9-1. Current Situation

Lisa is a 43-year-old marketing manager with a stable income of $100,000 per year. She is married with two children, and her family enjoys traveling and investing in their hobbies. While they live comfortably, Lisa is concerned about their long-term financial security.

9-2. Conflict Occurs

Lisa has been investing in actively managed funds for years, hoping to grow her savings for retirement. However, she’s realized that the high management fees associated with these funds are eating into her returns. She’s feeling frustrated because her investments are not performing as well as she had hoped, and her retirement goals seem increasingly out of reach.

9-3. Problem Analysis

Upon analyzing her situation, Lisa realizes that the high fees of actively managed funds are eroding her returns over time. The compounding effect of these fees can significantly reduce her retirement savings. If she doesn’t address this issue, she may have to work longer than planned or face financial challenges during retirement.

9-4. Solution

Lisa decided to explore low-cost index funds after reading about them in an article. She researches different index funds, considering factors like historical performance, expense ratios, and fund objectives. She chooses a low-cost index fund that aligns with her financial goals and risk tolerance.

Fast forward 20 years:

- Investment Amount: Lisa starts by investing $20,000 from her savings into the index fund.

- Expense Ratio: The chosen index fund has an expense ratio of 0.10%, significantly lower than her previous investments.

- Asset Allocation Ratio: She decides on an asset allocation of 60% stocks, 10% Real Estate Investment Trusts (REITs), and 30% bonds.

- Rate of Return: Historically, the index fund has provided an average annual return of 7%.

- Risk (Standard Deviation): The fund’s standard deviation is 12%, indicating moderate risk.

- Investment Period: Lisa plans to invest for 20 years until her retirement.

- She begins investing in this index fund using a dollar-cost averaging strategy, investing $1,000 monthly. Lisa also starts rebalancing her portfolio annually to maintain her desired asset allocation.

9-5. Effect After Execution

Within a few months of investing in low-cost index funds, Lisa started to notice a positive impact. The minimal expense ratios of these funds mean that more of her returns are compounding and growing. Over time, she sees her retirement savings grow more robustly than before.

Fast forward 20 years:

- Total Investment: Over 20 years, Lisa has invested $260,000.

- Total Returns: With an average annual return of 7%, her investments grow to approximately $569,340 by the time she retires.

- Reduction in Fees: Compared to her previous investments with an average expense ratio of 1.00%, Lisa saved around $57,000 in fees over the investment period.

- Despite initial concerns about making the switch, Lisa realizes that low-cost index funds are an effective way to reduce fees and enhance long-term returns. She also appreciates the simplicity of this investment approach, as it aligns with her busy lifestyle.

9-6. In Conclusion

Lisa’s decision to switch to low-cost index funds has put her on a path toward achieving her retirement goals more comfortably. She’s learned the importance of considering fees when investing and the power of strategies like dollar-cost averaging and portfolio rebalancing. Lisa now advises others in a similar situation to explore low-cost index funds as a way to secure their financial futures.

10. Checklist

| Questions for Self-Reflection | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review and Adjust |

| 1. Do I understand what low-cost index funds are? | Explore the basics of index funds by reading and researching. | ||||

| 2. Have I considered the benefits of investing in low-cost index funds? | Evaluate the advantages, such as diversification and cost-efficiency. | ||||

| 3. Am I aware of the factors to consider when finding the right low-cost index funds? | Learn about researching index funds, historical performance, and expense ratios. | ||||

| 4. Have I explored top low-cost index funds in the market and their features? | Investigate options like Vanguard 500 Index Fund and Fidelity Total Market Index Fund. | ||||

| 5. Do I understand strategies like dollar-cost averaging and portfolio rebalancing for maximizing returns with index funds? | Familiarize yourself with these strategies and their benefits. | ||||

| 6. Have I considered the potential risks associated with low-cost index funds? | Think about market fluctuations and tax implications in your investment plan. | ||||

| 7. Am I ready to apply these insights to build wealth with low-cost index funds? | Create a plan to start investing in low-cost index funds and track your progress. |