Welcome to the realm of personal tax deductions, where understanding the intricacies of tax law can lead to substantial financial gains. In this comprehensive guide, we’ll unravel the mysteries behind personal tax deductions, explore various avenues to optimize your tax situation and provide you with actionable insights to make the tax code work to your advantage.

Outline

Reading time: 24 minutes

1. Increasing Your Deductions

Deductions play a crucial role in reducing your taxable income before calculating the amount of taxes you owe. Understanding the methods available to determine your deductions can lead to significant tax savings. In this section, we’ll explore various strategies to increase your deductions and minimize your tax liability.

2. Choosing Standard or Itemized Deductions

When it comes to deductions, you have the option to choose between standard and itemized deductions. The standard deduction is straightforward and suitable for those with uncomplicated financial situations.

2-1. Standard Deduction for the 2022 and 2023 Tax Years

| Filing Status | 2022 Standard Deduction | 2023 Standard Deduction |

|---|---|---|

| Single | $12,950 | $13,850 |

| Married Filing Separately | $12,950 | $13,850 |

| Heads of Household | $19,400 | $20,800 |

| Married Filing Jointly | $25,900 | $27,700 |

| Surviving Spouses | $25,900 | $27,700 |

Here’s a noteworthy tidbit for taxpayers aged 65 or older, or those who are visually impaired: you have the chance to claim an extra standard deduction on top of the regular one. In the year 2022, this additional amount stands at $1,400 ($1,750 for individuals filing as single or heads of households). Now, if you’re both over 65 and blind, the perk becomes even better—you’re entitled to double the additional amount, meaning $2,800 or $3,500, depending on your filing status.

Fast forward to 2023, and the extra standard deduction increases to $1,500 ($1,850 for single filers and heads of households). It’s a gradual uptick aimed at providing a bit more financial breathing room for those in this category.

2-2. Itemizing Deductions

On the other hand, itemizing deductions involves listing out specific deductible expenses on your tax return. While this method can be more complex, it’s worth considering if your itemized deductions exceed the standard amounts. Schedule A of IRS Form 1040 is used to sum up your itemized deductions. Even if you opt for the standard deduction, familiarize yourself with the various legal itemized deductions listed on Schedule A to make well-informed financial decisions.

3. Common Personal Tax Deductions

When it comes to navigating the intricate landscape of personal tax deductions, a handful of deductions stand out as commonly utilized tools that can significantly impact your tax liability. These deductions are available to a wide range of taxpayers, making them essential knowledge for anyone seeking to optimize their financial situation. Let’s delve into these common personal tax deductions, understanding their mechanics and how they can potentially put money back in your pocket.

3-1. Mortgage Interest Deduction

For many individuals and families, homeownership is a cherished milestone. The mortgage interest deduction acknowledges the financial commitment of owning a home and offers a way to alleviate some of the associated costs. Put simply, this deduction enables you to subtract the interest paid on your mortgage from your taxable income. Particularly beneficial in the early years of your loan when interest payments are at their peak, this deduction can make a noticeable difference in your tax bill.

When purchasing a home, you can capitalize on deductions related to property ownership. Mortgage interest and property taxes are deductible expenses listed on Schedule A. The tax reform lowered the mortgage debt limit for interest deductions to $750,000 for primary and second homes, down from $1 million. Additionally, property tax deductions are now capped at a maximum of $10,000 annually.

Trading Consumer Debt for Mortgage Debt. Refinancing your mortgage or taking out a home equity loan can help you consolidate high-interest consumer debt into lower-interest mortgage debt. This strategy not only reduces interest costs but also offers potential tax deductions on mortgage interest payments. However, this approach requires caution, as it can lead to increased mortgage debt and financial challenges if not managed wisely.

3-2. Medical Expenses Deduction

Healthcare expenses are an inescapable reality for most people, and they can accumulate swiftly. The medical expenses deduction steps in to provide relief by allowing you to deduct qualified medical costs that exceed a certain percentage of your adjusted gross income (AGI). While it’s not a catch-all solution for all medical expenses, it can certainly offer financial reprieve to those who have encountered significant healthcare costs throughout the year.

The Internal Revenue Service (IRS) defines medical expenses in tax law as expenditures related to the diagnosis, treatment, prevention, or mitigation of diseases and treatments affecting bodily functions or parts.

This description encompasses various expenses such as health insurance premiums (unless they’re already deducted from your pre-tax earnings), expenses incurred for doctors, dentists, hospital stays, diagnostic tests, prescribed medications, and medical equipment. Nevertheless, the IRS extends its allowance to cover a broader range of costs that might not neatly fall into these mentioned categories.

In essence, if you’ve faced significant medical expenses that your insurance didn’t cover, you might be eligible to claim them as deductions on your tax return. This includes a spectrum of expenses like health insurance premiums, stays at hospitals, medical appointments with doctors, and the costs of prescriptions. It’s important not to overlook other qualifying expenses that people often miss, such as unconventional treatments like acupuncture, medical care for newborns, accommodation expenses during medical visits, and special dietary requirements.

3-3. State and Local Taxes (SALT) Deduction

Residents of states with income taxes often encounter the state and local taxes (SALT) deduction as a valuable opportunity to reduce their taxable income. This deduction permits you to deduct state and local income taxes or sales taxes, which can add up to substantial savings. However, recent changes in tax legislation have imposed limitations on the SALT deduction, impacting its scope and applicability.

Remembering Auto Registration Fees and State Insurance. Auto registration fees can be itemized as deductions, particularly the portion related to the value of your vehicle. State disability insurance fund payments can also be deducted as state and local income taxes. However, due to changes in tax laws, there’s now a $10,000 limit on state and local tax deductions combined with property tax payments.

3-4. Charitable Contributions Deduction

Generosity towards charitable causes not only benefits the community but also provides potential tax advantages. The charitable contributions deduction recognizes your philanthropic efforts by allowing you to deduct donations made to qualified charitable organizations. However, it’s important to maintain thorough records of your contributions to ensure that you can substantiate your claims and fully leverage this deduction. Per the IRS, you can generally deduct up to 60% of your adjusted gross income.

Contributions to charitable organizations are deductible if you itemize your deductions. Beyond cash donations, you can also deduct expenses incurred while working with charities. This includes transportation costs when volunteering and the fair market value of donated goods like clothing and household items. It’s important to maintain proper documentation, especially for contributions exceeding $250.

3-5. Education-Related Deductions

Education is a pathway to personal and professional growth, but it often comes with a financial burden. The tax code offers relief through education-related deductions. These deductions encompass various facets, such as student loan interest deductions and deductions for qualified education expenses like tuition and fees. As the cost of education continues to rise, these deductions can offer substantial relief for students and their families.

3-5-1. Student Loan Interest Deduction

The Student Loan Interest Deduction is a beneficial provision in federal income tax that allows borrowers to subtract up to $2,500 from their taxable income. This deduction applies to the interest paid on qualified student loans and is designed to aid in managing the costs of higher education expenses.

In the realm of educational tax benefits, this deduction is just one of the many available to both students and their parents. However, meeting specific eligibility criteria is necessary to access this deduction. Furthermore, there’s a gradual reduction in the student loan interest deduction based on your filing status and income level.

3-5-2. American Opportunity Tax Credit (AOTC)

Another valuable option is the American Opportunity Tax Credit (AOTC), which aims to alleviate the financial strain of higher education. It offers taxpayers credit for qualified expenses incurred during a student’s first four years at a post-secondary institution. The credit amount is capped at $2,500 annually per student. Essentially, you receive a 100% credit on the initial $2,000 of expenses and 25% on the subsequent $2,000 for that student.

3-5-3. Lifetime Learning Credit (LLC)

Moreover, there’s the Lifetime Learning Credit (LLC), extending support to students pursuing diverse educational paths. This credit allows a maximum tax credit of $2,000 per tax return for qualified tuition and related expenses. Whether you’re enrolled in an undergraduate, graduate, or professional program, this credit covers the costs of eligible courses. An interesting aspect of the LLC is that there’s no limit on the number of years you can claim this credit, which provides valuable ongoing support for your educational journey.

Understanding these common personal tax deductions empowers you to make informed financial decisions and strategically position yourself to take advantage of the tax benefits available to you. By leveraging these deductions effectively, you not only reduce your tax liability but also gain greater control over your financial well-being. Remember, the tax code is designed to reward responsible financial behavior, and these deductions exemplify that intention.

4. Work-Related Deductions

In the realm of personal tax deductions, work-related expenses are a realm of opportunity that can have a substantial impact on your overall tax liability. These deductions are particularly relevant for individuals who incur costs directly related to their employment. If you’re self-employed, understanding work-related deductions can translate into meaningful savings. Let’s delve into the intricacies of these deductions and explore how they can work in your favor.

4-1. Home Office Deduction

The modern workforce has evolved to include remote work scenarios, and the home office deduction recognizes the expenses associated with working from home. If you use a portion of your home exclusively for work purposes, you might be eligible for this deduction. It allows you to deduct a percentage of your home-related expenses, such as rent or mortgage interest, utilities, and even internet costs. This deduction acknowledges the extra financial burden that working from home can entail.

Here’s how it operates: Start by figuring out the percentage of your home’s total square footage that’s exclusively and regularly dedicated to business-related tasks. This becomes your deductible portion. For instance, if your home office constitutes 10% of your entire living space, then 10% of your housing expenses for the year could be eligible for deduction. It’s important to note that only expenses directly associated with the part of your home you’re using for business purposes are usually fully deductible. For instance, if you fix a window that’s in your designated home office area, that cost is generally deductible[1].

In exploring your options, you might consider the simplified method. This approach allows you to deduct $5 per square foot of your home used for business, up to 300 square feet, which is roughly equivalent to a 17-by-17-foot space. This alternative has the advantage of reducing the paperwork you need to maintain, but keep in mind that it might result in a slightly lower deduction. It’s a good idea to calculate your deduction both ways before you finalize your tax filing.

4-2. Business-Related Travel Expenses Deduction

For individuals whose jobs necessitate travel, business-related travel expenses can be a significant part of their financial landscape. The IRS acknowledges this reality by permitting a deduction for eligible travel costs. From airfare and accommodations to meals and transportation, these expenses can accumulate quickly. By leveraging this deduction, you can offset some of the financial strain that business travel can impose.

The scope of what’s deductible includes flights, hotel stays, taxi fares, and food expenses. The crucial caveat here is that these expenses must be genuinely tied to your business activities to qualify.

Here’s the mechanism at play: Travel expenses for yourself, your spouse, or family members typically don’t qualify for deductions, unless those individuals are also your employees. As of 2023, you have the opportunity to deduct 50% of the meal cost, provided the meal was related to your business, wasn’t overly extravagant, you or an employee were present at the meal, the meal benefited a business contact, and it didn’t include entertainment charges. It’s noteworthy that during 2021 and 2022, this deduction was temporarily boosted to 100% due to pandemic-related measures.

As an alternative approach, consider using the standard daily meal allowance instead of tracking every individual meal’s actual cost. This method involves deducting a fixed amount for meals, eliminating the need for extensive receipt collection. However, it’s wise to retain your receipts anyway, as they could serve as proof for your deduction, especially in case of an audit. The U.S. General Services Administration establishes the rate for the standard meal allowance, offering a streamlined and practical way to handle meal deductions.

4-3. Self-Employed Retirement Contributions Deduction

Self-employed individuals have unique financial considerations, including planning for their retirement. The self-employed retirement contributions deduction addresses this concern by allowing you to deduct contributions made to retirement plans designed for the self-employed, such as SEP-IRAs and Solo 401(k)s. These contributions not only secure your future but also provide immediate tax benefits by lowering your taxable income.

In terms of the 2023 tax year, you could potentially contribute up to $22,500 in deferred salary. If you’re aged 50 or above, you’re eligible for catch-up contributions amounting to $7,500, allowing for a total contribution of $30,000. Furthermore, you have the opportunity to add another 25% of your net self-employment earnings after accounting for half of the self-employment tax and your own contributions.

Should you opt for a self-employed 401(k), bear in mind that the maximum combined contributions for both employee and employer categories can’t exceed $61,000 in 2022 and $66,000 in 2023. This doesn’t include catch-up contributions, which are set at $7,500 (up from $6,500 in 2022) for both years. It’s important to note that contribution limits can vary based on the type of retirement plan, and the IRS regularly updates these limits.

Of course, a critical consideration is that you can’t contribute more than you earn. This deduction becomes truly advantageous when your business generates sufficient profits to take full advantage of this valuable benefit.

Work-related deductions are a testament to the tax code’s recognition of the costs individuals often incur to maintain gainful employment. They serve as a mechanism to level the playing field and provide relief to those who invest time, effort, and resources into their work. By capitalizing on these deductions, you can navigate the financial challenges of work more effectively while positioning yourself for a brighter financial future.

4-4. Common Mistakes of Self-Employed Individuals

Being aware of common mistakes can help self-employed individuals navigate tax complexities:

- Seeking Professional Help: Collaborating with tax professionals ensures you maximize deductions and comply with tax regulations.

- Administrative Tax Errors: Timely and accurate filing of taxes, including estimated payments, is crucial to avoid penalties.

- Documenting Expenses: Properly recording expenses, even cash transactions, prevents issues during audits.

- Funding Retirement Plans: Take advantage of retirement savings options for both tax benefits and financial security.

- Using Numbers for Business Management: Regularly track financial data to manage your business effectively.

- Paying Family Help: Compensating family members for business-related work can offer tax benefits and income distribution.

Incorporating these strategies and avoiding common pitfalls can lead to increased deductions, reduced tax liability, and improved financial management. For more guidance on taxes and financial strategies, consult tax advisors or financial professionals.

5. Investment-Related Deductions

5-1. Investment Interest Expense Deduction

Investors take note. The interest paid on investment-related loans might be deductible. However, ensure you understand the conditions and requirements to fully leverage this deduction.

5-2. Capital Losses Deduction

In the world of investments, losses are par for the course. But did you know you can leverage these losses for tax benefits? The capital losses deduction allows you to offset gains and potentially reduce your tax liability.

5-3. Rental Property Deductions

Owning rental property comes with its own set of expenses, but the good news is that many of them can be deducted. From property management fees to maintenance costs, these deductions can have a meaningful impact on your tax situation.

6. Record-Keeping and Documentation

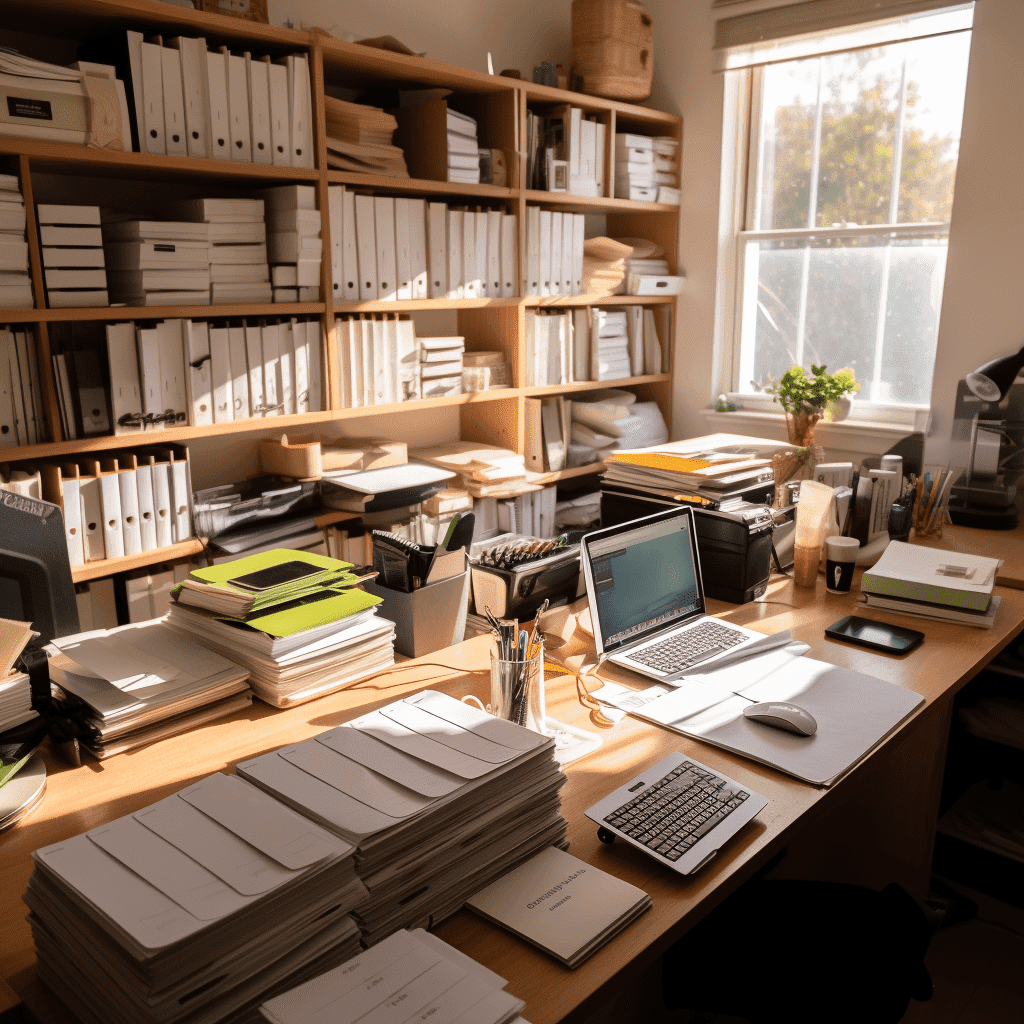

When it comes to maximizing your personal tax deductions, meticulous record-keeping and documentation play a pivotal role. The significance of maintaining organized records cannot be overstated, as they serve as the backbone of substantiating your claims and ensuring compliance with tax regulations. Let’s delve into the intricacies of record-keeping and the types of documentation you need to navigate the world of tax deductions successfully.

6-1. Importance of Accurate Record-Keeping

Accurate record-keeping is the cornerstone of a successful tax deduction strategy. Whether you’re claiming deductions for medical expenses, charitable contributions, or business-related expenses, having a detailed record of your financial transactions is essential. Not only does it provide clarity and transparency, but it also safeguards you in case of an audit. The IRS expects taxpayers to support their claims with documentation, and accurate records can make the process smoother and more efficient.

6-2. Types of Documentation Needed

Different deductions require different types of documentation to substantiate your claims effectively. For instance, if you’re claiming a deduction for charitable contributions, you should retain receipts from the charitable organization that detail your donations. Similarly, if you’re deducting medical expenses, keep records of bills, prescriptions, and healthcare-related costs. For business-related deductions, maintain a log of expenses, invoices, and receipts. By categorizing and organizing your records, you create a reliable paper trail that supports your deductions.

6-3. Leveraging Technology for Documentation

In today’s digital age, technology can be a powerful ally in your quest for accurate record-keeping. Utilize apps, software, and digital platforms to streamline the process of tracking and organizing your expenses. Digital copies of receipts and invoices are just as valid as physical ones, provided they contain all the necessary information. With digital tools, you can create a comprehensive and easily accessible archive that simplifies the task of compiling documentation during tax season.

Organizing Your Deductions

Efficiently organizing your deductions is essential to ensure you capture all eligible expenses. You can adopt different methods based on your financial situation:

- Folder or Shoebox Method: This simple approach is suitable for those with uncomplicated finances. Label a folder or shoebox with the tax year and keep all relevant documents, such as tax summary statements and receipts, in it. This method is particularly helpful for individuals who receive important tax documents in January and February.

- Accordion-Type File Method: For a more organized approach, create individual folders for various expense categories throughout the year. This method is crucial for self-employed individuals who need to track business expenditures. Since no one will provide a summary of office expenditures, maintaining your records is essential.

- Software Method: Utilize software programs to organize your tax information and save time during tax preparation. Such programs can streamline the process and help you stay on top of your financial records.

6-4. The Audit-Ready Advantage

Beyond facilitating your deduction claims, thorough record-keeping positions you for a potential audit. While audits are relatively rare, they can happen, and being audit-ready can make the experience less stressful. Having well-organized records demonstrates your commitment to compliance and honesty. It also gives you the confidence to stand behind your claims, knowing that you have the necessary evidence to support them.

Record-keeping is not merely a bureaucratic requirement; it’s a strategic practice that empowers you to optimize your personal tax deductions. By investing time and effort into maintaining accurate records and organizing your documentation, you lay the groundwork for financial success. Remember, a solid record-keeping system is your ally in navigating the complex world of tax deductions while ensuring that you’re taking full advantage of the benefits available to you.

7. Shifting or Bunching Deductions

Analyzing your itemized deductions and comparing them to the standard deduction is a smart strategy. If your itemized deductions fall short of the standard deduction, you should opt for the standard deduction. However, if you expect higher deductions in certain years, consider shifting or bunching deductible expenses to maximize tax benefits. For instance, if you plan to purchase a home next year and expect to have significant mortgage interest and property tax deductions, you can time your charitable contributions to align with your higher deduction year.

8. Tax Planning and Optimization

Strategic tax planning and optimization are key components of a successful financial strategy. The art of minimizing your tax liability while maximizing your personal tax deductions requires careful consideration, proactive decision-making, and a deep understanding of the tax code. Let’s delve into the world of tax planning and explore strategies to optimize your deductions effectively.

8-1. Strategies for Maximizing Deductions

To make the most of your personal tax deductions, strategic planning throughout the year is essential. Timing is a critical factor when it comes to deductions. For example, if you anticipate that your medical expenses will exceed the threshold for deductibility, consider scheduling elective procedures or treatments within the same tax year. Similarly, contributing to retirement plans before the year’s end can lower your taxable income and increase your potential deduction amount. By aligning your financial actions with the tax calendar, you position yourself to capitalize on deductions.

8-2. Consulting a Tax Professional

While navigating deductions on your own is possible, seeking guidance from a tax professional can yield significant benefits. Tax laws are complex and subject to change, and a tax expert can help you navigate the nuances and intricacies. They can offer tailored advice based on your financial situation, ensuring that you’re leveraging all available deductions while remaining compliant with tax regulations. A tax professional can also provide insights into lesser-known deductions that you might overlook.

8-3. Long-Term Tax Strategies

Effective tax planning involves considering not only the current year but also the long term. This includes evaluating the most tax-efficient investment strategies, retirement planning, and estate planning. Certain investments, such as tax-advantaged retirement accounts, can provide both immediate deductions and long-term tax benefits. By aligning your financial goals with tax-efficient strategies, you create a comprehensive plan that minimizes your tax burden while building wealth for the future.

8-4. Balancing Act: Itemized vs. Standard Deductions

Choosing between itemized and standard deductions requires careful consideration. While itemizing deductions can potentially lead to greater savings, it requires meticulous record-keeping and documentation. On the other hand, the standard deduction offers simplicity and ease of use. To determine the most advantageous approach, compare the total value of your potential itemized deductions against the standard deduction for your filing status. Remember, tax laws change, and what might have been the best choice one year could differ in subsequent years.

8-5. The Bottom Line

Tax planning and optimization are not tasks confined to tax season alone. They are ongoing processes that require proactive thinking, strategic decision-making, and a thorough understanding of your financial landscape. By strategically aligning your financial actions with the tax code, seeking professional guidance when needed, and making informed choices about deductions, you can substantially reduce your tax liability while safeguarding your financial future. Remember, every dollar saved in taxes is a dollar that can be directed toward your financial goals. By mastering the art of tax planning, you unlock a powerful tool for achieving financial success.

9. Conclusion

As we conclude our exploration of personal tax deductions, remember that this is your opportunity to make the tax code work for you. Each deduction you claim translates into more money in your pocket. By delving into deductions that align with your circumstances, maintaining meticulous records, and seeking expert advice when needed, you’re well-equipped to navigate the realm of personal tax deductions and seize the financial benefits they offer.

10. FAQs

10-1. What are personal tax deductions, and how do they work?

Personal tax deductions are expenses that individuals can subtract from their taxable income to reduce the amount of income subject to taxation. These deductions can include items like medical expenses, mortgage interest, and charitable contributions. By lowering your taxable income, you can potentially reduce your overall tax liability.

10-2. Is there a limit to the number of personal tax deductions I can claim?

There isn’t a specific limit on the number of deductions you can claim, but there are limits on the amount you can deduct for certain expenses. For instance, the deduction for state and local taxes (SALT) is capped at $10,000 annually, and there are income limits for certain deductions like student loan interest.

10-3. How do I decide between taking the standard deduction and itemizing my deductions?

The decision between the standard deduction and itemizing depends on the total amount of your deductible expenses. If your itemized deductions, like mortgage interest, medical expenses, and charitable donations, exceed the standard deduction amount for your filing status, it’s usually more beneficial to itemize. Otherwise, you should take the standard deduction.

10-4. Can I claim personal tax deductions if I work from home?

Yes, if you use a portion of your home exclusively for work purposes, you may be eligible for the home office deduction. This deduction allows you to deduct a percentage of your home-related expenses, such as rent, mortgage interest, utilities, and internet costs, that are related to your work.

10-5. What should I do if I’m unsure about which deductions I qualify for?

If you’re unsure about which deductions you qualify for or how to maximize your deductions, it’s a good idea to consult a tax professional or financial advisor. They can help you navigate the complexities of the tax code, identify potential deductions, and ensure you’re making the most of available tax-saving opportunities.

11. Case Study-Mia’s Journey to Financial Empowerment through Personal Tax Deductions

Meet Mia, a 37-year-old female architect with a passion for designing sustainable structures. Her dedication to her profession is evident in every project she takes on. Married and a mother of two, Mia’s life revolves around her family and her work.

Her income is stable and substantial, thanks to her successful architectural practice. However, Mia’s financial landscape was about to undergo a significant transformation.

11-1. Character Background Introduction

Mia’s annual income as an architect is $120,000. Her family budget includes mortgage payments of $18,000, property taxes of $6,000, and annual charitable donations of $2,000. Her monthly expenses amount to $4,000, including utilities, groceries, and childcare.

Here’s a summary of Mia’s financial situation:

| Income | Annual Amount |

|---|---|

| Architect Salary | $120,000 |

| Expenses | Annual Amount |

|---|---|

| Mortgage Payments | $18,000 |

| Property Taxes | $6,000 |

| Charitable Donations | $2,000 |

| Expenses include utilities, groceries, and childcare. | $4,000 |

11-2. Current Situation

It was a sunny afternoon when Mia received a notice from the tax authorities about an impending audit. The news struck her with a mix of worry and apprehension. She realized that despite her meticulous record-keeping, she might have overlooked certain deductions that could have an impact on her tax liability.

11-3. Conflict Arises

The audit revealed that Mia had missed out on several personal tax deductions that could have saved her a substantial amount of money. Emotionally, she felt a sense of frustration and regret, realizing that her lack of awareness had cost her financially. She recognized the need for change and decided to take action to optimize her tax situation.

11-4. Problem Analysis

The core problem was Mia’s insufficient understanding of the tax code’s intricacies. Her failure to claim deductions like home office expenses, mortgage interest, and charitable contributions led to a higher tax burden. If left unresolved, this could lead to missed opportunities to save money and reduce her overall tax liability.

11-5. Finding a Solution

To address the issue, Mia sought professional advice from a tax consultant. She learned about various personal tax deductions available to her and understood the importance of meticulous record-keeping and documentation. She chose to take advantage of deductions like the home office deduction, mortgage interest deduction, and charitable contributions deduction.

11-6. Implementation

Mia followed a structured approach. She organized her financial records, categorizing and tracking every expense that could be eligible for deductions. She kept detailed records of her home office expenses, tracked charitable donations, and meticulously documented her mortgage interest payments.

11-7. Effects After Execution

After implementing the solution, Mia started to see positive results within the first tax year. Her taxable income decreased significantly due to the deductions she claimed. Her tax payment amount was reduced by $5,500, and she realized a 27.5% reduction in her overall tax liability.

Here’s a summary of the results:

| Before | After | |

|---|---|---|

| Income | $120,000 | $120,000 |

| -)Standard Deduction | $13,850 | |

| -)Itemizing Deductions | $29,200 (=18,000+6,000+(2,000*0.6)+4,000) | |

| =) | $106,150 | $90,800 |

| *)Tax Rate | 24% | 22% |

| =)Tax Payment Amount | $25,476 | $19,976 |

11-8. After Overcoming the Challenge

Looking back, Mia felt a sense of empowerment and control over her finances. The biggest feeling she experienced was relief—knowing that she had taken the necessary steps to optimize her personal tax deductions and secure a brighter financial future for her family.

11-9. Advice to Others

Mia’s advice to others facing similar challenges is clear: “Don’t underestimate the power of personal tax deductions. Take the time to educate yourself about the deductions available to you and maintain thorough records. Seek professional advice if needed. Your proactive efforts can lead to significant savings and financial security.”

11-10. In conclusion

Mia’s journey from uncertainty to financial empowerment highlights the impact of personal tax deductions. Her story, backed by data and real financial details, serves as a testament to the transformative potential of knowledge and strategic decision-making in navigating the complex landscape of taxes.

12. Checklist

| Questions | Your Reflections | Suggested Improvement Strategies | Improvement Plans | Implementation Results | Review and Adjust |

| Are you aware of the potential impact of personal tax deductions on your financial situation? | Explore resources to understand the various deductions available and their benefits. | ||||

| Do you have a clear understanding of the difference between standard and itemized deductions? | Research the standard deduction thresholds and itemized deductions to make an informed choice. | ||||

| Are you keeping thorough records of your expenses and financial transactions? | Establish a system for organized record-keeping, whether physical or digital. | ||||

| Have you identified specific deductions that you might be missing out on? | Consult with a tax professional to identify potential deductions you may have overlooked. | ||||

| Are you maximizing deductions related to homeownership, medical expenses, and charitable contributions? | Review your expenses in these categories and ensure you’re claiming all eligible deductions. | ||||

| Have you explored work-related deductions, such as the home office deduction and business travel expenses? | Research work-related deductions and track relevant expenses for potential savings. | ||||

| Are you actively engaged in tax planning and optimization strategies? | Consult with a tax expert and implement strategies that align with your financial goals. |