Life insurance is a critical financial tool that provides peace of mind and financial security to your loved ones in times of need. When it comes to life insurance, two primary options stand out: term life insurance and whole life insurance. In this comprehensive guide, we’ll delve into the nuances of these two types of insurance, helping you make an informed decision about which one aligns best with your financial goals and circumstances.

Reading time: 22 minutes

Outline

1. What Is Term Life Insurance?

Term life insurance is a straightforward and budget-friendly type of life insurance. It offers coverage for a set period, commonly 10, 20, or 30 years. This coverage comes with a clear understanding: if the policyholder passes away within the specified term, the insurance company will provide a death benefit to the designated beneficiaries. However, if the policyholder outlives the term, there is no payout, and the insurance coverage typically expires.

1-1. Understanding Term Life Coverage

Term life insurance is like renting protection for your loved ones. It provides financial security during specific periods when it’s needed most, such as while raising a family or paying off a mortgage. Here’s a closer look at the features and nuances of term life coverage:

1-1-1. Flexible Term Options

Term life insurance offers flexibility by allowing you to choose the term length. Whether you need coverage for a decade or three, you can tailor the policy to align with your financial goals and family’s needs.

1-1-2. Affordability

One of the standout advantages of term life insurance is its affordability. Premiums for term policies are generally lower compared to other types of life insurance. This makes it accessible to a wide range of individuals, including young adults and those on a budget.

1-1-3. Temporary Nature

Term life insurance is designed to be temporary. It’s ideal for situations where you need coverage for a specific period, such as until your children are financially independent or your mortgage is paid off. Once the term ends, the policy expires, and there is no ongoing coverage unless you choose to renew it.

1-2. Pros and Cons of Term Life Insurance

1-2-1. Pros:

- Cost-Effective: Term life insurance is cost-effective, making it an attractive option for individuals and families looking to protect their loved ones without breaking the bank.

- Clear Purpose: It serves a specific purpose, providing a safety net during critical financial periods, like raising children or paying off debts.

- Flexibility: The ability to choose the term length gives you flexibility to match the coverage with your life stage and financial commitments.

- Simplicity: Term policies are straightforward, with no complex investment components. You pay premiums for coverage, and if a covered event occurs, your beneficiaries receive the payout.

1-2-2. Cons:

- No Cash Value: Unlike some other types of life insurance, term life policies do not accumulate cash value over time. They are purely protection-oriented and do not offer a savings or investment component.

- Coverage Limitations: If you outlive the term, the policy expires, and you’re left without coverage. Renewing a term policy can become more expensive as you age.

- Limited Suitability: While it’s excellent for specific life stages, term life insurance may not be the best choice for those seeking lifelong coverage or an investment component.

In conclusion, term life insurance serves as a practical and cost-effective solution to provide financial security for your loved ones during critical life stages. Its temporary nature, affordability, and clear purpose make it an appealing choice for many individuals. However, it’s essential to understand the limitations, such as the lack of cash value and the need to renew the policy if you require continued coverage beyond the initial term. Assess your unique circumstances and financial goals to determine if term life insurance aligns with your needs.

2. What Is Whole Life Insurance?

Whole life insurance, as the name implies, is a type of life insurance that provides coverage for your entire lifetime. Unlike term life insurance, which offers protection for a specific term, whole life insurance ensures that your beneficiaries will receive a death benefit whenever you pass away. What sets whole life insurance apart is its unique feature—an associated savings or investment component known as cash value. This cash value accumulates over time and can be leveraged for various financial purposes, offering a level of financial flexibility not found in term life insurance.

2-1. Exploring Whole Life Coverage

Whole life insurance is a comprehensive financial tool that combines insurance protection with an investment element. To fully understand its intricacies, let’s delve deeper into its coverage and the workings of the cash value component:

2-1-1. Lifelong Coverage

The hallmark of whole life insurance is its commitment to providing coverage for your entire lifetime. As long as you pay your premiums, you can rest assured that your loved ones will receive a death benefit when the time comes. This makes it an appealing choice for those seeking to leave a financial legacy or cover end-of-life expenses.

2-1-2. The Cash Value Component

One of the distinguishing features of whole life insurance is the cash value component. This is where a portion of your premium payments is allocated to an investment account within the policy. Over time, the cash value grows, often at a guaranteed rate of return set by the insurance company. You can think of it as a nest egg that accumulates within your policy.

2-1-3. Financial Flexibility

The cash value in your whole life insurance policy isn’t just a passive investment. It can be used for various purposes, including:

- Borrowing Against It: You can take out loans against the cash value at a relatively low-interest rate. This can be beneficial for unexpected expenses or financial opportunities.

- Withdrawing Funds: You can withdraw a portion of the cash value, although this may reduce the death benefit. This feature can be useful for supplementing retirement income or covering large expenses.

- Surrendering the Policy: If needed, you can surrender the policy and receive the accumulated cash value, although surrendering a policy should be carefully considered, as it typically terminates the coverage.

2-2. Pros and Cons of Whole Life Insurance

2-2-1. Pros:

- Lifelong Coverage: The most significant advantage of whole life insurance is the assurance of lifelong coverage, which can provide peace of mind to policyholders and their beneficiaries.

- Cash Value Growth: The cash value component offers the potential for growth over time, providing an additional source of savings or investment within the policy.

- Financial Flexibility: The ability to borrow against or withdraw from the cash value offers a degree of financial flexibility that can be valuable in various situations.

2-2-2. Cons:

- Higher Premiums: Whole life insurance premiums are typically higher than those of term life insurance, which can be a deterrent for individuals on a tight budget.

- Complexity: The combination of insurance and investments within whole life policies can be complex, requiring a deeper understanding of how the cash value works.

- Opportunity Cost: The returns on the cash value component may not always match those of other investment options, potentially resulting in missed investment opportunities.

In summary, whole life insurance provides lifelong coverage and a unique cash value component that can offer financial flexibility. It’s a comprehensive solution that appeals to those who want to build wealth within their insurance policy while ensuring their loved ones are financially protected. However, the higher premiums and complexity of these policies should be carefully considered against your financial goals and needs. Understanding the differences between term and whole life insurance is crucial in making the right choice for your unique circumstances.

3. Key Differences Between Term and Whole Life Insurance

When evaluating life insurance options, understanding the key differences between term and whole life insurance is crucial. Let’s delve deeper into these distinctions to help you make an informed decision:

3-1. Premiums and Costs

3-1-1. Term Insurance:

Term insurance is known for its affordability. It typically offers lower premiums, making it accessible to individuals on a budget. This affordability stems from the fact that term policies provide coverage for a specified period and do not include the cash value component found in whole life insurance.

3-1-2. Whole Life Insurance:

In contrast, whole life insurance comes with higher premiums. These premiums are relatively more expensive due to the lifelong coverage it provides and the cash value feature. The portion of the premium allocated to the cash value account and the insurance component contributes to the higher cost.

3-2. Duration and Payouts

3-2-1. Term Insurance:

Term life insurance, as the name suggests, has a set term. This can range from 10 to 30 years or more, depending on the policy you choose. During the term, if the policyholder passes away, the insurance company pays out the death benefit to the beneficiaries. However, if the policyholder survives the term, there is no payout, and the coverage typically expires.

3-2-2. Whole Life Insurance:

Whole life insurance, on the other hand, provides coverage for your entire life. This means that as long as you continue to pay premiums, the policy remains in force. The key difference here is that whole life insurance guarantees a death benefit payout whenever you pass away. There is no expiration date on the coverage.

3-3. Investment Component of Whole Life Insurance

A significant feature that sets whole life insurance apart is its investment component—the cash value. A portion of your premiums is allocated to this account, which accumulates over time. The cash value can be viewed as a financial asset within the policy that grows at a guaranteed or potentially higher rate, depending on the insurance company’s performance. It can be borrowed against or withdrawn, offering financial flexibility.

3-3-1. Benefits of the Investment Component:

- Savings: The cash value can serve as a form of savings, which can be useful for various financial goals.

- Borrowing: You can take out loans against the cash value at relatively low-interest rates, providing access to funds when needed.

- Potential for Growth: The cash value has the potential to grow over time, providing additional financial security.

3-3-2. Drawbacks of the Investment Component:

- Higher Premiums: The investment component contributes to the higher premiums associated with whole life insurance.

- Complexity: Managing the investment component requires understanding the policy’s workings and potential risks.

3-4. Suitability for Different Life Stages

The choice between term and whole life insurance depends on your life stage and financial objectives. Let’s explore when each type of insurance may be more suitable:

3-4-1. Term Insurance:

- Starting a Family: Term insurance is often a good choice for young couples starting a family. It provides affordable protection during the years when dependents are most financially vulnerable.

- Mortgage Protection: If you want to ensure that your mortgage is paid off if something happens to you, term insurance can be an excellent fit.

- Temporary Financial Needs: For specific financial obligations or goals that have an endpoint, such as paying for your children’s education, term insurance can offer cost-effective coverage.

3-4-2. Whole Life Insurance:

- Legacy Planning: Whole life insurance is suitable for those who want to leave a financial legacy to their heirs or charitable organizations.

- Lifetime Coverage: If you desire lifelong coverage, especially for estate planning or final expenses, whole life insurance ensures coverage until the end of your life.

- Cash Value Growth: Individuals looking for a savings component and financial flexibility may prefer whole life insurance.

In conclusion, the key differences between term and whole life insurance lie in premiums, duration, the presence of an investment component, and suitability for different life stages. Understanding these distinctions is essential for making an informed decision that aligns with your unique financial goals and circumstances.

4. Common Arguments for Cash Value Insurance

Insurance agents often pitch cash value life insurance, and they have some persuasive arguments. Let’s address these arguments and provide some perspective:

4-1. “Cash value policies are all paid up after X years.”

Agents may suggest that you won’t have to pay premiums indefinitely with cash value insurance, thanks to projections that imply the policy becomes self-sufficient after a certain period. However, this overlooks the fact that cash value insurance costs significantly more than term insurance. Imagine paying eight times the cost of your current auto insurance just to stop paying premiums after a decade.

4-2. “You won’t be able to afford term insurance when you’re older.”

While it’s true that term insurance becomes more expensive as you age, it’s essential to understand that life insurance needs evolve over time. By the time you retire, your financial obligations should decrease, making term insurance the more affordable choice during your peak earning years.

Age plays a significant role in the cost of life insurance. Term insurance is well-suited for younger individuals who have substantial financial commitments and obligations. As you age and these commitments decrease, the need for costly life insurance diminishes as well.

4-3. “You can borrow against the cash value at a low interest rate.”

Borrowing against your cash value policy might seem appealing, but it’s essentially borrowing your own money and comes with risks. You may jeopardize the policy’s sustainability and potentially end up with nothing to show for your premiums.

Borrowing against your cash value policy may seem convenient, but it comes with its share of risks. Furthermore, the tax-deferral aspect is not unique to cash value insurance, as more advantageous tax-advantaged retirement accounts are available.

4-4. “Your cash value grows tax-deferred.”

While the cash value does grow tax-deferred, there are better tax-advantaged retirement accounts available, such as 401(k)s and IRAs, which provide immediate tax deductions and tax-deferred growth.

Cash value insurance is often marketed as an investment, but it falls short in several ways. The variable interest rates and penalties for policy withdrawal make it a less appealing option compared to other investment opportunities.

4-5. “Cash value policies are forced savings.”

The idea of forced savings through cash value insurance is flawed, as many people abandon these policies after a few years. You can achieve forced savings through other means without incurring the high costs associated with cash value insurance.

The idea of cash value policies as a form of forced savings is debunked, as many people abandon these policies early on. While they can offer estate tax benefits when structured correctly, there are alternative strategies for reducing taxable estates.

4-6. Making Your Decision

It’s important to understand that insurance salespeople often push cash value policies due to the high commissions they receive. These commissions can be substantially higher than what they earn from selling term insurance, leading to a potential conflict of interest.

In conclusion, for the majority of individuals, purchasing low-cost term insurance and investing separately is the most cost-effective and financially sound approach. Life insurance needs change over time, and the high cost of cash value policies can result in inadequate coverage for most families. Evaluate your financial situation, goals, and priorities to make an informed decision that aligns with your long-term financial security.

5. Making the Right Choice

When it comes to choosing between term and whole life insurance, making an informed decision is paramount. Let’s explore the factors that should weigh into your choice:

5-1. Factors to Consider

5-1-1. Financial Situation

Your current financial situation plays a significant role in determining which type of insurance suits you best.

- Budget: Consider your budget and whether you can comfortably afford the premiums associated with whole life insurance. Term insurance is often more budget-friendly.

- Income Stability: Assess the stability of your income. If your income is inconsistent or you’re on a fixed income during retirement, term insurance may be a more practical choice.

5-1-2. Dependents

The presence and financial dependence of loved ones should heavily influence your decision.

- Number of Dependents: If you have children or other dependents relying on your financial support, ensuring they have adequate financial protection is crucial. Whole life insurance can provide lifelong support, while term insurance covers specific periods.

- Ages of Dependents: Consider the ages of your dependents. If they are young and require long-term financial support, whole life insurance may be more appropriate. For older dependents, term insurance might suffice.

5-1-3. Long-Term Goals

Your long-term financial goals also play a significant role in determining which insurance type aligns with your objectives.

- Estate Planning: If your goal is to leave a substantial inheritance or support charitable causes, whole life insurance can facilitate these long-term goals by ensuring a death benefit payout.

- Savings and Investments: Evaluate your existing savings and investment portfolio. If you have substantial investments and savings, you may not require the cash value component of whole life insurance.

- Retirement Planning: Consider how your insurance choice fits into your retirement plans. Whole life insurance can provide additional income during retirement if the cash value is accessed, while term insurance typically does not.

5-2. Assessing Your Needs

Understanding your insurance needs is the foundation of making the right choice. Here’s a step-by-step guide to assess your requirements:

5-2-1. Evaluate Your Financial Obligations

Begin by listing your financial responsibilities, such as:

- Mortgage or Rent

- Debts

- Childcare and Education Expenses

- Daily Living Costs

- Funeral Expenses

5-2-2. Calculate Your Financial Support Timeline

Determine how long you need financial protection. Consider:

- When your mortgage will be paid off

- When your children will become financially independent

- Your retirement age

5-2-3. Estimate Your Family’s Financial Needs

Consider the financial needs of your loved ones in your absence. This includes:

- Replacing Your Income

- Covering Outstanding Debts

- Funding Future Expenses (e.g., education)

5-2-4. Weigh the Benefits of Each Type

Compare the advantages and disadvantages of term and whole life insurance against your needs and goals. Consider factors like cost, duration, and the presence of a cash value component.

5-2-5. Seek Professional Advice

Consult with a financial advisor or insurance expert. They can provide tailored guidance based on your unique circumstances.

5-2-6. Review and Update Regularly

Your financial situation and goals may change over time. Periodically revisit your insurance choices to ensure they align with your evolving needs.

In conclusion, choosing between term and whole life insurance involves a careful evaluation of your financial situation, the presence of dependents, and your long-term goals. Assessing your needs and seeking professional advice can help you make the right choice that provides the financial security and peace of mind you and your loved ones deserve.

6. Real-Life Examples

Understanding the differences between term and whole life insurance is crucial for making an informed decision. To make these differences come to life, let’s explore real-life scenarios that showcase the suitability of each type of insurance:

5-1. Scenario 1: Young Couple Starting a Family

Background: John and Sarah, both in their late twenties, recently got married and are planning to start a family. They want to ensure financial security for their future children.

Insurance Choice: Term Life Insurance

Explanation: In this scenario, term life insurance makes sense. John and Sarah’s primary concern is providing financial support for their future family. Term insurance offers cost-effective coverage during the years when their dependents are most financially vulnerable. They can choose a 20- or 30-year term to align with their family planning timeline. If either of them passes away during the term, the death benefit can help cover living expenses, childcare, and education costs. As they anticipate becoming financially stable over time, term insurance fulfills their immediate needs.

6-2. Scenario 2: Wealthy Retiree with Grandchildren

Background: Robert, a wealthy retiree in his late 70s, has a substantial estate and wants to leave a financial legacy for his grandchildren.

Insurance Choice: Whole Life Insurance

Explanation: For Robert, whole life insurance is the preferred option. He has the financial means to afford the higher premiums associated with whole life policies. Robert’s goal is to create a lasting legacy by ensuring his grandchildren receive a substantial inheritance. Whole life insurance guarantees a death benefit payout whenever he passes away, providing the financial support he desires for his heirs. Additionally, the cash value component can serve as a supplementary source of income during his retirement years, enhancing his financial security.

6-3. Scenario 3: Middle-Aged Couple with Mortgage

Background: Lisa and Mark, a middle-aged couple with two teenage children, have an outstanding mortgage and want to ensure it’s paid off if something happens to either of them.

Insurance Choice: Term Life Insurance

Explanation: In this case, term life insurance is the practical choice. Lisa and Mark’s primary concern is the mortgage, which has a specific timeline for repayment. They can opt for a term policy that aligns with the remaining mortgage duration, ensuring that if either of them passes away during this period, the death benefit can be used to pay off the mortgage. This provides peace of mind for their family, allowing them to maintain their home without financial strain. As their children grow up and become financially independent, the need for insurance diminishes, making term insurance a suitable and cost-effective solution.

6-4. Scenario 4: Young Professional with Investment Savvy

Background: Emily, a young professional in her 30s, has a well-established investment portfolio and seeks a balanced financial strategy.

Insurance Choice: Term Life Insurance

Explanation: For Emily, who is financially savvy and has substantial investments, term life insurance aligns with her needs. She values the lower premiums of term policies and prefers to focus on managing her investments separately. Term insurance provides her with essential coverage during the years when her investments are growing, protecting her loved ones if something unexpected were to happen to her. Emily can invest the savings from lower premiums into her portfolio, potentially achieving higher returns than the cash value component of a whole life policy would offer.

In summary, these real-life examples demonstrate how the choice between term and whole life insurance depends on individual circumstances and financial goals. By analyzing their specific needs and objectives, individuals can select the insurance type that best fits their unique situations, providing the financial protection and peace of mind they seek.

7. Conclusion

In conclusion, the choice between term and whole life insurance hinges on your unique circumstances and financial objectives. By understanding the key differences and evaluating your needs, you can make an informed decision that provides the necessary financial protection for you and your loved ones.

8. FAQs

8-1. What is the primary difference between term and whole life insurance?

The main difference is in duration. Term life insurance covers a specific period, while whole life insurance provides lifelong coverage. Term offers temporary protection, while whole life ensures a payout whenever you pass away.

8-2. Which is more affordable, term or whole life insurance?

Term life insurance is generally more budget-friendly. It comes with lower premiums, making it accessible for individuals on a tight budget. Whole life insurance, due to its lifelong coverage and cash value component, tends to have higher premiums.

8-3. What is the cash value component in whole life insurance?

The cash value is an integral part of whole life insurance. It’s a savings or investment component within the policy that grows over time. Policyholders can borrow against it, withdraw funds, or even surrender the policy in exchange for the accumulated cash value.

8-4. When should I consider term life insurance?

Term life insurance is suitable for specific life stages, like when you’re raising a family or paying off a mortgage. It’s a practical choice when you need coverage for a set period, and affordability is a priority.

8-5. Is whole life insurance a good choice for estate planning?

Yes, whole life insurance is often used for estate planning. It ensures a guaranteed payout to beneficiaries, which can be essential for leaving a financial legacy or covering end-of-life expenses. Additionally, the cash value component can provide financial flexibility during retirement.

9. Case Study

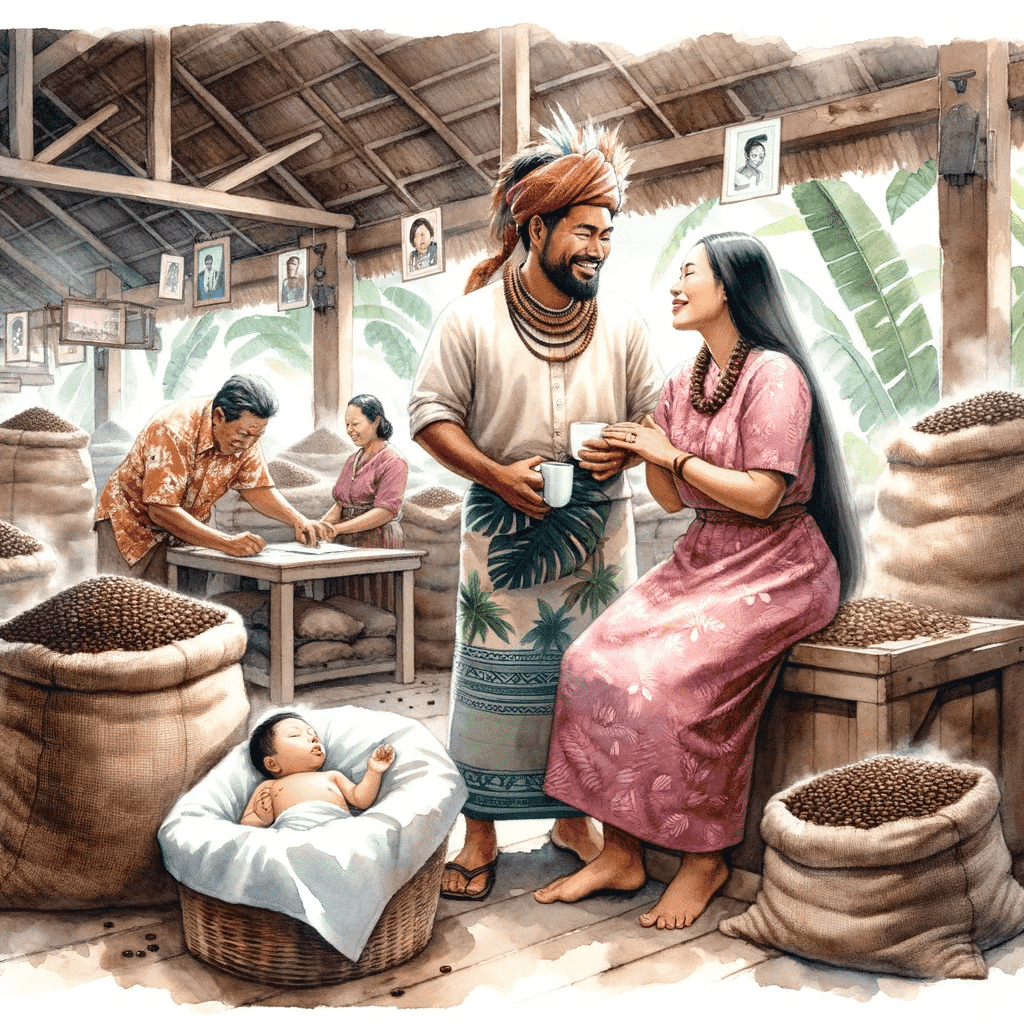

Emily, a 25-year-old female barista, is a coffee enthusiast with a passion for cooking and financial planning. She recently embarked on a journey of marriage, and she and her husband have joyfully welcomed a newborn son into their family.

Emily’s income is moderate, and she diligently manages her household finances. Their expenditures primarily revolve around their monthly mortgage payments, covering day-to-day living expenses, and ensuring quality childcare for their son. Emily and her husband have recently invested in their future by purchasing a new home, although this comes with the responsibility of a housing loan they are diligently repaying.

9-1. Current Situation

As a new mother and homeowner, Emily realizes the need for financial security, especially for her son’s education and the mortgage she shares with her husband. Emily’s parents run a successful coffee wholesale company, and it’s understood that Emily will be the future heir to the business. Emily feels a sense of responsibility as the potential heir to her family’s coffee business, which has been her family’s legacy for generations.

9-2. Conflict Occurs

Emily understands that she must make financial plans to secure her son’s future and protect her inheritance. However, she also feels overwhelmed by the various options and the complexity of insurance products available. The emotional weight of ensuring her family’s financial stability and the legacy of the coffee business weighs heavily on her.

9-3. Problem Analysis

The main problem Emily faces is the need for financial protection. She has a young son whose education she wants to secure in case something happens to her, and she shares a housing loan with her husband. Moreover, as the potential heir to her family’s coffee business, there’s the added responsibility of preserving the business and ensuring a smooth transition.

The dilemma arises from the fact that Emily is unsure about the best insurance solutions to address these concerns. Without proper planning, the negative impact could be significant: her son’s education might be at risk, and the family coffee business could face challenges in the future.

9-4. Solution

Emily and her financial advisor discussed her unique situation and decided on a two-policy approach. Emily purchased a term life insurance policy to protect her son’s education expenses and ensure that the housing loan in her name would be repaid if something were to happen to her. This term policy provides a death benefit that would cover these expenses.

In addition, Emily’s parents purchased a whole life insurance policy on her behalf. This policy would protect her inheritance in the family coffee business and serve as a source of funds to pay any inheritance taxes that might arise in the future.

The implementation of these insurance policies was relatively straightforward, as Emily’s financial advisor guided her through the process. She set up automatic premium payments to ensure the policies remained active.

9-5. Effect After Execution

Term life insurance provides immediate coverage, so Emily’s son is protected right away, and the mortgage repayment is assured if needed. The whole life insurance policy secures her future inheritance in the family business and offers financial flexibility for potential estate taxes.

The costs associated with the insurance premiums were manageable within Emily’s budget, and the peace of mind she gained was immeasurable. Knowing that her son’s future and the family coffee business are protected has relieved a significant burden.

9-6. In Conclusion

Emily’s case exemplifies the importance of proper financial planning, especially when transitioning into new life stages like marriage, parenthood, and homeownership. By understanding her unique needs and seeking professional advice, Emily was able to secure her family’s future and legacy through a well-thought-out insurance strategy. Her story serves as a valuable lesson for others facing similar challenges and responsibilities.

10 Checklist

| Questions for Self-Reflection | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review and Adjust |

| Do I understand the difference between term and whole life insurance? | If not, revisit the article and take notes on key distinctions. | ||||

| Have I assessed my current financial situation? | If not, review my budget and income stability. | ||||

| Do I have dependents who rely on my financial support? | Evaluate the number and ages of dependents. | ||||

| What are my long-term financial goals and objectives? | Consider if I want to leave a financial legacy or require financial flexibility. | ||||

| Have I evaluated my financial obligations and timeline? | List current financial responsibilities and determine timelines. | ||||

| Do I understand the concept of cash value in whole life insurance? | If not, research further or seek professional advice. | ||||

| Have I compared the costs and benefits of term and whole life insurance? | Review the pros and cons of each type and align with my needs. |