When it comes to safeguarding your financial future, understanding your insurance needs is crucial. In this article, we’ll delve into the world of umbrella insurance and help you determine just how much coverage you need. So, let’s start by unraveling the basics of umbrella insurance.

Reading time: 23 minutes

Outline

- Understanding the Basics of Umbrella Insurance

- Determining Your Umbrella Insurance Needs

- Factors Influencing Umbrella Insurance Coverage

- How to Calculate the Right Amount of Umbrella Insurance

- Benefits and Drawbacks of Umbrella Insurance

- Tips for Finding the Best Umbrella Insurance Policy

- Conclusion

- FAQs

- Case Study

- Checklist

1. Understanding the Basics of Umbrella Insurance

Discover the world of umbrella insurance, or excess liability insurance, which adds an extra layer of financial protection beyond your standard policies.

1-1. What Is Umbrella Insurance?

Umbrella insurance, often referred to as excess liability insurance, is a supplementary form of coverage that extends beyond the limits of your primary insurance policies. It’s designed to provide an additional layer of financial protection, stepping in when the coverage limits of your standard policies, such as auto or homeowners insurance, have been exhausted due to a covered claim.

1-1-1. The Key Purpose of Umbrella Insurance

The primary purpose of umbrella insurance is to safeguard your assets and protect your financial well-being in the event of a lawsuit or a liability claim against you. When your standard insurance policies reach their maximum limits, excess liability insurance becomes a crucial safety net, covering the excess costs and ensuring that you don’t have to deplete your savings or liquidate assets to settle a claim.

1-1-2. Coverage Beyond Standard Policies

Umbrella insurance not only provides additional funds for liability claims but also extends coverage to areas that might not be adequately addressed by your primary policies. It can protect you from various liability risks, including bodily injury, property damage, libel, slander, and even legal defense costs. This comprehensive coverage ensures that you’re well-protected in a wide range of situations.

1-1-3. How It Works

When a covered incident occurs, and the liability claim surpasses the limits of your primary insurance policy, your umbrella insurance comes into play. Let’s say you’re involved in a car accident, and the medical expenses and property damage claims exceed your auto insurance limits. Your umbrella policy will cover the excess costs, up to its coverage limit. This prevents you from having to pay out of pocket for the remaining expenses, reducing financial strain.

For Example

If you have $600,000 in assets, it’s a prudent decision to purchase a $1 million umbrella liability policy to supplement the $400,000 liability insurance you have on your home and car. This additional coverage can offer significant protection at a relatively small cost, typically amounting to between $200 to $500 dollars annually.

Here’s why it’s a wise choice:

- Asset Protection: Your umbrella policy provides an extra layer of protection that kicks in when the liability limits of your primary policies are exhausted. In this scenario, your $1 million umbrella policy would cover any liability claims beyond the $400,000 provided by your home and auto insurance. This safeguards your assets, including savings, investments, and valuable possessions.

- Affordability: The cost of umbrella insurance is relatively low when compared to the potential financial consequences of a large liability claim. Paying a few hundred dollars a year for this added protection is a small investment to ensure your financial security.

- Coverage for High-Risk Situations: Accidents and incidents can sometimes result in liability claims well beyond $400,000. With your umbrella policy in place, you can have peace of mind knowing that you’re covered for such high-risk situations, whether they relate to your car or home.

- Lawsuit Protection: Lawsuits involving cars and homes can quickly escalate to claims exceeding $1 million. Without umbrella coverage, you might be forced to deplete your savings or liquidate assets to settle such claims. With the umbrella policy, you have a financial safety net to handle these potentially devastating situations.

- Common Liability Claims: It’s essential to consider that each year, thousands of individuals face lawsuits exceeding $1 million related to their cars and homes. These claims can stem from accidents, injuries, or property damage. Having umbrella insurance ensures you’re prepared for these unexpected and costly events.

1-2. Who Should Consider Umbrella Insurance?

Umbrella insurance is a valuable asset for a diverse range of individuals and situations. Here’s a closer look at who should consider this type of coverage:

1-2-1. Homeowners

If you own a home, umbrella insurance is essential. While your homeowners’ insurance provides liability coverage, it may not be sufficient to protect you in case of a significant lawsuit, such as a slip-and-fall accident on your property. Excess liability insurance can fill this gap and provide the extra protection you need.

1-2-2. Parents

Parents often face increased liability risks, especially if they have children involved in sports or social activities. Injuries or accidents involving your children or their friends could result in legal claims against you. Umbrella insurance ensures that you have the financial support to handle such situations without jeopardizing your family’s financial security.

1-2-3. Business Owners

Business owners, particularly those with substantial assets or high-risk professions, should strongly consider umbrella insurance. It provides a vital safety net for potential lawsuits related to business operations or accidents that occur on business premises. Without umbrella coverage, your personal assets may be at risk in case of a business-related lawsuit.

1-2-4. Individuals with Significant Assets

If you’ve accumulated substantial assets, such as real estate, investments, or savings, umbrella insurance is a must. Your valuable assets make you a target for larger liability claims. Having an umbrella policy in place ensures that your hard-earned wealth remains protected, even when faced with substantial legal claims.

1-2-5. Higher Risk Factors

Individuals with higher risk factors, such as those involved in recreational activities, volunteering, or public speaking engagements, can benefit greatly from umbrella insurance. It offers peace of mind, knowing that you have extra protection in case an unforeseen liability situation arises due to your activities or involvement in various events.

In conclusion, umbrella insurance serves as a critical safety net, providing additional liability coverage and protecting your financial well-being. It is a valuable asset for homeowners, parents, business owners, individuals with significant assets, and those with higher risk factors. Understanding the basics of excess liability insurance is the first step towards ensuring your financial security and peace of mind in an unpredictable world.

2. Determining Your Umbrella Insurance Needs

Exploring umbrella insurance is a crucial step in protecting your financial well-being. To determine the right coverage, we’ll assess your assets, liabilities, and unique risks, ensuring you have the security you need.

2-1. Assessing Your Assets and Liabilities

When it comes to determining the right amount of umbrella insurance coverage, a thorough assessment of your financial situation is paramount. This step-by-step process ensures that you have adequate protection in place.

2-1-1. Calculating Your Assets

Begin by calculating your total assets. This includes the value of your home, investments, savings accounts, vehicles, and any other valuable possessions. Be sure to use current market values for accuracy.

2-1-2. Evaluating Your Liabilities

Next, evaluate your liabilities. This involves identifying your outstanding debts, including mortgages, loans, credit card balances, and any other financial obligations. Subtract your total liabilities from your assets to get a clear picture of your net worth.

2-1-3. Importance of Accurate Valuations

Accurate valuations are crucial because they determine the financial impact of a liability claim. In case of a lawsuit, your umbrella insurance will cover costs exceeding the limits of your primary policies. A precise assessment ensures that you have the necessary coverage to protect your assets.

2-2. Evaluating Your Risk Factors

Understanding your risk factors is another key element in determining the right amount of umbrella insurance coverage. Your unique circumstances and lifestyle choices play a significant role in this evaluation.

2-2-1. Family Size and Lifestyle

Consider the size of your family and their activities. Larger families may face higher risks, as accidents or incidents involving multiple family members can lead to more substantial liability claims. Additionally, your family’s lifestyle choices, such as owning pets or participating in sports, can impact your liability exposure.

2-2-2. High-Risk Activities

Assess any high-risk activities you or your family members engage in. This might include hobbies like boating, skiing, or off-road biking. High-risk activities can increase the likelihood of accidents and, consequently, liability claims.

2-2-3. Social and Volunteer Activities

Your involvement in social and volunteer activities can also affect your liability risk. Activities like hosting parties, volunteering at events, or serving on community boards can expose you to potential liability claims. Take these activities into account when determining your coverage needs.

2-3. The Role of Existing Insurance Policies

Reviewing your existing insurance policies is a critical step in the process of deciding your umbrella insurance coverage. This step ensures that your umbrella policy complements your primary coverage effectively.

2-3-1. Auto Insurance

Start by examining your auto insurance policy. Note the liability limits it provides for bodily injury and property damage. To assess the need for umbrella insurance, consider the potential costs of a serious accident, which can quickly exceed the limits of your auto insurance.

2-3-2. Homeowners and Renters Insurance

If you own a home or rent a property, review your homeowners or renters insurance policy. These policies typically include liability coverage. However, evaluate whether the coverage limits are sufficient to protect your assets in case of a lawsuit related to your property.

2-3-3. Identifying Coverage Gaps

Identify any gaps in your existing coverage. If the limits of your primary policies fall short of providing complete protection for your assets and potential liability claims, umbrella insurance can fill these gaps effectively.

In conclusion, determining your needs involves a comprehensive assessment of your assets, liabilities, risk factors, and existing insurance policies. By calculating your net worth, evaluating your unique circumstances, and understanding the coverage gaps in your primary policies, you can confidently decide how much excess liability insurance you need to safeguard your financial well-being and enjoy peace of mind.

3. Factors Influencing Umbrella Insurance Coverage

Understanding the factors that impact your umbrella insurance coverage is crucial. Family size, lifestyle choices, and future financial planning all influence your coverage needs. Let’s explore these factors to secure your financial future.

3-1. Family Size and Lifestyle

When contemplating how much umbrella insurance you need, it’s crucial to delve deeper into the specifics of your family size and lifestyle choices, as these factors significantly influence your coverage requirements.

3-1-1. Family Size Matters

The size of your family is a key determinant in assessing your umbrella insurance needs. Larger families inherently face a higher potential for accidents or incidents involving multiple family members. These situations can lead to more extensive liability claims, necessitating a higher coverage amount to adequately protect your assets.

3-1-2. Lifestyle Choices and Activities

Your family’s lifestyle choices and activities can also impact your liability exposure. Engaging in activities such as water sports, skiing, or even owning certain pets can elevate your risk of accidents or injuries. High-risk activities often correlate with an increased likelihood of liability claims, making it imperative to consider these factors when determining your coverage level.

3-2. Future Financial Planning

While assessing your umbrella insurance needs, it’s essential to consider your long-term financial goals. Your coverage should align with your future financial plans and potential liabilities that may arise as you progress through life.

3-2-1. Asset Growth

As you work towards building wealth and assets over time, your umbrella insurance should evolve accordingly. A policy that may have been adequate in the past may no longer provide sufficient protection as your assets grow. Regularly review and adjust your coverage to match your increasing financial stability.

3-2-2. Life Milestones

Life milestones, such as purchasing a home, starting a family, or advancing in your career, can change your financial landscape and liability exposure. It’s essential to anticipate these milestones and assess how they may impact your umbrella insurance needs.

3-2-3. Retirement and Estate Planning

As you plan for retirement and consider the transfer of your assets to heirs, your umbrella insurance becomes a crucial component of your estate planning. Ensuring that you have adequate coverage can safeguard your legacy and protect your loved ones from potential financial burdens.

In conclusion, several factors influence your umbrella insurance coverage needs. Family size, lifestyle choices, and future financial planning all play significant roles in determining the right amount of coverage. By taking these factors into account and periodically reviewing your insurance policies, you can ensure that your excess liability insurance provides the protection you need to safeguard your financial well-being and future.

4. How to Calculate the Right Amount of Umbrella Insurance

Determining the appropriate amount of umbrella insurance is a critical step to ensure you have adequate protection. Let’s delve into the details of how to calculate the right coverage amount, considering various scenarios and case studies.

4-1. Common Coverage Amounts

Before diving into the calculation process, it’s essential to understand the common coverage amounts available for umbrella insurance. Typically, policies offer coverage ranging from $1 million to $5 million.

Firstly, you should aim to have enough liability insurance to safeguard your assets. Ideally, your coverage should extend to cover twice the value of your assets. While this might sound excessive, it provides an extra layer of security against unforeseen liabilities.

Despite the substantial protection it offers, umbrella insurance is relatively affordable. The cost typically amounts to just a few hundred dollars annually, making it a small price to pay for significant financial security.

4-1-1. Evaluating Your Risk Tolerance

Your risk tolerance plays a significant role in selecting the coverage amount that suits your needs. Consider your comfort level with potential liability claims and your ability to cover excess costs. Individuals with a lower risk tolerance may opt for higher coverage amounts to provide greater peace of mind.

4-1-2. Assessing Your Assets

To determine the right amount, assess your total assets. This includes your home, investments, savings, vehicles, and valuable possessions. The coverage amount should be sufficient to protect these assets in case of a lawsuit.

4-2. Exploring Different Scenarios

Calculating the right amount of umbrella insurance requires thoughtful consideration of various scenarios that may lead to liability claims. Let’s explore these scenarios to better understand your coverage needs.

4-2-1. Auto Accident Scenario

Imagine being involved in a severe auto accident where you are deemed at fault, resulting in multiple injuries and significant property damage. Calculate the potential liability costs, including medical bills, property repairs, and legal fees. Your umbrella insurance should cover these costs if they exceed your auto insurance limits.

4-2-2. Slip and Fall Incident

Consider a scenario where someone slips and falls on your property, sustaining serious injuries. Calculate the potential medical expenses, rehabilitation costs, and legal fees that could arise from such an incident. Your umbrella policy should provide coverage in case your homeowners insurance limits are exceeded.

4-2-3. Liability Lawsuit

Think about a situation where you are facing a liability lawsuit, such as a defamation case or an accident involving your boat or recreational vehicle. Calculate the legal expenses and potential damages you might be required to pay. Ensure your umbrella insurance can cover these costs to protect your assets.

In conclusion, determining the right amount of umbrella insurance involves assessing common coverage amounts, evaluating your risk tolerance, and exploring different scenarios and case studies. By calculating potential liability costs and ensuring your coverage matches your assets and risk exposure, you can confidently select the excess liability insurance amount that provides the necessary protection for your financial well-being and peace of mind.

5. Benefits and Drawbacks of Umbrella Insurance

Umbrella insurance offers valuable benefits and protection, but like any financial product, it comes with its share of potential drawbacks. In this section, we’ll explore the advantages of having extra liability protection and the potential downsides to consider.

5-1. The Advantages of Extra Liability Protection

Understanding the advantages of umbrella insurance is crucial in determining if it’s the right choice for you and your financial well-being.

5-1-1. Safeguarding Your Assets

One of the primary benefits of umbrella insurance is the protection it provides for your assets. In the event of a significant liability claim, your primary insurance policies may not cover all the expenses. Umbrella insurance steps in to cover the excess costs, ensuring that your assets, including your home, investments, and savings, remain secure.

5-1-2. Protecting Your Reputation

A less commonly discussed advantage is the protection of your reputation. Legal battles and liability claims can tarnish your image and standing in the community. Umbrella insurance can help resolve these issues without having to admit fault, thereby preserving your reputation.

5-1-3. Peace of Mind

Perhaps the most significant advantage is the peace of mind that umbrella insurance offers. Knowing that you have an extra layer of liability protection can alleviate the stress and anxiety associated with potential legal and financial burdens. It allows you to enjoy life without constantly worrying about unforeseen accidents or incidents.

5-2. Potential Downsides to Consider

While umbrella insurance provides numerous benefits, it’s essential to be aware of the potential drawbacks and limitations that come with this coverage.

5-2-1. Cost

One of the main drawbacks of umbrella insurance is the cost. Premiums can vary significantly based on your coverage amount and individual risk factors. While the added protection is valuable, you must assess whether the expense aligns with your budget.

The typical cost of umbrella insurance for an individual with a single residence, two vehicles, and two drivers.

| Umbrella insurance limit | Annual cost of umbrella insurance |

|---|---|

| $1 million | $383 |

| $2 million | $474 |

| $5 million | $608 |

| $10 million | $999 |

5-2-2. Coverage Gaps

Another consideration is that umbrella insurance may not cover certain types of claims or specific situations. It’s vital to thoroughly review your policy and understand its limitations. For instance, intentional acts, criminal activities, or business-related claims might not be covered.

5-2-3. Underlying Insurance Requirements

Most umbrella insurance policies require you to maintain specific minimum limits on your primary insurance policies, such as auto or homeowners insurance. Failing to meet these requirements can lead to coverage gaps or policy cancellations.

The majority of insurance companies typically mandate that an applicant maintain a minimum of $250,000 in liability coverage for their auto insurance and approximately $300,000 in liability coverage for their homeowners’ insurance before they can purchase a $1 million umbrella insurance policy.

5-2-4. Qualification Requirements

Qualifying for umbrella insurance might require meeting certain criteria, such as having a clean driving record or maintaining a specific level of income. Be sure to check the qualifications with your insurance provider to ensure you are eligible for this coverage.

5-2-5. Policy Complexity

Umbrella insurance policies can be complex, with various terms and conditions. Understanding the fine print and nuances of your policy is crucial to ensuring you receive the expected benefits when the need arises.

In conclusion, umbrella insurance offers significant advantages, such as safeguarding your assets, protecting your reputation, and providing peace of mind. However, it’s essential to consider potential drawbacks, including the cost, coverage gaps, underlying insurance requirements, qualification criteria, and policy complexity. By weighing these factors carefully, you can make an informed decision about whether excess liability insurance is the right choice for your financial protection and peace of mind.

6. Tips for Finding the Best Umbrella Insurance Policy

Selecting the best umbrella insurance policy involves careful consideration and informed decision-making. In this section, we’ll provide valuable tips to help you navigate the process successfully.

6-1. Comparison Shopping for Quotes

Comparing quotes from different insurance providers is a crucial step in finding the ideal umbrella insurance policy that meets your needs and budget.

6-1-1. Gather Multiple Quotes

Start by gathering quotes from various insurance companies. Request quotes online or contact insurance agents directly. Ensure that you provide consistent information to each provider for accurate comparisons.

Contacting existing insurance company. Obtaining umbrella insurance is a straightforward process, and it often begins with a call to your existing homeowner’s or auto insurance company. They can provide valuable insights into your current coverage and guide you through the steps to secure umbrella insurance. Your existing insurance company is a logical starting point because they are already familiar with your financial profile and insurance needs. They can tailor the excess liability insurance policy to complement your existing coverage seamlessly.

6-1-2. Evaluate Coverage Limits

Examine the coverage limits offered by each insurance provider. Compare the maximum coverage amounts they can offer and assess whether they align with your assessment of how much umbrella insurance you need. Keep in mind that higher limits typically come with higher premiums.

6-1-3. Consider Deductibles

Deductibles for umbrella insurance policies can vary. Analyze the deductible options available and how they impact your premiums. A higher deductible may lower your premium but could result in higher out-of-pocket expenses in the event of a claim.

6-1-4. Review Policy Terms

Carefully review the terms and conditions of each policy. Pay attention to any exclusions or limitations that may affect your coverage. Understanding the fine print is essential to ensure the policy meets your specific needs.

6-1-5. Inquire About Discounts

Ask each insurance provider about potential discounts. Some companies offer multi-policy discounts if you bundle your umbrella insurance with other policies like auto or homeowners insurance. Taking advantage of discounts can lead to cost savings.

6-2. Working with a Knowledgeable Insurance Agent

Having a knowledgeable insurance agent by your side can simplify the process and help you make informed decisions.

6-2-1. Seek Recommendations

Start by seeking recommendations from friends, family, or colleagues who have experience with umbrella insurance. They may be able to refer you to a trusted agent.

6-2-2. Verify Credentials

Ensure that the insurance agent you choose is licensed and qualified to offer umbrella insurance. Verify their credentials and check if they are affiliated with reputable insurance companies.

6-2-3. Assess Industry Experience

Consider the agent’s experience in the insurance industry, especially with umbrella policies. An agent with a strong background in this specific area can provide valuable insights and guidance.

6-2-4. Discuss Your Unique Needs

When working with an insurance agent, discuss your unique circumstances and how much umbrella insurance you need. Provide details about your assets, liabilities, risk factors, and coverage preferences to help the agent tailor the policy to your requirements.

6-2-5. Ask Questions

Don’t hesitate to ask questions and seek clarification on any aspects of the policy or the insurance process. A knowledgeable agent should be able to provide clear and informative answers to your queries.

In conclusion, finding the best umbrella insurance policy involves comparison shopping for quotes and working with a knowledgeable insurance agent. By gathering multiple quotes, evaluating coverage limits and deductibles, reviewing policy terms, and inquiring about discounts, you can make an informed choice. Additionally, partnering with a qualified agent who can offer recommendations, verify credentials, assess industry experience, and tailor the policy to your needs will help you secure the ideal excess liability insurance coverage for your financial well-being and peace of mind.

7. Conclusion

In summary, umbrella insurance is a versatile and invaluable asset. By assessing your assets, evaluating risk factors, and understanding your existing insurance, you can determine the right coverage. While it offers benefits like asset protection and peace of mind, be aware of potential drawbacks and consult a knowledgeable agent to find the best policy. Make informed decisions to secure ideal umbrella insurance coverage for confidence in an unpredictable world.

8. FAQs

8-1. What is umbrella insurance, and why do I need it?

Umbrella insurance, often referred to as excess liability insurance, is an additional layer of coverage that extends beyond the limits of your primary insurance policies. You need it to safeguard your assets and protect your financial well-being in case of a lawsuit or liability claim that exceeds your standard policy limits.

8-2. How do I determine the right amount of umbrella insurance?

Assess your assets, evaluate your liabilities, and consider your risk factors. Your coverage should ideally be enough to protect your assets, and it can vary based on your unique circumstances.

8-3. Who should consider purchasing umbrella insurance?

Individuals who should consider umbrella insurance include homeowners, parents, business owners, those with significant assets, and individuals engaged in high-risk activities. It provides valuable protection in various situations.

8-4. What are the benefits of having umbrella insurance?

Umbrella insurance offers benefits like asset protection, reputation preservation, and peace of mind. It covers liabilities that may not be fully addressed by your primary policies, ensuring your financial security.

8-5. Are there any drawbacks or limitations to umbrella insurance?

While umbrella insurance is valuable, it comes with costs and certain limitations. You need to pay premiums, meet underlying insurance requirements, and consider policy complexity. Understanding these factors is essential for making an informed decision.

9. Case Study

Samantha is a 44-year-old female lawyer with a busy and demanding career. Her life revolves around legal cases, contracts, and courtrooms.

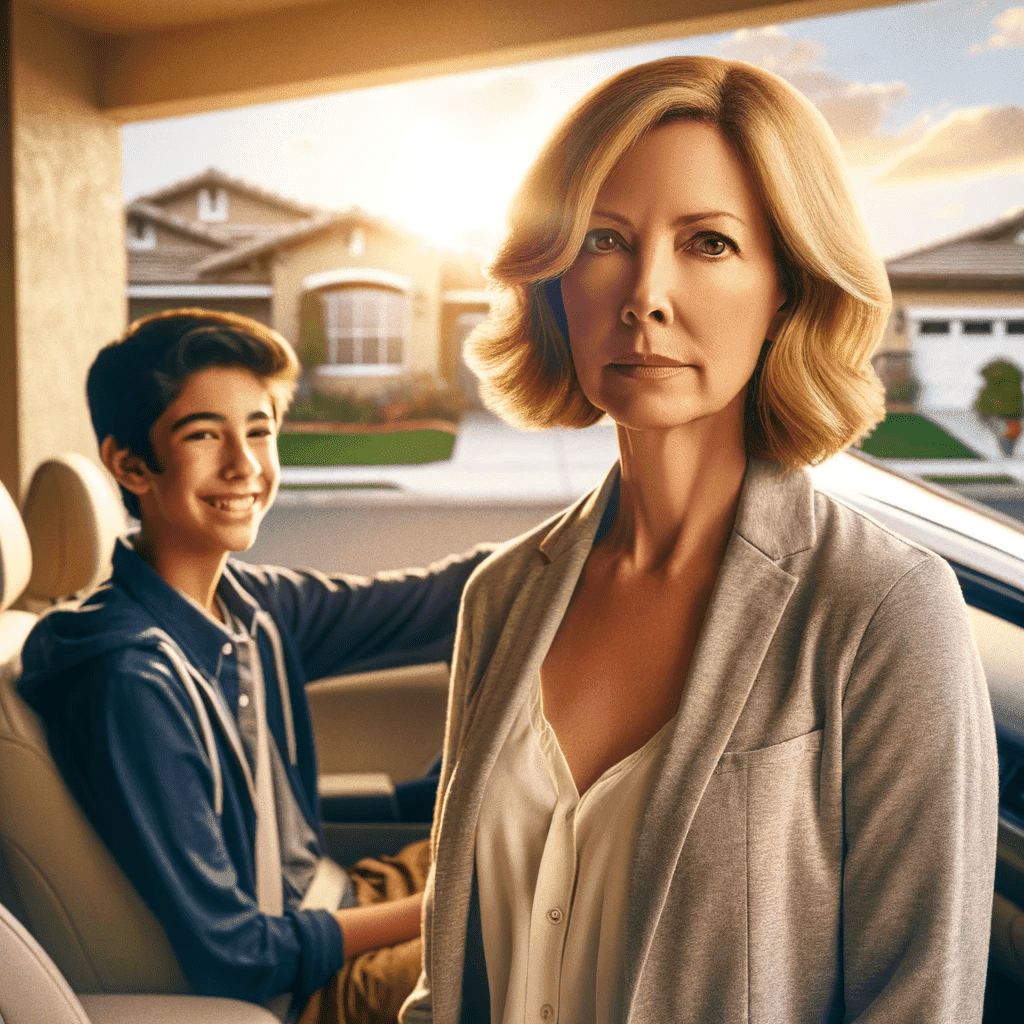

Despite her intense work life, Samantha has always prioritized her family, especially her teenage son, who recently obtained his driver’s license. Samantha is a dedicated mother, and her primary concern is ensuring her family’s financial well-being.

9-1. Current Situation

One sunny afternoon, Samantha’s son excitedly announced that he had passed his driving test and was now a licensed driver. While Samantha shared in his joy, she couldn’t help but feel a sense of unease. Her legal background had exposed her to numerous cases involving accidents and liabilities related to inexperienced drivers. Samantha knew that having a new driver in the family meant a potential increase in their exposure to liability risks, including accidents and injuries.

9-2. Conflict Occurs

Samantha found herself in a dilemma. As a lawyer, she understood the importance of protecting her family’s assets and financial security. She was aware that her existing auto insurance policy had coverage limits that might not be sufficient to handle a significant liability claim in case of an accident caused by her son. Samantha felt anxious about the potential financial repercussions if such an unfortunate event were to occur.

Emotionally, Samantha was torn between her role as a mother and her professional knowledge. She realized that she needed to take action to ensure her family’s financial safety. However, she initially hesitated due to the fear of increased insurance premiums and the misconception that umbrella insurance was an unnecessary expense.

9-3. Problem Analysis

The dilemma Samantha faced was twofold. Firstly, her existing auto insurance policy had limited liability coverage, which might not fully protect her family’s assets in the event of a severe accident caused by her son. Secondly, Samantha was reluctant to explore the option of umbrella insurance, fearing it would lead to a significant increase in her monthly expenses.

If Samantha didn’t address this issue, her family could be at risk of facing substantial financial burdens in the event of a severe accident. Without the appropriate coverage, they might have to deplete their savings or liquidate assets to settle a liability claim.

9-4. Solution

After careful consideration and research, Samantha realized that obtaining umbrella insurance was the most practical solution to her dilemma. It would provide her family with additional liability coverage beyond the limits of their existing auto insurance policy, ensuring their assets were protected in case of a major accident.

Samantha took the following steps to implement her solution:

- Researched Different Insurance Providers: Samantha reached out to various insurance companies to gather quotes and compare coverage options.

- Consulted with an Experienced Insurance Agent: She sought the guidance of an experienced insurance agent who could provide expert advice and tailor the policy to her family’s needs.

- Evaluated Coverage Limits: Samantha considered the potential costs of liability claims and assessed her family’s assets to determine the appropriate coverage amount.

- Discussed Budget and Premiums: She discussed her budget constraints with the insurance agent and explored options to find affordable umbrella insurance.

During the implementation process, Samantha faced challenges related to selecting the right policy and managing the additional cost within her budget. However, with the guidance of her insurance agent, she was able to choose a suitable plan that offered peace of mind without breaking the bank.

9-5. Effect After Execution

The solution took effect immediately after Samantha secured an umbrella insurance policy. Although there was a slight increase in her monthly insurance premiums, it was a small price to pay for the peace of mind she gained. Samantha knew that her family’s assets were now well-protected in case of a liability claim resulting from her son’s driving activities.

The positive effect of this decision was evident in Samantha’s reduced anxiety and her ability to enjoy her son’s newfound independence without constant worry. She was relieved that she had taken the necessary steps to safeguard her family’s financial future.

9-6. In Conclusion

Samantha’s case serves as a valuable lesson in the importance of assessing one’s insurance needs and taking proactive steps to protect assets and financial well-being. By overcoming her initial hesitation and misconceptions about umbrella insurance, Samantha ensured her family’s security and set an example for others facing similar dilemmas. The key takeaway is that informed decisions about insurance can lead to lasting peace of mind.

10. Checklist

| Questions for Self-Reflection | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review and Adjust |

| 1. Do I understand what umbrella insurance is and its importance? | If not, educate myself on umbrella insurance basics from reliable sources. | ||||

| 2. Have I assessed my assets and liabilities accurately? | Double-check my financial situation, including assets and liabilities, for accuracy. | ||||

| 3. Am I aware of my unique risk factors and lifestyle choices that might impact my insurance needs? | Identify any high-risk activities or lifestyle choices that need consideration. | ||||

| 4. Have I reviewed my existing insurance policies and their coverage limits? | Ensure I fully understand the coverage provided by my current insurance policies. | ||||

| 5. Have I calculated the potential costs of liability claims that could exceed my primary insurance limits? | Use scenarios to calculate potential costs and assess if my umbrella coverage is adequate. | ||||

| 6. Do I know the advantages and drawbacks of umbrella insurance? | Educate myself about the benefits and limitations of excess liability insurance. | ||||

| 7. Have I explored options for finding the best umbrella insurance policy? | Research and compare quotes from different providers, and consider working with an experienced insurance agent. |