In the realm of finance, the path to prosperity goes beyond conventional stocks and bonds. Types of alternative investments present a dynamic route to wealth creation, allowing investors to expand their portfolios beyond traditional avenues. This comprehensive guide explores diverse strategies within types of alternative investments, illuminating precious metals, cryptocurrency, annuities, collectibles, and more. By examining the advantages, risks, and appropriate investor profiles for each approach, you can make well-informed choices that shape your financial journey.

Outline

Reading time: 20 minutes

1. Precious Metals: A Tangible Path to Wealth

Investors have long turned to precious metals as a reliable strategy for safeguarding their wealth against economic uncertainties. The enduring appeal of gold and silver lies in their tangible nature, making them assets that have stood the test of time. These metals possess a unique quality – the ability to preserve their value over the long term, transcending geopolitical shifts and financial turmoil.

1-1. The Allure of Tangibility

At the heart of precious metals’ charm is their tangibility. In a world where digital transactions dominate, gold and silver stand as physical manifestations of wealth. Holding a bar of gold or a silver coin in your hand evokes a sense of connection to generations before us, reminding us of their historical significance as forms of currency and stores of value.

Gold and silver have a historical significance as currency and mediums of exchange in various civilizations. One notable advantage of precious metals as currency is their immunity to government debasement. Unlike paper currencies like the U.S. dollar, governments can’t simply print more precious metals. Printing excessive currency can lead to currency devaluation and inflation.

1-2. Gold: The Digital Haven

Often referred to as “digital gold,” the allure of gold as an investment shines brightly during times of market volatility. When traditional assets experience turbulence, investors seek refuge in gold due to its inverse correlation with other markets. This coveted characteristic has earned gold a reputation as a safe haven, a place where investors can find solace amid economic storms.

1-3. Silver’s Dual Nature

Silver, with its industrial applications, presents a unique duality in the precious metals landscape. Beyond its role as an investment, silver finds use in various industries, including electronics, solar panels, and medical technology. This industrial demand contributes to its price dynamics, as shifts in manufacturing and technological trends impact silver’s value. Therefore, investing in silver involves not only considering its appeal as a store of wealth but also monitoring its industrial utility.

1-4. Navigating Price Fluctuations and Market Manipulation

While precious metals offer stability, they are not immune to market dynamics. Price fluctuations can be substantial, influenced by factors such as geopolitical tensions, interest rates, and supply and demand dynamics. Additionally, the precious metals market is not immune to manipulation, with instances of price suppression or speculative behavior. Investors must be mindful of these risks and possess the patience to weather short-term fluctuations.

1-5. As a Hedge Against Inflation

During the late 1970s and early 1980s, the United States experienced significant inflation, which negatively impacted stocks and bonds. However, the value of gold and silver surged remarkably—over 500 percent from 1972 to 1980, even after adjusting for inflation. Such periods are rare. Although precious metals yielded decent returns in the 2000s, their prices plummeted after reaching a peak in 2011.

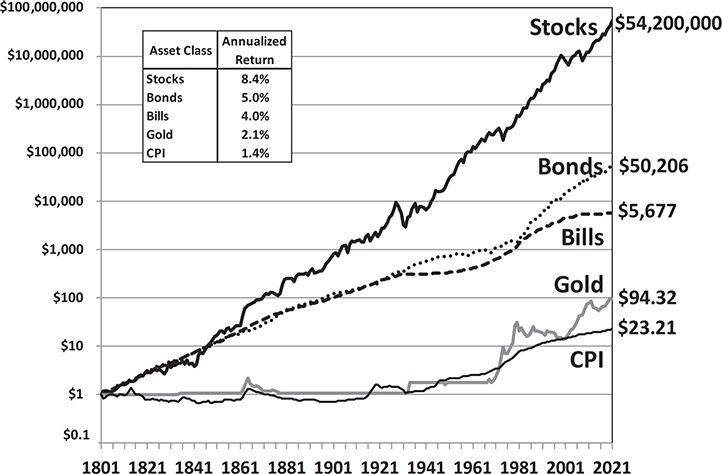

FIGURE 1 Total nominal return indexes, 1802–2021

Over decades, gold often proved to be a subpar investment. Their returns tend to match inflation rates.

To invest in precious metals as an inflation hedge, consider mutual funds or exchange-traded funds. Avoid purchasing precious metals futures, as they are short-term bets on gold or silver price movements. It’s advisable to steer clear of firms selling coins and bullion due to the high costs of storage and insurance. Even finding a legitimate firm poses challenges, and markups can be substantial.

1-6. Prime Candidates for Precious Metal Investments

Those who seek stability and wish to preserve their capital find themselves prime candidates for investing in precious metals. Investors who value diversification within their portfolios recognize the importance of including assets that have demonstrated resilience across history. Moreover, individuals who are concerned about potential economic downturns or currency devaluation can find comfort in knowing that precious metals have maintained their value through various financial crises.

In conclusion, investing in precious metals, particularly gold and silver, offers a tangible path to wealth that transcends mere paper assets. The appeal of these metals lies in their ability to endure, offering stability during times of uncertainty. Gold’s safe-haven status and silver’s dual role as an industrial commodity and store of value add layers of complexity to these investments. While not devoid of risks, the enduring allure of precious metals continues to attract those who seek to secure their financial futures through time-tested means.

2. Cryptocurrency: Navigating the Digital Frontier

In the realm of finance, cryptocurrency has emerged as a revolutionary digital asset class, promising to reshape the landscape of traditional financial systems. Spearheaded by Bitcoin, the first and most renowned cryptocurrency, this new frontier has ushered in a wave of decentralized innovation that challenges the very foundations of how we view and interact with money.

2-1. The Disruptive Potential

At its core, cryptocurrency represents a departure from centralized financial systems, offering the promise of democratized transactions and ownership. The technology that underpins cryptocurrencies, known as blockchain, enables secure and transparent peer-to-peer transactions without the need for intermediaries. This innovation has sparked immense interest from both investors and technology enthusiasts, as it has the potential to reshape the way we conduct business, transfer value, and even govern contracts.

2-2. The Bitcoin Genesis

Bitcoin, often referred to as digital gold, set the stage for the cryptocurrency revolution. Introduced by the mysterious Satoshi Nakamoto, Bitcoin brought to life the concept of a decentralized digital currency. Its limited supply, transparent ledger, and resistance to censorship captured the imagination of those disillusioned by traditional banking systems. As a result, Bitcoin’s value skyrocketed over time, attracting early adopters who recognized its potential.

2-3. Bitcoin has Risks

2-3-1. No Recourse

Online Bitcoin transactions are anonymous and irreversible. If a purchase issue arises, there’s no recourse unlike with credit card purchases. Cryptocurrencies attract those attempting to hide money or engage in illegal activities.

2-3-2. Lack of Inherent Value

Unlike gold with industrial uses, Bitcoin lacks inherent value. Bitcoin’s mining process requires specialized equipment and energy.

2-3-3. Limited Supply

Bitcoin’s supply is artificially capped. It’s one of many cryptocurrencies; competition could lead to its value drop.

2-3-4. Limited Acceptance

Despite its popularity, few merchants accept Bitcoin. Unfavorable conversion rates add to purchase costs.

2-4. High Returns Amidst Volatility

One of the defining characteristics of the cryptocurrency market is its propensity for high returns. Some early investors in Bitcoin and other cryptocurrencies have witnessed extraordinary gains over relatively short periods. However, the flip side of this potential lies in the extreme volatility that characterizes the market. Prices of cryptocurrencies can experience rapid and dramatic fluctuations, driven by factors ranging from market sentiment to regulatory announcements.

2-5. Navigating Regulatory Uncertainties

Regulatory environments for cryptocurrencies vary across different jurisdictions, contributing to the uncertainty that surrounds this asset class. Governments and financial institutions worldwide are still grappling with how to classify, tax, and regulate cryptocurrencies. The lack of a uniform approach adds an additional layer of complexity for investors. Changes in regulations, such as bans or restrictions, can significantly impact the value and legality of certain cryptocurrencies.

2-6. Tech-Savvy Investors and Blockchain Advocates

Cryptocurrency investments often attract tech-savvy individuals who possess a deep understanding of blockchain technology and its transformative potential. These investors believe in the decentralized future that cryptocurrencies promise and see opportunities beyond financial gains. Their familiarity with the intricacies of blockchain allows them to identify projects with genuine utility and long-term viability.

2-7. Exercising Caution in the Cryptosphere

While the allure of high returns is undeniable, it’s crucial to approach cryptocurrency investments with caution. The speculative nature of the market means that investments can lead to significant gains or losses. It’s advisable to conduct thorough research, diversify portfolios, and exercise prudence when entering this volatile landscape. Consulting with financial experts who understand the nuances of cryptocurrency investments can help navigate the complexities of this digital frontier.

In conclusion, Cryptocurrency presents an exhilarating journey into the digital frontier of finance. The disruptive potential of blockchain technology, epitomized by Bitcoin’s emergence, has ignited interest and investment. However, the crypto market’s extreme volatility and regulatory uncertainties underscore the importance of informed decision-making. Tech-savvy investors, drawn to the transformative power of cryptocurrencies, must balance their enthusiasm with caution, recognizing that while the rewards can be significant, the risks are equally substantial.

3. Annuities: Ensuring Financial Security

As individuals approach their golden years, the pursuit of financial security during retirement becomes paramount. Annuities step into the spotlight as a unique strategy designed to provide a reliable and consistent stream of income throughout one’s post-employment years. These insurance products operate on the principle of a contractual agreement between an individual and an insurer, establishing a foundation for financial stability in retirement.

3-1. The Foundation of Steady Income

Annuities are structured to offer a consistent income flow, akin to receiving a pension or social security payments. This predictability can help retirees cover essential living expenses and enjoy a certain standard of living. By converting a lump sum into periodic payments, individuals can ensure that their retirement years are marked by financial comfort and peace of mind.

Annuities, like retirement accounts, compound tax-free until withdrawal. However, unlike some retirement accounts, there are no upfront tax breaks for annuity contributions. Ongoing investment costs are higher. Consider annuities after fully funding tax-deductible retirement accounts. Annuities can also insure against outliving assets in retirement, though careful consideration is essential.

3-2. Understanding the Annuitization Process

The annuitization process, a core component of annuity investments, involves converting a lump-sum payment into a series of payments over a specified period. These payments can be tailored to align with the individual’s retirement needs, whether it’s monthly, quarterly, or annually. This process safeguards against the risk of outliving one’s savings, providing a safety net against longevity risk.

3-3. Fixed Annuities: The Stability Option

Fixed annuities are characterized by their predictability. They guarantee a predetermined interest rate for a specified period, ensuring a steady income regardless of market fluctuations. This stability makes fixed annuities an attractive choice for risk-averse retirees who prioritize the assurance of regular income over potentially higher but uncertain returns.

3-4. Variable Annuities: The Growth Opportunity

On the other end of the spectrum are variable annuities, offering a blend of growth potential and income certainty. With variable annuities, the investment performance is tied to underlying investment options, such as mutual funds. This structure allows investors to potentially benefit from market gains, but it also exposes them to market risks. Variable annuities cater to retirees who are open to assuming a degree of risk in exchange for the potential for higher returns.

3-5. Balancing High Fees and Limited Liquidity

While annuities offer financial security, they are not without drawbacks. One challenge is the presence of fees, which can include administrative charges, mortality and expense fees, and investment management fees. These fees can impact the overall returns earned from an annuity. Additionally, annuities often come with limited liquidity. Once funds are committed, withdrawing a significant portion before the term’s end may incur penalties.

3-6. Suitability for Risk-Averse Investors

Annuities are particularly well-suited for risk-averse investors who prioritize stable income over the potential for growth. Retirees who have a low tolerance for market volatility and are seeking a reliable source of funds to cover basic living expenses find value in the security offered by annuities. These individuals prioritize financial stability and peace of mind, placing a premium on a guaranteed income stream.

In conclusion, Annuities serve as a powerful tool for individuals seeking to secure their financial well-being during retirement. Whether through fixed annuities, which provide stability, or variable annuities, which offer growth potential, these investment vehicles offer a reliable income stream in an era marked by economic uncertainties. However, prospective annuity investors must be aware of associated fees and limited liquidity. By aligning annuity choices with retirement goals and risk tolerance, retirees can embrace financial security while enjoying the fruits of their labor in their golden years.

4. Collectibles: Investing in Passion

In the realm of alternative investments, collectibles emerge as a unique avenue that blends the worlds of passion and profit potential. These tangible assets span a vast spectrum, ranging from art and vintage cars to rare coins and stamps. Investing in collectibles offers a chance to engage in a pursuit driven by personal interest while also reaping potential financial rewards. However, this intriguing landscape comes with its own set of complexities and considerations.

4-1. The Allure of Passion-Driven Investments

Unlike traditional investment vehicles, collectibles resonate with individuals on a deeply personal level. Art lovers, car enthusiasts, philatelists, and numismatists find themselves drawn to the world of collectibles due to their intrinsic passion for these objects. This emotional connection transforms the act of investing into a rewarding experience that goes beyond monetary gains.

4-2. Merging Passion and Profit Potential

What sets collectibles apart is their dual role as both cherished possessions and potential financial assets. While investing in stocks or bonds may lack emotional resonance, collectible investments intertwine the joy of ownership with the anticipation of appreciation in value. This unique dynamic appeals to those who relish the prospect of profiting from their passions.

4-3. The Soaring Values Over Time

Collectibles often carry the allure of witnessing remarkable value appreciation over extended periods. Rare art pieces, vintage automobiles, and unique stamps have shown the potential to appreciate substantially over decades. This historical performance attracts collectors who view their investments as not only aesthetic treasures but also as vehicles for generating wealth.

4-4. The Challenge of Limited Liquidity

Despite the potential for high returns, the collectibles market presents challenges rooted in its lack of liquidity. Unlike stocks that can be readily bought or sold, collectibles require a patient approach. Finding the right buyer or seller can take time, impacting the ease of converting collectibles into cash. This illiquidity factor underscores the need for a long-term perspective when investing in collectibles.

Collectibles are often poor investment choices due to high dealer markups, maintenance costs, and uncertain returns. Long-term gains are taxed at up to 28 percent, higher than rates on stocks and real estate. Buy collectibles for enjoyment, not solely for financial gain. Treat collecting as a hobby and purchase directly to avoid high markups.

4-5. Navigating Specialized Knowledge

Successful collectible investing hinges on a comprehensive understanding of the market’s nuances. This knowledge includes identifying factors that contribute to an item’s value, such as rarity, historical significance, provenance, and condition. Collectors armed with specialized insights are better equipped to make informed decisions that align with their investment goals.

4-6. The Long-Term Perspective

Investing in collectibles demands patience and a willingness to adopt a long-term outlook. The value appreciation of these assets often unfolds gradually, making them more suitable for individuals who can afford to hold onto their investments without the need for immediate liquidity. This aligns with the mindset of collectors who cherish their items over time.

In conclusion, Collectible investments offer a distinct fusion of passion and potential profitability. From art connoisseurs to vintage car aficionados, individuals with a deep appreciation for specific objects can transform their passion into an investment strategy. The journey, however, requires understanding the intricacies of the market, embracing the challenges of illiquidity, and possessing the expertise to gauge an item’s true value. Collectible investors navigate a landscape where personal passion and prudent financial decisions converge, creating a harmonious blend of heart and returns.

5. Other Alternative Investments: Expanding Horizons

While precious metals, cryptocurrency, annuities, and collectibles garner significant attention, the landscape of alternative investments extends far beyond these well-trodden paths. Exploring these lesser-explored avenues opens the door to a world of diverse opportunities that cater to a range of risk appetites and investment goals. From real estate crowdfunding to peer-to-peer lending, these alternative strategies offer distinct advantages and challenges worth delving into.

5-1. Embracing Real Estate Crowdfunding

Real estate crowdfunding emerges as an innovative approach for individuals seeking exposure to the real estate market without the commitment of purchasing an entire property. Through online platforms, investors can pool their resources to fund real estate projects. This method provides diversification by allowing investment across various properties while minimizing the traditional barriers to entry.

5-2. The Rise of Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms enable investors to lend money directly to individuals or small businesses in need of funding. This approach bypasses traditional financial institutions, potentially offering higher returns for investors and lower interest rates for borrowers. P2P lending platforms connect lenders and borrowers, facilitating transactions in an online ecosystem.

5-3. Exploring Agricultural Investments

Agricultural investments invite investors to participate in the global demand for food and commodities. Through agricultural funds or direct investments, individuals can gain exposure to sectors such as farmland, timber, and crop production. These investments align with the growing need for sustainable agriculture practices and can provide returns tied to global consumption trends.

5-4. Navigating Varying Risk and Return Profiles

The allure of other alternative investments lies in their potential to deliver unique risk and return profiles. Real estate crowdfunding offers exposure to property markets, with potential for rental income and property appreciation. P2P lending presents an opportunity to earn interest income from loans extended to individuals or small businesses. Agricultural investments tap into the global demand for resources. Each option carries distinct risk factors, necessitating careful consideration based on individual risk tolerance and investment objectives.

5-5. Thorough Research and Expert Consultation

Venturing into these unconventional spaces demands a commitment to thorough research and expert guidance. Unlike more established investment avenues, these alternatives often lack the historical data and established norms that guide decision-making. Engaging with financial experts who understand the nuances of each strategy is essential for mitigating risks and optimizing potential returns.

5-6. Customizing Portfolios with Alternatives

Investors seeking to diversify their portfolios can benefit from incorporating these alternative options. By allocating a portion of their investments to real estate crowdfunding, P2P lending, or agricultural ventures, individuals can reduce overall risk while tapping into various income streams and potential appreciation.

In conclusion, Exploring other alternative investments broadens the horizons of wealth-building strategies. Real estate crowdfunding, P2P lending, and agricultural investments provide avenues for those seeking unconventional ways to diversify their portfolios and capitalize on emerging trends. As with any investment, thorough research, understanding risk factors, and seeking expert advice are essential to harnessing the potential benefits of these alternative options.

6. Conclusion

Wealth building through alternative investments presents a dynamic journey requiring careful consideration. Precious metals, cryptocurrency, annuities, and collectibles each offer unique avenues for growth, accompanied by distinct risks. While alternative investments can enhance portfolio diversification, they demand a thorough understanding of their intricacies. By assessing your financial goals, risk tolerance, and investment horizon, you can harness the potential of alternative investments to pave the way for a prosperous future.

7. FAQs

7-1. What Are Alternative Investments and Why Are They Important?

Alternative investments refer to a diverse range of investment options beyond traditional stocks and bonds. These options offer investors a chance to diversify their portfolios and potentially achieve higher returns. They include assets like precious metals, cryptocurrency, real estate, and collectibles. Alternative investments are crucial because they can help reduce overall portfolio risk, provide opportunities for growth in unique market segments, and act as a hedge against market volatility.

7-2. How Do Precious Metals Fit into Alternative Investment Strategies?

Precious metals, such as gold and silver, play a significant role in alternative investment strategies. They are considered tangible assets that can preserve value over time and act as a hedge against economic uncertainties. Investors often turn to precious metals as a safe haven during market turbulence. Gold’s historical status as a store of value and silver’s dual role as an industrial metal and investment contribute to their appeal in alternative investment portfolios.

7-3. Is Cryptocurrency a Viable Alternative Investment?

Cryptocurrency has emerged as a viable alternative investment option with the potential for high returns. Bitcoin and other cryptocurrencies operate on blockchain technology, offering decentralized transactions. However, the cryptocurrency market is characterized by extreme volatility and regulatory uncertainties. Investors interested in cryptocurrency should conduct thorough research, understand the technology, and carefully assess their risk tolerance before venturing into this digital frontier.

7-4. How Do Annuities Provide Financial Security for Retirement?

Annuities are insurance products that offer a steady stream of income during retirement. They provide retirees with a predictable source of funds, helping cover essential expenses and ensuring financial stability. Fixed annuities offer a guaranteed interest rate over a specific period, while variable annuities allow for growth tied to investment performance. However, annuities come with fees and limited liquidity, making them suitable for risk-averse individuals seeking consistent income in their golden years.

7-5. What Are the Advantages of Exploring Other Alternative Investments?

Beyond the well-known options, there are other alternative investments like real estate crowdfunding, peer-to-peer lending, and agricultural investments. These avenues offer diverse opportunities for investors to diversify their portfolios and potentially achieve unique risk and return profiles. Real estate crowdfunding allows fractional ownership of properties, while P2P lending offers direct lending to individuals. Agricultural investments tap into global consumption trends. Thorough research and consultation with financial experts are essential before venturing into these unconventional spaces.

8. Case Study-Chloe’s Journey to Financial Diversification

Meet Chloe, a 31-year-old female nurse dedicated to her profession.

Her monthly income as a nurse is $4,000, providing her with a stable source of earnings.

Living with her parents, Chloe’s expenses are modest, amounting to around $1,500 per month, covering personal expenses and contributing to household costs.

She has a total savings of $30,000 in her bank account, but she’s well aware that relying solely on this traditional savings approach might not be sufficient for her long-term financial goals.

8-1. Current Situation

In her late 20s, Chloe started to explore ways to grow her savings beyond her bank account. She discovered the concept of alternative investments, and her interest was piqued by the potential to diversify her portfolio. Aware of her limited knowledge in this area, Chloe decided to take matters into her own hands and educate herself.

8-2. Conflict Occurs

As Chloe delved into alternative investments, she faced the challenge of navigating a new landscape. She felt emotionally torn between the excitement of potential growth and the apprehension of the unknown. She realized that her lack of knowledge about precious metals, cryptocurrency, annuities, and collectibles was a roadblock to making informed decisions.

Chloe recognized the need for change, but initial doubts held her back. She worried about potential risks and the possibility of losing her hard-earned money.

8-3. Problem Analysis

Chloe’s predicament was rooted in her limited investment knowledge and fear of risks. Depending solely on her savings account might lead to missed opportunities for financial growth. If left unresolved, this issue could hinder her dreams of buying a home or securing her retirement.

8-4. Solution

Chloe devised a plan to enhance her understanding of alternative investments. She allocated a budget of $500 for education, including online courses and books. She decided to dedicate an hour each day to learning about precious metals, cryptocurrency, annuities, and collectibles. Her approach aimed to acquire comprehensive knowledge about the history, market dynamics, risks, and potential returns of each investment type.

Chloe’s goal was to allocate a portion of her portfolio to alternative investments, not exceeding 10% of her total savings, to manage risks effectively.

8-5. Effects After Execution

After a few months of consistent effort, Chloe began to witness positive changes. Her newfound knowledge provided her with the confidence to explore alternative investments cautiously. Chloe allocated $2,000 from her savings to invest in precious metals and cryptocurrency, each with an expected annual return of 6-8%.

She was aware of the risks and accepted the possibility of short-term fluctuations. Chloe developed an investment period of five years, aligning with her long-term goals.

8-6. In Conclusion

Chloe’s journey to overcome her initial hesitations and expand her investment horizons has brought about tangible results. With a diversified portfolio including alternative investments, Chloe is better positioned for potential growth. Her data-driven approach, including allocating a portion of her savings to alternative investments and staying informed about market trends, has given her financial strategy a solid foundation.

Chloe’s case serves as a reminder that a proactive approach to learning and implementing new investment strategies can pave the way for achieving long-term financial objectives. Her advice to others in a similar position is to allocate time and resources to education and to be open to diversifying their portfolios wisely.

9. Checklist

| Questions | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review |

| How familiar am I with alternative investment strategies like precious metals, cryptocurrency, annuities, and collectibles? | Explore the articles and resources mentioned in the content for a deeper understanding. | ||||

| Have I considered diversifying my investment portfolio beyond traditional options? | Research the benefits of diversification and explore alternative investment options. | ||||

| Do I understand the risks associated with alternative investments such as price fluctuations, market manipulation, and regulatory uncertainties? | Review the article’s insights on risks to make informed decisions. | ||||

| What is my risk tolerance, and how does it align with the investment strategies discussed? | Assess my risk tolerance and explore investment options that match my comfort level. | ||||

| Am I open to investing in alternative assets based on my financial goals and the potential for growth? | Reflect on my financial goals and consider incorporating alternative investments into my strategy. | ||||

| Have I conducted thorough research and sought expert advice before considering investments like cryptocurrency and collectibles? | Ensure I’ve gathered sufficient information and consulted professionals to make informed choices. | ||||

| How can I balance passion-driven investments like collectibles with the potential for financial gain? | Find ways to enjoy investments while considering their financial potential and long-term goals. |