Real estate stands as one of the most lucrative avenues for building substantial wealth over time. The allure of this investment strategy lies in its potential to generate passive income, foster property appreciation, and offer various tax advantages. If you’re a young adult aiming to establish financial stability and create lasting wealth, delving into the world of real estate could be your path to success.

Outline

- Real Estate’s Unique Qualities

- Benefits of Real Estate Investment

- Getting Started: Steps to Begin Your Real Estate Journey

- Choosing the Right Investment Property

- Financing Your Investment

- Generating Passive Income from Rental Properties

- Wealth-Building Strategies: Flipping and Long-Term Holding

- Drawbacks of Real Estate

- Mitigating Risks and Challenges

- Avoiding Poor Real Estate Investments

- Comparing Real Estate and Stocks

- Investing through REITs

- Conclusion

- FAQs

- Case Study

- Checklist

Reading time: 38 minutes

1. Real Estate’s Unique Qualities

Real estate distinguishes itself from other investment types through its unique attributes, setting the stage for building wealth through real estate. These qualities provide investors with opportunities and challenges that are worth exploring in greater detail.

1-1. Livability and Income Generation

Real estate possesses a dual nature, serving both as a place to call home and as a source of income. This duality allows individuals to reside in their properties while also benefiting from potential rental income. This versatility is a hallmark of real estate investment, enabling owners to capitalize on the property in multiple ways simultaneously.

1-2. Limited Land Supply

The concept of scarcity plays a pivotal role in the real estate market, particularly when it comes to land supply. The Earth’s landmass is fixed, and as populations expand, the demand for housing and real estate grows. This inherent limitation contributes to the preservation and appreciation of real estate values, especially in densely populated regions where available land for new construction is scarce.

1-3. Zoning Impact

Local governments exert significant influence over real estate through zoning regulations. These regulations determine how properties can be used, which affects their potential value. Policies that restrict expansive growth can work to an investor’s advantage by creating a favorable environment for future property appreciation. Furthermore, understanding zoning laws can uncover hidden potential in properties that may not have been fully developed to their maximum value.

1-4. Leverage Opportunities

One of the most distinctive aspects of real estate investment is the ability to leverage borrowed funds to acquire properties. This potential for leveraging allows investors to purchase properties with a fraction of the total value as a down payment, amplifying their return on investment. Leveraging can lead to substantial gains, but it’s important to recognize that it also magnifies the risks associated with property value fluctuations.

In conclusion, Real estate’s unique qualities lay the foundation for a dynamic investment strategy that can lead to wealth accumulation. These characteristics—livability and income generation, limited land supply, zoning impact, and leverage opportunities—offer avenues for investors to capitalize on the potential of real estate as a wealth-building tool. By harnessing these attributes wisely, individuals can navigate the nuances of the real estate market and work towards financial prosperity.

2. Benefits of Real Estate Investment

Investing in real estate offers a multitude of advantages that distinguish it from traditional investment avenues. Let’s delve deeper into these benefits and explore how building wealth through real estate can transform your financial trajectory.

2-1. Steady Stream of Passive Income

One of the standout advantages of real estate investment is the consistent generation of passive income. This income stems primarily from rental properties such as apartments, houses, and commercial spaces. Tenants paying rent provide you with a regular inflow of funds, which can cover not only your property-related expenses but also leave you with a surplus. This surplus income can then be reinvested or utilized to bolster your financial stability.

2-2. Capital Appreciation: Your Wealth Amplifier

Beyond generating regular income, real estate is known for its inherent potential for property appreciation. Unlike certain assets that lose value over time, real estate generally tends to appreciate, leading to the possibility of substantial capital gains when you decide to sell. This appreciation becomes especially prominent in markets where demand for properties surpasses the available supply. This mechanism allows you to accrue wealth not only through rental income but also by the increase in the value of your property over time.

2-3. Tax Advantages That Boost Your Finances

Real estate investment opens the door to a realm of tax benefits that can significantly enhance your financial well-being. Expenses related to your investment property, such as mortgage interest and property taxes, are often tax-deductible. This means that a portion of your income can be shielded from taxation, resulting in potential savings. Additionally, real estate investments can offer you the flexibility to utilize 1031 exchanges, allowing you to defer capital gains taxes when reinvesting in another property. These tax advantages can work to your advantage and contribute to your overall wealth accumulation strategy.

2-4. Creating Diversification and Security

In the world of investment, diversification is often considered a key strategy for mitigating risks. Real estate provides an avenue for diversification by offering an asset class that behaves differently from stocks, bonds, and other traditional investments. This diversification can add a layer of stability to your investment portfolio, helping you weather market volatility more effectively. Even during economic downturns, the demand for housing remains relatively stable, ensuring that your investment retains value.

2-5. Inflation Hedge: Safeguarding Your Wealth

Real estate also functions as a valuable inflation hedge. When inflation occurs, the value of money decreases, causing prices to rise. However, real estate tends to appreciate in value during inflationary periods, helping you maintain and even increase your purchasing power. As rental income and property value rise with inflation, your investment becomes an effective safeguard against the eroding effects of inflation on your wealth.

2-6. Leveraging Your Investment

Another compelling aspect of real estate investment is the ability to leverage your investment. Through borrowing funds (typically via a mortgage), you can acquire properties with a relatively small initial investment. As the property appreciates, the return on your invested capital becomes proportionally larger. This leverage amplifies your potential gains, allowing you to build wealth more rapidly than with many other investment types.

Leverage amplifies real estate investment potential. For instance, a $20,000 investment in a $100,000 property that appreciates to $120,000 yields a 100 percent return on the original investment. However, leverage also increases risk, as a decrease in property value could lead to substantial losses.

2-7. Long-Term Wealth Building and Financial Freedom

Real estate investment aligns well with long-term wealth building and the pursuit of financial freedom. The combination of passive income, property appreciation, tax benefits, diversification, and inflation protection provides a holistic framework for accumulating and preserving wealth over time. By making informed decisions and strategically expanding your real estate portfolio, you can work toward achieving financial independence and securing a comfortable future.

In conclusion, the benefits of real estate investment extend far beyond the surface advantages. From generating passive income and capital appreciation to leveraging your investment and serving as an inflation hedge, real estate offers a comprehensive approach to building wealth. By understanding and harnessing these benefits, you have the opportunity to shape a robust financial future for yourself through strategic and informed real estate investments.

3. Getting Started: Steps to Begin Your Real Estate Journey

Embarking on your real estate investment journey is an exciting endeavor that calls for a structured approach. By laying a strong foundation and setting the right course, you can navigate the complexities of the real estate market with confidence. Let’s explore the key steps to initiate your journey towards building wealth through real estate.

3-1. Define Your Financial Goals

The first crucial step in your real estate journey is to define your financial goals. Are you aiming for immediate income, long-term appreciation, or a balanced mix of both? Clearly outlining your objectives will guide your investment decisions and shape your strategy. Whether you aspire to secure a steady stream of rental income or focus on property appreciation, having well-defined goals helps you stay on track.

3-2. Understand Property Types

Real estate encompasses a diverse range of property types, each with its own characteristics and potential returns. Take the time to research and understand the nuances of residential, commercial, and industrial real estate. Residential properties include single-family homes, condos, and apartments, while commercial properties encompass retail spaces, offices, and warehouses. Familiarize yourself with these categories to identify which aligns best with your investment goals.

3-3. Grasp Market Dynamics

A comprehensive understanding of market dynamics is fundamental to successful real estate investing. Study market indicators such as supply and demand, vacancy rates, and rental trends. Pay attention to the local real estate market in your chosen area, as different markets can exhibit varying behaviors. By staying informed about market conditions, you can make more informed decisions and adapt your strategies accordingly.

3-4. Educate Yourself

Education is the cornerstone of effective real estate investing. Immerse yourself in learning by researching property types, investment strategies, and financing options. Familiarize yourself with key terms like cap rate, cash-on-cash return, and equity. Online resources, books, courses, and networking events can provide valuable insights and help you become a more informed investor.

3-5. Analyze Financing Options

Real estate investments often require substantial capital, and understanding financing options is crucial. Research different types of loans, mortgages, and funding sources available to you. Your credit score will play a pivotal role in securing favorable financing terms, so maintain a good credit history. Exploring partnerships or investment groups is another avenue to consider for pooling resources and spreading risks.

3-6. Evaluate Risk Tolerance

Before diving into real estate, evaluate your risk tolerance. Real estate investments, like all forms of investment, carry inherent risks. Determine how comfortable you are with potential market fluctuations, property management challenges, and unexpected expenses. Your risk tolerance will influence your choice of investment properties and strategies, ensuring that they align with your financial comfort zone.

3-7. Create a Solid Plan

With your goals, knowledge, and risk tolerance in mind, it’s time to create a solid investment plan. Define your investment criteria, such as property type, location, budget, and expected returns. Your plan should also outline your exit strategy, whether it’s selling, renting, or other options. A well-structured plan acts as a roadmap, guiding your decisions and actions in the dynamic real estate landscape.

In conclusion, the journey to building wealth through real estate begins with a systematic and informed approach. By clarifying your financial goals, understanding property types, grasping market dynamics, educating yourself, analyzing financing options, evaluating risk tolerance, and creating a solid plan, you set the stage for a successful venture into real estate investment. Remember, knowledge is your greatest asset on this journey, and each step you take brings you closer to your wealth-building objectives.

4. Choosing the Right Investment Property

Selecting the right investment property is a pivotal decision that can significantly influence your success in building wealth through real estate. This process requires careful consideration and a thorough analysis of various factors. Let’s delve into the key considerations that will guide you toward making a strategic choice.

4-1. Location: The Cornerstone of Success

When it comes to real estate, location is paramount. A property’s location plays a crucial role in determining its potential for growth and profitability. Seek out properties situated in desirable neighborhoods with a track record of stability and positive growth trends. Look for areas that offer good amenities, access to public transportation, schools, shopping centers, and recreational facilities. Properties located in these neighborhoods are more likely to attract tenants or buyers, ensuring a steady stream of income and potential for property appreciation.

4-2. Neighborhood Analysis: Digging Deeper

To assess the suitability of a neighborhood, conduct a comprehensive neighborhood analysis. Research crime rates, school quality, job opportunities, and overall community development. Pay attention to future development plans, such as new infrastructure projects or commercial centers, that could enhance the neighborhood’s appeal and potential for growth. A thriving neighborhood with a strong sense of community is not only attractive to residents but also contributes to the long-term value of your investment.

4-3. Property Condition: Inspection and Evaluation

The condition of the property itself is another critical aspect to evaluate. Before finalizing your decision, conduct a thorough property inspection. This inspection should cover structural components, plumbing, electrical systems, roofing, and more. Identify any necessary repairs, maintenance, or renovations that might be required to bring the property up to standard. Accurately assessing the condition of the property allows you to factor potential costs into your investment calculations.

4-4. Market Trends and Demand

Understanding the current market trends is essential to making an informed choice. Research whether the real estate market in your chosen area is appreciating, stagnating, or experiencing declines. Analyze data on property values, rental rates, and vacancy rates. A growing market often indicates a higher demand for housing, which can lead to increased property values and rental income. Conversely, a declining market might present challenges in terms of maintaining property value and finding reliable tenants.

4-5. Rental Potential and Cash Flow

For rental properties, rental potential, and cash flow are crucial factors. Research the average rental rates in the area and compare them to your property’s potential income. Ensure that the rental income not only covers your mortgage payments but also leaves room for other expenses, such as property management, maintenance, and vacancies. Positive cash flow is essential for sustaining your investment over the long term and ensuring a steady stream of income.

4-6. Growth Potential and Future Value

Beyond the present, consider the growth potential and future value of the property. Investigate any planned developments or infrastructure projects in the vicinity that could impact property values positively. A well-researched investment in an area with anticipated growth can yield substantial returns as the surrounding community develops and property values rise.

4-7. Financial Analysis and ROI

Perform a comprehensive financial analysis to evaluate the potential return on investment (ROI). Factor in all costs associated with the property, including purchase price, financing costs, property taxes, insurance, maintenance, and potential vacancies. Compare these expenses to the expected rental income or future resale value. Calculating your potential ROI provides a clear picture of the profitability of the investment and helps you make an informed decision.

In conclusion, choosing the right investment property is a critical step in your real estate journey. By considering factors such as location, neighborhood analysis, property condition, market trends, rental potential, and growth potential, and conducting a thorough financial analysis, you can make a well-informed choice that aligns with your wealth-building goals. Remember, a strategic and meticulous approach to property selection can set the stage for a successful and rewarding real estate investment venture.

5. Financing Your Investment

Financing is a cornerstone of real estate investment, enabling you to turn your aspirations of building wealth through real estate into reality. Navigating the world of real estate financing requires a deep understanding of various options available to fund your investment endeavors. Let’s explore the avenues through which you can secure the financial resources necessary to embark on your real estate journey.

5-1. Mortgage: Your Path to Property Ownership

One of the most common financing methods for real estate investment is obtaining a mortgage. A mortgage allows you to secure a property by putting down a down payment and borrowing the remaining funds from a financial institution. Mortgages offer the advantage of spreading out the cost of the property over time while providing the opportunity to benefit from potential property appreciation. Understanding the terms of the mortgage, including interest rates, repayment schedules, and associated fees, is crucial for making an informed decision.

5-2. Loans and Hard Money Lending

In addition to mortgages, loans can serve as a viable financing option. Traditional banks, credit unions, and online lenders offer various loan products tailored to real estate investment. Personal loans, home equity loans, and business loans can provide you with the necessary funds to acquire properties or cover renovation costs. Moreover, if you’re in need of quick and short-term financing, hard money lending might be an option. Hard money lenders provide loans backed by the value of the property, making it suitable for investors seeking fast capital without the stringent requirements of traditional lenders.

5-3. Partnerships: Pooling Resources and Expertise

Collaborating with partnerships is another strategy to secure financing for your real estate investments. Partnerships involve teaming up with individuals or groups who contribute funds, expertise, or both. This arrangement allows you to access a larger pool of capital while also benefiting from the experience and insights of your partners. Whether it’s a joint venture with experienced investors or a partnership with family and friends, finding the right partners can be a mutually beneficial way to fund your real estate projects.

5-4. Private and Hard Money Lenders

Beyond traditional lending institutions, consider private lenders and hard money lenders. Private lenders are individuals or companies willing to lend funds for real estate investments, often with more flexible terms than banks. Hard money lenders specialize in short-term, high-interest loans secured by the property’s value. While these options may come with higher interest rates, they can be valuable for quick transactions or when traditional financing is not readily available.

5-5. Credit Score: Unlocking Favorable Terms

Your credit score is a crucial factor that significantly influences the terms of your real estate financing. A high credit score demonstrates your financial responsibility and increases your chances of securing favorable interest rates and terms. Before seeking financing, review your credit report, address any inaccuracies, and work to improve your score if needed. A good credit score can save you a significant amount of money over the life of your loan.

5-6. Creative Financing Strategies

Innovative financing strategies can also play a role in your real estate journey. Strategies such as seller financing, where the seller acts as the lender, lease options, and subject-to-financing can provide alternative paths to ownership. These creative methods can offer more flexibility and opportunities to structure deals that align with your investment goals and financial situation.

5-7. Due Diligence: Making Informed Decisions

Regardless of the financing avenue you choose, due diligence is paramount. Thoroughly research the terms, interest rates, fees, and requirements associated with each option. Understand the impact of interest rates on your overall investment and calculate the potential return on investment based on your financing terms. Taking the time to conduct thorough due diligence ensures that you’re making informed decisions that support your long-term wealth-building objectives.

In conclusion, financing your real estate investment is a pivotal step in your journey towards building wealth. By exploring options such as mortgages, loans, partnerships, private lenders, and creative financing strategies, you can secure the financial resources needed to acquire and develop properties. Remember that your credit score plays a pivotal role in securing favorable terms, and conducting thorough due diligence is essential for making well-informed financing decisions that align with your investment goals.

6. Generating Passive Income from Rental Properties

Rental properties stand as a tried-and-true avenue for generating passive income and are a fundamental aspect of the journey toward building wealth through real estate. The consistent inflow of rental revenue can provide you with financial stability and help you work towards achieving your long-term financial goals. However, successful property management is an integral component of realizing the full potential of your investment. Let’s delve into the strategies and considerations for generating sustainable passive income from your rental properties.

6-1. Rigorous Tenant Screening: Quality Over Quantity

The foundation of a successful rental property investment lies in rigorous tenant screening. The quality of your tenants directly impacts the stability of your income and the overall management of the property. Screen potential tenants meticulously by conducting background checks, verifying employment and income, and checking rental history. Choosing reliable, responsible tenants who can meet their rental obligations reduces the risk of late payments or property damage, ensuring a smoother investment experience.

6-2. Protective Lease Agreements

Creating well-structured and protective lease agreements is a crucial step in safeguarding your interests as a landlord. Lease agreements outline the terms and conditions of the rental, including rent amount, payment schedule, security deposit, and maintenance responsibilities. A comprehensive lease agreement helps prevent misunderstandings and provides a legal framework for addressing disputes or issues that may arise during the tenancy.

6-3. Timely Maintenance and Repairs

Maintaining the condition of your rental property is pivotal for sustaining a positive reputation and ensuring a steady stream of rental income. Addressing maintenance concerns and repairs promptly demonstrates your commitment to providing a comfortable living environment for tenants. Regular property inspections can help identify issues early on, allowing you to address them before they escalate into major problems. A well-maintained property not only enhances tenant satisfaction but also contributes to the long-term value of your investment.

6-4. Effective Property Management

Managing a rental property involves numerous responsibilities, from collecting rent to addressing maintenance requests. Effective property management is essential to ensure the seamless operation of your investment. If you prefer a hands-on approach, be prepared to handle tenant interactions, property maintenance, and administrative tasks. Alternatively, you can consider hiring a professional property management company to handle these responsibilities on your behalf. While this incurs a cost, it can save you time and alleviate the stress of day-to-day management.

6-5. Rental Income Optimization

Strategically optimizing your rental income involves setting appropriate rental rates that reflect the property’s value, location, and amenities. Research the rental rates in the area to ensure that your rates are competitive yet reflective of the property’s features. Consider offering incentives, such as utility coverage or flexible lease terms, to attract and retain quality tenants. Regularly reassess your rental rates to ensure they remain in line with market trends and property improvements.

6-6. Addressing Tenant Concerns

Open communication with tenants is a cornerstone of successful property management. Addressing tenant concerns promptly fosters a positive landlord-tenant relationship and encourages tenant retention. Create channels for tenants to report maintenance issues or concerns and ensure that you respond in a timely manner. Taking tenant feedback into account can lead to improvements that enhance tenant satisfaction and the overall rental experience.

6-7. Long-Term Investment Perspective

Generating passive income from rental properties requires a long-term investment perspective. While immediate income is important, focusing on sustainable income over time is equally critical. Building strong relationships with reliable tenants, maintaining your property’s condition, and consistently providing quality service contribute to tenant loyalty and longevity. A well-managed property can lead to extended tenancies, reducing vacancy periods and maximizing your passive income potential.

In conclusion, rental properties offer a reliable avenue for generating passive income and contributing to your journey of building wealth through real estate. By rigorously screening tenants, creating protective lease agreements, addressing maintenance needs, employing effective property management practices, optimizing rental income, addressing tenant concerns, and maintaining a long-term investment perspective, you can create a rental property portfolio that provides a consistent and substantial source of passive income. Remember that successful property management is not solely about generating income but also about fostering positive tenant experiences that contribute to the long-term success of your investment.

7. Wealth-Building Strategies: Flipping and Long-Term Holding

When it comes to building wealth through real estate, two prominent strategies take center stage: property flipping and long-term holding. These strategies offer distinct pathways to achieving your financial goals, each with its own set of benefits and considerations. Let’s explore the intricacies of these strategies and how they can contribute to your journey of wealth accumulation.

7-1. Property Flipping: The Art of Quick Gains

Property flipping involves a dynamic approach to real estate investment. It entails purchasing properties at a lower price, making strategic renovations or improvements, and subsequently selling them at a higher price, ideally generating a substantial profit. This strategy capitalizes on the rapid appreciation of property value achieved through renovations, aesthetic upgrades, or addressing structural issues. Property flipping requires a keen eye for identifying undervalued properties, a solid understanding of renovation costs, and the ability to accurately gauge the potential resale value.

7-1-1. Finding Undervalued Properties

The first step in property flipping is to find undervalued properties with untapped potential. Scour the market for properties that are priced below their market value due to neglect, disrepair, or other factors. Properties in desirable locations with room for improvement are prime candidates for flipping.

7-1-2. Calculating Renovation Costs

Accurate estimation of renovation costs is pivotal. Conduct a thorough assessment of the property’s condition and identify necessary repairs or improvements. From structural enhancements to cosmetic upgrades, each element should be budgeted for to ensure that the overall costs align with your profit objectives.

7-1-3. Timing the Sale

Timing plays a critical role in property flipping. Market conditions, demand, and economic factors can influence the optimal time to sell the renovated property. Selling at the right time maximizes your returns and minimizes holding costs.

7-2. Long-Term Holding: The Steady Accumulator

Long-term holding, also known as buy-and-hold investing, takes a patient and strategic approach to wealth building. This strategy involves acquiring properties with the intention of holding onto them for an extended period, typically with the aim of generating rental income and benefiting from long-term property appreciation.

7-2-1. Rental Income Generation

Long-term holding primarily revolves around rental income generation. By owning properties that consistently generate rental revenue, you create a reliable stream of passive income. Rental income can cover mortgage payments, property management fees, and maintenance costs, while also contributing to your overall financial stability.

7-2-2. Capital Appreciation

An essential aspect of long-term holding is capital appreciation. Over time, properties tend to appreciate in value due to factors such as inflation, increased demand, and development in the surrounding area. This appreciation builds your wealth steadily and enhances your equity in the property.

7-2-3. Risk Mitigation

Long-term holding can act as a form of risk mitigation. The stability of rental income and the potential for property appreciation can help offset the risks associated with short-term market fluctuations. Holding onto properties allows you to weather market downturns and benefit from the cyclical nature of real estate markets.

7-3. Choosing the Right Strategy

Selecting the appropriate strategy—whether property flipping or long-term holding—requires a deep understanding of your financial goals, risk tolerance, and market dynamics.

7-3-1. Consider Your Goals

Consider whether you seek quick gains through property flipping or prefer the stability and long-term growth potential of long-term holding. Your goals will determine which strategy aligns best with your aspirations.

7-3-2. Assess Risk Tolerance

Assess your risk tolerance. Property flipping carries higher risks due to market volatility and renovation complexities. Long-term holding offers a more stable approach but requires patience to realize substantial gains.

7-3-3. Market Analysis

Conduct a thorough market analysis to determine which strategy is more viable in your chosen area. Analyze local market trends, demand for housing, and the potential for property appreciation.

In conclusion, both property flipping and long-term holding present viable avenues for building wealth through real estate. Property flipping offers the potential for quick gains through strategic renovations and timely sales, while long-term holding provides the stability of rental income and gradual property appreciation. By understanding the intricacies of each strategy, and assessing your financial goals, risk tolerance, and market conditions, you can make an informed decision that aligns with your wealth-building objectives. Remember that the right strategy for you is the one that complements your vision for long-term financial success.

8. Drawbacks of Real Estate

While the potential for building wealth through real estate is significant, it’s crucial to acknowledge and understand the challenges that accompany this investment avenue. Real estate comes with its set of drawbacks that investors should consider and prepare for.

8-1. Time-Intensive Property Transactions

Real estate transactions involve a series of complex steps, from property search and due diligence to negotiations and legal processes. These steps can be time-consuming, requiring careful attention to detail and thorough research. The time commitment increases further if you’re involved in selling or purchasing multiple properties. It’s essential to allocate sufficient time to navigate these transactions effectively.

8-2. Responsibilities of Property Management

Investing in real estate often involves the role of a landlord, which brings along a range of responsibilities. Property management encompasses tasks such as tenant screening, lease agreements, property maintenance, and addressing tenant concerns. Effective property management ensures tenant satisfaction and property upkeep, but it can demand substantial time and effort. Investors should be prepared to take on these responsibilities or consider hiring property management services.

8-3. Negative Cash Flow in Initial Stages

In the early stages of real estate investment, particularly in rental properties, it’s common for property expenses to outweigh rental income. This scenario results in negative cash flow, where you’re spending more on mortgage payments, maintenance, taxes, and other expenses than you’re generating from rental revenue. This negative cash flow can strain your finances temporarily, and it’s important to have a contingency plan in place to manage this phase.

In conclusion, acknowledging the drawbacks of real estate is a vital part of crafting a successful investment strategy. While time-intensive transactions and property management responsibilities can pose challenges, careful planning and preparation can help investors overcome these obstacles. Additionally, understanding the potential for negative cash flow in the initial stages allows investors to make informed decisions and weather temporary financial strains.

9. Mitigating Risks and Challenges

While real estate holds the promise of building wealth through real estate, it’s important to acknowledge that like any investment, it comes with inherent risks. Effective risk management is essential to safeguard your investment and navigate challenges that may arise. From market fluctuations to unexpected expenses, understanding and mitigating these risks is a key aspect of achieving long-term success in real estate. Let’s delve into strategies for managing these risks and overcoming challenges.

9-1. Understanding Market Fluctuations

Market fluctuations are a common risk in real estate. Property values can rise or fall due to factors such as economic conditions, supply and demand imbalances, and interest rate changes. Staying informed about market trends through research and analysis can help you anticipate potential fluctuations and adjust your investment strategy accordingly.

9-2. Preparing for Economic Downturns

Economic downturns can impact the real estate market, affecting property values and rental demand. One strategy to prepare for economic downturns is to ensure your investment properties have strong fundamentals. Properties in desirable locations with access to essential amenities are more likely to retain value and attract tenants even during challenging economic times.

9-3. Accounting for Unexpected Expenses

Unexpected maintenance costs and repairs can catch investors off guard. Creating a reserve fund for each property can help you account for these unforeseen expenses. This fund acts as a safety net to cover repair and maintenance costs, ensuring that unexpected financial burdens do not compromise your investment’s profitability.

9-4. Diversification: Spreading Risk

Diversification is a fundamental strategy in risk mitigation. Instead of focusing solely on one property or location, consider investing in different types of properties and diverse geographic areas. Diversification spreads risk and reduces the impact of poor performance in a single property or market. For example, having a mix of residential and commercial properties can provide stability, as they may respond differently to market changes.

9-5. Conducting Due Diligence

Thorough due diligence is critical before acquiring any property. Investigate the property’s history, condition, and legal status. Assess the local market conditions, potential for appreciation, and rental demand. Comprehensive due diligence helps you make informed decisions and minimizes the risk of investing in properties with hidden issues or unfavorable market dynamics.

9-6. Risk Tolerance Assessment

Understanding your risk tolerance is paramount. Assess how comfortable you are with potential challenges, market fluctuations, and unexpected events. Your risk tolerance will influence your investment decisions, strategy, and the types of properties you choose to invest in. Aligning your risk tolerance with your investment approach ensures that you are prepared to handle uncertainties.

9-7. Professional Guidance

Enlisting the expertise of real estate professionals can be invaluable. Real estate agents, property managers, financial advisors, and attorneys can provide guidance and insights that help you make informed decisions. Their experience can help you navigate challenges, avoid common pitfalls, and enhance your overall investment strategy.

9-8. Having a Contingency Plan

Developing a contingency plan is essential for risk management. This plan outlines your response to potential challenges, such as tenant turnover, market downturns, or unexpected repairs. Having a clear course of action in place reduces uncertainty and helps you address challenges promptly and effectively.

9-9. Staying Informed and Adapting

Real estate is dynamic, and staying informed about industry trends, local markets, and economic indicators is an ongoing endeavor. Continuously monitor market conditions and be prepared to adapt your strategy as needed. Flexibility and the ability to adjust to changing circumstances are essential for long-term success.

In conclusion, while real estate presents lucrative opportunities for wealth-building, it’s crucial to approach it with a clear understanding of the associated risks and challenges. By comprehensively understanding market fluctuations, preparing for economic downturns, accounting for unexpected expenses, diversifying your investments, conducting due diligence, assessing your risk tolerance, seeking professional guidance, having a contingency plan, and staying informed, you can effectively mitigate risks and overcome challenges. Remember that a well-informed and strategic approach to risk management is a key factor in realizing the full potential of your real estate investments.

10. Avoiding Poor Real Estate Investments

In the pursuit of building wealth through real estate, it’s crucial to exercise caution and discernment, especially when considering certain types of real estate investments. While the real estate market offers tremendous potential, there are pitfalls that investors should be aware of and actively avoid.

10-1. Limited Partnerships: High Fees and Illiquidity

10-1-1. Understanding Limited Partnerships

Limited partnerships (LPs) are investment structures that involve multiple partners, with one or more taking on active roles as general partners, while others become limited partners who contribute capital.

10-1-2. High Costs

LPs often come with high sales commissions and ongoing management fees that can significantly erode potential returns. The salesperson’s commission, which can be up to 10 percent, reduces the amount actually invested. Management fees and other expenses further diminish the investment’s profitability.

10-1-3. Illiquidity

LPs lack liquidity, meaning that your investment cannot be easily converted into cash without substantial losses. Typically, LPs are locked in for several years before you can access your funds, making it a long-term commitment.

10-2. Time Shares: Excessive Costs and Limited Value

10-2-1. Understanding Time Shares

Time shares involve purchasing a specific timeframe of ownership or usage in a property, often a vacation condominium. Buyers share ownership with others and can use the property for a designated period each year.

10-2-2. Exorbitant Costs

Time shares are notorious for their inflated costs compared to the actual value of the property. Buyers often end up paying far more than the property’s worth, primarily due to sales commissions, administrative fees, and profits for the time-share company.

10-2-3. Limited Value

Despite the promise of vacation ownership, many timeshare owners find that the actual value and benefits are limited. The rigid scheduling and fees associated with trading time slots for different locations can diminish the overall appeal of timeshares.

10-3. Second Homes: Expense and Financial Constraints

10-3-1. Understanding Second Homes

Owning a second home is a tempting notion, offering the allure of a getaway and potential rental income when not in use.

10-3-2. Financial Strain

Second homes are often accompanied by significant expenses, including mortgage payments, maintenance, property taxes, and insurance. The burden of these costs can hinder your ability to achieve other financial goals, such as saving for retirement or paying for your primary residence.

10-3-3. Limited Rental Income

While renting out a second home can generate income, many second-home owners fail to do so frequently. The limited usage and sporadic rental income often result in the property being a financial drain rather than a fruitful investment.

In conclusion, building wealth through real estate requires a discerning approach that avoids certain investment pitfalls. Steering clear of limited partnerships with high fees and illiquidity, being cautious about the costs and limited value of timeshares, and carefully considering the financial constraints of second homes are essential steps in making prudent real estate investment decisions. By sidestepping these potential traps, you can navigate the real estate market more effectively and build a more secure path to wealth accumulation.

11. Comparing Real Estate and Stocks

The decision to allocate resources towards either real estate or stocks is a pivotal choice that shapes your path to building wealth through real estate. Both options offer distinct advantages and considerations, and understanding the factors that set them apart is crucial for making an informed investment decision.

11-1. Responsibilities: Active Management vs. Professional Management

11-1-1. Real Estate

Investing in real estate often requires active and hands-on management. Landlords are responsible for property maintenance, tenant interactions, and handling various operational aspects. This level of involvement demands time and effort, making real estate suitable for those willing to take on these responsibilities.

11-1-2. Stocks

Stocks, on the other hand, can be managed professionally through mutual funds or exchange-traded funds (ETFs). These investment vehicles are managed by experts who handle stock selection and portfolio adjustments, relieving investors from the direct management responsibilities associated with real estate.

11-2. Tax Benefits: Immediate Deductions vs. Deferred Benefits

11-2-1. Real Estate

Unlike some retirement accounts that offer immediate tax deductions, real estate lacks upfront tax benefits. While you can deduct property-related expenses and mortgage interest, these deductions are usually spread out over time. This means that the immediate tax advantages are not as pronounced as those offered by certain retirement accounts.

11-2-2. Stocks

Retirement accounts like 401(k)s and IRAs provide immediate tax deductions on contributions. These accounts allow you to reduce your taxable income in the year of contribution, offering more immediate tax benefits compared to real estate.

11-3. Understanding: Familiarity and Comfort

11-3-1. Real Estate

Your comfort and familiarity with real estate versus stocks play a significant role in your investment decision. If you have a solid understanding of real estate markets, property management, and local dynamics, you might lean towards real estate investments. Your knowledge empowers you to make well-informed decisions that align with your expertise.

11-3-2. Stocks

Similarly, if you’re more knowledgeable about stock markets, economic indicators, and investment strategies, you might find stocks to be a more comfortable choice. Your understanding of market trends and financial analysis can guide your stock investment decisions.

In conclusion, comparing real estate and stocks involves weighing these considerations against your personal preferences and financial goals. The balance between active real estate management and professional stock management, the timing of tax benefits, and your familiarity with each investment type all factor into the decision-making process. Understanding these nuances empowers you to make a choice that aligns with your comfort level and objectives in building wealth through real estate.

12. Investing through REITs

Real Estate Investment Trusts (REITs) provide an intriguing avenue for building wealth through real estate that offers distinct advantages over direct property ownership. REITs introduce a level of convenience and diversification that appeals to investors seeking exposure to the real estate market without the complexities of managing individual properties.

12-1. Diversification through Portfolio Management

Real Estate Investment Trusts function as investment vehicles that pool funds from multiple investors to acquire and manage a diverse range of real estate assets. These assets can include commercial properties such as office buildings, shopping centers, and apartment complexes. By investing in a REIT, you gain exposure to a diversified portfolio of properties across different geographic locations and property types.

12-2. Accessible on Stock Exchanges and Mutual Funds

12-2-1. REITs on Stock Exchanges

One of the key advantages of REITs is their accessibility. They are listed and traded on major stock exchanges, making them as easy to buy and sell as stocks. This liquidity provides investors with the flexibility to enter or exit their investment positions with relative ease.

12-2-2. REITs through Mutual Funds

Additionally, investors can gain exposure to REITs through mutual funds that specialize in real estate. These mutual funds allocate their assets to a variety of REITs, offering a more diversified approach to real estate investment.

12-3. Professional Management and Passive Income

12-3-1. Managed by Experts

REITs are managed by professionals with expertise in real estate investment. These experts handle property acquisition, management, and strategic decisions, alleviating investors from the hands-on responsibilities of property ownership and management.

12-3-2. Passive Income Generation

Similar to owning rental properties, investing in REITs can provide a steady stream of passive income. REITs are required by law to distribute a significant portion of their income to shareholders in the form of dividends, making them an attractive option for investors seeking regular income.

12-4. Mitigating Direct Ownership Risks

Investing in REITs reduces the risks associated with direct property ownership. Property management challenges, maintenance costs, and vacancies are managed by the REIT’s professional team, allowing you to benefit from real estate’s potential without taking on the day-to-day operational burdens.

12-5. Comparing Returns of REITs and S&P 500

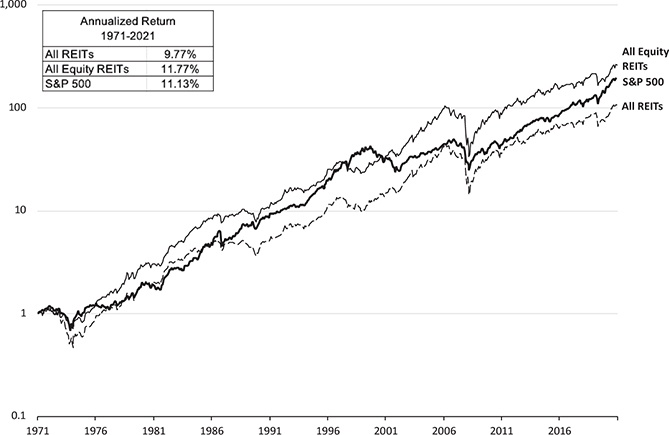

Real Estate Investment Trusts (REITs) have been a popular choice for investors seeking exposure to the real estate market without direct ownership of properties. This article delves into the performance of two main types of REITs – Equity REITs and Mortgage REITs – and compares their returns over the period from 1971 through November 2020.

12-5-1. All REIT Index Performance (1971 – November 2020)

The All REIT index exhibited an average annual return of 9.8 percent from 1971 to November 2020. However, this trailed behind the robust 11.20 percent return achieved by the S&P 500, a widely recognized benchmark for the overall stock market performance.

12-5-2. Equity REITs Performance

Equity REITs, encompassing entities that own and manage real estate properties, showcased a commendable performance. They posted an impressive return of approximately 11.7 percent per year during the specified period. This remarkable performance by Equity REITs outpaced the S&P 500 Index by about 0.5 percentage points annually.

12-5-3. Mortgage REITs Performance

In contrast, the performance of mortgage REITs, financial institutions specializing in real estate financing, was less inspiring. Over the same period, mortgage REITs realized returns of only 5.3 percent per year. Their relatively lackluster performance significantly contributed to dragging down the overall returns of the All REIT index.

12-5-4. Comparison with S&P 500

While both Equity REITs and mortgage REITs yielded returns lower than the S&P 500, Equity REITs managed to outshine the broader market index by a slight margin. Their consistent outperformance by 0.5 percentage points annually highlights their potential as an attractive investment avenue, particularly for investors interested in real estate exposure.

In the realm of REIT investments, it’s evident that Equity REITs have stood out as the more lucrative option compared to mortgage REITs. The superior performance of Equity REITs, boasting an average annual return of 11.7 percent, underscores their potential to deliver competitive returns even when compared to established benchmarks like the S&P 500. However, it’s essential for investors to carefully consider their investment goals and risk tolerance before venturing into any investment avenue.

FIGURE 1 Total REIT, All Equity REIT, and S&P 500 returns, 1971–2021

In conclusion, REITs offer an efficient and accessible means of participating in the real estate market while mitigating the challenges of direct property ownership. Whether purchased through stock exchanges or mutual funds, REITs provide diversification, professional management, and the potential for passive income. This alternative approach to building wealth through real estate is particularly appealing to investors who value convenience and want to leverage the expertise of real estate professionals.

13. Conclusion

Building wealth through real estate is a viable and rewarding endeavor, especially for young adults aiming to secure their financial future. The multifaceted benefits of passive income, property appreciation, and tax advantages make real estate investment a strategic choice. By setting clear financial goals, conducting thorough research, and understanding market trends, you can navigate the real estate landscape successfully. Remember, informed decisions and prudent risk management are key to maximizing your returns. Now is the time to take action and embark on your journey towards building wealth through real estate.

14. FAQs

14-1. What exactly does “building wealth through real estate” mean?

Building wealth through real estate refers to the strategic process of using real estate investments as a means to accumulate financial prosperity over time. This involves either buying properties to hold for the long term, generating rental income and capital appreciation, or engaging in property flipping for quick gains through renovations and resales.

14-2. How does property flipping contribute to building wealth through real estate?

Property flipping is a strategy within real estate where investors purchase undervalued properties, renovate or improve them, and then sell them at a higher price for a profit. This approach leverages rapid property value appreciation achieved through strategic upgrades, allowing investors to generate quick gains.

14-3. Can you explain the concept of long-term holding in real estate?

Long-term holding, also known as buy-and-hold investing, involves acquiring properties with the intention of keeping them for an extended period. This strategy aims to generate rental income and benefit from property appreciation over time. It provides a stable and gradual approach to building wealth through real estate.

14-4. What factors should I consider when choosing between property flipping and long-term holding?

When deciding between these strategies, it’s important to consider your financial goals, risk tolerance, and market dynamics. Property flipping offers quick gains but involves higher risks and active management. On the other hand, long-term holding provides stable rental income and equity growth but requires patience for substantial gains.

14-5. How do Real Estate Investment Trusts (REITs) fit into the concept of building wealth through real estate?

REITs offer an alternative way to build wealth through real estate without direct property ownership. They allow investors to buy shares in a portfolio of real estate properties managed by professionals. REITs provide diversification, passive income, and the convenience of stock-like trading, making them an appealing option for those interested in real estate but not the complexities of property management.

15. Case Study-Victoria: Building Wealth Through Real Estate

Meet Victoria, a 35-year-old female event planner who’s passionate about crafting unforgettable experiences.

She’s happily married with two children and works hard to provide for her family.

With an annual income of $60,000 and monthly expenses of $4,500, Victoria’s financial commitments often leave her feeling financially stretched.

15-1. Current Situation

In the midst of her event planning career, Victoria stumbled upon a life-changing opportunity – building wealth through real estate. Attending a local real estate seminar opened her eyes to the potential benefits of property investment. Intrigued and motivated, Victoria decided to explore this avenue.

15-2. Conflict Occurs

At the start, Victoria faced challenges in selecting the right investment property. The prospect of stepping out of her comfort zone triggered a mix of emotions. She recognized that a mindset shift was needed to fully embrace the potential of real estate. Her initial reluctance was fueled by the fear of the unknown and concerns about financial risk.

15-3. Problem Analysis

Victoria’s financial situation prompted a closer look at her options. Her primary income as an event planner felt limiting for building long-term wealth. The absence of additional income streams raised concerns about her family’s financial security. Victoria realized that a passive income source was essential to secure her family’s future.

15-4. Solution

Victoria’s approach was twofold. First, she decided to hold onto real estate for extended periods and generate cash flow through rentals. After researching, she purchased a property for $200,000, using a $150,000 mortgage at an interest rate of 4%. This property generated a rental income of $1,500 per month, covering the mortgage payments and leaving her with a positive cash flow of $300 monthly.

Second, Victoria allocated 30% of her investment budget to global Real Estate Investment Trusts (REITs). She diversified across residential, commercial, and industrial REITs, minimizing the risks associated with a single regional market. Her total investment in REITs amounted to $50,000.

15-5. Effects After Execution

Implementing her solutions yielded remarkable results. Over a period of five years, the steady rental income from her property not only covered mortgage payments but also contributed to her family’s financial stability. Moreover, her investments in global REITs provided diversification, and she saw an average annual return of 7% on her REIT investments. The property appreciated by 15% in value over the same period.

| Data Analysis | Victoria’s Case |

| Income | $60,000 annually |

| Expenses | $4,500 monthly |

| Investment Budget | $250,000 |

| Property Purchase Price | $200,000 |

| Mortgage | $150,000 at 4% interest |

| Rental Income | $1,500 per month |

| REITs Investment | $50,000 (30% of budget) |

| REITs Annual Return | Average 7% |

| Property Appreciation | 15% over 5 years |

| Cash Flow | Positive $300 per month |

| Investment Period | 5 years |

15-6. In Conclusion

Victoria’s journey to building wealth through real estate brought about transformative changes. By adopting a long-term rental strategy and embracing global REITs, she created a diversified income portfolio that bolstered her financial foundation. Victoria now faces the future with confidence, knowing she’s secured her family’s financial well-being. Her advice to others is to step out of their comfort zones, harness calculated risks, and explore the world of real estate for lasting financial success.

16. Checklist

| Questions | Your Reflections | Suggested Improvement Strategies | Improvement Plans | Implementation Results | Review and Adjust |

| 1. Have I clearly defined my financial goals for building wealth through real estate? | Reflect on short-term gains versus long-term growth. | ||||

| 2. How comfortable am I with taking calculated risks in my real estate investments? | Explore strategies for assessing and managing risks effectively. | ||||

| 3. Have I thoroughly researched the local real estate market trends and demand in my chosen area? | Enhance market analysis skills to make more informed decisions. | ||||

| 4. Do I understand the responsibilities and time commitment involved in property management? | Consider strategies for balancing active management with other commitments. | ||||

| 5. Am I aware of the tax benefits associated with real estate investments and how to maximize them? | Learn about tax strategies that align with my investment approach. | ||||

| 6. Have I evaluated my knowledge in real estate versus stocks and how it influences my decisions? | Explore educational opportunities to strengthen expertise in chosen investment areas. | ||||

| 7. Have I considered the advantages of investing in Real Estate Investment Trusts (REITs) for diversification? | Research and assess different types of REITs to integrate into my portfolio. |