In the dynamic landscape of today’s swiftly evolving financial world, the quest for optimal investment avenues can prove to be a daunting endeavor. As emerging adults, we ardently pursue both the fortification of our fiscal horizon and the adept handling of existing obligations. This journey leads us to explore the domain of investment instruments, wherein mutual funds and exchange-traded funds (ETFs) emerge as highly favorable choices. By delving deep into their distinctive attributes, merits, and the manifold Benefits of Mutual Funds and ETFs, we empower ourselves with the indispensable knowledge required to navigate the realm of investment decisions with prudence and confidence.

Outline

Reading time: 25 minutes

1. Understanding Mutual Funds and ETFs

Before diving into their benefits, let’s understand what mutual funds and ETFs are. Mutual funds are pooled investments that gather money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. On the other hand, ETFs are similar but trade on exchanges like stocks, offering real-time pricing and intraday trading. Diversification, a key principle of both investment options, helps spread risk across different assets, minimizing the impact of poor-performing investments.

2. Characteristics of Mutual Funds and ETFs

2-1. Diversification for Risk Management

Investing your hard-earned money in a single stock can feel like a thrilling gamble, but it’s a gamble that carries substantial risks. Imagine the scenario: you put all your eggs in one basket, betting on the success of a single company. Now, consider what could happen if that company faces unexpected challenges or experiences a sudden decline in stock value. The consequences could be financially devastating, leaving your portfolio in tatters. This is where the profound concept of diversification comes into play.

2-1-1. Diversification: The Shield Against Volatility

Picture diversification as your investment shield against market volatility. When you opt for mutual funds or exchange-traded funds (ETFs), you’re essentially distributing your investments across an assortment of assets—stocks, bonds, commodities, and sometimes even real estate. This strategic spread of your funds minimizes the impact of a single asset’s underperformance on your entire investment portfolio. By mitigating the risk associated with relying solely on one asset, you’re setting the stage for smoother financial sailing.

2-1-2. Balancing the Scales: Gains and Losses

To illustrate this, consider the following scenario: You’ve invested in a mutual fund or ETF that holds a mix of stocks from various industries and bonds from different sectors. Now, let’s say one of the companies represented in your fund faces a downturn, causing its stock value to plummet. While this situation might cause the value of that particular asset to decline, the positive performance of the other holdings within your fund can potentially offset the losses. This balancing act reduces the impact of individual poor-performing assets, helping maintain the overall stability of your investment.

2-1-3. Swift Recovery: Learning from History

Historical data paints a compelling picture of the benefits of diversification, especially during market downturns. Analyzing past market crashes reveals that diversified portfolios tend to rebound more swiftly compared to those heavily concentrated in a single asset. This phenomenon can be attributed to the fact that diversified portfolios are less susceptible to severe losses from the decline of a single investment. Instead of waiting for the value of a sole stock to recover, diversified investors can witness the combined strength of their various assets aiding in a faster financial revival.

2-2. Investment Expertise Through Professional Management

As we traverse the realm of investing, it’s crucial to acknowledge that not everyone possesses the time or expertise to meticulously analyze, research, and manage individual investments. Enter mutual funds and ETFs—a gateway to a world of investment expertise that’s typically beyond the scope of the average individual investor.

2-2-1. The Role of Fund Managers: Unveiling Expert Insights

When you invest in a mutual fund or an ETF, you’re essentially tapping into a pool of resources managed by skilled and experienced professionals. These experts are well-versed in the complexities of market trends, economic indicators, and the nuances of various industries. They dedicate their time to scrutinizing company performances, identifying emerging market trends, and assessing macroeconomic factors that can impact investments.

2-2-2. Dynamic Decision-Making: Navigating Market Changes

One of the exceptional qualities of mutual funds and ETFs lies in the hands of these fund managers. In a constantly shifting financial landscape, these managers possess the ability to make dynamic investment decisions. As market conditions change, they can adjust the allocation of the fund’s assets. During periods of economic uncertainty, for instance, a proficient fund manager might strategically increase the allocation to defensive assets like bonds. This astute maneuver aims to shield the portfolio from potential downturns, showcasing the finesse of their decision-making skills.

2-2-3. The Advantage of Collective Wisdom

The collective wisdom and expertise of these fund managers are assets that can potentially lead to superior investment outcomes. Think of it as entrusting your investments to a team of dedicated experts who are in constant pursuit of identifying opportunities, managing risks, and optimizing your returns. Their ability to navigate the intricate web of financial markets can serve as a powerful tool in your investment arsenal.

In the ever-evolving landscape of investment, the depth of knowledge and strategic acumen offered by mutual fund and ETF managers holds the potential to elevate your investment journey beyond what individual stock picking might achieve. The benefits of this professional insight extend to diverse market conditions, making it a valuable proposition for those seeking to harness the full power of informed investment decisions.

3. Advantages Compared with Other Tools

3-1. Cost Efficiency and Accessibility

When it comes to investing, the world of individual stock trading can be a bit like a costly maze to navigate. Transaction fees, commissions, and hidden charges often eat into your potential gains. However, this is where the brilliance of mutual funds and exchange-traded funds (ETFs) shines. They offer a refreshing paradigm of cost efficiency and accessibility that’s especially appealing to young adults venturing into the investment landscape.

3-1-1. Economies of Scale: Lower Costs Beckon

One of the standout advantages of mutual funds and ETFs is the result of a simple principle: economies of scale. These investment vehicles pool money from a multitude of investors, collectively amassing substantial sums. As a result, the costs associated with managing these funds get distributed across the investor base. This translates to significantly lower transaction fees and operational expenses compared to the often exorbitant costs tied to individual stock trading.

3-1-2. Opening Doors for Small Investors: Affordability and Accessibility

Consider this scenario: You’re a young adult with a limited budget, but the desire to grow your wealth steadily. Individual stocks might seem like an exclusive club with high barriers to entry. Mutual funds and ETFs, on the other hand, extend a warm invitation to all investors, regardless of their starting capital. With an investment as modest as $50 or $100, you can gain access to a diversified portfolio that would otherwise remain elusive. This democratization of investment opportunities empowers young adults to take their first steps toward financial prosperity.

3-2. Liquidity and Flexibility

Picture this—you’re faced with an unexpected financial need that demands immediate attention. Whether it’s a medical emergency or an enticing investment opportunity, the ability to access your funds swiftly can make all the difference. Enter the realm of liquidity—a factor that distinguishes mutual funds and ETFs, and presents a host of benefits.

3-2-1. The Power of Liquid Assets: Quick Access to Cash

Liquidity, in investment parlance, refers to how quickly you can convert an investment into cold, hard cash. This is where mutual funds and ETFs hold a distinct advantage. Unlike the rigidity of certain investments that tie your money down, these vehicles offer a level of fluidity that can be invaluable in times of urgency. Need funds for a down payment on a new home or an unforeseen expense? Mutual funds and ETFs allow you to tap into your investments with relative ease.

3-2-2. ETFs: Trading at Your Fingertips

Within the realm of ETFs lies an intriguing facet: intraday trading. Imagine being able to buy and sell shares throughout the trading day, much like you would with individual stocks. This attribute ushers in a new era of flexibility, enabling you to react swiftly to market trends, news, or any emerging opportunities. Whether it’s seizing a potential upswing or cutting losses, intraday trading can be a powerful tool in your investment toolkit. But generally, I don’t recommend that novices implement intraday trading investment strategies.

3-3. Tax Benefits and Transparency

As you embark on your investment journey, consider the often-overlooked aspect of tax implications. Beyond the quest for growth and returns lies the realm of tax efficiency—a domain where mutual funds and ETFs hold the potential to offer significant advantages.

3-3-1. Tax Optimization Through Structured Funds

Certain mutual funds and ETFs are masterfully structured to minimize tax liabilities. This is particularly notable with index funds, which tend to have lower turnover compared to actively managed funds. Lower turnover results in fewer capital gains distributions, potentially reducing your tax bill. For the astute investor seeking to maximize returns while minimizing tax obligations, these investment vehicles can be a beacon of tax optimization.

3-3-2. Transparency: Illuminating the Investment Landscape

In a world where information is power, transparency stands as a cornerstone of the mutual fund and ETF landscape. Imagine having access to a window that reveals the inner workings of your investments. These vehicles embrace transparency by regularly disclosing their holdings. This means you have the ability to see exactly what assets your fund contains. Such clarity not only empowers you to make well-informed investment decisions but also fosters a sense of trust between investors and fund managers.

As you navigate the intricate pathways of investment, the benefits of mutual funds and ETFs extend far beyond their ease of accessibility. They bring forth a cost-efficient universe, accompanied by liquidity, flexibility, tax advantages, and a commitment to transparency. These attributes collectively paint a portrait of investment vehicles designed to empower young adults with the tools they need to chart a path toward financial prosperity.

4. Benefits for Investors

4-1. Steady Growth and Long-Term Returns

As young adults, envisioning our financial future is not just a dream—it’s a strategic endeavor. Mutual funds and exchange-traded funds (ETFs) present us with a compelling narrative of steady growth and long-term returns that resonate deeply with those aiming to build wealth over time.

4-1-1. Past as a Window to the Future: Historical Growth

While it’s true that past performance does not guarantee future results, historical data offers a valuable glimpse into the potential of mutual funds and ETFs. These investment vehicles have demonstrated consistent growth over the years, weathering various market conditions and economic shifts. By analyzing the track record of these options, we can discern patterns of reliability that speak to the potential for steady returns.

4-1-2. Building for Tomorrow: Planning for Long-Term Goals

Imagine the canvas of your financial life stretched out before you. On this canvas, long-term goals like retirement, education funding, or owning a home are painted with aspirations. Mutual funds and ETFs offer a brush that can help you color these dreams with reality. By harnessing the power of steady growth, you’re creating a pathway toward accumulating the resources necessary to realize these ambitions. This is especially pertinent for young adults with the advantage of time on their side—a critical element in the equation of wealth accumulation.

4-2. Reduced Individual Risk

In the exhilarating world of investing, risk is a constant companion. It’s the thrill that accompanies potential rewards, but it’s also the shadow that lingers behind the allure. Here’s where mutual funds and ETFs step in as a beacon of risk management, offering a multifaceted approach to reducing individual risk.

4-2-1. Diversification: Spreading the Safety Net

Diversification is the secret sauce that helps seasoned investors sleep soundly at night. When you invest in a mutual fund or an ETF, your money is distributed across a tapestry of assets. Imagine this tapestry as a mosaic of stocks, bonds, and other investment instruments. If one piece of the mosaic loses its luster, the others continue to shine. This strategic spread of your investments mitigates the potential blow of poor performance from a single asset, thereby cushioning the overall impact on your portfolio.

4-2-2. Learning from the Past: The Global Financial Crisis

Consider the pivotal moment in financial history—the global financial crisis of 2008. It serves as a poignant example of the advantages offered by diversification. Investors with diversified portfolios found themselves better equipped to weather the storm compared to those who had placed their bets on a single sector. The diversified approach reduced the vulnerability of their investments to the turmoil that engulfed the financial markets.

4-3. Simplicity and Convenience

Investing—often hailed as a daunting landscape of complex jargon, intricate strategies, and the constant pulse of market fluctuations. Yet, mutual funds and ETFs beckon young adults with an oasis of simplicity and convenience that can serve as a springboard into the world of financial growth.

4-3-1. Simplicity in Action: No Stock-Picking Required

Imagine not having to spend hours analyzing individual stocks, deciphering intricate market trends, or navigating the treacherous terrain of economic indicators. When you invest in mutual funds or ETFs, you’re relieved of the burden of stock-picking. Instead, you choose funds aligned with your financial goals and risk tolerance. This means you can bypass the labyrinthine complexities and invest with ease.

4-3-2. User-Friendly Universe: Investment Platforms

For young adults just dipping their toes into the investment waters, the idea of navigating complex platforms can be intimidating. Fortunately, mutual funds and ETFs come with a user-friendly passport to the investment universe. Investment platforms offer interfaces that are intuitive, simple, and accessible. This means you can embark on your investment journey with confidence, knowing that the tools you need to invest, monitor, and adjust your portfolio are at your fingertips.

As young adults aspire to sculpt their financial destinies, the benefits of mutual funds and ETFs provide a canvas of opportunity. Steady growth, risk mitigation, and the embrace of simplicity are threads woven into their fabric, offering a pathway to financial empowerment. By capitalizing on these benefits, we can forge ahead with confidence, fueled by the promise of a brighter financial future.

5. Evidence of Benefits

5-1. Case Studies and Performance Data

When it comes to investing, words are persuasive, but numbers and real-world examples have a profound impact. Enter the realm of case studies and performance data—a treasure trove of evidence showcasing the benefits of mutual funds and exchange-traded funds (ETFs).

5-1-1. The Vanguard 500 Index Fund: A Success Story

Consider the remarkable journey of the Vanguard 500 Index Fund. This fund, acting as a mirror to the renowned S&P 500 index, has etched a path of consistent growth over the long term. The historical performance of this fund unveils a narrative of reliable returns. As you delve into the numbers, you’ll witness a trajectory that closely shadows the index’s gains. This case study stands as a testament to the potential of mutual funds to harness the power of renowned benchmarks and translate them into real, tangible growth.

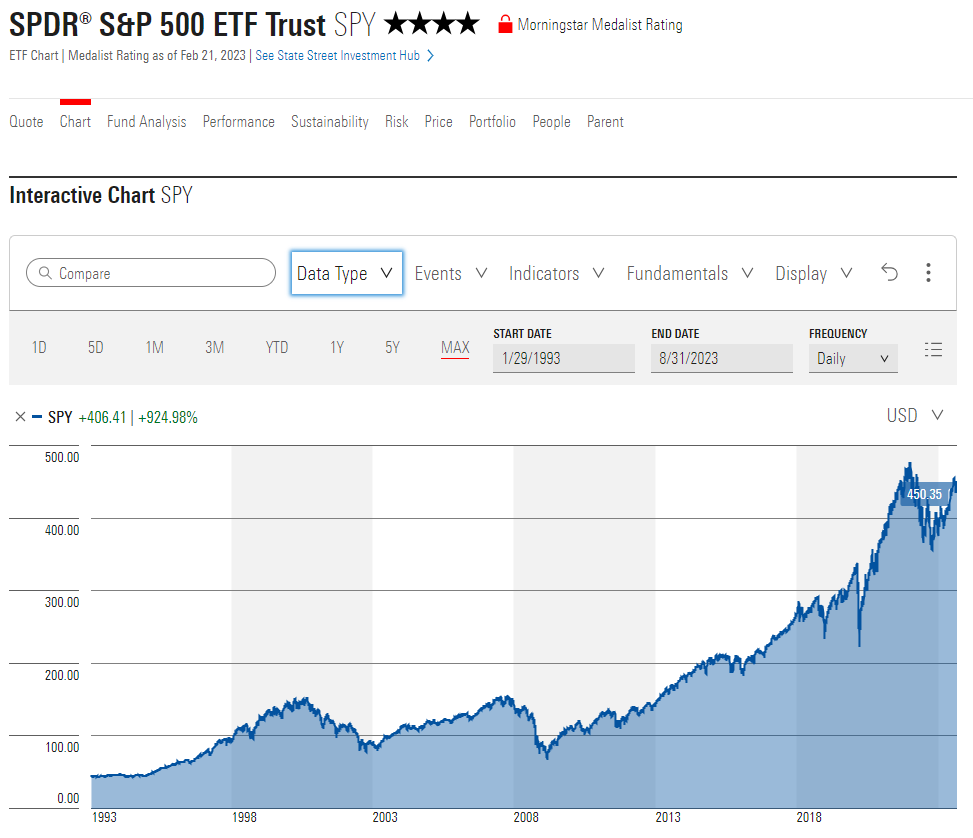

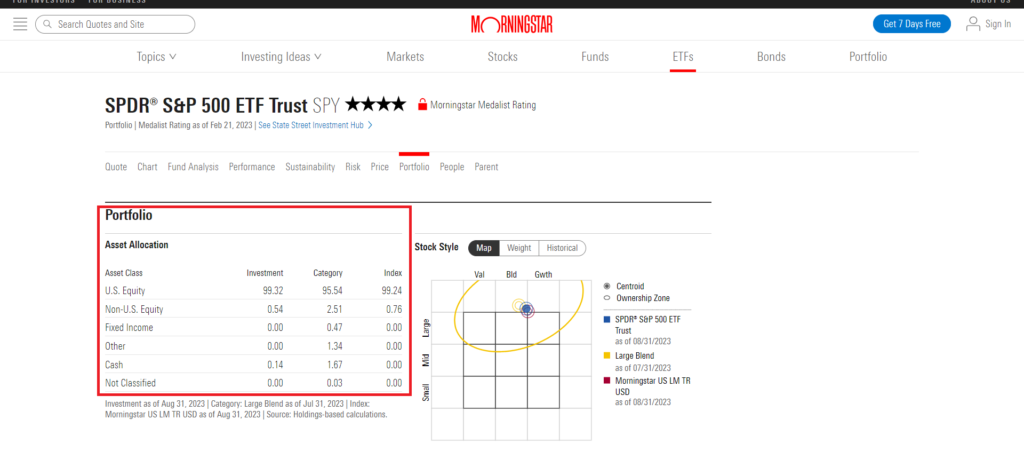

5-1-2. SPDR S&P 500 ETF Trust: Reliability in Action

But the story doesn’t end there. The SPDR S&P 500 ETF Trust, another star in the constellation of ETFs, adds another layer to the narrative. With its own track record of steadfast performance, this ETF echoes the sentiment of the Vanguard 500 Index Fund. These case studies underscore the consistent growth patterns that mutual funds and ETFs have displayed over the years. The lessons they offer are powerful: the potential for reliable returns is not merely theoretical—it’s etched in the annals of investment history.

5-2. Comparison with Individual Stock Performance

Venturing into the labyrinth of investment history, one cannot ignore the ebb and flow of market volatility. The stock market, a theater of financial drama, has seen periods of meteoric highs and gut-wrenching crashes. Within this ever-changing landscape, the divergence between individual stock performance and the resilience of diversified portfolios offered by mutual funds and ETFs is a storyline that holds profound significance.

5-2-1. Weathering the Storms: Diversified Portfolios in Downturns

Cast your gaze back to the moments of market turbulence—times when uncertainty reigned supreme, and red ink dominated the trading screens. Individual stocks, vulnerable to the whims of market sentiment, often experienced the full brunt of these downturns. However, in the shadows of these tumultuous times, diversified portfolios stood resilient. The presence of various assets within mutual funds and ETFs acted as a protective shield, softening the impact of market fluctuations on the overall portfolio.

5-2-2. Resilience in the Face of Uncertainty: The Tale of 2008

In the annals of financial history, the year 2008 stands as a monumental chapter. The global financial crisis shook the very foundations of the market. Amid the chaos and uncertainty, a crucial lesson emerged: diversified portfolios, fortified by the breadth of their holdings, fared better than their concentrated counterparts. While individual stocks faced staggering losses, diversified investments showcased their capacity to weather storms and emerge on the other side with lesser scars.

As the pages of investment history unfold, the evidence speaks volumes. Case studies, performance data, and comparative analyses illuminate the benefits of mutual funds and ETFs. These tools not only offer reliable growth but also provide a safety net in the face of market turbulence. The stories etched in numbers and experiences underscore a resounding truth: mutual funds and ETFs stand as anchors of stability and growth in the ever-shifting tides of the investment world.

6. Suitable Investors for Mutual Funds and ETFs

As we explore the benefits of mutual funds and ETFs, it’s crucial to identify the types of investors who can make the most of these investment vehicles. Let’s delve into two distinct categories: young professionals and individuals with limited time.

6-1. Young Professionals: Long-Term Gains Ahead

Mutual funds and ETFs form a symbiotic relationship with young professionals, individuals setting out on the exciting journey of their careers. These investment options resonate particularly well with their aspirations for long-term financial success, such as crafting retirement plans and methodically accumulating wealth over the years.

6-1-1. The Power of Time

Imagine time as a powerful ally in your investment strategy. Young professionals have the distinct advantage of a longer investment horizon, the period during which their investments have the opportunity to grow and compound. Every dollar invested can potentially multiply as it generates returns that are reinvested. The compounding effect over time can result in exponential growth, catapulting the value of their investments to new heights.

6-1-2. Wealth Building Blueprint

Picture a blueprint for constructing financial prosperity. Young professionals, armed with time and consistent contributions to mutual funds or ETFs, lay down the foundation for a solid financial future. By starting early, they’re positioned to weather market fluctuations, take calculated risks, and ultimately reap the rewards of well-timed investment decisions. As they advance in their careers, their investment portfolio matures alongside them, reflecting their evolving financial goals.

6-2. Individuals with Limited Time: Unleashing Efficiency

For those leading lives of perpetual motion, time is a precious commodity. Mutual funds and ETFs present an alluring proposition for these time-constrained individuals, offering a streamlined path to active participation in the financial markets without the burden of constant monitoring.

6-2-1. Delegating Expertise

Imagine having a team of experienced professionals managing your investments while you navigate your busy life. This is precisely what mutual funds and ETFs provide for individuals with limited time. By investing in these vehicles, you essentially delegate the task of researching, analyzing, and making investment decisions to fund managers. These experts are well-versed in market dynamics and equipped to navigate the intricacies of portfolio management.

6-2-2. Focus on What Matters

Consider the concept of balance in modern life. With careers, families, and personal pursuits, individuals often find themselves pulled in multiple directions. For those with limited time, investing in mutual funds or ETFs becomes a way to strike that balance. By entrusting their investments to skilled professionals, they can focus on their primary responsibilities and passions, secure in the knowledge that their financial well-being is in capable hands.

6-3. Making the Right Choice

In the realm of investing, it’s not just about numbers—it’s about aligning investment choices with personal circumstances and goals. Mutual funds and ETFs offer distinct advantages to both young professionals and those with limited time. For young professionals, it’s a chance to harness the power of compounding and create a strong financial foundation for the future. For time-constrained individuals, it’s an opportunity to invest efficiently without sacrificing quality decision-making. Ultimately, the suitability of these investment options hinges on understanding one’s financial aspirations, lifestyle, and the commitment required for successful investing.

7. Considerations When Investing

7-1. Risk Tolerance and Investment Goals

Embarking on an investment journey is akin to setting sail on uncharted waters. Amidst the waves of opportunity and potential, one must navigate the currents of risk and reward. This is where the compass of risk tolerance and investment goals comes into play—a compass that can steer you towards a prosperous destination.

7-1-1. Navigating the Risk Spectrum: Your Risk Tolerance

Picture risk tolerance as your personal barometer of uncertainty. Are you someone who finds comfort in the unknown, seeking higher rewards despite the potential for greater risks? Or do you lean towards a cautious approach, prioritizing capital preservation and the gradual accumulation of wealth? Understanding your own risk tolerance is fundamental to choosing the right mutual funds or ETFs.

7-1-2. Customized to Your Aspirations: Investment Goals

Every investor’s journey is unique, painted with individual aspirations and dreams. Your investment goals could range from building a retirement nest egg, funding higher education, or achieving financial freedom. These goals form the backbone of your investment strategy. If you’re comfortable with a dash of risk to expedite growth, equity-focused funds might align with your ambitions. Conversely, if you’re seeking a balance between growth and stability, bond or balanced funds could be your preferred pathway.

7-2. Fund Selection and Due Diligence

Imagine you’re a discerning art collector in search of a masterpiece. Similarly, when it comes to mutual funds and ETFs, the art of fund selection and due diligence demands a meticulous eye for detail. The brushstrokes of expense ratios, historical performance, and underlying assets shape the canvas of your investment portfolio.

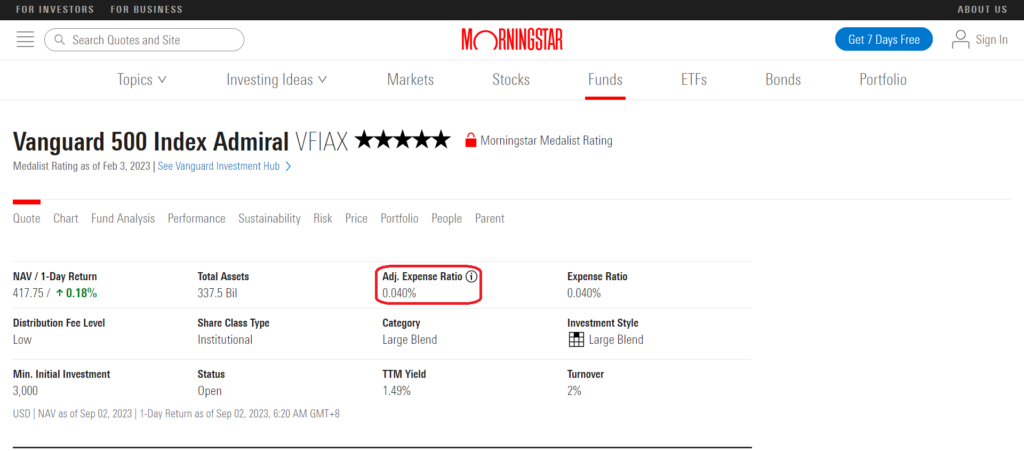

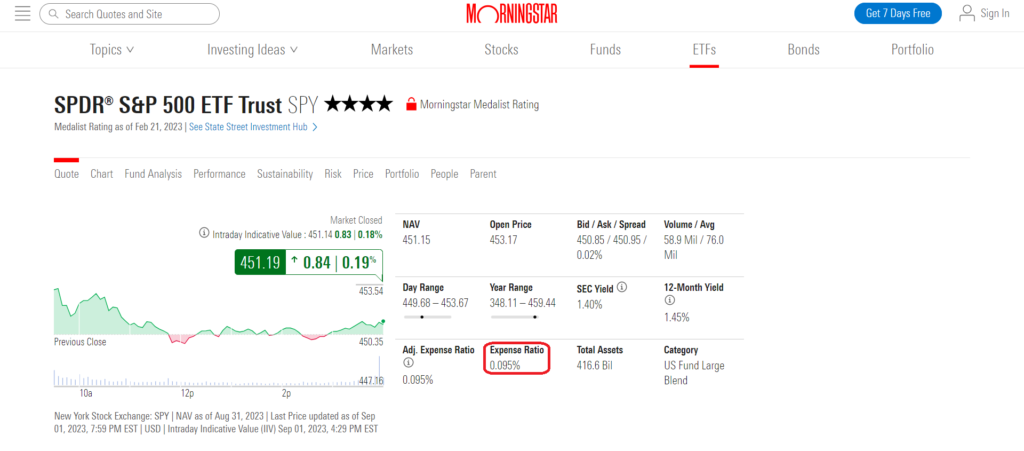

7-2-1. Unveiling the Fine Print: Expense Ratios

Expense ratios—a seemingly innocuous term that holds immense significance. This ratio represents the percentage of your investment that goes toward covering the fund’s operating expenses. A lower expense ratio translates to a higher portion of your returns ending up in your pocket. Delve into the prospectus to uncover this crucial detail and ensure that your investment isn’t bogged down by unnecessary fees.

7-2-2. The Trail of the Past: Historical Performance

History holds within its grasp a treasure trove of insights. As you explore mutual funds and ETFs, journey through their historical performance data. This data is a portal to understanding how a fund has fared over different market conditions. While past performance is not a crystal ball into the future, it offers a glimpse into the fund’s resilience and adaptability.

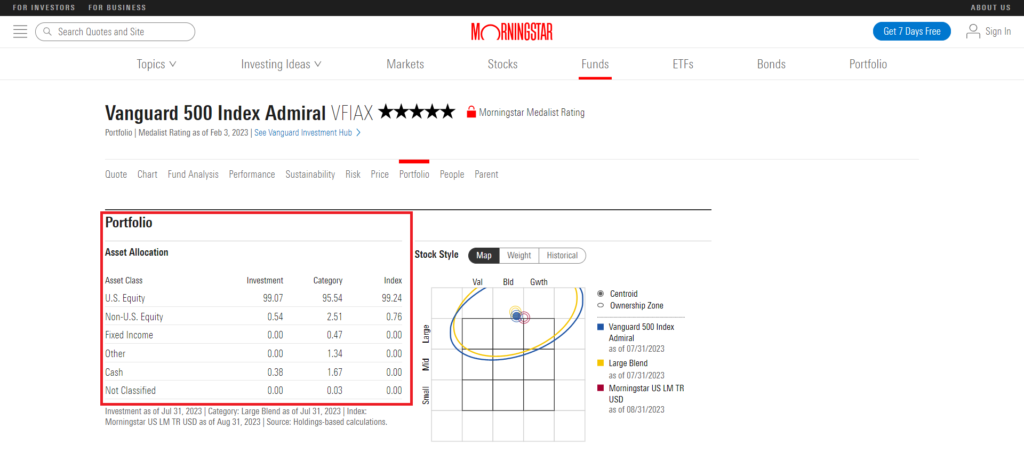

7-2-3. Peering Beneath the Surface: Underlying Assets

Imagine a mutual fund or ETF as a treasure chest brimming with assets—stocks, bonds, commodities, and more. The mix of these underlying assets shapes the fund’s risk profile and potential for returns. Before embarking on an investment journey, delve into the fund’s holdings. Scrutinize the allocation—how much is in stocks, how much in bonds? This insight empowers you to align your investments with your risk tolerance and financial aspirations.

7-2-4. The Craft of Due Diligence: Research and Insight

In the realm of investment, due diligence is your trusted guide. Just as you wouldn’t venture into unfamiliar terrain without a map, you shouldn’t invest without conducting thorough research. Websites like Morningstar, with their comprehensive analysis, and the official websites of the funds themselves, offer a wealth of information. Dive into the prospectus, study the fund’s strategy, and unearth insights that help you make informed decisions.

The journey of investing unfolds with thoughtful consideration. Risk tolerance and investment goals form the compass, guiding your choices. Fund selection and due diligence act as your anchors, ensuring your investment decisions are rooted in sound information. As you embark on this voyage, remember that every decision you make shapes your financial destiny, painting a portrait of prosperity that echoes through the years.

8. Conclusion

In the realm of investment, mutual funds, and ETFs present young adults with compelling advantages. These vehicles offer diversification, professional management, cost efficiency, liquidity, tax benefits, and steady growth potential. With reduced individual risk and user-friendly accessibility, they cater to a wide range of investors. By understanding their benefits and aligning investments with personal goals, young adults can embark on a path to financial success. Making informed investment decisions today can lead to a prosperous tomorrow.

9. FAQs

9-1. What exactly are mutual funds and ETFs, and how do they work?

Mutual funds and exchange-traded funds (ETFs) are investment vehicles that pool money from multiple investors to create a diversified portfolio of assets, such as stocks, bonds, or commodities. While mutual funds are managed by professionals who make investment decisions, ETFs are traded on exchanges like stocks. Both options provide the advantage of diversification, which spreads risk across various assets to minimize the impact of poor-performing investments.

9-2. What role does diversification play in mutual funds and ETFs?

Diversification is a crucial concept in both mutual funds and ETFs. It involves spreading your investments across different types of assets, industries, and sectors. This strategy acts as a shield against market volatility. If one asset underperforms, the impact on your overall portfolio is reduced because the positive performance of other assets can offset the losses. This approach helps manage risk and maintain stability in your investment journey.

9-3. How do mutual funds and ETFs offer cost efficiency and accessibility?

Mutual funds and ETFs offer a cost-efficient alternative to individual stock trading. These investment options utilize economies of scale by pooling funds from many investors, resulting in lower transaction fees and operational costs. This affordability is a game-changer for young adults who may have limited funds to invest. It opens up investment opportunities to a wider range of investors, regardless of their starting capital.

9-4. Can you explain the concept of liquidity and flexibility in mutual funds and ETFs?

Liquidity refers to the ease of converting an investment into cash. Mutual funds and ETFs provide high liquidity, allowing investors to access their money quickly when needed. ETFs, in particular, offer the added advantage of intraday trading, enabling you to buy and sell shares throughout the trading day. This flexibility is beneficial for making swift financial decisions, whether it’s capitalizing on market trends or addressing unexpected financial needs.

9-5. How do mutual funds and ETFs suit different types of investors?

Mutual funds and ETFs cater to a diverse range of investors. For young professionals with a long investment horizon, these options provide the potential for steady growth and compounding over time. On the other hand, individuals with limited time can benefit from the professional management offered by fund managers. These experts navigate market complexities, allowing busy investors to focus on their priorities while still participating in the financial markets. Ultimately, the choice depends on your risk tolerance, investment goals, and lifestyle.

10. Case Study-Justin: Navigating Financial Success through Index Funds

Meet Justin, a 43-year-old male pilot with a passion for flying high in the skies.

As a devoted husband and father of two, Justin’s aspirations are to provide a secure and comfortable life for his family.

Yet, Justin’s path to financial security was marked by challenges that demanded a strategic shift in his investment approach.

10-1. Current Situation

As a pilot, Justin’s income averaged $100,000 annually. His family’s monthly expenditure included $3,000 for mortgage payments, $1,500 for groceries and utilities, and $500 for miscellaneous expenses. With assets totaling $300,000, including his home and savings, and liabilities amounting to $150,000 in mortgage debt, Justin’s financial picture seemed stable. However, his investment decisions were about to be put to the test.

10-2. Conflict Occurs

Placing all his investments in a single company’s stock left Justin vulnerable to market volatility. The company’s poor earnings and subsequent stock price decline resulted in a loss of $20,000 – a significant blow to his finances. This wake-up call made Justin realize the importance of diversification and prompted him to seek a more prudent investment strategy.

10-3. Problem Analysis

The heart of Justin’s problem lay in his concentrated investment strategy. His reliance on a single stock led to substantial losses due to its poor performance. Recognizing the need for a well-rounded approach, Justin sought a way to reduce risk and enhance his financial stability.

10-4. Solution

Determined to make a change, Justin learned about low-cost index funds with expense ratios as low as 0.05%. He decided to allocate his investments strategically: 60% in stock index funds, 30% in bond index funds, and 10% in real estate index funds. By diversifying his portfolio, he aimed to mitigate risks associated with any one sector.

Justin invested $50,000 in his new index fund portfolio, with an expected average rate of return of 7% over a 15-year investment period. This diversified approach lowered his risk exposure and aligned with his long-term financial goals.

10-5. Effects After Execution

As Justin’s diversified portfolio began to gain traction, he witnessed a positive transformation. His portfolio’s performance was more stable, and he saw an annualized return of 7.5% after five years. The decision to diversify not only protected his investments from severe downturns but also improved his financial well-being.

Moreover, the newfound financial security positively impacted Justin’s career. With reduced financial stress, he was able to focus more on his pilot duties and excel in his profession. The stability offered by his diversified investments made him a more focused and confident pilot, potentially leading to increased compensation opportunities in the future.

10-6. In Conclusion

Justin’s journey from experiencing stock losses to embracing the benefits of index funds underscores the value of informed decision-making. By diversifying his portfolio and considering long-term goals, Justin not only achieved financial stability but also enhanced his career prospects. The case of Justin serves as a testament to the transformative power of strategic investment decisions and continuous learning. For others facing similar challenges, Justin’s story stands as a reminder that adapting and evolving can lead to both financial success and improved overall well-being.

11. Checklist

| Questions | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review |

| How familiar am I with mutual funds and ETFs? | Research and understand the basics of mutual funds and ETFs to make informed investment decisions. | ||||

| What are my long-term financial goals? | Clearly define my financial goals, such as retirement or education funding, to align with suitable investment options. | ||||

| Am I comfortable with risk or do I prioritize stability? | Evaluate my risk tolerance to determine whether equity-focused or balanced funds are more appropriate for my investment strategy. | ||||

| Do I have the time and expertise to manage individual investments? | Consider whether mutual funds or ETFs can provide professional management and simplify my investment journey. | ||||

| How can I diversify my investment portfolio effectively? | Explore mutual funds or ETFs to diversify my investments across various assets and reduce individual risk. | ||||

| Am I aware of the tax implications of my investments? | Research tax-efficient funds to optimize returns and minimize tax obligations. | ||||

| Do I prioritize liquidity and easy access to funds? | Choose mutual funds or ETFs for liquidity and flexibility, ensuring quick access to funds when needed. |