Setting savings goals is the first step toward financial success. It’s like creating a roadmap to your dreams and aspirations. In this article, we’ll explore the art of prioritizing savings goals, making your financial journey smoother and more rewarding.

Outline

- Understanding Savings Goals

- Establishing Retirement Age Goals

- Tips for Saving for Goals

- Understanding Savings Goals by Age

- The Power of a Saving Target Calculator

- Short-Term versus Long-Term Savings Goals

- Developing Financial Goals

- The Importance of an Emergency Savings Goal

- Setting Realistic Savings Goals

- Savings Goals for Couples

- Making Savings Goals Fun: Ideas and Examples

- Conclusion

- FAQs

- Case Study

- Checklist

Reading time: 8 minutes

1. Understanding Savings Goals

Before we dive into prioritization, let’s understand what savings goals are all about. Savings goals are financial milestones that you aim to reach by saving money consistently. They come in various forms, be it short, medium, or long-term. The importance of having clear goals cannot be overstated. They provide motivation, and direction, and help cultivate good money habits.

2. Establishing Retirement Age Goals

Retirement is a significant life stage that requires careful planning. One of the primary savings goals is establishing retirement age goals. Determine when you want to retire and estimate the amount you’ll need to maintain a comfortable lifestyle. Starting early is the key to harnessing the power of compounding, giving your money more time to grow.

2-1. Retirement Goals and Retirement Saving Goals

Retirement goals encompass more than just setting a retirement age. You’ll need to consider how much money you’ll need to cover your expenses during your golden years. Aim to replace 70-80% of your pre-retirement income to ensure a stress-free retirement. Retirement saving goals involve putting money aside now to secure your future.

3. Tips for Saving for Goals

Effective saving requires discipline and consistency. Embrace budgeting to track your expenses and identify areas where you can cut back. Make use of saving goal apps that act as your personal financial coach, guiding you toward your targets. Small, regular contributions can make a significant difference over time.

4. Understanding Savings Goals by Age

Your life stage plays a crucial role in determining your savings goals. In your 20s, you might focus on saving for higher education or a down payment on a house. In your 30s, family expenses, children’s education, and retirement might take center stage. Tailor your savings goals to align with your current life priorities.

5. The Power of a Saving Target Calculator

A saving target calculator is a valuable tool to visualize your savings journey. It helps you determine how much you need to save regularly to reach your goals, taking into account interest rates and time horizons. This powerful tool empowers you to stay on track and measure your progress.

6. Short-Term versus Long-Term Savings Goals

Balance is essential when setting savings goals. Short-term goals might include building an emergency fund or saving for a vacation, while long-term goals focus on retirement or purchasing a home. Striking a balance between short and long-term goals contributes to a healthy financial life.

7. Developing Financial Goals

Creating financial goals requires a systematic approach. Identify what you want to achieve and set specific, measurable, achievable, relevant, and time-bound (SMART) targets. Regularly review and adjust your goals as your life circumstances change.

8. The Importance of an Emergency Savings Goal

Life is unpredictable, and having an emergency fund acts as a financial safety net. Aim to save three to six months’ worth of living expenses for unexpected events like job loss or medical emergencies. An emergency fund prevents you from falling into debt during challenging times.

9. Setting Realistic Savings Goals

While ambition is admirable, setting realistic goals is crucial to avoid frustration. Consider your income, expenses, and personal circumstances when defining your savings targets. Challenging yet attainable goals keep you motivated and on the path to success.

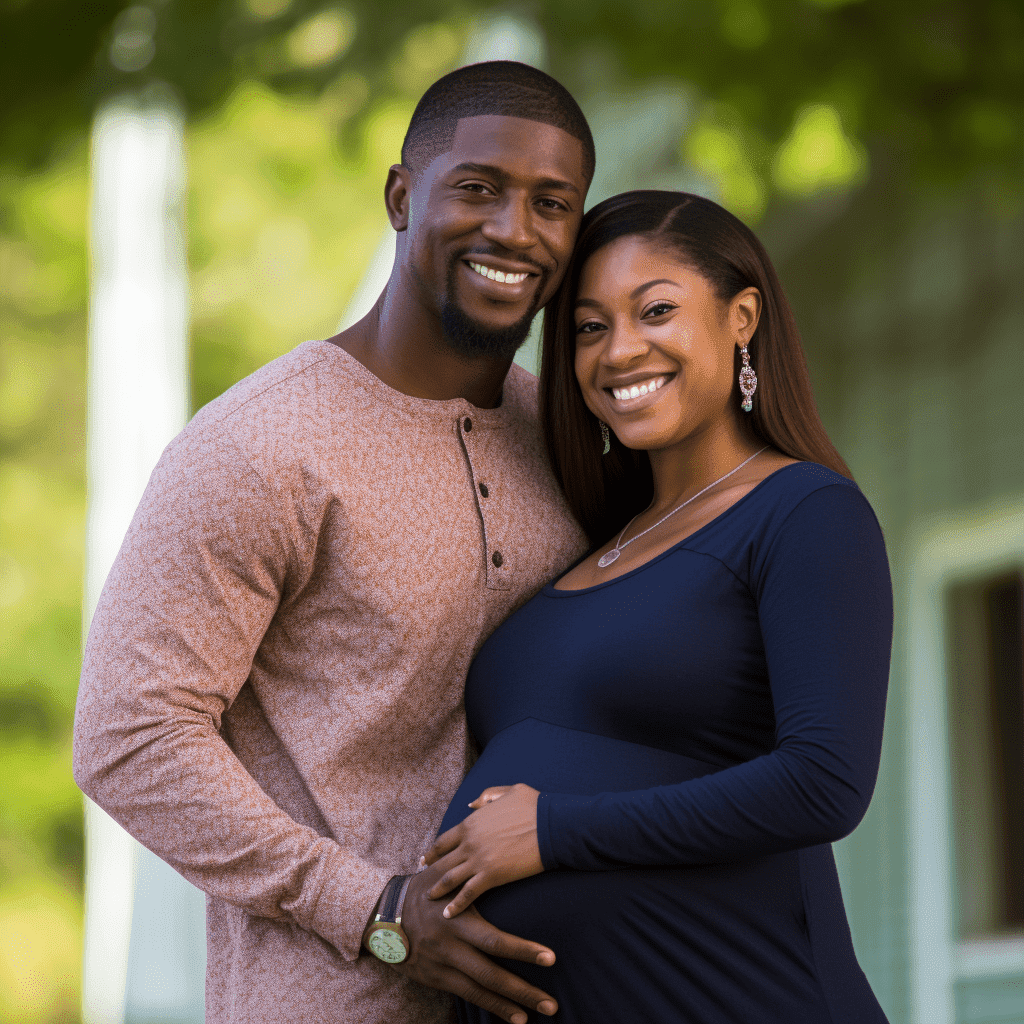

10. Savings Goals for Couples

When you share financial goals with a partner, open communication and alignment are vital. Whether it’s saving for a home, a family, or travel adventures, working together strengthens your financial journey. Embrace mutual agreement and enjoy achieving your dreams as a team.

11. Making Savings Goals Fun: Ideas and Examples

Saving money doesn’t have to be dull! Infuse excitement into your savings journey by gamifying the process. Challenge yourself with no-spend days or reward yourself when you reach milestones. Remember, the journey towards your goals can be just as enjoyable as achieving them.

12. Conclusion

Prioritizing savings goals might seem daunting, but with a clear understanding, strategic planning, and regular monitoring, it becomes a rewarding journey. Start now, stay focused, and watch your financial future unfold!

13. FAQs

13-1. How do I start setting savings goals?

To begin setting savings goals, think about what you want to achieve financially. Whether it’s saving for retirement, a vacation, or a down payment on a house, having clear goals is essential.

13-2. What’s the importance of an emergency savings goal?

An emergency savings goal acts as a safety net during unexpected events like job loss or medical emergencies. Having three to six months’ worth of living expenses set aside can prevent you from going into debt during tough times.

13-3. How can I prioritize my saving goals effectively?

Prioritizing saving goals involves understanding your life stage and aligning your goals with your current priorities. Consider both short-term and long-term goals to strike a balance between immediate needs and future plans.

13-4. Are saving goal apps helpful?

Yes, saving goal apps can be incredibly helpful in tracking your progress, setting targets, and providing personalized tips. They act as your financial coach, keeping you on track toward achieving your savings goals.

13-5. How can couples work together on their savings goals?

Couples can align their savings goals through open communication and mutual agreement. Discuss financial priorities and create joint goals, whether it’s saving for a home, starting a family, or planning exciting adventures together.

14. Case Study-Alexis’ Journey Towards Secure Savings Goals

Meet Alexis, a 30-year-old male engineer working in the electrical industry.

As a young professional, he enjoyed the thrill of life and the freedom of managing his own finances.

However, life took a turn when he got married, and his wife became pregnant.

Suddenly, he realized the need for a secure financial future to provide for his growing family.

14-1. Problems Encountered Before

Before getting married, Alexis had a carefree approach to money. He would spend freely on outings, dining, and gadgets without considering the importance of saving for the future. As a result, he didn’t have any emergency funds, retirement plans, or savings goals in place.

14-2. How to Reflect on the Problem and Find the Cause

As Alexis prepared for the arrival of his child, he took a hard look at his financial situation and recognized the need for change. He realized that he lacked clear saving goals and a structured plan for the future. He knew it was time to get serious about his financial well-being and build a strong foundation for his family’s future.

14-3. Find a Solution

Alexis started researching and educating himself on personal finance and savings goals. He read articles and sought advice from financial experts. This helped him understand the significance of setting priorities and establishing a well-thought-out financial plan.

14-4. Concrete Steps to Implement the Solution

Step1: Defining Savings Goals

Alexis and his wife sat down to determine their short-term and long-term financial goals. They decided to start with an emergency fund, followed by saving for their child’s education and retirement.

Step2: Creating a Budget

They created a budget that included all their expenses and allowed for regular savings contributions. They cut back on unnecessary expenses and focused on living within their means.

Step3: Opening Savings Accounts

Alexis opened separate savings accounts for each of their goals. He selected accounts with higher interest rates and minimal fees to maximize their savings potential.

Step4: Utilizing Savings Apps

Alexis downloaded a savings goal app to track their progress and set reminders for regular contributions. The app made it easy to stay on top of their financial goals.

14-5. Change Result after Execution

With dedication and discipline, Alexis and his wife saw significant changes in their financial situation. They built an emergency fund that provided a safety net for unexpected events. Regular contributions to their retirement fund and their child’s education fund gave them peace of mind about their future.

14-6. Conclusion

Alexis’ transformation from a carefree spender to a responsible saver is a true success story. By reflecting on his financial habits, setting clear savings goals, and implementing a strategic plan, he secured a promising financial future for his growing family. This case study highlights the importance of financial education and the power of taking proactive steps toward savings goals.

15. Checklist

| Questions | Your Reflections | Improvement Strategies |

|---|---|---|

| 1. Have you set clear savings goals? | Define specific short and long-term savings goals and prioritize them based on importance and timeline. | |

| 2. Do you have an emergency fund? | Start building an emergency fund by setting aside a portion of your income each month until you have 3 to 6 months’ worth of living expenses saved. | |

| 3. Are you contributing to retirement savings? | Start contributing to a retirement plan, such as a 401(k) or IRA, and aim to save at least 15% of your income for retirement. | |

| 4. Have you created a budget? | Develop a budget to track your income and expenses, and identify areas where you can cut back on unnecessary spending. | |

| 5. Are you using savings apps? | Consider using savings goal apps to help you track your progress, set reminders for contributions, and stay motivated. | |

| 6. Have you diversified your savings? | Explore different savings and investment options, such as high-yield savings accounts, mutual funds, or stocks, to diversify your savings and potentially earn higher returns. | |

| 7. Are your savings goals realistic? | Evaluate whether your savings goals are achievable based on your income and expenses. Adjust them if necessary to make them more attainable. |