Tax season can bring both anxiety and opportunity. While it’s natural to be concerned about the impending tax bill, there are strategic methods to reduce your taxable income and ease the financial burden. By understanding the intricacies of taxable income and exploring various tax-saving strategies, you can potentially maximize your savings while staying within legal boundaries.

Outline

Reading time: 17 minutes

1. Understanding Taxable Income

Taxable income encompasses various sources of earnings that are subject to taxation. It’s important to differentiate between taxable and non-taxable income to ensure accurate reporting. While wages, salaries, and investment gains are typically taxable, gifts and certain types of benefits might be non-taxable. Understanding the nuances helps you identify areas where you can legitimately reduce your taxable income.

1-1. Sources of Taxable Income

Taxable income can originate from a range of sources, including earned income from employment, self-employment income, rental income, capital gains from investments, and dividends. By assessing the different streams of income contributing to your overall earnings, you can tailor your tax-saving strategies more effectively.

1-2. Differentiating Taxable and Non-Taxable Income

Certain income sources, like gifts, inheritances, and life insurance payouts, might be non-taxable. Navigating the complexity of these distinctions is crucial for accurate tax planning. Consulting a tax professional can help ensure you’re correctly categorizing income and leveraging potential exemptions.

2. Maximizing Retirement Contributions

One of the most powerful ways to decrease taxable income is through retirement contributions. Retirement accounts offer not only a means to secure your financial future but also immediate tax advantages.

Contributing to Retirement Plans. When it comes to your hard-earned income, paying taxes is a necessary obligation. While various illicit methods might promise reduced taxable employment income through underreporting, the consequences can be dire, including hefty penalties and potential legal repercussions. To ensure you don’t find yourself facing such issues, this section focuses on legitimate avenues to minimize your income taxes within the bounds of the law.

2-1. Benefits of Retirement Accounts

Retirement accounts, such as 401(k)s and IRAs (Individual Retirement Accounts), offer a dual advantage: they enable you to build a nest egg for your retirement years while simultaneously providing a mechanism to lower your taxable income in the present. When you contribute to these accounts, the money is invested with the goal of growing over time, setting you up for a financially secure retirement.

However, the immediate advantage comes from the fact that contributions to certain retirement accounts are often tax-deductible. When you contribute to a traditional 401(k) or traditional IRA, the amount you contribute is subtracted from your taxable income for the current tax year. This means that you’ll owe less in taxes based on your reduced taxable income, effectively putting more money back in your pocket.

Tucking Away Income in Retirement Plans. One of the most effective and lawful means of reducing your taxable employment income is by participating in a retirement plan. Beyond the tax benefits, these plans enable you to build a financial cushion for your post-work years, offering the prospect of a more secure future.

Retirement planning allows you to exclude a portion of your income from taxation. You can achieve this by contributing to employer-based retirement plans such as 401(k) or 403(b), as well as self-employed retirement plans like SEP-IRAs. Imagine having a combined federal and state marginal tax rate of 33 percent. By allocating $1,000 to such a plan, you instantly slash your federal and state taxes by $330. Moreover, if you contribute another $1,000 while remaining in the same tax bracket, your tax burden drops another $330. Additionally, funds within a retirement account can grow and compound without being subject to taxes.

Advocating for Retirement Plans at Work. In cases where your employer doesn’t provide the opportunity to save via a retirement plan, it’s worth engaging with the benefits and human resources departments. If met with resistance, this consideration could weigh in when contemplating alternative employment options. While numerous employers offer this valuable benefit, some remain unconvinced about its merits, fearing setup and administrative costs.

2-2. Roth vs. Traditional Retirement Accounts

If your employer doesn’t furnish a retirement savings scheme, tax deductibility for individual retirement account (IRA) contributions hinges on individual circumstances. Prioritize maximizing contributions to the aforementioned tax-deductible accounts before exploring IRA options.

When considering retirement contributions, it’s important to choose between Roth and traditional accounts based on your financial situation and long-term goals.

Traditional Retirement Accounts:

- Contributions are made with pre-tax dollars, reducing your current taxable income.

- Withdrawals during retirement are taxed as regular income.

- Ideal if you anticipate being in a lower tax bracket during retirement.

Roth Retirement Accounts:

- Contributions are made with after-tax dollars, meaning they don’t reduce your current taxable income.

- Withdrawals during retirement are tax-free.

- Beneficial if you expect to be in a higher tax bracket during retirement or if you prioritize tax-free growth.

Selecting the right account type requires considering factors such as your current tax bracket, future tax projections, and whether you prefer immediate or future tax benefits.

Both Roth and traditional retirement accounts offer distinct tax advantages. Traditional accounts provide upfront tax deductions, while Roth accounts offer tax-free withdrawals in retirement. Analyzing your current and future tax situation can help you choose the account type that aligns with your goals.

2-3. Contribution Limits and Tax Benefits

Understanding contribution limits is essential for maximizing the benefits of retirement accounts. These limits vary based on the type of account and your age. By contributing the maximum allowable amount, you can achieve optimal tax savings and secure your retirement.

Understanding the contribution limits of retirement accounts is crucial for optimizing your tax savings. These limits are set by the government and vary based on the type of account and your age. For example, in 2023, the annual contribution limit for a traditional 401(k) is $22,500 for individuals under 50 and $30,000 for those 50 and older, including catch-up contributions. The limit on annual contributions to an IRA increased to $6,500, up from $6,000. The IRA catch‑up contribution limit for individuals aged 50 and over is not subject to an annual cost‑of‑living adjustment and remains $1,000.

Contributing the maximum allowed amount provides you with the highest possible tax benefit. For instance, if you’re in a 25% tax bracket and you contribute $10,000 to your traditional 401(k), you effectively reduce your taxable income by $10,000. This reduction translates to $2,500 less in taxes owed.

Overcoming Spending Challenges. Unfortunately, many individuals miss out on these tax advantages because they exhaust the entirety, or an excessive portion, of their current employment income. This situation leaves little or nothing to allocate toward a retirement fund. Should you find yourself in this predicament, the first step is to curtail your expenses.

2-4. Tax Credits for Retirement Contributions

Married couples filing jointly with adjusted gross incomes (AGIs) below $73,000, as well as single taxpayers with an AGI under $36,500, may qualify for a tax credit linked to retirement account contributions. Unlike deductions, a tax credit directly diminishes your tax liability by the credited amount. This credit, detailed in Table-1, is a percentage of the initial $2,000 contributed ($4,000 for joint returns). Exemptions apply to those under 18, full-time students, and dependents claimed on another’s tax return.

TABLE-1 Special Tax Credit for Retirement Plan Contributions

| Tax Credit for Retirement Account Contributions | Married Filing Jointly | Head of Household | All Other Filers* |

|---|---|---|---|

| 50% | AGI not more than $43,500 | AGI not more than $32,625 | AGI not more than $21,750 |

| 20% | $43,501- $47,500 | $32,626 – $35,625 | $21,751 – $23,750 |

| 10% | $47,501 – $73,000 | $35,626 – $54,750 | $23,751 – $36,500 |

| 0% | more than $73,000 | more than $54,750 | more than $36,500 |

3. Health Savings Options

Managing healthcare costs is a critical aspect of your overall financial well-being. Health savings options, such as Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs), offer valuable tools for both saving on medical expenses and reducing your taxable income. Let’s explore the details of these health savings options and how they can contribute to your financial strategy.

3-1. Health Savings Accounts (HSAs) in Detail

Health Savings Accounts (HSAs) are specialized accounts designed to assist individuals and families covered by high-deductible health insurance plans in managing their medical expenses. HSAs offer a unique triple-tax advantage, positioning them as a potent tool for both immediate healthcare costs and long-term financial planning.

Tax-Deductible Contributions

Contributions made to an HSA are tax-deductible for the current tax year. This translates to a reduction in your taxable income by the exact amount of your HSA contributions, resulting in immediate tax savings.

Tax-Free Growth

The funds within your HSA can be invested and will grow tax-free. This feature enables the potential growth of your contributions over time, ensuring a growing pool of resources to address medical expenses.

Tax-Free Withdrawals

When funds from your HSA are utilized for qualified medical expenses, the withdrawals are tax-free. This includes expenses like doctor visits, prescribed medications, and even specific medical equipment.

It’s important to acknowledge that HSAs have predefined annual contribution limits, contingent on whether you possess individual or family coverage. Any unspent funds within your HSA at the year-end will carry forward to the next year, thereby allowing the creation of a substantial reserve for future healthcare needs.

For self-employed individuals or those working for smaller companies, HSAs present a viable option. To qualify, a high-deductible health insurance policy is necessary, with minimum deductibles of $1,500 for individuals and $3,000 for families. The plan must also have an annual out-of-pocket maximum of $7,500 for self-coverage for the 2023 tax year and $15,000 for families for the 2023 tax year. HSAs permit the allocation of funds specifically for medical expenses into an investment account. This account provides tax benefits comparable to retirement accounts: contributions are deductible (up to $3,850 for singles and $7,750 for families. Individuals age 55 or older by the end of the tax year can make catch-up contributions of an additional $1,000 to their HSAs.), and funds grow tax-deferred through compounding. Unlike flexible spending accounts, HSAs lack a year-end spending deadline. Thus, funds can accumulate and compound for years within the HSA. To explore HSAs, research insurers offering compatible health plans or consult your existing coverage provider.

3-2. Flexible Spending Accounts (FSAs) Explained

Flexible Spending Accounts (FSAs) are an alternative kind of tax-advantaged account frequently included in employers’ benefits packages. Differing from HSAs, FSAs are generally intended for short-term expenses incurred during the plan year and are subject to a “use it or lose it” policy. This implies that unspent FSA funds at the plan year’s conclusion do not roll over, underscoring the significance of meticulous contribution planning.

Contributions to FSAs are made using pre-tax funds, thereby decreasing your taxable income for the current year. FSAs encompass a variety of healthcare costs, including medical co-pays, prescribed medications, and specific over-the-counter items. Some FSAs even permit the utilization of funds for dependent care costs, like child care.

The IRS sets the maximum amount that you can contribute to a Flexible Spending Account (FSA) every year. When it comes to FSA accounts meant for medical expenses, each employee can contribute up to $3,050 for the year 2023.

If you’re married, your spouse also has the option to save up to the same contribution limit through their employer. Employers can choose to add money to your FSA, but they’re not obligated to do so. Even if they decide to contribute, the amount they put in doesn’t affect the maximum you’re allowed to contribute. The money your employer adds to your FSA isn’t considered as taxable income.

One effective approach is to ascertain if your employer extends a flexible spending or healthcare reimbursement account. These accounts offer the advantage of employing pre-tax dollars for medical expenses not covered by your insurance. Imagine being in a combined 35-percent federal and state income tax bracket; these accounts essentially offer a 35-percent discount on essential healthcare expenses. These accounts aren’t limited solely to medical expenses; they can also cover costs related to vision and dental care.

Considerations and Limitations of FSAs

While medical reimbursement accounts can be a valuable asset, potential challenges should be acknowledged. To benefit from these accounts, it’s generally necessary to decide on fund allocation from your paycheck at the plan year’s commencement. Exceptions are made during significant life changes, such as marriage, divorce, the passing of a family member, or the birth of a child. Spending the funds within the same year is imperative since most of these accounts function under a “use it or lose it” policy. Some employers now allow a carryover of up to $500, but always confirm the specifics of your plan.

3-3. Tax Benefits of Health Savings Options

Both HSAs and FSAs present substantial tax benefits that can facilitate more effective management of healthcare expenses while concurrently lowering your taxable income. By contributing to these accounts, you not only mitigate your immediate tax responsibility but also establish a dedicated fund for medical expenses. Whether aiming for long-term savings potential with an HSA or immediate expense coverage with an FSA, these health savings options offer valuable tools for attaining financial security.

In summary, health savings options such as HSAs and FSAs serve a dual purpose of managing healthcare expenses and optimizing your tax situation. By comprehending the merits of each choice and aligning them with your healthcare requirements and financial objectives, you can confidently navigate the intricate realm of medical expenses, bolstering both your financial stability and assurance.

4. Timing Your Income

Managing your finances isn’t just about how much you earn; it’s also about when you earn it. The timing of your income can play a significant role in how much you owe in taxes. By strategically planning when you receive income and when you make deductible expenses, you can effectively minimize your taxable income and potentially reduce your tax bill. Let’s dig into the details of timing your income and how it can be a smart tax-saving strategy.

4-1. Strategies for Income Deferral

Imagine this: you’ve just finished a big project that’s due for payment in December. But, hey, it’s only November. Consider delaying the payment until January of the next year. By doing so, you defer the taxable income into the following tax year. This can be particularly beneficial if you anticipate that your income will be lower next year, perhaps due to a planned career change or other financial circumstances.

4-2. Accelerating Deductible Expenses

On the flip side, let’s say you have some deductible expenses that you could pay this year or next. If you’re expecting higher income this year and lower income next year, it might make sense to accelerate those expenses into the current year. This can help offset your current taxable income, potentially putting you in a lower tax bracket for the year.

Think about it like this: paying next year’s property tax bill a bit early or making that extra mortgage payment before the year ends can increase your itemized deductions for the current year. This means you’re essentially reducing your taxable income by the amount of those deductible expenses.

4-3. Balancing Timing for Optimal Tax Planning

Balancing income deferral and expense acceleration requires a bit of crystal ball gazing. You need to consider not only your current financial situation but also your future outlook. Take into account any expected changes in income, family circumstances, or tax laws that might influence your tax liability.

And remember, the goal isn’t just to reduce your tax bill for the current year; it’s to optimize your tax situation over the long term. You might decide to defer some income this year but accelerate some expenses into next year if that aligns better with your financial goals.

In essence, timing your income is like choreographing a dance between your income and your expenses. You want to orchestrate the moves so that you’re paying the least in taxes without breaking any tax rules. It’s a balancing act that involves both strategy and a bit of financial foresight.

So, whether it’s delaying that year-end bonus or prepaying certain expenses, understanding the rhythm of your financial flows can help you execute a well-timed performance that keeps your tax liability in check. Just remember, while the timing might be an art, the goal is all about optimizing your financial scorecard.

5. Conclusion

Reducing taxable income is a strategic endeavor that requires careful consideration of your financial situation and goals. By understanding the various sources of taxable income and employing smart strategies such as maximizing retirement contributions, investing in tax-advantaged accounts, and optimizing the timing of your income, you can significantly minimize your tax liability and enhance your financial well-being. Remember, seeking advice from tax professionals and financial advisors can further refine your tax-reduction plan.

6. FAQs

6-1. How can I effectively reduce my taxable income?

Exploring ways to reduce taxable income is a smart financial strategy. Consider contributing to retirement accounts, like 401(k)s and IRAs, to lower your taxable income while securing your future. Also, take advantage of health savings options such as HSAs and FSAs to save on medical expenses while minimizing your tax liability.

6-2. What are the benefits of maximizing retirement contributions?

Maximizing retirement contributions is a powerful way to reduce taxable income. By contributing to retirement accounts, you not only secure your financial future but also lower your current taxable income. These contributions often offer immediate tax advantages, helping you save now while building for the years ahead.

6-3. How do Health Savings Accounts (HSAs) help in reducing taxable income?

HSAs provide a triple-tax advantage, making them a valuable tool to reduce taxable income. Your contributions to an HSA are tax-deductible for the current year, and the funds grow tax-free. When used for qualified medical expenses, withdrawals are tax-free. HSAs offer both immediate tax benefits and a long-term way to manage healthcare costs.

6-4. What’s the significance of timing income to reduce taxable income?

Timing your income strategically can have a significant impact on your taxable income. By deferring income or accelerating deductible expenses, you can minimize your tax liability. Balancing these strategies involves considering your current financial situation and anticipating changes in income and expenses.

6-5. How can I balance between Roth and traditional retirement accounts to reduce taxable income?

Choosing between Roth and traditional retirement accounts depends on your tax situation and future goals. Traditional accounts offer upfront tax deductions, reducing your current taxable income, while Roth accounts provide tax-free withdrawals in retirement. Analyze your current and projected tax brackets to determine which account aligns better with your financial strategy.

7. Case Study-Chris’s Journey: Reducing Taxable Income for Financial Freedom

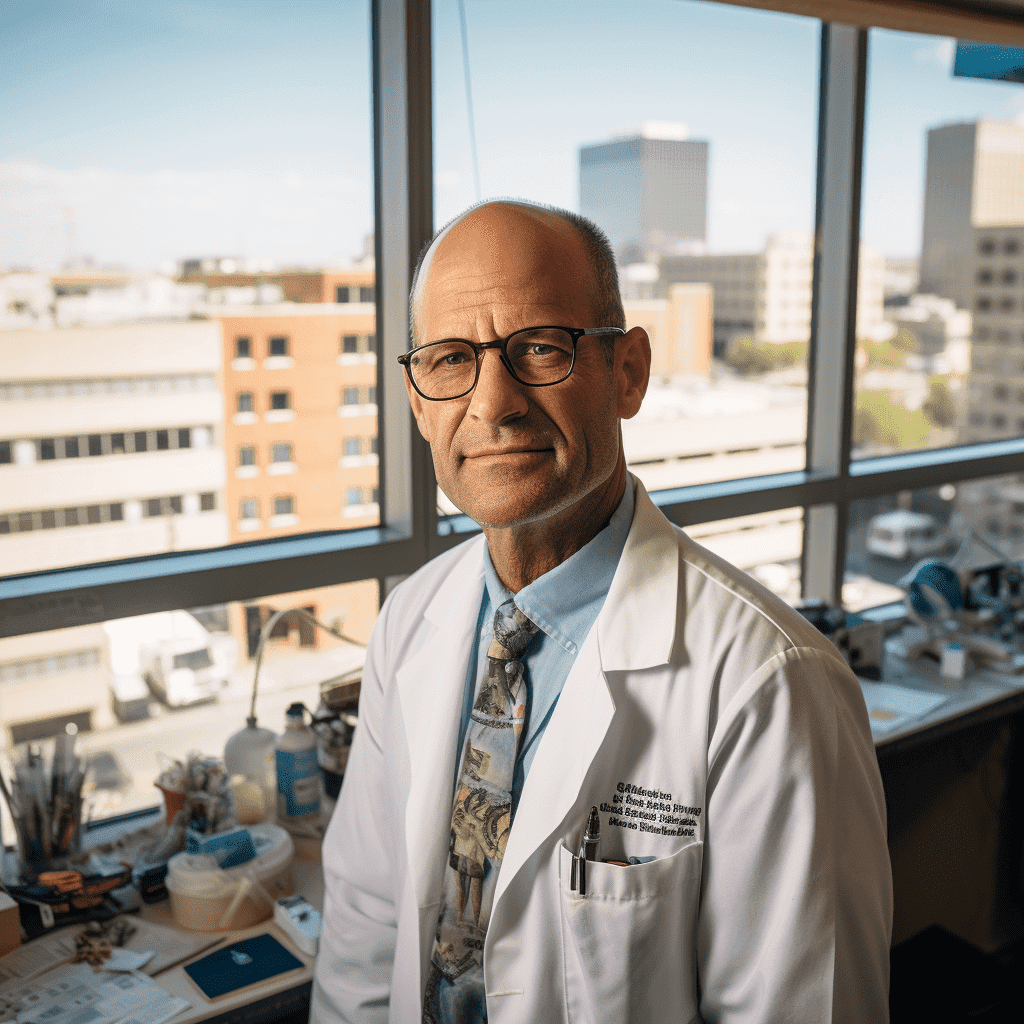

Meet Chris, a 48-year-old male doctor who is dedicated to his medical practice and cherishes his family.

Married with two children, Chris is passionate about providing quality healthcare while ensuring his loved ones’ well-being.

7-1. Current Situation

Despite a successful medical career, Chris was grappling with an ever-increasing tax burden. His annual income of $250,000 was subject to substantial taxes, leaving him concerned about securing his family’s future.

7-2. Conflict Occurs

Emotionally burdened by the realization that a significant portion of his earnings was going toward taxes, Chris knew he had to make a change. He understood that his approach to finances needed adjustment but initially hesitated due to the complexity of the task.

7-3. Problem Analysis

Upon deeper analysis, Chris recognized that his taxable income was the core of his dilemma. He was paying 35% of his income in taxes. This hindered his ability to save for his children’s education and invest in long-term goals. He saw that without intervention, this situation could have a severe impact on his family’s financial future.

7-4. Solution

Armed with knowledge, Chris decided to take action. He began by maximizing his retirement contributions. He allocated $22,500 annually to his 401(k), effectively lowering his taxable income. Additionally, he started an HSA, contributing $6,000 annually, allowing him to save on medical expenses while reducing taxable income.

Chris also adjusted his timing of income and expenses. He deferred a $20,000 bonus from December to January, decreasing his taxable income for the current year. Similarly, he accelerated his deductible expenses, prepaying $8,000 in property taxes before year-end.

7-5. Effects After Execution

After two years of diligent implementation, Chris noticed remarkable changes. His taxable income was reduced to $215,000, leading to a significant decrease in his tax liability. Previously, he paid $87,500 in taxes annually ($250,000*35%=$87,500); now, he paid $67,520(($250,000-$22,500-$6,000-$8,000)*32%=$68,320)—a $19,180 reduction($87,500-$68,320=$19,180).

With more funds at his disposal, Chris created a college fund for his children, invested in stocks, and even took a well-deserved family vacation. He felt a renewed sense of financial control and peace of mind.

7-6. In Conclusion

Chris’s journey exemplifies how knowledge and proactive steps can lead to financial freedom. By understanding strategies to reduce taxable income, he not only secured his family’s future but also unlocked opportunities for growth. His advice to others facing similar challenges is clear: take charge of your financial destiny, seek expert guidance, and embrace the power of strategic planning. In doing so, you can transform your financial landscape and achieve the freedom you desire.

8. Checklist

| Questions | Your Reflections | Suggested Improvement Strategies | Improvement Plans | Implementation Results | Review and Adjust |

| Are you aware of strategies to reduce taxable income? | Research tax-saving strategies online and consult financial experts | ||||

| Do you know the sources of your taxable income? | List all sources of income and categorize them as taxable or non-taxable | ||||

| Are you maximizing your retirement contributions? | Review your current contributions and consider increasing them if possible | ||||

| Have you explored health savings options? | Research Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) | ||||

| Have you considered timing your income strategically? | Analyze your income and expenses to identify opportunities for timing adjustments | ||||

| Are you aware of the potential tax benefits of retirement accounts? | Learn about tax deductions and growth potential of retirement accounts | ||||

| Have you sought professional advice for tax planning? | Schedule a consultation with a tax professional to optimize your tax-saving strategy |