When it comes to securing your home and your financial future, homeowners insurance plays a pivotal role. In this comprehensive guide, we’ll delve into the world of homeowners insurance, exploring whether it’s a requirement and why it’s crucial for homeowners.

Reading time: 24 minutes

Outline

- Understanding the Importance of Homeowners Insurance

- Legal Requirements for Homeowners Insurance

- Factors Influencing Homeowners Insurance Requirements

- Benefits of Having Homeowners Insurance

- How to Obtain Homeowners Insurance

- When Homeowners Insurance Isn’t Mandatory

- Conclusion

- FAQs

- Case Study

- Checklist

1. Understanding the Importance of Homeowners Insurance

Homeowners insurance, often called home insurance, provides comprehensive protection for your home against various risks, including natural disasters, theft, vandalism, and accidental damage. But is homeowners insurance required? In this guide, we’ll explore its significance, coverage options, and the reasons it’s essential.

1-1. What is Homeowners Insurance?

1-1-1. Comprehensive Protection for Your Home

Homeowners insurance, often referred to as home insurance, is a comprehensive coverage plan designed to provide financial protection in the face of adversity. It encompasses a broad spectrum of potential risks, ensuring that your most significant investment—your home—is safeguarded against various threats.

1-1-2. Coverage Against Natural Disasters

One of the core functions of homeowners insurance is to shield you from the financial fallout of natural disasters. From hurricanes and tornadoes to earthquakes and wildfires, Mother Nature can unleash her fury unexpectedly. Without adequate protection, the cost of repairing or rebuilding your home could be astronomical.

1-1-3. Theft and Vandalism Protection

In addition to natural disasters, homeowners insurance also extends its protective shield to guard against man-made threats. Theft and vandalism are unfortunate realities, and having the right policy can help you recover from such traumatic events, both emotionally and financially.

1-1-4. Accidental Damage Coverage

Accidents can happen at any time. Whether it’s a kitchen fire, a burst pipe, or a fallen tree damaging your roof, homeowners insurance steps in to cover the expenses associated with repairing or replacing damaged property within your home.

1-2. Why Do You Need Homeowners Insurance?

1-2-1. Safeguarding Your Financial Well-Being

Homeownership is not just about having a place to call your own; it’s also a significant financial investment. Imagine the emotional and financial turmoil of having to shoulder the entire burden of rebuilding your home after a catastrophic event. Homeowners insurance acts as a safety net, ensuring that your financial well-being remains intact.

1-2-2. Protection Against Liability

It’s not just your property that homeowners insurance shields; it also guards your financial interests in case of liability. If someone is injured on your property, you could be held responsible for medical expenses and legal fees. Homeowners insurance steps in to cover these costs, preventing them from draining your savings or assets.

1-2-3. Meeting Lender Requirements

If you have a mortgage, your lender is likely to require homeowners insurance. They want to ensure their investment—the property you’re financing—is adequately protected. Lender-mandated insurance is not just for their benefit; it ultimately protects your interests as well.

1-2-4. Peace of Mind

Beyond the financial aspects, homeowners insurance provides something equally valuable—peace of mind. Knowing that you have a safety net in place allows you to sleep soundly at night, knowing that even in the face of adversity, you and your family will have a place to call home.

1-3. Coverage Options

When it comes to homeowners insurance, understanding the coverage options available is paramount. Let’s break down these options into greater detail:

1-3-1. Dwelling Coverage

Dwelling coverage is the heart of your homeowner’s insurance policy. It safeguards your home’s structure, including the walls, roof, floors, and built-in appliances. If disaster strikes and your home is damaged or destroyed by a covered peril like a fire or a severe storm, dwelling coverage steps in to help with repair or reconstruction costs. It’s essential to assess the replacement cost of your home accurately to determine the appropriate amount of dwelling coverage.

- Determining the cost to rebuild: When insuring your home, one of the critical factors to consider is how much it would cost to rebuild your property from the ground up, particularly in the event of total destruction, such as a fire. This cost should be based on your home’s size in square footage, not its purchase price or mortgage size.

- Guaranteed replacement cost provision: To ensure comprehensive protection, make sure your homeowner’s policy includes a guaranteed replacement cost provision. This feature guarantees that your insurance company will cover the full cost of rebuilding, even if it exceeds the policy’s coverage limit. It’s worth noting that different insurers define guaranteed replacement cost differently, with some setting limits on coverage. Always clarify this with your insurer to avoid surprises.

- Code upgrades for older properties: If you own an older property that doesn’t meet current building standards, consider purchasing a rider to cover code upgrades. This supplemental coverage ensures that your home can be rebuilt in compliance with updated building codes, which may be more stringent than when your house was constructed. Some policies already include a percentage of dwelling coverage for code upgrades, but it’s essential to verify this with your insurer.

1-3-2. Personal Property Coverage

Your home isn’t just bricks and mortar; it’s filled with personal belongings that hold sentimental and monetary value. Personal property coverage extends protection to your furniture, electronics, clothing, and other possessions within your home. If these items are damaged or stolen, your policy can assist in covering the replacement or repair costs. To ensure your personal property is adequately protected, it’s wise to create a home inventory detailing your belongings and their estimated values.

- Assessing personal property coverage: The amount of personal property coverage on your homeowner’s policy is often linked to your dwelling coverage. Typically, you’ll have coverage equal to 50-75% of your dwelling coverage, which is generally sufficient. However, it’s essential to evaluate whether additional coverage is necessary for high-value items.

- Riders for valuable items: For valuable possessions like jewelry, computers, or collectibles that may not be fully covered by standard policies, consider riders. These supplementary policies can provide reimbursement at replacement cost, which often exceeds the item’s pre-loss value. Evaluate whether riders are needed, considering the financial impact of potential losses.

- Documenting belongings: Whether you’re a renter or homeowner, maintaining a detailed inventory of your possessions is vital. Create a list or, even better, take photographs or videos of your belongings, estimating their value. Keep this inventory updated and store it outside your home to prevent loss in case of a disaster. Retain receipts for significant purchases as additional documentation.

1-3-3. Liability Coverage

Liability coverage is a vital component of homeowners insurance that shields you from financial harm in case someone is injured on your property, and you’re found responsible. This coverage can assist with medical expenses, legal fees, and even settlement costs if a lawsuit arises. It doesn’t just apply to injuries on your property but also extends to incidents outside your home where you may be held liable. Maintaining adequate liability coverage is crucial, as lawsuits can be financially devastating.

- Importance of liability insurance: Liability insurance safeguards you from financial consequences if someone is injured on your property, including injuries caused by pets. It’s crucial to have sufficient coverage that at least matches your financial assets, and having twice your assets in coverage is advisable. While the likelihood of being sued is relatively low, the potential financial impact of a lawsuit can be substantial.

- Consideration of umbrella policies: For those with substantial assets to protect, an umbrella or excess liability policy can provide an extra layer of security. This type of coverage extends beyond typical liability limits and offers broader protection. An umbrella policy can be an affordable way to increase your liability coverage significantly.

1-3-4. Flood and Earthquake Insurance: Protection from Mother Nature

- The need for additional disaster coverage: Standard homeowner’s insurance often falls short when it comes to natural disasters like earthquakes and floods. Purchasing separate coverage for these events is essential to prevent significant financial losses.

- Common misconceptions about earthquake and flood risk: Don’t underestimate the risk of earthquakes and floods in your area based on misconceptions. Earthquakes can occur in unexpected regions, and floods pose threats to numerous communities. Relying on government assistance can lead to loans that must be repaid, impacting your finances.

- Managing costs through deductibles: You can manage the cost of earthquake or flood insurance by adjusting deductibles. While a 10 percent deductible may seem substantial, it’s a reasonable trade-off to protect against the remaining 90 percent of potential losses. Evaluate deductible options to find a balance between affordability and coverage.

1-3-5. Additional Living Expenses Coverage

When your home becomes uninhabitable due to covered damage, you may need to find temporary housing. This is where additional living expenses coverage comes into play. It helps cover the cost of accommodations, meals, and other essential expenses while your home is being repaired or rebuilt. Keep in mind that coverage limits and duration can vary, so it’s essential to understand the specifics of this provision in your policy.

1-4. Typical Components of a Policy

Now that we’ve delved into the coverage options let’s explore the typical components found within a homeowners insurance policy:

1-4-1. What It Covers

Understanding what your homeowner’s insurance covers is fundamental. It typically includes damage caused by perils like fire, windstorms, hail, theft, vandalism, and more. However, it’s essential to review your policy’s specific list of covered perils, as not all policies are identical. Some events, such as earthquakes and floods, may require separate policies or endorsements.

1-4-2. What It Doesn’t Cover

Equally crucial is understanding what your homeowner’s insurance doesn’t cover. Certain perils, as mentioned earlier, may be excluded from standard policies. Additionally, intentional acts of damage or neglect may not be covered. It’s imperative to read the policy exclusions carefully to avoid surprises when making a claim.

1-4-3. Policy Limits

Policy limits dictate the maximum amount your insurer will pay for covered losses. They can vary for different components of your policy, such as dwelling coverage, personal property coverage, and liability coverage. Understanding these limits is essential to ensure you have sufficient coverage in place. If your policy’s limits are too low, you may find yourself underinsured when you need it most.

In summary, homeowners insurance isn’t just a financial safety net; it’s vital protection for your home and peace of mind. Whether mandated by your mortgage lender or chosen for your family’s security, it’s a wise investment for safeguarding your property and financial well-being.

2. Legal Requirements for Homeowners Insurance

Wondering if homeowners insurance is a must? The answer depends on where you live and your mortgage terms. Let’s explore the legal aspects of homeowners insurance, including state regulations and mortgage lender requirements.

2-1. State Regulations on Homeowners Insurance

Homeowners insurance is not required by state or federal law, but a mortgage or home equity loan holder may demand that you buy coverage. If you’re unsure about the requirements in your state, it’s crucial to research and understand your local laws regarding homeowners insurance. Consulting with a local insurance agent can also provide clarity on your specific obligations.

2-2. Mortgage Lender Requirements

2-2-1. The Lender’s Stake

If you have a mortgage on your home, your lender holds a significant stake in your property. They want to ensure their investment remains secure. To achieve this, mortgage lenders often require homeowners insurance as a condition of the loan agreement.

2-2-2. Non-Negotiable Condition

For most mortgage lenders, the requirement for homeowners insurance is non-negotiable. It’s a standard practice to protect their interests, as well as yours, by ensuring that the property they’re financing is adequately insured.

2-2-3. Escrow Accounts

Many lenders also set up escrow accounts where you pay a portion of your homeowners insurance premium along with your monthly mortgage payment. This ensures that your insurance premiums are paid on time, preventing lapses in coverage.

2-2-4. Shop for Insurance Early

It’s advisable to start shopping for homeowners insurance early in the home-buying process if you’re financing your purchase with a mortgage. Ensuring you have coverage lined up before closing on the property is a wise and responsible approach.

In brief, homeowners insurance isn’t legally required, but it’s typically mandatory with a mortgage. Lenders want to protect their investment, so they make it a non-negotiable condition. They may also set up escrow accounts. To stay informed, research your state’s laws and consult with a local insurance agent. Being prepared with homeowners insurance is a responsible choice when securing your home.

3. Factors Influencing Homeowners Insurance Requirements

Homeowners insurance requirements can vary significantly based on factors such as your homeownership status and where you live. This section explores two key factors that play a pivotal role in determining whether homeowners insurance is required for you: Homeownership vs. Renting and Location and Climate Considerations.

3-1. Homeownership vs. Renting

3-1-1. Exclusive Need for Property Owners

The fundamental distinction when it comes to homeowners insurance requirements lies in whether you own or rent your dwelling. If you’re a homeowner, the responsibility for obtaining homeowners insurance falls squarely on your shoulders. It’s not just a matter of choice; it’s a necessity to protect your investment.

3-1-2. Landlord Responsibility for Renters

On the other hand, if you’re renting your residence, the dynamic shifts. In most cases, the property owner or landlord assumes the responsibility for insuring the physical structure of the building. However, this insurance doesn’t extend to your personal belongings within the rental unit. For renters, it’s highly advisable to consider renters insurance to protect their possessions.

3-2. Location and Climate Considerations

3-2-1. Geographical Vulnerability

Where you choose to live can significantly impact your homeowners insurance requirements. Geographical location plays a crucial role, particularly in areas prone to specific natural disasters.

3-2-2. Natural Disasters and Stricter Requirements

Regions with a history of natural disasters like hurricanes, earthquakes, or wildfires often have stricter homeowners insurance requirements. This is because the risk of property damage in these areas is substantially higher, necessitating comprehensive coverage to mitigate potential financial devastation.

3-2-3. Insurance Specifics by Region

The specific requirements can vary by region and state. For instance, coastal states may impose additional regulations for hurricane insurance, while earthquake-prone areas may have separate coverage requirements.

3-2-3. Consulting with Local Experts

To fully understand the homeowners insurance requirements in your location, it’s essential to consult with local insurance experts who are well-versed in the specific risks and regulations applicable to your area.

In summary, whether homeowners insurance is required or not depends on several factors, with two key influencers being homeownership status and geographical location. Property owners typically bear the responsibility of obtaining homeowners insurance to protect their investment, while renters are encouraged to consider renters insurance. Geographical location, especially in areas susceptible to natural disasters, can lead to stricter insurance requirements. To navigate these considerations effectively, it’s essential to consult with insurance professionals who can provide tailored guidance based on your unique circumstances and location.

4. Benefits of Having Homeowners Insurance

Homeowners insurance is not just a legal requirement or a financial safeguard; it offers a range of crucial benefits that extend far beyond mere compliance. In this section, we delve into these benefits, focusing on Protection Against Property Damage and Liability Coverage.

4-1. Protection Against Property Damage

4-1-1. Comprehensive Peril Coverage

One of the foremost advantages of homeowners insurance is its capacity to shield your property against a wide array of perils. These perils encompass events that can lead to property damage or loss, including:

4-1-2. Fire Damage

The devastation caused by a fire can be catastrophic, both emotionally and financially. Homeowners insurance steps in to cover the costs of repairing or rebuilding your home in the aftermath of a fire, sparing you from bearing this substantial burden alone.

4-1-3. Vandalism and Theft

Acts of vandalism or theft can leave you feeling violated and insecure. Homeowners insurance offers protection against the repair or replacement of stolen or vandalized property, ensuring that your peace of mind is restored.

4-1-4. Storm Damage

Storms, including hurricanes, tornadoes, and severe thunderstorms, pose a constant threat to homes across the country. Homeowners insurance provides the necessary financial safety net to address the damage inflicted by these natural forces, preventing you from facing financial ruin.

4-1-5. Accidental Damage

Accidents can occur at any moment, leading to unexpected property damage. Whether it’s a kitchen fire, a burst pipe, or a fallen tree damaging your roof, homeowners insurance covers the expenses associated with repairing or replacing damaged property within your home.

4-2. Liability Coverage

4-2-1. Protection from Lawsuits

While property protection is a fundamental component of homeowners insurance, it also offers a lesser-known but equally critical benefit—liability coverage. This facet of your policy safeguards your financial interests in the event of an accident or injury on your property.

4-2-2. Injury Coverage

If someone is injured while on your property, whether due to a slip and fall or any other accident, you could be held legally liable for their medical expenses and related costs. Homeowners insurance steps in to cover these expenses, preventing them from draining your savings or assets.

4-2-3. Legal Defense

In addition to covering the injured party’s expenses, homeowners insurance also provides for your legal defense if you are sued. Legal fees can be exorbitant, and this coverage ensures that you have the resources necessary to mount a proper defense.

In conclusion, homeowners insurance is not merely a financial safeguard; it offers comprehensive protection against property damage and liability. It shields your home and belongings from a wide range of perils, including fire, vandalism, theft, and storm damage. Moreover, it provides crucial liability coverage, protecting you from the potentially devastating financial repercussions of accidents or injuries on your property. Having homeowners insurance is not just a legal requirement; it’s a vital shield that provides peace of mind and ensures your financial well-being in times of crisis.

5. How to Obtain Homeowners Insurance

When it comes to homeowners insurance, one size doesn’t fit all. Customizing your coverage is essential to ensure your home and assets are adequately protected.

5-1. Choosing the Right Policy

5-1-1. Customizing Your Coverage

Selecting the right homeowners insurance policy is not a one-size-fits-all endeavor. It involves tailoring the coverage to your specific needs and circumstances. Here are the key considerations:

5-1-2. Coverage Limits

The coverage limits of your policy dictate how much your insurer will pay in the event of a claim. It’s essential to assess the value of your home and possessions to determine the appropriate coverage limits. Underinsurance can leave you financially vulnerable, while overinsurance may lead to unnecessary expenses.

5-1-3. Deductibles

Deductibles are the out-of-pocket expenses you must pay before your insurance coverage kicks in. Choosing a higher deductible can lower your premium but increases your financial responsibility in the event of a claim. Conversely, a lower deductible means higher premiums but lower immediate costs.

5-1-4. Optional Endorsements

Homeowners insurance policies often come with optional endorsements or riders. These allow you to customize your coverage further. For example, if you live in an area prone to floods, you may want to add a flood insurance endorsement. Understanding your unique needs and risks will guide your decision on which endorsements to include.

5-2. Cost Factors

5-2-1. Determinants of Premium Costs

The cost of homeowners insurance can vary widely based on several factors. Understanding these cost factors is crucial to managing your insurance expenses effectively.

5-2-2. Home Value

The value of your home is a significant factor in determining your insurance premium. More expensive homes typically require higher coverage limits, leading to higher premiums. Conversely, smaller homes with lower values may have lower insurance costs.

5-2-3. Location Matters

Where you live plays a significant role in your insurance costs. Homes in areas prone to natural disasters or high crime rates typically have higher premiums. Conversely, homes in safer neighborhoods or regions with favorable weather conditions may enjoy lower insurance rates.

5-2-4. Coverage Options

The level of coverage you choose directly impacts your premium. Comprehensive coverage with additional endorsements will result in higher premiums, while basic coverage with lower limits and deductibles will be more affordable.

5-2-5. Discounts and Mitigating Costs

To mitigate insurance costs, consider factors like bundling your homeowners and auto insurance with the same provider, installing security systems, or making home improvements that reduce risk, such as updating your roof or plumbing.

- Eligibility for discounts: You may qualify for special discounts on your insurance policy, such as those related to security systems, age, or bundling multiple policies with the same insurer. Don’t hesitate to inquire about potential discounts when obtaining quotes, as they can significantly reduce your premium costs.

- The role of credit scores: Insurers often use credit scores as a factor in setting rates, as higher credit scores are associated with fewer accidents and claims. Improving your credit score can lead to more favorable insurance rates.

5-3. Buying Homeowner’s or Renter’s Insurance

5-3-1. Comparison shopping for the best rates

Insurance companies price their homeowner’s and renter’s policies differently, making it essential to shop around for the best rates. The companies listed below are known for offering competitive prices and satisfactory customer service:

- Amica

- Auto-Owners

- Erie Insurance

- GEICO

- Liberty Mutual

- Nationwide Mutual

- State Farm

- USAA (for military members and families)

5-3-2. Contacting insurers for quotes

Some insurers require you to call a toll-free number for a price quote, which can save you money as they don’t have to pay agent commissions. Local claims representatives are available to assist with claims when needed.

5-3-3. Additional types of insurance

Some of the recommended companies may also offer other types of insurance, such as life insurance.

In conclusion, obtaining homeowners insurance is a critical step in safeguarding your home and financial well-being. By choosing the right policy, and understanding coverage limits, deductibles, and optional endorsements, you can create a tailored insurance plan that fits your unique situation. Don’t forget to explore cost factors, seek discounts, and compare rates from reputable insurers to get the best coverage at the right price.

6. When Homeowners Insurance Isn’t Mandatory

While homeowners insurance is often a requirement or strongly recommended, there are specific scenarios where it may not be mandatory. In this section, we explore situations where homeowners insurance becomes optional, primarily focusing on Paid-off Homes and the importance of Voluntary Coverage.

6-1. Paid-off Homes

6-1-1. Mortgage Freedom

One of the primary instances where homeowners insurance is no longer mandatory is when you have paid off your mortgage. With no outstanding mortgage lender to enforce the insurance requirement, you technically have the choice to go without coverage. However, this newfound freedom comes with some critical considerations:

6-1-2. Ownership Unchanged

Although your mortgage is paid off, you still own your home outright. This means that you retain full responsibility for your property’s welfare and the financial consequences of any damage or loss.

6-1-3. Voluntary Coverage Advised

While it may be legally optional, forgoing homeowners insurance on a paid-off home is a decision that should not be taken lightly. The importance of voluntary coverage cannot be overstated, as it serves as a safety net to protect your significant investment in your home.

6-2. Voluntary Coverage

6-2-1. Protecting Your Investment

Voluntary homeowners insurance, as the name suggests, is a policy you choose to maintain even when it’s not legally required. It’s an act of prudence and responsible homeownership, and here’s why it’s advisable:

6-2-2. Comprehensive Protection

Voluntary coverage ensures that your home and personal belongings are safeguarded against unforeseen perils, including fire, theft, vandalism, and natural disasters. Without insurance, the financial burden of repairing or rebuilding your home in the event of such disasters falls squarely on your shoulders.

6-2-3. Liability Protection

Voluntary homeowners insurance also extends liability coverage, protecting you from potential lawsuits if someone is injured on your property. Without it, legal expenses and potential settlements can have devastating financial consequences.

6-2-4. Peace of Mind

Maintaining homeowners insurance, even when it’s optional, offers peace of mind. You can rest easy knowing that your investment is protected, and you won’t be caught off guard by unexpected financial challenges.

6-2-5. Future Mortgage Considerations

In some cases, even if you’ve paid off your mortgage, you may choose to maintain homeowners insurance if you plan to refinance or take out a home equity loan in the future. Lenders may require insurance as a condition of these financial transactions.

In conclusion, homeowners insurance may not be mandatory in situations where you own your home outright and are not bound by mortgage lender requirements. However, it’s essential to recognize that this newfound freedom comes with responsibility. Voluntary homeowners insurance is highly advisable to protect your investment, provide comprehensive coverage, and ensure peace of mind. It’s a proactive step towards responsible homeownership, safeguarding your financial well-being and the security of your home, even when legal requirements are no longer in play.

7. Conclusion

While homeowners insurance isn’t always legally required, it remains a smart financial move for anyone who owns a home. The protection it offers against unforeseen events and potential liability is invaluable, providing peace of mind for homeowners of all ages.

8. FAQs

8-1. What is homeowners insurance, and do I really need it?

Homeowners insurance, often called home insurance, is a protective coverage plan that shields your home and belongings from various risks, including natural disasters, theft, and accidents. While it’s not legally required in all cases, having homeowners insurance is highly advisable to safeguard your investment and financial well-being.

8-2. What are the legal requirements for homeowners insurance?

Legal requirements for homeowners insurance can vary by state and mortgage terms. Many mortgage lenders make it mandatory to protect their investments. It’s essential to research your local laws and understand your specific obligations.

8-3. How does homeownership affect insurance requirements?

If you own your home, the responsibility for obtaining homeowners insurance typically falls on you. It’s more than just a choice; it’s a necessity to protect your significant investment. Renters, on the other hand, may not need homeowners insurance, as the property owner or landlord usually covers the structure.

8-4. What are the key benefits of having homeowners insurance?

Homeowners insurance offers comprehensive protection against property damage, liability coverage, and peace of mind. It shields you from financial ruin caused by disasters, theft, and accidents, and ensures you have a place to call home even in challenging times.

8-5. How do I choose the right homeowners insurance policy?

To select the right homeowner’s insurance policy, consider factors like coverage limits, deductibles, and optional endorsements. It’s crucial to customize your policy to your specific needs, assess your property’s value accurately, and explore additional coverage options to tailor your protection.

9. Case Study

Isabella, a 39-year-old female, is an interior designer by profession, earning an annual income of $80,000. She is passionate about creating beautiful and functional living spaces for her clients. Isabella is married to John, a school teacher, and they have two children, Emma and Liam. Their combined household income is $120,000 annually.

They own a lovely home valued at $400,000 and have a mortgage balance of $250,000 remaining. Their monthly mortgage payment is $1,200, and they have an outstanding student loan of $20,000. Isabella’s family relies on her income, which provides a comfortable lifestyle, including monthly expenses such as groceries, utilities, transportation, and childcare.

9-1. Current Situation

Isabella and her family recently moved into their dream home in a picturesque neighborhood. They were excited about this new chapter in their lives, but with homeownership came the responsibility of securing homeowners insurance. While Isabella had heard about homeowners insurance before, she never fully grasped its importance.

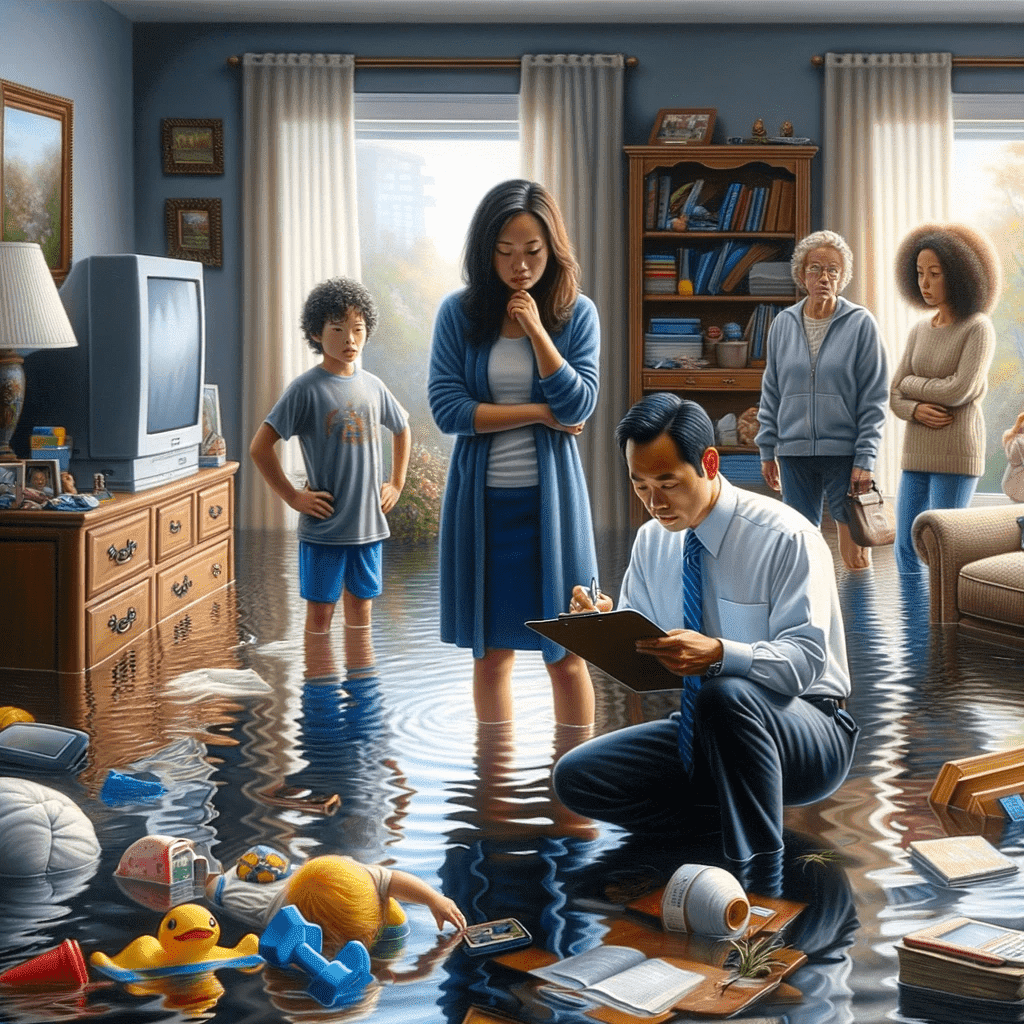

9-2. Conflict Occurs

The first conflict arose when Isabella’s neighbor, Sarah, experienced a devastating house fire. Witnessing the emotional and financial turmoil Sarah went through was a wake-up call for Isabella. She realized that her family’s precious home, valued at $400,000, and their personal belongings were also at risk without proper homeowners insurance.

Isabella’s initial reaction was a mix of fear and reluctance. Fear of the financial burden that might follow a disaster and reluctance to invest in homeowners insurance due to perceived high costs.

9-3. Problem Analysis

Isabella’s dilemma stemmed from not fully understanding the potential consequences of not having homeowners insurance. Her lack of knowledge about the benefits of coverage and how it could protect her family’s assets and financial well-being created anxiety and uncertainty.

If the problem persisted, Isabella risked significant financial loss in the event of a disaster, as her home was their most significant investment. The emotional toll and stress it could bring to her family were also substantial concerns.

9-4. Solution

Upon realizing the gravity of the situation, Isabella decided to seek information and educate herself about homeowners insurance. She began by researching different insurance providers and policy options to find the best fit for her family’s needs.

Isabella also reached out to insurance agents for guidance. With their help, she selected a homeowners insurance policy with a coverage amount of $350,000, covering her home’s value, and personal belongings, and providing liability protection. Isabella opted for a higher deductible of $2,500 to lower her premium costs, a decision that aligned with her family’s budget.

9-5. Effect After Execution

The impact of Isabella’s decision was almost immediate. Although it took some time to finalize the policy and pay the premium, the peace of mind it provided was invaluable. Isabella felt a sense of security knowing that her family’s home and possessions, valued at over $400,000, were protected.

In the unfortunate event of a covered disaster, the insurance would cover the costs of repairs or replacement, sparing her family from a devastating financial blow. While the insurance had an annual premium of $1,200, Isabella considered it a wise investment in safeguarding their future.

9-6. In Conclusion

Isabella’s journey from initial reluctance to informed decision-making regarding homeowners insurance taught her the importance of proactive financial planning. She realized that homeowners insurance was not an unnecessary expense but a crucial shield against unexpected disasters.

Isabella’s advice to others facing a similar situation is clear: educate yourself about homeowners insurance, explore your options, and seek guidance from professionals. Don’t wait for a crisis to strike before understanding the significance of protecting your home and family. In the end, the peace of mind and financial security provided by homeowners insurance far outweigh any costs associated with it.

10. Checklist

| Questions for Self-Reflection | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review and Adjust |

| Do I understand what homeowners insurance is and its significance? | Take the time to research homeowners insurance to grasp its importance better. | ||||

| Have I assessed whether homeowners insurance is legally required in my area or based on my mortgage terms? | Research local laws and mortgage requirements to determine my obligations. | ||||

| Do I own a home, and if so, have I ensured that it’s adequately insured? | Review my current homeowners insurance coverage and assess if it aligns with my property’s value. | ||||

| Am I aware of the benefits homeowners insurance provides, including property protection and liability coverage? | Familiarize myself with the advantages of homeowners insurance and how it safeguards my financial interests. | ||||

| Have I considered customizing my homeowners insurance policy to suit my specific needs? | Explore coverage limits, deductibles, and optional endorsements to tailor my policy effectively. | ||||

| Do I understand the factors that impact the cost of homeowners insurance, and have I explored ways to manage these costs? | Research cost factors, such as home value and location, and seek potential discounts to lower premiums. | ||||

| If I own my home outright, have I weighed the importance of maintaining voluntary homeowners insurance for my investment’s protection? | Reflect on the responsibility that comes with homeownership and consider the value of voluntary coverage. |