The world of retirement planning can be complex, but a 401k plan is a valuable tool that can help you secure your financial future. In this comprehensive guide, we’ll delve into the ins and outs of 401k plans, ensuring you have a clear understanding of how they work and how to make the most of them.

Reading time: 22 minutes

Outline

1. Understanding the Basics of a 401k

1-1. What Is a 401k Plan?

A 401k plan is a financial vehicle that plays a pivotal role in your journey toward a secure retirement. This retirement savings account, often referred to simply as a 401k, is made available to employees by their employers. The core principle behind it is to empower you to save and invest wisely for your golden years.

A 401k functions by allowing you to divert a portion of your hard-earned income into this dedicated account before taxes are deducted. This pre-tax contribution is a key feature, as it reduces your taxable income, putting more of your money to work for your future. Think of it as a strategic financial move that not only sets money aside but also lowers your immediate tax burden.

Once your money finds its way into your 401k, you’re faced with a world of investment opportunities. This account serves as a gateway to the financial markets, granting you the ability to invest in a diverse array of assets, such as stocks, bonds, and mutual funds. These investments can potentially grow over time, giving your retirement savings a significant boost.

1-2. Who Can Contribute to a 401k?

Now, let’s dive into the eligibility aspect of 401k plans. These plans are predominantly tailored for full-time employees, aiming to provide a long-term savings strategy. However, it’s important to note that specific eligibility criteria can vary from one employer to another.

In essence, if you’re a full-time employee in an organization that offers a 401k plan, you’re likely eligible to participate. But don’t take this for granted – always check with your employer to ensure you meet their specific requirements.

The beauty of a 401k lies in its inclusivity. It doesn’t discriminate based on age, and it’s not restricted to only those who are nearing retirement. Whether you’re fresh out of college or well into your career, taking advantage of a 401k can be a smart financial move.

1-3. Different Types of 401k Plans

While the core concept of a 401k remains consistent, there are variations worth exploring. Two primary types are traditional 401ks and Roth 401ks. Understanding these differences is crucial as they can impact your retirement savings strategy.

- Traditional 401ks: With a traditional 401k, your contributions are made with pre-tax dollars, lowering your current tax bill. This can be particularly advantageous if you’re in a higher tax bracket now and anticipate being in a lower one during retirement. Earnings grow tax-deferred until you withdraw them in retirement, at which point they are taxed as regular income.

- Roth 401ks: In contrast, Roth 401ks involve contributions made with after-tax dollars. This means you won’t get an immediate tax break, but the big perk is that your withdrawals in retirement are typically tax-free. This can be a fantastic choice if you expect your tax rate to be higher in retirement or if you simply prefer the idea of tax-free income down the road.

Choosing between these options requires careful consideration of your current financial situation and future goals. It’s a decision that should align with your unique circumstances.

In sum, a 401k is a financial tool that empowers you to save for retirement by allowing pre-tax contributions, offering a broad spectrum of investment choices, and catering to a wide range of employees. Understanding the basics of a 401k, its eligibility criteria, and the variations within this retirement plan can set you on the path to a more financially secure future.

2. The Benefits of a 401k

A 401k plan offers a multitude of benefits, making it a cornerstone of many individuals’ retirement strategies. In this section, we will delve deeper into the advantages of a 401k, focusing on its tax advantages, employer matching contributions, and the array of investment options it provides.

2-1. Tax Advantages of a 401k

Tax advantages are at the core of what makes a 401k a powerful retirement savings tool. Contributions to your 401k are made with pre-tax dollars, which means the money you put into your account is deducted from your income before taxes are calculated. This simple yet impactful feature can significantly reduce your annual tax bill.

Here’s how it works: If you earn $50,000 annually and contribute $5,000 to your 401k, you’ll only be taxed on $45,000 of your income for that year. This not only lowers your immediate tax burden but also allows your contributions to grow tax-deferred until retirement. As a result, your savings have the potential to compound over the years, increasing the overall value of your retirement nest egg.

2-2. Employer Matching Contributions

Another substantial benefit of many 401k plans is employer matching contributions. This is essentially free money from your employer to help you save for retirement. Here’s how it typically works:

Your employer offers to match a percentage of your contributions, often up to a certain limit. For example, if your employer matches 50% of your contributions up to 6% of your salary, and you earn $60,000 a year, your employer will contribute an additional $1,800 to your 401k if you contribute at least $3,600 (6% of your salary).

Maximizing these employer contributions is like receiving an instant return on your investment. It’s a valuable incentive designed to encourage employees to save for retirement. Be sure to understand your employer’s matching policy and take full advantage of it to boost your retirement savings.

2-3. Investment Options in a 401k

One of the most appealing aspects of a 401k is the diverse range of investment options it offers. Unlike some retirement accounts with limited choices, a 401k typically provides access to various financial instruments such as stocks, bonds, and mutual funds.

Here’s a closer look at these investment vehicles:

- Stocks: Investing in individual stocks within your 401k allows you to potentially benefit from the growth of specific companies. It can offer higher returns but also comes with increased risk due to market fluctuations.

- Bonds: Bonds are generally considered less risky than stocks and can provide a stable source of income in your portfolio. They are often used to balance risk in a 401k.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They are a convenient way to achieve diversification within your 401k.

- Target-Date Funds: These funds are designed to align with your retirement date. They automatically adjust their asset allocation, becoming more conservative as you approach retirement.

- Index Funds: These passively managed funds aim to replicate the performance of a specific market index, offering low expense ratios.

The key to making the most of your 401k investment options is to diversify your portfolio to manage risk and align with your financial goals and risk tolerance. It’s wise to periodically review and adjust your investments as your circumstances change.

In conclusion, a 401k is a versatile retirement savings tool that offers tax advantages, employer-matching contributions, and a diverse array of investment options. Understanding and leveraging these benefits can put you on the path to a more financially secure retirement.

3. How to Set Up and Manage Your 401k

Managing your 401k effectively is crucial to securing your financial future. In this section, we’ll dive deeper into the key steps of setting up and managing your 401k, covering enrolling in a 401k plan, choosing your investments, and monitoring your 401k portfolio.

3-1. Enrolling in a 401k Plan

Enrolling in a 401k plan is often the first step towards building a robust retirement fund. Fortunately, the process is typically straightforward, guided by your employer’s HR department. Here’s how it generally works:

- Eligibility Check: Ensure you meet your employer’s eligibility criteria for participating in their 401k plan. This usually involves factors like employment status (full-time or part-time) and the length of your employment.

- Plan Selection: If you meet the eligibility requirements, you’ll need to select a 401k plan from the options your employer offers. Plans may vary in terms of the investment options they provide.

- Contribution Amount: Decide how much of your pre-tax income you want to contribute to your 401k. Many experts recommend contributing at least enough to take full advantage of any employer-matching contributions, as this is essentially free money.

- Complete Enrollment Forms: Fill out the necessary enrollment forms provided by your employer. These forms will specify your contribution amount and how your contributions should be invested.

- Beneficiary Designation: Designate beneficiaries who will receive your 401k assets in case of your passing. This is an essential step in estate planning.

- Review Plan Details: Take the time to review the plan’s details, including investment options, fees, and any vesting schedules that may apply to employer contributions.

3-2. Choosing Your Investments

Once you’re enrolled in your 401k plan, it’s time to make strategic decisions about how your money will be invested. Your investment choices will have a significant impact on the growth of your retirement savings. Here’s what you should consider:

- Risk Tolerance: Assess your risk tolerance by considering how comfortable you are with the potential ups and downs of the financial markets. Your risk tolerance should align with your age, financial goals, and overall comfort level.

- Diversification: Building a diversified portfolio is key to managing risk. Diversification means spreading your investments across different asset classes, such as stocks, bonds, and cash equivalents. This can help balance your portfolio and reduce exposure to individual market fluctuations.

- Asset Allocation: Determine the ideal mix of assets in your portfolio. Younger investors with a longer time horizon may lean towards a higher allocation of stocks, while those closer to retirement may opt for a more conservative allocation.

- Investment Selection: Choose specific investments within your 401k’s available options. Look for funds or securities that align with your risk tolerance and long-term goals. Many 401ks offer target-date funds that automatically adjust your asset allocation based on your projected retirement date.

3-3. Monitoring Your 401k Portfolio

Setting up your 401k and selecting investments is just the beginning. To maximize its potential, you must regularly monitor and adjust your portfolio. Here’s how to do it effectively:

- Regular Check-Ins: Schedule regular check-ins to review your 401k portfolio. This could be quarterly, semi-annually, or annually, depending on your preference and comfort level.

- Rebalancing: Rebalance your portfolio as needed to maintain your desired asset allocation. Market fluctuations may cause your portfolio to drift from your original allocation, so rebalancing helps realign it.

- Life Changes: Whenever you experience significant life changes, such as a job change, marriage, or the birth of a child, review and adjust your 401k contributions and investment strategy accordingly.

- Stay Informed: Keep yourself informed about changes in the financial markets, tax laws, and investment options. Being knowledgeable empowers you to make informed decisions.

In conclusion, setting up and managing your 401k involves enrolling in your employer’s plan, choosing the right investments, and actively monitoring your portfolio over time. With a well-structured approach, you can ensure that your 401k works effectively to secure your financial future.

4. 401k Withdrawals and Distributions

As your retirement approaches, understanding 401k withdrawals and distributions becomes vital to ensuring your financial security during your golden years. In this section, we’ll delve deeper into the intricacies of early withdrawal penalties, required minimum distributions (RMDs), and strategies for retirement withdrawals.

4-1. Early Withdrawal Penalties

A 401k is primarily designed to be a long-term savings vehicle for retirement. However, life can throw unexpected financial curveballs, tempting you to tap into your 401k before reaching retirement age. While it’s possible to access your funds early, doing so can come with significant financial consequences.

Early withdrawal penalties serve as a deterrent to encourage individuals to use their 401k for its intended purpose—retirement. If you withdraw funds before the age of 59½, you can generally expect:

- Income Tax: You’ll owe regular income tax on the amount withdrawn since 401k contributions are made with pre-tax dollars.

- Additional Penalty: In addition to income tax, you’ll typically face an additional penalty of 10% on the early withdrawal amount.

While there are exceptions, such as financial hardship withdrawals or specific qualified expenses, it’s crucial to weigh the pros and cons carefully before accessing your 401k early. Consulting with a financial advisor can help you make informed decisions.

4-2. Required Minimum Distributions (RMDs)

Once you reach a certain age, typically 73 years old (Anyone who turns 73 on or after Jan. 1, 2023, must begin taking these withdrawals beginning April 1. Individuals who are 72 on or before Dec. 31, 2022. 70½ if you reached this age before January 1, 2020), the IRS mandates that you begin taking annual withdrawals from your 401k. These are known as Required Minimum Distributions (RMDs). The purpose of RMDs is to ensure that tax-deferred retirement savings are gradually distributed and taxed.

Key points to understand about RMDs:

- Age Requirement: RMDs usually start at age 73. If you fail to take RMDs, you may face substantial tax penalties.

- Calculation: RMDs are calculated based on your account balance and life expectancy. The IRS provides tables to determine the specific amount you must withdraw each year.

- Tax Implications: RMDs are typically taxed as ordinary income. Proper planning can help minimize the tax impact.

- Exceptions: Roth 401k accounts do not require RMDs during the account holder’s lifetime, making them an attractive option for those looking to minimize mandatory withdrawals.

4-3. Strategies for Retirement Withdrawals

Planning how and when to withdraw funds from your 401k during retirement is crucial for financial stability. Here are some strategies to consider:

- Delaying Social Security: Delaying the start of your Social Security benefits can increase your monthly payments. Using your 401k to bridge the income gap can be a smart strategy.

- Tax-Efficient Withdrawals: Strategically withdrawing from taxable, tax-deferred, and tax-free accounts can optimize your tax situation. Consult with a tax advisor for guidance.

- Budgeting: Develop a realistic retirement budget to ensure your withdrawals align with your financial needs and goals.

- Consider Annuities: Annuities can provide a steady stream of income throughout retirement, supplementing your 401k withdrawals.

- Emergency Fund: Maintain an emergency fund to cover unexpected expenses, reducing the need to dip into your retirement savings prematurely.

- Long-Term Care Planning: Consider long-term care insurance to protect your retirement assets from the potentially devastating costs of healthcare in later years.

In conclusion, navigating 401k withdrawals and distributions requires careful planning and a thorough understanding of the penalties, RMDs, and effective withdrawal strategies. By making informed decisions and seeking professional guidance when needed, you can make your retirement savings last as long as possible and enjoy financial peace in your retirement years.

5. 401k vs. Other Retirement Accounts

When it comes to planning for retirement, you have several options at your disposal. In this section, we’ll explore the differences between a 401k and other retirement accounts, namely IRAs (Individual Retirement Accounts) and Roth IRAs. We’ll also discuss the pros and cons of a 401k and the potential benefits of combining multiple retirement accounts.

5-1. Comparing 401k to IRA and Roth IRA

IRAs and Roth IRAs are two popular alternatives to a 401k, each with its unique features. Let’s break down the key differences:

| Aspect | 401k | Traditional IRA | Roth IRA |

|---|---|---|---|

| Account Type | Employer-sponsored retirement account | Individual retirement account | Individual retirement account |

| Contribution Tax Treatment | Contributions made with pre-tax dollars | Contributions may be tax-deductible, depending on income and participation in employer-sponsored plans | Contributions are made with after-tax dollars |

| Employer Matching Contributions | Offers employer matching contributions in some cases | No employer match | No employer match |

| Taxation Upon Withdrawal | Taxed upon withdrawal in retirement | Taxed upon withdrawal in retirement | Tax-free withdrawals in retirement |

Let’s explore these differences in more detail:

- Account Type: A 401k is an employer-sponsored retirement account, while both Traditional IRA and Roth IRA are individual retirement accounts. The key distinction here is whether your employer sponsors the account.

- Contribution Tax Treatment: In a 401k, contributions are made with pre-tax dollars, meaning they reduce your taxable income in the year you make them. In a Traditional IRA, contributions may be tax-deductible depending on your income and participation in employer-sponsored plans. In contrast, Roth IRA contributions are made with after-tax dollars and are not tax-deductible.

- Employer Matching Contributions: 401k plans often offer employer matching contributions, which can significantly boost your retirement savings. Traditional and Roth IRAs do not have employer matching.

- Taxation Upon Withdrawal: The tax treatment upon withdrawal is a crucial difference. In a 401k, withdrawals in retirement are taxed as ordinary income. Similarly, Traditional IRA withdrawals are also taxed as ordinary income. However, Roth IRA withdrawals are tax-free in retirement, offering a distinct tax advantage.

- Which to Choose: If your employer offers a 401k with matching contributions, it’s often wise to start there to take advantage of the “free money.” If not, or if you want more control over your investments, consider an IRA or Roth IRA. Your choice should align with your financial goals and tax situation.

The choice between these retirement accounts depends on factors like your income, tax situation, employer offerings, and your preference for pre-tax or after-tax contributions. It’s essential to consider your individual circumstances and long-term financial goals when deciding which retirement account is best for you. Consulting with a financial advisor can also provide valuable guidance tailored to your specific needs.

5-2. Pros and Cons of a 401k

Understanding the strengths and weaknesses of a 401k can help you make an informed decision:

Pros:

- Employer Contributions: Many employers match your contributions, effectively doubling your savings.

- Tax Advantages: Contributions are made with pre-tax dollars, reducing your current tax bill.

- High Contribution Limits: 401ks allow for higher annual contributions compared to IRAs.

- Automatic Payroll Deductions: Easy and convenient contributions directly from your paycheck.

- Investment Options: A 401k typically offers a range of investment choices.

Cons:

- Limited Control: Your employer selects the plan’s investment options, limiting your control.

- Early Withdrawal Penalties: Withdrawing funds before age 59½ can result in penalties.

- Required Minimum Distributions: RMDs are mandatory, starting at age 73, potentially affecting your tax situation.

- Limited Investment Choices: While there are options, you might prefer more flexibility in investment selection.

5-3. Combining Multiple Retirement Accounts

For some, a diversified retirement strategy involves multiple accounts, such as a 401k, an IRA, and a Roth IRA. Combining these accounts can offer various benefits:

- Tax Diversification: Holding both pre-tax and after-tax retirement accounts can provide tax flexibility in retirement. You can choose where to withdraw funds to optimize your tax situation.

- Investment Control: IRAs and Roth IRAs often offer a broader range of investment options, giving you more control over your portfolio.

- Estate Planning: Diversifying your accounts can have implications for estate planning, allowing you to pass on assets more efficiently to heirs.

- RMD Management: Combining accounts may offer more flexibility in managing required minimum distributions (RMDs).

- Risk Mitigation: Spreading your retirement savings across various accounts can help mitigate risks associated with changes in tax laws, market volatility, or personal financial needs.

In conclusion, choosing between a 401k, an IRA, or a Roth IRA depends on your individual circumstances, goals, and tax situation. Understanding the nuances of each option and considering the potential benefits of combining multiple retirement accounts can help you make the right choices to secure a comfortable retirement.

6. Maximizing Your 401k for a Comfortable Retirement

Planning for a comfortable retirement requires a strategic approach to maximizing your 401k. In this section, we’ll delve into key strategies to ensure your 401k works effectively for your retirement goals, including setting savings goals, making regular contributions, and rebalancing your portfolio.

6-1. Setting Savings Goals

A crucial first step in making the most of your 401k is to define your retirement savings goals:

- Assess Your Retirement Lifestyle: Consider the kind of lifestyle you want during retirement. Will you travel frequently, downsize your home, or pursue expensive hobbies? Your goals will influence how much you need to save.

- Calculate Expenses: Estimate your anticipated expenses during retirement, including housing, healthcare, travel, and daily living costs. Don’t forget to account for inflation.

- Determine Your Retirement Age: Decide when you want to retire. The age at which you stop working can significantly impact how much you need to save.

- Consider Additional Income Sources: Assess other sources of retirement income, such as Social Security, pensions, or part-time work. Understanding your expected income can help you set more realistic savings goals.

- Consult a Financial Advisor: Seeking advice from a financial advisor can provide valuable insights into your retirement goals and help you develop a tailored savings plan.

6-2. Making Regular Contributions

Consistency is a cornerstone of building wealth with a 401k. Here’s how to make regular contributions work for you:

- Automate Contributions: Set up automatic contributions from your paycheck to your 401k. This “set it and forget it” approach ensures you consistently save for retirement.

- Increase Contributions Over Time: As your income grows or when you receive bonuses, consider increasing your 401k contributions. Many employers allow you to adjust your contribution percentage at any time.

- Take Advantage of Employer Matching: If your employer offers matching contributions, aim to contribute at least enough to maximize this benefit. It’s essentially free money added to your retirement savings.

- Catch-Up Contributions: Once you reach age 50, you’re eligible to make additional catch-up contributions to your 401k. Take advantage of this opportunity to accelerate your retirement savings. The catch-up contribution limit is $7,500 in 2023 on top of the annual $22,500 contribution limit.

- Regularly Review Your Contributions: Periodically assess your contributions to ensure they align with your savings goals and financial situation.

6-3. Rebalancing Your Portfolio

Maintaining a well-balanced and diversified 401k portfolio is essential for long-term success. Here’s how to ensure your investments align with your goals:

- Set an Allocation Strategy: Determine your ideal asset allocation, considering factors like your risk tolerance, retirement timeline, and financial objectives.

- Periodic Rebalancing: Regularly review your portfolio and rebalance it if necessary. Market fluctuations can cause your asset allocation to drift from your target.

- Consider Target-Date Funds: If you prefer a hands-off approach, target-date funds automatically adjust your asset allocation based on your projected retirement date.

- Stay Informed: Keep yourself informed about market trends, investment options, and changes in your financial situation that may warrant adjustments.

- Seek Professional Guidance: Consulting with a financial advisor can provide valuable insights into your investment strategy and ensure it aligns with your retirement goals.

In conclusion, maximizing your 401k for a comfortable retirement involves setting clear savings goals, making regular contributions, and maintaining a well-balanced portfolio through periodic rebalancing. By taking a proactive and strategic approach to your retirement savings, you can work towards achieving the financial security and comfort you desire in your golden years.

7. Conclusion: Securing Your Financial Future with a 401k

In conclusion, a 401k plan is a powerful tool for building a comfortable retirement. By understanding how 401k works and implementing smart strategies, you can take control of your financial future and enjoy peace of mind in your retirement years.

8. FAQs

8-1. How do 401k plans function as a retirement savings tool?

401k plans are retirement savings accounts offered by employers. They allow you to divert a portion of your pre-tax income into the account, which is then invested in various assets like stocks and bonds. This money grows tax-deferred until you reach retirement age.

8-2. Who is eligible for a 401k plan, and how does eligibility work?

Eligibility for a 401k plan can vary by employer, but they are generally available to full-time employees. However, specific eligibility criteria can differ, so it’s essential to check with your employer to see if you meet their requirements.

8-3. What are the key differences between traditional 401ks and Roth 401ks?

Traditional 401ks involve contributions with pre-tax dollars, while Roth 401ks use after-tax dollars. Withdrawals from traditional 401ks are taxed in retirement, while Roth 401k withdrawals are typically tax-free.

8-4. How do employer matching contributions in a 401k plan work?

Employer matching contributions are essentially free money. Employers may match a percentage of your contributions, up to a certain limit. It’s crucial to understand your employer’s matching policy and maximize this benefit to boost your retirement savings.

8-5. What strategies can I use to make the most of my 401k for a comfortable retirement?

To maximize your 401k, consider setting clear savings goals, making regular contributions, and periodically rebalancing your investment portfolio. It’s also essential to stay informed about market trends and tax laws that may affect your retirement planning.

9. Case Study

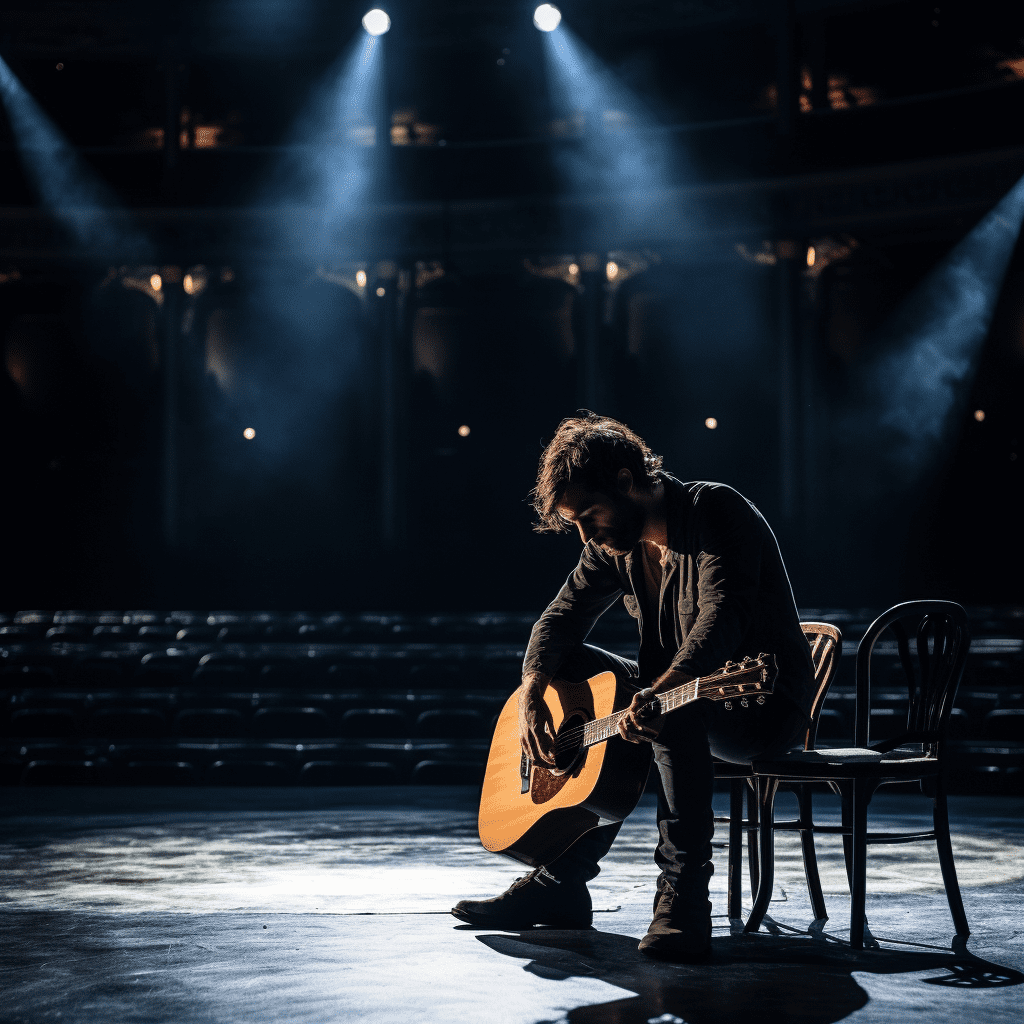

Meet William, a 27-year-old male musician working as an employee at a music company. His interests include playing the guitar and songwriting, and he’s currently single with no dependents.

William earns an annual income of $50,000, while his yearly expenses, including rent, groceries, utilities, and occasional indulgences in musical equipment, amount to $30,000. He possesses limited savings of $5,000, primarily in his guitar collection, but also carries a student loan debt of $10,000.

9-1. Current Situation

William works as a musician for a music company and earns a consistent income of $50,000 annually. He lives in a rented apartment, enjoys a fairly modest lifestyle, and manages his expenses, including rent, groceries, utilities, and occasional musical equipment purchases, which total $30,000 annually. He’s passionate about his music but has concerns about his financial future.

9-2. Conflict Occurs

William realizes he has been neglecting his financial planning and retirement savings. He understands the need to secure his financial future but is uncertain about where to start. He’s worried about his limited savings, student loan debt, and lack of investments.

9-3. Problem Analysis

The core problem for William is his lack of retirement savings and financial planning. He recognizes that without taking action, he may struggle financially in his later years, especially as an employee with a music company, where he needs to plan for retirement independently. Failing to address this issue could result in a less comfortable retirement and potential financial stress in the future.

9-4. Solution

William decides to educate himself on retirement planning and specifically on how 401k plans work. After researching, he understands the benefits of a 401k, such as pre-tax contributions and potential employer matching. He also assesses his financial situation more comprehensively:

- Budget: He creates a detailed budget to track his income and expenses more effectively.

- Investment Tools: William explores various investment tools available, including 401k plans and mutual funds.

- Expense Ratio: He analyzes the expense ratios associated with different investment options to minimize fees.

- Asset Allocation Ratio: William determines his ideal asset allocation based on his risk tolerance and retirement goals.

William decides to open a 401k account through his music company, which offers an employer match. He commits to making regular contributions of 10% of his salary, which amounts to $5,000 annually. He selects a diversified portfolio of low-cost index funds and aims for a balanced asset allocation to spread risk.

9-5. Effect After Execution

After implementing his plan, William immediately begins contributing to his 401k. He sets up automatic contributions, ensuring he saves consistently. It takes a few months for him to see significant growth in his account, but he notices the positive effect of tax-deferred growth on his savings. His portfolio’s average annual rate of return is around 7%, with a standard deviation of 10%, demonstrating steady growth with manageable risk.

9-6. In Conclusion

William’s decision to educate himself about 401k plans and take action to secure his financial future is a significant step forward. While he initially felt overwhelmed, he realized the importance of planning for retirement early. His story serves as a reminder that even employees in the music industry can benefit from retirement savings plans like a 401k. William now feels more confident about his financial future and encourages others in similar situations to take proactive steps toward securing their retirements.

10. Checklist

| Questions for Self-Reflection | Your Reflection | Recommended Improvement Strategies | Improvement Plan | Implementation Results | Review & Adjust |

| 1. Have I fully grasped the basics of how 401k plans work? | Ensure a comprehensive understanding by revisiting the article and seeking additional resources if needed. | ||||

| 2. Am I eligible for a 401k plan, and have I checked my eligibility with my employer? | Confirm eligibility and, if eligible, initiate enrollment if not already enrolled. | ||||

| 3. Have I considered the differences between traditional and Roth 401ks to align with my financial goals? | Evaluate my current financial situation to determine which option is more advantageous and make the necessary changes. | ||||

| 4. Am I taking full advantage of any employer matching contributions in my 401k plan? | Review my contributions and adjust to maximize employer matches if I’m not already doing so. | ||||

| 5. Have I set clear retirement savings goals and assessed my retirement lifestyle and expenses? | Reevaluate my goals and expenses to ensure alignment with my retirement plans. | ||||

| 6. Am I consistently making regular contributions to my 401k? | Establish automated contributions and consider increasing contributions as my income grows. | ||||

| 7. Do I periodically review and rebalance my 401k portfolio to ensure it aligns with my goals and risk tolerance? | Set up regular check-ins and rebalancing schedules, taking into account market changes and my evolving circumstances. |