Investing – it’s a captivating dance between uncertainty and reward, where two steadfast companions, risk and return, set the rhythm. As we dive into the realm of investment, it’s imperative to unravel the intricacies of this partnership and unveil the art of making informed financial choices.

Outline

- The Basics of Risk and Return

- Types of Risk in Investment

- Measuring Risk and Return

- Factors Influencing Risk and Return

- Balancing Risk and Return

- Investment Vehicles and Risk-Return Profiles

- Risk Management Strategies

- Historical Events

- Psychology of Risk and Return

- Conclusion

- FAQs

- Case Study

- Checklist

Reading time: 30 minutes

1. The Basics of Risk and Return

In the heart of every investment journey lies a duo that drives decisions – risk and return. Risk, the shadow of uncertainty, is the question mark that hovers over the outcome of your investment. Contrastingly, return is the pot of gold at the end of the risk-taking rainbow. The catch is this: the higher the risk, the greater the potential return. Imagine standing at a crossroads with two paths – one leading to substantial gains with daring risk, and the other to modest rewards with safe strides. Welcome to the risk-return trade-off, where the balance you strike determines your investment destiny.

2. Types of Risk in Investment

When delving into the realm of investments, one must navigate a landscape riddled with uncertainties. These uncertainties are the various facets of risk that can influence the outcomes of your financial decisions. Understanding these distinct types of risk is essential for crafting a well-informed investment strategy that aligns with your goals and risk tolerance.

2-1. Market Risk

Also known as systematic risk, this type stems from broader market movements and macroeconomic factors. Economic downturns, geopolitical tensions, and changes in interest rates can send shockwaves throughout the investment landscape. Market risk affects all investments to some degree, highlighting the interconnectedness of global financial systems.

2-2. Interest Rate Risk

This risk revolves around the impact of fluctuating interest rates on your investments. It’s particularly pertinent to fixed-income securities like bonds. When interest rates rise, bond prices tend to fall, affecting the value of your holdings. Conversely, falling interest rates can lead to price appreciation.

2-3. Credit Risk

Also referred to as default risk, this is the potential for borrowers to fail to fulfill their debt obligations. It’s a concern when investing in bonds, as entities issuing the bonds might struggle to meet interest payments or even default entirely. The creditworthiness of the issuer plays a pivotal role in assessing this type of risk.

2-4. Liquidity Risk

Imagine owning an investment that you’re unable to sell quickly without compromising its value. That’s liquidity risk – the danger of being unable to convert an investment into cash promptly. Investments with low trading volumes or those tied up in illiquid markets are more susceptible to this risk.

2-5. Political and Regulatory Risk

The global investment landscape is influenced by political decisions and regulatory changes. Governments can alter tax policies, implement trade restrictions, or introduce new regulations that impact businesses and investments. Political and regulatory risk introduces an element of unpredictability that investors must consider.

Diversification and risk management strategies play a crucial role in addressing these types of risk. By spreading investments across different assets, industries, and geographical locations, investors can mitigate the impact of specific risk factors. Furthermore, analyzing risk factors and their potential impact on investment returns is pivotal for constructing a resilient portfolio that stands strong even in the face of uncertainty.

3. Measuring Risk and Return

Investing is a delicate dance between the allure of potential returns and the caution warranted by the presence of risks. To make informed investment decisions, it’s crucial to have quantifiable measures that assess both risk and return. These measures provide a structured framework for evaluating the attractiveness of various investment opportunities.

3-1. Standard Deviation

One of the primary measures of risk in investments is the standard deviation. For instance, imagine you’re comparing two investment portfolios: Portfolio A has an average annual return of 10%, with a standard deviation of 15%; Portfolio B also has an average annual return of 10% but with a standard deviation of 5%. This means that Portfolio A’s returns tend to fluctuate more widely from its average, indicating higher volatility and potentially greater risk. In contrast, Portfolio B’s returns are more tightly clustered around its average, suggesting lower volatility and less risk.

3-2. Calculating Returns

On the other side of the equation is return, the reward investors seek in exchange for shouldering the risk. Let’s consider an example: You invested $10,000 in a stock, and over the course of a year, it grew to $12,000. The nominal rate of return can be calculated as follows: (($12,000 – $10,000) / $10,000) = 0.2 or 20%. However, it’s important to consider the impact of inflation. If the inflation rate during that year was 3%, the real rate of return would be 17%. This adjustment accounts for the decrease in purchasing power due to inflation, providing a more accurate representation of your actual return.

3-3. Risk-Adjusted Metrics

While understanding the raw risk and return figures is essential, it’s equally important to consider them in relation to each other. This is where risk-adjusted metrics come into play. These metrics, such as the Sharpe ratio, Treynor ratio, and Jensen’s alpha, take into account the amount of risk undertaken to achieve a certain level of return. Let’s take the Sharpe ratio as an example. If you have two investment options with the same return, the one with the higher Sharpe ratio is more attractive because it achieved that return with less risk. In essence, it quantifies the additional return an investor receives for each unit of risk taken.

3-4. Realizing the Trade-Off

As the saying goes, “There’s no such thing as a free lunch.” The risk and return relationship is a constant reminder of this principle. Consider an investment in two different asset classes: Company X stock with an expected return of 15% and a standard deviation of 20%, and Government Bonds with an expected return of 5% and a standard deviation of 5%. Here, the potential return from Company X is higher, but it comes with significantly more risk compared to the safer Government Bonds. The decision to invest in Company X or Government Bonds depends on your risk appetite and investment goals.

3-5. External Factors

It’s important to note that measuring risk and return isn’t an isolated exercise. It’s influenced by external factors such as the current economic environment, market sentiment, and global events. A bullish market might downplay perceived risk, leading investors to take on more risk for potentially higher returns. Conversely, during periods of uncertainty, investors might opt for safer, lower-risk investments, willing to sacrifice potentially higher returns for greater stability.

Incorporating these measures and insights into your investment decision-making process can empower you to make more informed choices. It’s not just about chasing the highest return or avoiding all risk; it’s about striking a balance that aligns with your financial goals, risk tolerance, and investment horizon. This delicate equilibrium between risk and return is the heart of successful investing.

4. Factors Influencing Risk and Return

Investing is a journey that takes you through a landscape marked by various terrains of risk and return. As you navigate this landscape, it’s essential to recognize the multiple factors that play a pivotal role in shaping the delicate balance between the potential for gains and the exposure to losses. Let’s delve into some key factors that wield influence over the dynamics of risk and return.

4-1. Diversification

Picture your investment portfolio as a garden. Just as planting a variety of crops reduces the risk of a single pest decimating your entire harvest, diversification helps mitigate the impact of poor performance in a single asset. By spreading your investments across different asset classes, sectors, and geographic regions, you reduce the risk that a single negative event could severely affect your overall portfolio. Diversification doesn’t eliminate risk, but it manages it by harnessing the power of correlation – not all investments move in the same direction at the same time.

4-2. Time Horizon

Imagine two individuals, both investing in the same stock. One plans to hold the stock for a year, while the other intends to hold it for a decade. The shorter-term investor is more exposed to short-term fluctuations in the stock’s value, which could be influenced by market sentiment or even temporary industry trends. The longer-term investor, however, can weather these short-term storms with the understanding that the stock’s fundamental value may prevail over time. Thus, your investment time horizon significantly impacts your tolerance for short-term risk and your potential for long-term return.

4-3. Risk-Reward Relationship

The principle of risk and return is a trade-off, where the potential for higher returns is often accompanied by an increase in risk. Consider government bonds, often considered relatively low-risk investments. While they provide stability and preserve capital, their returns are typically lower than those of riskier investments like stocks. Conversely, stocks offer greater potential for growth, but their prices can be volatile. Your comfort with this trade-off should align with your financial goals and risk appetite.

4-4. The Impact of Inflation

An often overlooked factor is the insidious effect of inflation on investment returns. If your investments don’t outpace inflation, the purchasing power of your earnings diminishes over time. For instance, a consistent annual return of 5% might seem substantial, but if the inflation rate is 4%, your real return is just 1%. To truly grow your wealth, your investments must surpass the rate of inflation, highlighting the importance of seeking higher returns while managing risk.

4-5. External Forces

The world of investments doesn’t exist in a vacuum; it’s subject to the currents of global events, economic trends, and regulatory changes. A favorable economic environment can propel investments to new heights, but a sudden shift in government policies or a geopolitical event can trigger turbulence. Investors must remain vigilant and adaptable, ready to recalibrate their portfolios in response to changing risk and return dynamics.

4-6. Personal Risk Tolerance

One of the most subjective factors influencing your investment decisions is your own risk tolerance. This is influenced by your financial situation, temperament, and goals. Some investors are comfortable with higher levels of risk if they believe the potential returns are worth it. Others prefer more conservative investments to protect their principal. Recognizing and understanding your personal risk tolerance is crucial for building a portfolio that aligns with your individual preferences.

In your quest for successful investing, these factors serve as compass points, guiding you through the ever-changing landscape of risk and return. As you weave these considerations into your investment strategy, remember that there’s no one-size-fits-all formula. The optimal balance between risk and return is as unique as your financial aspirations, requiring thoughtful analysis, strategic planning, and the agility to adapt to the evolving investment terrain.

5. Balancing Risk and Return

Imagine standing on a tightrope, high above the ground, with one end labeled “Risk” and the other “Return.” This balancing act aptly symbolizes the intricate dance that investors perform as they strive to achieve their financial goals while managing the inherent uncertainties of the market. Achieving this equilibrium between risk and return requires a delicate blend of strategy, introspection, and an understanding of one’s financial landscape.

5-1. Conservative vs. Aggressive

One of the first decisions an investor must make is the approach they’ll take – conservative or aggressive. A conservative strategy emphasizes the preservation of capital and aims to minimize risk exposure. Investments might include stable assets like bonds or dividend-paying stocks. On the other end of the spectrum, an aggressive approach is willing to embrace higher risk for the potential of greater returns. Aggressive investors might allocate a significant portion of their portfolio to growth stocks or emerging industries. The choice between these strategies hinges on your financial goals, timeline, and comfort level with uncertainty.

5-2. Risk Tolerance and Risk Appetite

Your risk tolerance is akin to a barometer that measures your capacity to endure market fluctuations. It’s influenced by factors such as your financial situation, age, and emotional temperament. For instance, a young investor might have a higher risk tolerance, as they have time to recover from market downturns. Conversely, a retiree might prioritize capital preservation due to limited earning years. Your risk appetite, on the other hand, is the level of risk you’re willing to accept to achieve a specific financial objective. Striking a balance between your risk tolerance and appetite is critical; being too cautious could hinder potential growth, while being overly aggressive could lead to unnerving volatility.

5-3. Portfolio Allocation Strategies

Diversification, often hailed as the golden rule of investing, plays a significant role in balancing risk and return. Allocating your investments across different asset classes like stocks, bonds, and real estate not only mitigates risk but also harnesses the potential for growth in various economic conditions. The allocation strategy you choose – whether it’s a conservative mix of assets or a more aggressive one – should mirror your financial aspirations while respecting your risk boundaries.

5-4. Stress Testing

Just as engineers test structures against extreme conditions to ensure their stability, investors should stress-test their portfolios against different scenarios. These scenarios could include market crashes, economic recessions, or unexpected personal financial events. Stress testing helps you gauge how your portfolio might fare under adverse conditions and allows you to adjust your strategy accordingly.

5-5. Market Timing

The allure of timing the market to maximize returns and minimize risk can be enticing. However, successfully predicting market movements consistently is challenging, if not impossible. Attempting to time the market can lead to missed opportunities or costly mistakes. Instead, focus on a long-term investment horizon, knowing that over time, the market tends to reward patient and disciplined investors.

5-6. Dynamic Rebalancing

Markets are dynamic, and the composition of your portfolio can shift over time due to varying returns from different assets. Regularly rebalancing your portfolio – selling assets that have performed well and buying those that have lagged – maintains your desired asset allocation and minimizes unintended risk exposure.

Finding the equilibrium between risk and return is an ongoing process, not a one-time decision. It involves periodic reflection, recalibration, and alignment with your financial goals. Your balancing act may shift as life stages change, markets evolve, and your aspirations grow. By embracing a well-thought-out strategy that accounts for your risk tolerance, goals, and the fluid nature of the market, you can confidently traverse the tightrope of investing, reaching for the rewards while keeping your footing secure.

6. Investment Vehicles and Risk-Return Profiles

Delving into the world of investments, you’ll find a diverse array of investment vehicles, each with its own distinctive risk-return profile. These vehicles are akin to various routes through a financial landscape, with each path leading to a unique intersection of risk and return. Grasping the nuances of these investment options is pivotal for sculpting a well-rounded investment strategy that harmonizes with your financial aspirations and tolerance for risk.

6-1. Stocks and Equities

Among the most familiar investment avenues are stocks and equities. Owning shares of a company’s stock translates to owning a slice of its assets and earnings. Stocks are synonymous with the potential for remarkable returns, yet they also bear the hallmark of higher risk due to market volatility. The value of stocks can swing dramatically in response to economic shifts, company performance, and even the sentiment of investors. Therefore, stocks often attract those with an elevated risk appetite and a long-term investment horizon.

6-2. Bonds and Fixed-Income Securities

Bonds represent a different facet of the investment landscape. Purchasing a bond essentially entails lending money to a government or corporation in exchange for periodic interest payments and the eventual return of your principal when the bond matures. Bonds are generally considered less volatile than stocks, delivering a foreseeable stream of income. However, their potential for returns is typically more modest than that of stocks. Bonds are favored by conservative investors seeking stability and a consistent income source.

6-3. Mutual Funds and Exchange-Traded Funds (ETFs)

Mutual funds and ETFs offer a convenient avenue for investing in a diversified portfolio of assets without the need to delve into individual stocks or bonds. These funds pool money from multiple investors and channel it into a variety of securities, dispersing risk across different assets. They span a wide array, from equity funds to bond funds to sector-specific funds. While mutual funds are priced at the day’s end, ETFs can be bought and sold throughout the trading day, similar to stocks. Both options provide an intermediary position between the heightened risk of individual stocks and the moderated risk of bonds.

6-4. Real Estate and Alternative Investments

The realm of real estate and alternative investments encompasses an array of opportunities, spanning from acquiring tangible properties to investing in commodities, hedge funds, or private equity. Real estate can offer a stable stream of rental income and the potential appreciation of property value. However, real estate investments necessitate thorough research and management, as they are subject to market conditions and property-specific factors. Alternative investments, such as hedge funds or venture capital, offer the distinctive potential for returns, often accompanied by an escalated level of risk and requiring a sophisticated grasp of the investment landscape.

6-5. Risk-Return Profiles

Each investment vehicle boasts a distinctive risk-return profile, outlining the interplay between potential returns and the associated risk. Generally, investments with heightened potential for returns are accompanied by amplified levels of risk, while investments with lower risk generally yield more modest returns. The selection of investment vehicles should stem from a meticulous assessment of your financial goals, tolerance for risk, and investment horizon. Striking the right balance among investment vehicles in your portfolio can facilitate a diversified and harmonious approach to risk and return.

6-5-1. Ownership Investments vs. Lending Investments

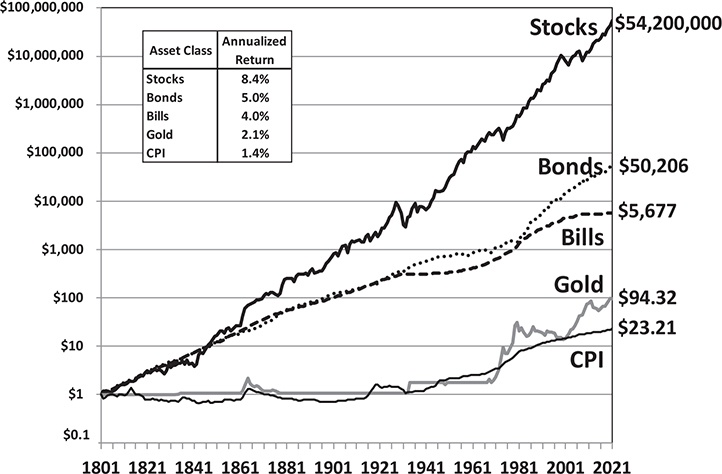

Throughout history, ownership investments, notably stocks and investment real estate, have demonstrated a commendable average annual return of approximately 9 percent. This stands in stark contrast to lending investments such as bonds, which have yielded an average return of around 5 percent, and the more conservative savings accounts, offering a modest return of roughly 4 percent. It’s important to note that these returns take into account the prevalent risk levels associated with each investment type.

6-5-2. Inflation’s Role

In tandem with these returns, the steady erosion caused by inflation has been a key consideration. With an average annual inflation rate of 1.4 percent, the effective purchasing power of returns needs to be evaluated against this backdrop.

FIGURE-1 Total nominal return indexes, 1802–2021

6-5-3.The Compounding Effect

Imagine the scenario illustrated in Table-1, where the power of compounding is exemplified. A difference of a mere few percentage points in annual returns can lead to exponential growth in your investment. This phenomenon becomes more pronounced as the investment duration extends. The longer you have to invest, the more significant the disparity in returns becomes.

At the given rate of return, consider an initial investment of $10,000. Here’s a snapshot of the growth disparity in Table-1:

| Rate of Return | After 10 Years | After 20 Years | After 30 Years | After 40 Years | After 50 Years |

|---|---|---|---|---|---|

| 4% (savings account) | $14,802 | $21,911 | $32,434 | $48,010 | $71,067 |

| 5% (bond) | $16,289 | $26,533 | $43,219 | $70,400 | $114,674 |

| 9% (stocks and investment real estate) | $23,674 | $56,044 | $132,677 | $314,094 | $743,575 |

6-5-4. Comparing the Risks of Stocks and Bonds

In the realm of investments, the delicate balance between risk and return guides our decisions. The allure of higher historic returns from ownership investments, like stocks and real estate, often leads people to contemplate going all-in on these options. However, there’s a crucial caveat to consider.

One cannot ignore the inherent risk associated with ownership investments. Their value is subject to short-term fluctuations that can be quite unsettling. Over the past century, stocks experienced average declines of over 10 percent roughly once every five years. Additionally, drops exceeding 20 percent occurred, on average, approximately once every ten years. Similar periodic setbacks have affected real estate prices.

6-5-5. Navigating Volatility

To reap the benefits of the substantial long-term returns that ownership investments offer, such as those from stocks and real estate, you must be prepared to weather volatility. Placing your entire financial stake in the stock or real estate market is not advisable, especially for funds designated for emergencies or expenses within the next five years.

Time Horizon Matters. The duration for which you intend to invest your money plays a pivotal role in determining the viability of growth-oriented investments like stocks versus lending-oriented investments like bonds. The relationship is illustrated in Table-2.

| Number of Years Investment Held | Likelihood of Stocks Beating Bonds |

|---|---|

| 1 | 60% |

| 5 | 70% |

| 10 | 80% |

| 20 | 91% |

| 30 | 99% |

6-5-6. Bonds: Balancing Risk and Reward

Diverse Bond Yields. Bonds, too, have their own intricacies. While some types yield higher returns, the risk-reward relationship remains consistent.

A bond’s interest rate hinges on factors like:

- Lower credit rating: A compensatory mechanism for the heightened risk of default and the increased chance of losing your investment.

- Longer-term maturity: An offset for the risk that a fixed interest rate might become less appealing if market interest rates rise.

6-5-7.Embracing Risk for Higher Returns

Given the well-established volatility of the stock market, one might question the rationale behind investing in stocks despite the anxiety and potential losses. The answer lies in the potential for higher returns. While the incremental difference of a few percentage points per year might seem negligible, its impact can be substantial over an extended investment horizon.

In the intricate realm of investments, the interplay between risk and return is a central tenet. While ownership investments may entail higher risk, they also offer the potential for more substantial returns, especially when observed over an extended period. By understanding and strategically navigating this relationship, investors can make informed decisions that align with their financial goals and risk tolerance.

Harnessing the potential of investment vehicles demands a clear understanding of available options, as well as a comprehension of how these options integrate into your overarching financial strategy. As you explore these possibilities, bear in mind that successful investing entails not solely maximizing returns but also adeptly managing risk in a manner that supports your long-term objectives. By forging an informed portfolio that aligns with your risk appetite and financial ambitions, you can chart a course toward optimizing the delicate equilibrium of risk and return.

7. Risk Management Strategies

In the intricate tapestry of investment, the art of risk management serves as a guiding light for prudent investors. While the allure of potential returns can be captivating, the backdrop of uncertainty demands a well-structured approach to safeguarding your investments. Enter risk management strategies – a toolkit of methodologies designed to shield your portfolio from the caprices of the financial world and foster a harmonious interplay between risk and return.

7-1. Crafting a Well-Structured Investment Plan

The cornerstone of effective risk management lies in formulating a robust investment plan. This plan should outline your financial goals, investment horizon, and risk tolerance. It serves as a compass, guiding your decisions and preventing impulsive actions that could amplify risk. By detailing your objectives and delineating a path to reach them, you’re better equipped to navigate the ebb and flow of the market without succumbing to emotional reactions.

7-2. Hedging Against Specific Risks

Just as a seasoned sailor navigates through stormy waters with a sturdy anchor, investors employ hedging strategies to mitigate specific risks. Hedging entails the use of financial instruments, such as options or futures, to offset potential losses. For instance, an investor fearing a decline in the value of a stock holding might purchase put options, granting the right to sell the stock at a predetermined price, effectively safeguarding against losses in a downturn. But this strategy is not recommended for novices.

7-3. Monitoring and Adjusting Investments

A dynamic market landscape demands continuous vigilance. Regularly reviewing and adjusting your investments is a cornerstone of effective risk management. As economic conditions evolve and the factors influencing risk and return shift, rebalancing your portfolio can ensure that your asset allocation remains aligned with your goals. Revisiting your investment plan periodically empowers you to capitalize on opportunities and respond to emerging risks.

7-4. Case in Point – The Great Recession

The cataclysmic economic events of the Great Recession underscore the significance of sound risk management strategies. Investors who had diversified their portfolios across different asset classes were better poised to withstand market turbulence. Those heavily exposed to a single asset class, however, encountered amplified risk and sustained substantial losses. The crisis illuminated the value of a well-structured investment plan and the pivotal role that risk management plays in preserving capital.

While the future remains uncertain, a proactive approach to risk management empowers you to navigate the financial landscape with prudence and resilience. A well-constructed investment plan serves as a rudder to guide your choices, while strategic hedging acts as a protective shield. The ongoing vigilance of monitoring and adjusting your investments hones your ability to adapt to changing conditions. Drawing insights from historical events, such as the Great Recession, serves as a reminder that astute risk management strategies are not merely optional but paramount.

Embarking on an investment journey is akin to setting sail into uncharted waters. Yet, armed with a well-honed risk management arsenal, you can face the tempests with equanimity. By grounding your decisions in a carefully devised investment plan, embracing hedging techniques, and remaining vigilant in the face of change, you can harmonize the intricate dance of risk and return in a manner that aligns with your financial aspirations.

8. Historical Events

Diving into the annals of financial history, case studies illuminate the intricate interplay between risk and return, revealing lessons that resonate with investors across time. These real-world narratives encapsulate triumphs and tribulations, offering invaluable insights into the dynamics of investment decisions and their repercussions.

8-1. The Dot-Com Bubble Burst

The late 1990s witnessed the meteoric rise of technology stocks, fueled by the euphoria surrounding the internet revolution. Investors were captivated by the allure of exponential returns, pouring their capital into tech companies with sky-high valuations. However, the bubble inevitably burst in the early 2000s, leading to catastrophic losses for those who had invested heavily. The dot-com crash stands as a stark reminder that unchecked exuberance can yield dire consequences, underscoring the need for astute risk assessment even amid fervent market optimism.

8-2. The 2008 Financial Crisis

A seismic event that reverberated globally, the 2008 financial crisis showcased the systemic risks embedded within the financial system. Complex financial instruments and loose lending practices culminated in a housing market collapse, triggering a domino effect across industries. Many investors suffered massive losses as financial institutions crumbled. This crisis underscores the far-reaching implications of interconnected risks and the critical role of diversification in managing exposure to potential market upheavals.

8-3. Contrasting Strategies

Examining the strategies of two renowned investors provides further clarity on the risk-return paradigm. Warren Buffett, known for his value investing approach, seeks undervalued assets with solid fundamentals, emphasizing the preservation of capital. On the other hand, George Soros is famed for his hedge fund’s speculative strategies that capitalize on short-term market trends. While both have achieved substantial returns, their differing risk profiles exemplify the divergence between conservative and aggressive investment philosophies.

8-4. The Evolution of Apple Inc.

The trajectory of Apple Inc. offers a compelling tale of risk and reward. In the early 2000s, the company was on the brink of bankruptcy, with its stock trading at a fraction of its current value. Steve Jobs’ triumphant return and the subsequent launch of innovative products catapulted Apple to new heights. Investors who recognized the potential at a time of heightened risk were rewarded with remarkable returns. This case underscores the significance of astute timing and the courage to invest during periods of uncertainty.

Through these case studies, investors are beckoned to consider the past as a guiding beacon for the future. The risks and returns witnessed in these events provide valuable lessons in assessing investments, managing risks, and aligning strategies with financial aspirations. The dot-com bubble burst and the 2008 financial crisis serve as cautionary tales, highlighting the perils of unchecked enthusiasm and the importance of diversification. Contrasting investment styles and the evolution of companies like Apple remind us that the art of investment involves a nuanced understanding of risk dynamics and the potential rewards that can be reaped by embracing calculated risks.

The pages of financial history are replete with illuminating narratives that chart the intricate course of risk and return. These case studies offer a mosaic of experiences, a blend of triumphs and setbacks, and a treasury of insights for those who seek to navigate the unpredictable terrain of investment. By studying the paths of those who walked before, investors can equip themselves with a deeper understanding of the ever-evolving relationship between risk and return and make more informed choices in their pursuit of financial prosperity.

9. Psychology of Risk and Return

In the captivating realm of investments, the psychology of risk and return exerts a profound influence, steering the decisions of investors as they navigate the complex waters of financial markets. The human psyche, with its intricate interplay of emotions and cognitive biases, often plays a pivotal role in shaping investment choices, and understanding this psychological landscape is paramount for achieving success in the world of finance.

9-1. Emotions as Driving Forces

Emotions, whether fear, greed, or euphoria, can exert a powerful grip on investors, swaying them to make decisions that may deviate from rationality. During times of market volatility, fear can prompt a rush to sell, driving down asset prices and potentially leading to missed opportunities. Conversely, during periods of exuberance, the allure of high returns may lead to impulsive investments with inadequate consideration of associated risks. By acknowledging and managing emotional responses, investors can strive for a more balanced decision-making process.

9-2. Cognitive Biases and Decision Pitfalls

A litany of cognitive biases can cloud judgment and lead to suboptimal investment outcomes. Anchoring bias, for instance, causes individuals to rely excessively on initial information, potentially causing them to overlook crucial developments. Confirmation bias, on the other hand, reinforces pre-existing beliefs while filtering out contradictory information. Such biases can hinder objective assessment of risks and returns, prompting investors to cling to preconceived notions even when market dynamics shift.

9-3. Overcoming Biases

Recognizing and mitigating cognitive biases is a cornerstone of effective risk management. Diversifying investments across different asset classes and industries can counteract the impact of biases by spreading risks. Moreover, developing an investment plan that aligns with long-term financial goals helps anchor decision-making in rationality rather than emotional impulses. Seeking diverse perspectives and remaining open to contrarian viewpoints can provide a broader perspective, reducing the influence of confirmation bias.

9-4. The Role of Education

Financial literacy and education play an instrumental role in shaping investor behavior. An educated investor is better equipped to assess information critically, make informed decisions, and resist the allure of get-rich-quick schemes. Understanding the nuances of investment vehicles, deciphering market trends, and grasping the implications of various risks and potential returns empower individuals to approach investments with a clearer lens.

9-5. Aligning Strategy with Psychology

Successful investors harness the psychology of risk and return to their advantage. They build investment strategies that align with their psychological profiles, risk tolerances, and long-term objectives. For instance, risk-averse individuals might gravitate toward more conservative investment options that prioritize capital preservation. Aggressive investors, conversely, might be willing to embrace higher risks in pursuit of potentially greater returns. The key lies in understanding one’s own psychological tendencies and crafting an investment plan that capitalizes on strengths while mitigating weaknesses.

9-6. The Rational Investor

While emotions and biases exert considerable influence, the rational investor recognizes their presence and seeks to temper their impact. Engaging in thorough research, conducting due diligence, and consulting with financial advisors can contribute to more informed decision-making. A clear-eyed assessment of risks and returns coupled with a well-structured investment plan provides a solid foundation for navigating the psychological complexities of investing.

In the ever-fluctuating landscape of financial markets, the psychology of risk and return serves as a crucial compass for investors. Acknowledging and addressing emotional responses, countering cognitive biases, and aligning investment strategies with individual psychology are essential steps toward achieving a harmonious equilibrium between rational decision-making and the unpredictable currents of human emotions. By transcending psychological pitfalls and embracing a disciplined approach, investors can chart a course toward achieving their financial aspirations.

10. Conclusion

In the intricate tapestry of investing, risk, and return are the threads that weave together. Understanding their dance is essential for informed decision-making. The path isn’t about avoiding risk but about mastering its tango. So, whether you’re just starting or you’re a seasoned investor, embrace the dynamic partnership of risk and return, and let it guide you to a prosperous financial horizon.

11. FAQs

11-1. What is the relationship between risk and return in investing?

The relationship between risk and return in investing is often described as a trade-off. Generally, investments with higher potential returns tend to come with higher levels of risk. Investors seek to balance their desire for greater returns with their tolerance for risk, finding an optimal mix that aligns with their financial goals.

11-2. How can I manage risk when making investment decisions?

Managing risk involves various strategies. Crafting a well-structured investment plan is crucial, outlining your financial goals, investment horizon, and risk tolerance. Additionally, diversification across different asset classes and industries can help mitigate the impact of potential losses in any single investment.

11-3. What are some common risk management strategies?

Hedging against specific risks is a common strategy. This involves using financial instruments like options or futures to offset potential losses. Monitoring and adjusting your investments regularly is another key strategy. Revisiting your investment plan periodically allows you to adapt to changing market conditions and opportunities.

11-4. Can you provide an example of the risk and return trade-off?

Certainly. Let’s say you have two investment options: Option A offers a potential return of 10%, while Option B offers a potential return of 5%. Option A is riskier, meaning it carries a higher chance of loss, while Option B is more conservative. Investors need to decide which option aligns better with their risk tolerance and financial goals.

11-5. How did the Great Recession highlight the importance of risk management?

The Great Recession demonstrated the significance of risk management strategies. Investors with diversified portfolios across different asset classes were better equipped to withstand the market turbulence compared to those heavily exposed to a single asset class. This event underscored the value of a well-structured investment plan and the role of risk management in preserving capital.

11-6. What role does psychology play in risk and return decisions?

Psychology plays a significant role in investment decisions. Emotions like fear, greed, and euphoria can influence choices. Cognitive biases, such as confirmation bias, can cloud judgment. Recognizing and managing these emotional and cognitive aspects is essential for making rational investment decisions.

11-7. How can I align my investment strategy with my psychological profile?

Aligning your investment strategy with your psychological profile involves understanding your risk tolerance and long-term objectives. Risk-averse individuals might opt for more conservative investments, while those willing to take on higher risks might pursue potentially greater returns. The key is to craft an investment plan that capitalizes on your strengths and mitigates your weaknesses.

12. Case Study-Grace: Navigating Risk and Return in Pursuit of Financial Freedom

Meet Grace, a 39-year-old female interior designer, who channels her creativity into transforming spaces. Grace is happily married and a proud mother of two children.

Her family relies on her income, which amounts to $75,000 annually, to maintain their comfortable lifestyle. Grace has a knack for turning ordinary spaces into works of art, but her financial journey hasn’t always been as picturesque.

With her family’s future in mind, she manages her finances meticulously, ensuring they strike the right balance between spending and saving.

12-1. Current Situation

Recently, Grace’s family faced a pivotal investment opportunity in the real estate market. The project promised a potential return of 20% annually over five years. However, the real estate market’s volatile nature presented a formidable risk, with a standard deviation of returns around 15%. This decision was critical, as Grace was at a significant juncture in her career.

12-2. Conflict Occurs

The decision to invest in real estate put Grace in a quandary. She grappled with the risk of a volatile market versus the allure of substantial returns. Emotionally torn between her family’s aspirations and her instinct for financial security, Grace felt an array of emotions—apprehension, excitement, and trepidation. It became evident that she needed to transcend her reservations and make a well-informed choice.

12-3. Problem Analysis

Grace’s predicament was rooted in the classic tension between risk and return. The uncertain real estate market posed a potential threat to the family’s finances, and this tension was exacerbated by Grace’s risk-averse nature. If left unresolved, this could jeopardize her family’s financial stability, affecting their long-term goals.

12-3. Solution

After thorough analysis, Grace devised a strategic approach to manage risk and return effectively. She decided to allocate 60% of her family’s investment portfolio to the real estate venture, while the remaining 40% was diversified across stocks, bonds, and fixed deposits. By doing so, she aimed to benefit from the real estate project’s anticipated returns while mitigating potential losses through diversification.

12-4. Effects After Execution

A year later, the real estate project yielded a return of 18%, slightly below the projected 20%. However, the actual risk standard deviation was only 12%, demonstrating lower volatility than anticipated. Grace’s diversified portfolio saw steady growth, and the overall portfolio return was 12%, aligning with her calculated risk appetite. The costs of implementation were well within her budget, thanks to her calculated approach.

12-5. In Conclusion

Grace’s journey is a testament to the delicate dance of risk and return in financial decision-making. By striking a balance between potential gains and acceptable risk, she achieved financial stability and growth for her family. Her advice to others facing similar dilemmas is to analyze investment opportunities thoroughly, diversify their portfolios, and make decisions that align with their risk tolerance. Grace’s story is a guiding light for those striving to navigate risk and return on their path to financial freedom.

13. Checklist

| Questions | Your Reflections | Suggested Improvement Strategies | Improvement Plans | Implementation Results | Review Adjustments |

| How well do I understand the concept of risk and return in investments? | Study articles, seek expert advice | ||||

| Do I tend to make impulsive investment decisions based on emotions? | Practice mindfulness, seek rational input | ||||

| Have I diversified my investment portfolio to manage risk effectively? | Research diversified options, allocate properly | ||||

| Do I regularly monitor and rebalance my investments? | Set regular review schedule, stay informed | ||||

| Am I aware of my own cognitive biases that might affect investment decisions? | Study cognitive biases, seek diverse viewpoints | ||||

| Have I aligned my investment strategy with my long-term financial goals? | Define clear goals, reassess periodically | ||||

| Do I understand how different investment strategies impact risk and return? | Educate myself, consult professionals |